The US financial and monetary empire is trapped in a corner. The default is probably not far away. This could be triggered by the next decent-sized crisis.

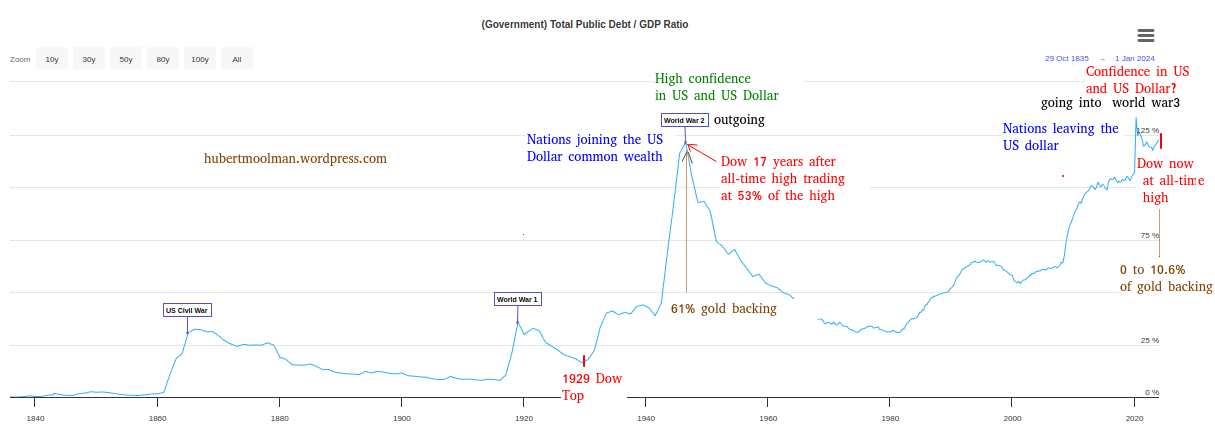

A debt default will also likely mean an end to the current monetary system. I do not know exactly when this will happen. However, I know there is something wrong with the picture below:

US public debt to GDP climbed above the 100% level in the 1940s and now since 2020. On the surface, the situation seems the same now as during the 1940s. However, the current situation is potentially fatal and could lead to a completely opposite outcome to the former.

Instead of cementing its position as the premier economy with the world’s reserve currency (as it has since the 1940s), it could become the next failed state with a new fiat currency every other year.

By 1946 (at the peak of the public debt to GDP ratio), the US dollar was the world’s premier currency (thanks to the Bretton Woods agreement), whereas today, many nations are abandoning the US dollar. Confidence in the US and its financial system was high, as opposed to the waning confidence that is exposed by the current ongoing Russia issue.

In 1946, the gold backing for the US monetary base was about 61%. Today, it could be anywhere between 0 and 10.6% (that famous 261.5 million ounces of gold divided by the monetary base).

In 1946, the world was just coming out of a war, but now it is just getting started. These are not really the ideal conditions to get debt problems under control. Moreover, significantly increasing debt levels from here will come at a very high price.

The US stock market is the icon for the US system, and while it is doing well, most other shortcomings can be overlooked.

Currently, the stock market is trading at all-time highs and is probably at risk of a big decline. By comparison, in 1946, the Dow was trading at 53% of its all-time high, which had been printed 17 years earlier.

A stock market crisis at these debt levels would limit the government's response, especially if you consider that the 1929 peak occurred when the ratio was at around 17%. There was more room for the government to take on more debt, whereas now it seems quite saturated.

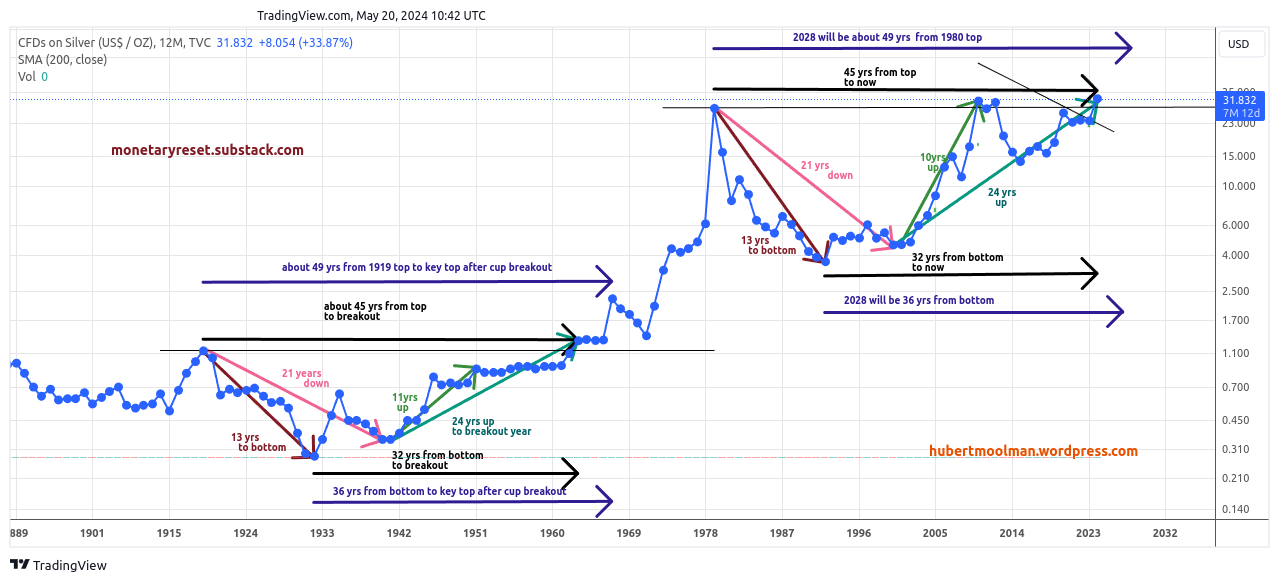

It is probably better to just choose one’s own reserve currency rather than try to figure out the risks pertaining to these fiat currencies. Gold and silver are the true monetary base. Insurance against the inevitable collapse. Here is my analysis of the long-term silver chart:

Silver is probably close to a generational breakout and could rise for the majority of this decade.

Warm regards

Hubert Moolman