“No bears left,” is the worrying refrain that one headline uses to cover the stock market, which slid for a second day in a row. That mean’s everyone is on the same side of the boat, and we all know how severely the market can tip when the insanity has risen to such an extent that everyone is on the same side of the boat and then bad news hits the market and sends bets in a mad rush the other way.

Is that likely to happen in December, though, the month of good cheer, Santa Claus rallies and thinning trades due to self-fattening traders, end-of-the-year capture of profits and balanced-portfolio adjustments? Well, aside from how much last-minute portfolio adjustments can rock the boat at the end of a year and end of a quarter when everyone is on the same side of the market as 60/40 portfolios have to adjust their balance of bonds and stocks, that might not be as much of a concern this year since both stocks and bonds have been on a tear together.

However, the boat is listing hard toward the side the passengers are on because the Fed is putting in a hard turn — they believe. If the Fed suddenly turns hard the other way and throws the boat into a list to the other side and everyone starts running opposite to their current bets as happens when the market realizes everyone’s on the wrong side, it will launch a lot of passengers over the opposite rail.

Awareness of this possible peril in the situation has suddenly caused the stock rally to stall, though bonds remained in delusion and yields dropped further today:

Overstretched technicals and the belief that the Federal Reserve won’t cut interest rates as quickly as markets expect are driving a sudden pessimistic turn from equity specialists at JPMorgan Chase & Co. and Morgan Stanley. As Goldman Sachs Group Inc. Managing Director Scott Rubner put it in a report, there are “no longer any bears left.”

After a roaring rally in November that sent the S&P 500 surging 9% and US bond yields tumbling, markets are now trading more cautiously. The question on everyone’s mind is whether the Fed will actually start cutting rates as aggressively as what’s been priced into swap markets, or whether traders called it too early again.

The advance was “a sign of excessive euphoria,” said Florian Ielpo, the head of macro research at Lombard Odier Asset Management. “Valuations are no longer attractive. Equities should be seen for what they are: expensive.”

The bulls who are all crowded on the low side of the boat are getting a little nervous about where they have placed all their delusional hopes.

“We see the risk of these hopes being disappointed,” strategists including Wei Li and Alex Brazier wrote. “Higher rates and greater volatility define the new regime.”

What might cause the Fed to suddenly change course from the turn investors believed in so intensely?

Well, consider, first, that the single statement by Papa Powell that sent stock and bond markets into a euphoric rally was the one where he said the Fed may be done if the bond market continues to do its dirty work or raising rates. The bond market immediately did exactly the opposite and sent interest rates tumbling rapidly. So, doesn’t that automatically negate the soft assurance Powell offered, as it means the Fed will have to do the dirty work, itself. He did not say, after all, that the Fed was done. He only said it might be done IF bond yields keep rising. They didn’t.

So, this could be the perfect setup of mass euphoria that turns to mass hysteria and swamps the boat if the Fed says ANYTHING that indicates it needs to get back to work on its own this December.

Goldman’s Rubner said the odds of a stocks selloff are greater after commodity trading advisers, who usually trade on market momentum, rushed to equities. He estimates that CTAs bought $225 billion worth of stocks during the past month. That’s “the fastest increase in exposure that we have ever seen,” Rubner wrote in a note, and reinforces the view that traders will be more inclined to sell, rather than buy.

According to data from Morgan Stanley’s prime brokerage business, some fast-moving traders are already starting to cut their stock positions.

The stillness in the market today as the Dow fell, the S&P landed at unch, and the NASDAQ barely rose feels like everyone is holding their breath to see whether or not the Fed puts in a different turn … or even gives word of a turn back to more tightening. Remember one JPMorgan Chase strategist yesterday whispering,

“Perhaps one should be contrarian.”

Perhaps, indeed, or mishaps to follow.

What else might rock the boat for all the one-sided betters?

Here’s a piece of news. Remember, how we had that big repo crisis in the fall of 2019 where banks started charging extremely high rates to make those normally boring loans to each other that banks use to keep their accounts looking proper when they have more debits to clear than they can manage? That’s called the repo market, and it is usually the most boring market on earth for very long stretches of time, and it is supposed to be boring because it means bank reserves are in trouble when it gets rough.

Well, the repo market is getting rough again. Now, that could be good news for stocks because solving it back in 2019 forced the Fed back into full QE to pump bank reserves back up after it had drained them further than they could handle with QT. (The now old “bad news is good news” model of stock investing that the Fed has created by making the market entirely dependent on it.) Or the emergence of trouble could mean panic for stocks as they ponder the source of the trouble inside major banks.

However, the Fed didn’t have inflation to fight in 2019, so this is a bigger conundrum IF it blows up like 2019, though all the repo market has been showing in the last few days is signs of agitation on its normally placid surface. Still, it makes one wonder what is down there rippling the normally glassy sea of boring loans that lubricate normal bank transactions and that are made with bonds as collateral, especially since bonds held in reserve are where we saw the spring outbreak of bank failures emerge. What monstrosity is down there this time that the Fed is not seeing?

Spikes in a key short-term interest rate are raising eyebrows in the arcane-but-vital overnight funding market, drawing unsettling comparisons with turmoil that rocked the space more than four years ago.

Strains started showing up late last week. The bond-buying frenzy that stoked November’s US debt rally led to a surge in demand for financing in the market for repurchase agreements, where participants engage in short-term lending or borrowing that’s collateralized by government securities.

This led to a large jump in short-term rates on the final trading day of November, with yields on overnight general collateral repo soaring above 5.5%. Even more unusual, the elevated levels persisted as December began.

Something is amiss in this key market. Remember how significantly the Fed failed to see that the value of bonds held in reserves had dropped enough that it would imperil bank reserves if they were needed last spring. When banks start raising the rates they charge on loans backed with those same bonds in reserves, it indicates peril in the reserve department. The Fed also failed to see that its QT would imperil bank reserves back in 2019, something I warned would likely happen at that point in the year months before it did and something I’ve reminded people of here several times this year because it could happen again this year .

If the Fed goes back to QE this time to solve a problem, should a larger problem emerge out of the small movements seen on the surface right now (and it emerged very quickly in 2019), then it will likely crush its own fight against inflation and send inflation soaring. It know this, so what will it do? Probably some emergency action that it will claim is “not QE” as it did in 2019 and this past spring. My concern is that it appears to be sleeping at the switch just as much now as during its problems with bank reserves on those two other occasions.

“It looks, walks, and talks like September 2019, but yet I don’t think it’s being driven by quite the same reserve scarcity reasons this time around,” said Gennadiy Goldberg, head of US interest rates strategy at TD Securities, who said he fielded several calls about the market on Monday.

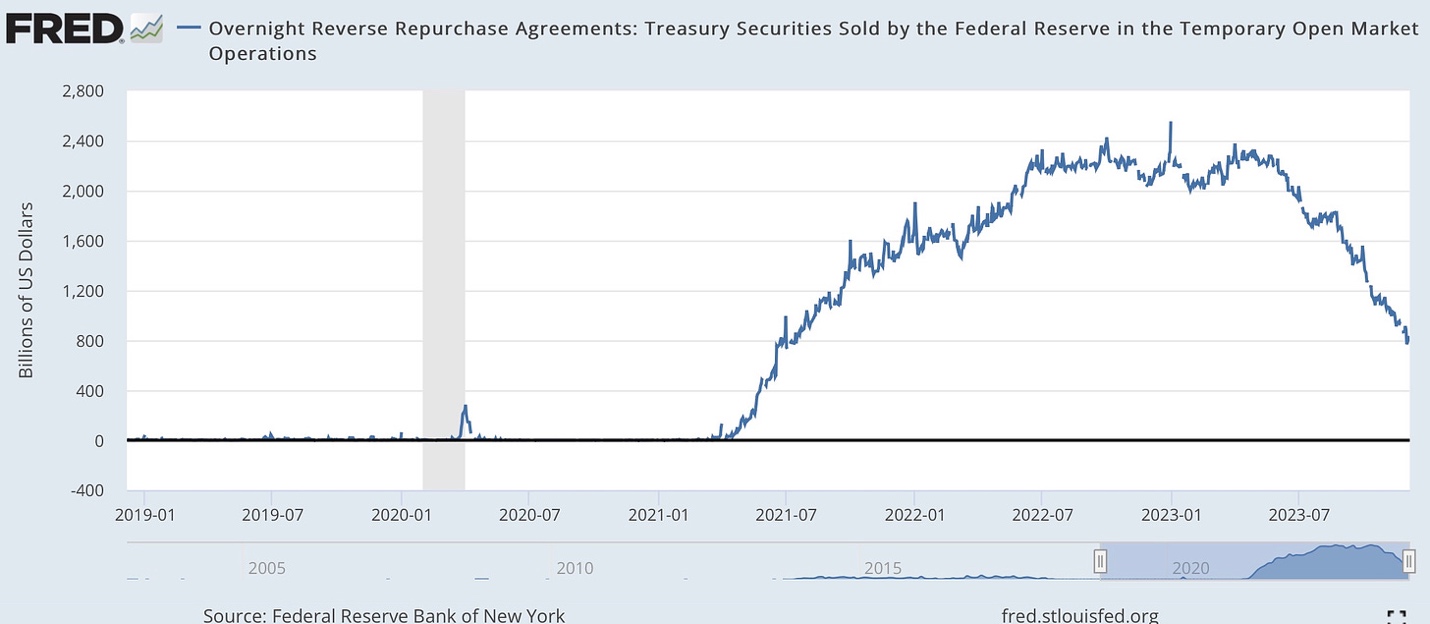

Reverse repo market is backing up

Why would you think such a foolish thing when the Fed created such reserve scarcity with the last QT it did, and it is doing far more QT now?! We’ve also seen that the reverse repo market is backing out of those loans that are the opposite of repo loans, which indicates banks are looking to get cash by giving their bond collateral back to the Fed.

These reverse repo loans happened between banks and the Fed when the Fed did way too much QE and banks started looking for ways to park too much excess cash that was slopping around in their reserves. At the time, I said the only reason I could think the Fed would keep pumping QE cash into bank reserves to such an enormous degree when they clearly had more cash than they wanted was to build up a buffer of reverse repo loans that banks could back out of to get more cash, as they needed to, if their reserves faltered under QT. In that arrangement the Fed gives banks Treasuries as security in exchange for the cash that the Fed moves off the bank’s reserves on its balance sheet. The Fed, in practice, is taking a loan of cash from the banks, which it will repay with interest, and giving the banks Treasuries as collateral. It’s not because the Fed needs cash, but because the banks want the cash off out of their reserves for the time being but want to get it quickly later if needed.

We’ve seen that happening rapidly all of a sudden. The decline in reverse-repo loans still has room to go, yet something is troubling the surface of the repo market. (In all repo loans, there is a party that takes the repo side and a party that takes the reverse-repo side; i.e, one that takes out a cash loan from the other with promised interest, and one that gets a Treasury as collateral from the borrower. How you call it depends on which side you are looking from.)

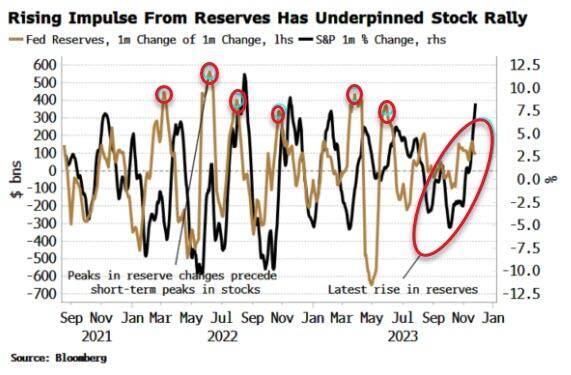

In fact, movements in bank reserves appear to have been funding the stock rally, according to Zero Hedge:

Thus, the amount of cash in bank reserves has risen as banks reversed out of their reverse repos with the Fed:

Thus, the amount of cash in bank reserves has risen as banks reversed out of their reverse repos with the Fed:

The resulting almost $200 billion rise in reserves has been a formidable tailwind for stocks over the last month.

As a result, look at what has happened to all of those banked reverse repos this year:

Federal Reserve Bank of St. Louis

Federal Reserve Bank of St. Louis

$2.8 billion has been reduced to $0.8 billion. This was, of course, the plan as a buffer for QT, so it is going according plan, but the Fed plans a lot more QT, and the buffer is getting low. MAYBE the ripples now appearing indicated that the plan is starting to tremble as those stashed reverse repos that were security for the bank’s reserves begin to close in on normal levels of almost zero. They’ve a ways to go, but we don’t know if they can get down that far without hitting trouble.