We may be in recession all over the world; but, at least, the rich are getting richer. So, there is that bit of good news. Not only is their wealth rising rapidly due to the stock market’s recent rally, but their spending is up substantially. Still, you read today from the financial publications that cater to the rich such talk as how the US may need to bring in more cheap immigrant labor so that those at the top of US society can continue to enjoy their lavish lifestyles.

Of course, the financial media doesn’t quite phrase it that way as that doesn’t sell well. What they say is that companies are unable to find sufficient workers; therefore, the US may need to import more workers. It would be ill-mannered of me to suggest companies raise wages enough to attract more people into the work force. That would eat into those 20% annual gains the slinky fat cats have come to feel entitled to dine on after more than a decade of the Fed force-feeding all their financial markets.

Take, for example, the story in the headlines today about hard-hat construction jobs having more vacancies than any other industry:

The construction industry in America is facing an extreme labor shortage, roughly 650,000 workers, slowing completion of construction projects from residential homes to infrastructure to hospitals. The shortage of construction workers has many causes: the pandemic, and shifts in American cultural values and workforce demographics.

Do you want to shift those values back? Then seriously up the pay. Can we do that without raising inflation? We can if the money all gets sucked out of the tight pockets of the rich made tighter by years of growing fatter. We all know the top 10% have accumulated about 90% of the wealth in America and make about 80% of the income. We also know their incomes expanded rapidly over the decade when we were “recovering” from the Great Recession while American labor remained essentially starving for any appreciation in real wages.

Now — just as labor is starting to find it has some leverage to fight for a larger piece of the pie — we hear that all inflation is to blame on wage gains that must be stifled to save us from that inflation. To do that, we must bring in more immigrants. However, I have read one or two articles this year that made a good case that inflation is due to the rising incomes of the slinky fat cats who are exploiting necessary inflation as a cover to cloak rising profit margins in order to fatten their tight pockets even more.

In other words, now that Americans have accepted some inflation, big business have raised prices more than their costs have risen in order to benefit themselves at the cost of the middle class, and that is working well for them. Since about 80% of US income is made by this small club of considerable cachet and cash, obviously cutting their income way back to where they have to live on annual gains of, say, only 8%, instead of 20%, would cover a lot of wage increases. (And they'd still be getting richer faster than anyone else.)

The solution presented in today’s articles, however, is to bring in more cheap labor from other nations. There are other solutions. We could start by eliminating their privileged capital-gains tax break in order to create a little more of a tax break for the middle class, leaving them with more take-home pay. We can also refuse to allow any immigration that is for economic motivations (as opposed to say life-saving refuge or marriage). While I have often heard people argue that immigration doesn’t bring down US wages, it obviously hurts America’s “hard-hat” workers if the solution to labor shortages is to bring in hundreds of thousands more immigrants in order keep big corporations from increasing labor costs as necessary to attract more workers from within the country.

If corporations have to increase wages even more to find enough labor rather than insourcing it from other nations or outsourcing it to those other nations for cheaper labor (and then bringing the products back here to sell to their underpaid workers), then corporations will have lower earnings to share via high dividends and less free cash to exploit in stock buybacks — the very things that have made the rich richer. That is why we hear them caterwauling now about needing to increase immigration. Just what the US needs is a lot more population and mouths to feed.

Our nation does not owe the people of other nations a living. Plain and simple. Both Republicans and Democrats have LONG turned a blind eye toward illegal immigration while making it illegal because that is how you create a cheap peasant class of workers in democratic America and suppress American wage-earners from getting too much of the pie.

You start by setting out rules that make immigrants illegal, and then you let them cross the border in absolutely massive numbers anyway BECAUSE, if they are illegal they have to keep their heads down, can’t complain much about their low benefits, own no land, have no voting rights. They are true peasants. (But they are better off than where they were, so they come in droves.) Obviously, the only way American laborers can compete against a huge influx of people like that is by accepting similar working conditions and lifestyles, so their wages and benefits also stay suppressed.

However, the articles today, still spin the usual establishment diatribe that we must import our labor to fill the vacancies. Just know that is because the slinky fat cats want to maintain living their lives of ever-expanding luxury via a cheap labor force. Another article in the headlines tells of the extraordinary extent to which they are doing that. We’re talking about keeping the backbone of America suppressed so that the rich can keep rising, rather than truly sharing the wealth.

According to an outlook from Associated Builders and Contractors, a trade group for the non-union construction industry, construction firms will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor….

“There is a labor shortage. There are about 650,000 workers missing from the construction industry, and construction backlogs are now at a four-year high,” said Maria Davidson, CEO and Founder of Kojo, a materials management company….

Turmail cited an aging labor force as a reason for the continued shortage. Workers retire at earlier ages since it is such a physically demanding industry, and the labor force skews older. Construction firms have been incentivizing workers to delay their retirement and work as trainers or teachers.

This is not so much a total boom as a backlog of work that can’t be done due to lack of workers following the Covidcrisis and its forced lockdowns under both Trump and Biden. Pay people a lot more, however, and I think you’ll get people excited about rejoining the work force … at least, to the full extent they are able since many retired early with a “screw it” response to the lockdowns. You’ll also get more younger, able-bodied people willing to consider construction because it pays so well. It is amazing how money motivates, especially in the job world!

Instead, we read about the rich doing so much better even in these recessionary times of high inflation:

The ultra-wealthy have never been richer and they're still spending like crazy.

The so-called "richcession"—the idea that the super wealthy are feeling economic pain more than other groups right now—isn't panning out as a reality, and in fact, rich people have never been wealthier, and are spending more than they were before the pandemic, experts told Insider.

"The rich are a lot richer today than they were pre-pandemic … according to Moody's chief economist Mark Zandi. "When people say 'richcession' I just don't see it."

Unsurprising, the term “richcession” was coined by the Wall Street Journal to convince everyone that the rich are really suffering in our recessionary times. The argument is a sales job by the leading publication that especially caters to the rich.

Notions of richcession—a term coined by the Wall Street Journal recently to describe a downturn that disproportionately impacts the wealthy—have been gaining traction this year. But the idea is largely a misinterpretation of some economic data, Zandi said, such as the wealthiest consumers pulling back on Rolexes and other luxury goods.

Poor babies are hurting because they can’t afford a new Rolex every Christmas. However, even that much suffering isn’t true! The thick cream that crusts the top of society are just too greedy to spend the money:

It's not because they're too poor to afford a Rolex: High-income households have over a trillion sitting in savings, Zandi estimates, and the top 1% are holding onto around 30% of all national wealth, Fed data shows. In fact, the top 1% hasn't been this wealthy since 1989.

Well, not quite too greedy to spend. They just want to be served more:

Rather, the focus of consumers has largely shifted to services – experiences, like, say, pricey Taylor Swift tickets – rather than goods, which were in red-hot demand during the pandemic. Most Americans now have "spent up" demand for goods, but still have pent up demand for services, Zandi says.

"It's just a shift in preferences," he added. "They're out doing things, so that's where the money is. They're going to see Taylor Swift for $2,000 a pop. They're not buying Rolex watches…."

The wealthy are actually spending more now than they were prior to the pandemic, according to Claudia D'Arpizio, a partner at the consulting firm Bain & Company. In her experience, luxury spending is highly correlated with the stock market, and investors have enjoyed handsome returns so far this year as the S&P 500 rebounds from its 2022 lows.

And, actually, sales on luxury goods boomed 20%. It’s just that sales of luxury services boomed a whole lot more! How are you going to drink Dom Pérignon like it is water with friends on a mega-yacht cruise if you start paying the help more? So, quick get the presses whirring about bringing in more immigrants to bolster the peasant labor force, but whatever you do, don’t say it that way.

Scott Dunn, a luxury vacation planner and travel tour operator, says high-end vacation bookings have increased 34% in the last six months compared to the same period last year.

The big bond bust is busting out

Of course, we are funding a huge amount of new construction this year with massive increases in government debt under the Biden Inflation Redux Act: (It is amazing how some things can boom when no one is paying for it because we are shoving the cost off to our children or grandchildren, having good times on their credit cards. And, thus, we are able to give the rich those huge tax cuts they got during the Trump years by not paying for any of the huge spending increases that came along with them and then more increases added by Biden.)

What’s more, with the passage of Biden’s infrastructure bill, American municipalities have large sums of money to invest in the revitalization of their buildings, but no one to perform said revitalization.

Then pay them more. There is a price at which the work looks good. If that means some people have to live with only one house, instead of five, I won’t be playing any violins for them.

Earlier this year, I warned that a great flood of US Treasuries would inundate the bond market in the second half of this year, repricing government debt up astronomically and repricing bonds back down to valuations the set up this spring’s banking crisis. (Yields up equal prices/valuation down so that banks holdings in reserves are devalued again).

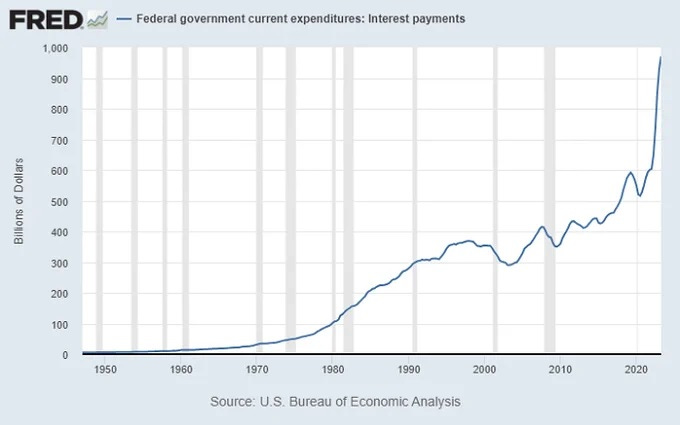

Now we can see, as John Rubino points out in the first headline below, what that rocket-ride in repricing of government debt looks like in terms of soaring interest on the debt that will be passed as a continuing expense on to the next generation since we never pay down the debt and are not likely to ever see the low interest rates the Fed used to create today’s inflation, lest they fan those flames right back up:

That is a rocket ride to hell or, as John Rubino calls it, “a death spiral.” Why a death spiral? Because, as interest rates rise this fast, you quickly move to the point where your need to raise even more debt just to cover the rising cost of interest on your debt, which reprices the interest on your debt higher still. It becomes a fire tornado, so we reap the whirlwind.

The reason I said this crisis would suddenly pop up in the second half of the year was that the US government had been out of the bond market for half a year in terms of adding any new debt to finance its burgeoning deficits under Biden’s big spending plans. Therefore, once the debt ceiling was raised, the government would suddenly be hitting the market with massive new Treasury issuances to cover half a year of bloated deficits that had spent its bank account down to almost zero. That would force interest on that debt up to attract enough buyers so quickly.

Worse still, the government would be financing new debt for its bloated new spending bill while refinancing old debt that the Fed is now refusing to soak up because of its quantitative tightening, and it would be doing this following a period in which the Fed had been raising interest rates for half of a year. All of that would make for a shock arrival back into the bond market.

That is what that graph shows — the debt shock.

Evaluating how the full extent of the shock is playing out in the Treasury market now is the topic I’ll be covering in this week’s “Deeper Dive” for paying subscribers, but I wanted to give everyone a snapshot preview of the severity of what is happening.

More fancy news about ugly truths

As we talk about that severity, I am less than amused by the dreamy-eyed reporting on Europe’s ongoing fall into recession. As usual, the mainstream media for some reason feels compelled to sugar-coat the news of Europe’s sweeping decline. Leading headlines tend to run like this one: “Euro zone pulls out of dip with higher growth than expected.”

That sounds pretty good! In my last “Deeper Dive,” however, I stated that we are very likely in the middle of a double-dip recession (Europe, too), and I laid out the basis from some metrics that flat-out contradict GDP (and one metric that the recession-delaying NBER says it weighs as heavily as GDP when determining recession). These metrics all show we entered a recession in the first half of 2022, barely nosed out of it in the second half and actually fell back into it at the start of the first half of 2023. BlackRock agrees with me, saying GDP appears to be dangerously wrong; so, this isn’t some hare-brained idea to cover my predictions of the past. Even the Fed just said something looks seriously wrong with the latest GDP numbers, calling them into question.

So, when the headline above says Europe pulls out of a dip into recession and emphasizes “higher growth than expected,” that needs to be read with the sense that the whole world is experiencing a double-dip recession. Just as I laid out in that “Deeper Dive.” Given lower corporate earnings, lower Gross Domestic Income, and lower government tax receipts that all correlate plus a very deeply inverted yield curve, “higher growth than expected” in GDP needs to be read with circumspect doubt and a strong emphasis on “than expected.”

When I read Europe’s GDP numbers for the second quarter, after reading cheery-sounding titles like the one above about GDP growth picking up, I thought the numbers I was reading must be quarter-on-quarter numbers because of how small they were. Even then, they seemed like relatively meager rises for a single quarter. I thought it odd, however, that the first few articles I read on the topic this morning did not even mention either the annualized rate of GDP growth in Europe or the year-on-year growth. Usually the financial media quotes what the percentage growth was from the last quarter to the previous then states where this would put annual inflation if that growth holds or gives a backward-looking year-on-year rate.

So, I kept digging to find other articles and eventually realized the quarterly figures being presented were the annualized numbers. Growth did stick its nose above the zero line but not even enough to get within sight of a single full digit of annual growth if it even continues. Moreover, deeper within the articles were claims by some that this growth is not expected to continue.

GDP growth accelerated in the second quarter, expanding by 0.3% — higher than the 0.2% expected by analysts polled by Reuters.

Yeah, that must have been growth annualized (projected to what it will amount to by year’s end), though the articles didn’t expressly say what was being measured because backward-looking year-on-year growth from this time last year, I finally discovered, came to a whopping 0.5%. Hardly a statistical nudge above the flat-line zero growth of the previous quarter.

In fact, as Trading Economics says,

It was the weakest pace of growth since the 2020-21 period of recession due to a large drop in real incomes and surging interest rates.

Oh, so, in other words, year-on-year growth was not only merely dead, but really most sincerely dead.

It was just another case of beating expectations, as if that is a good thing, but because expectations were already dismally low. That is like being glad to find out your fevered and emaciated child has put back on a tenth of a pound, instead of held at zero as you feared or glad her fever is only running 103 degrees because you were concerned it might be 104. Some improvement, but till pretty bad. Europe, in other words, is sick and wasting away, while the longer-term prognosis remains worse, not better:

However, Capital Economics’ Kenningham attributed the second-quarter GDP number to one-off increases in France and Ireland, which he said “give a misleading impression of the underlying strength of the economy.”

″[It] does not change our view that the economy is heading for recession….”

“Excluding [France and Ireland] GDP growth would have been only 0.04% q/q, or zero to one decimal place! As these factors are unlikely to be repeated in the coming quarters and the impact of monetary policy tightening is still intensifying, we think euro-zone GDP will contract in the second half of the year….”

Bert Colijn, senior euro zone economist at ING, noted “…risks are to the downside for the coming quarters.”

So far, this has been a great recession for a few because we are doing a lot that puts money in their corporate coffers while paying for almost none of it as we go. Paying those expenses is what children and grandchildren are for and why we need to keep increasing the peasant pool to clean the swimming pools … and floaty toys called “yachts” … of the rich … because those are jobs that Americans don’t want to do … at such low wages. All work has its price at which it can find ready participants