Having written that Powell’s Peril Lies in the Lanquishing Labor Market and that we are Fed up and Under-Fed All at the Same Time because Everyone Sings the “Strong Labor Market” Tune in Unison … and They’re All DEAD Wrong, I finally get some VINDICATION! Major vindication!

Until now, I’ve read no one agreeing with my views about Powell’s labor blindspot being a source of peril for all of us, which could prove to be the biggest Fed error in history.

I’ve pointed out in past years how badly cooked the government’s jobs numbers are and how the Bureau of Lying Statistics, as I call it, revises its numbers down by hundreds of thousands in an annual audit just about every year, but mostly by applying the corrections to months so far back in the year that no one cares anymore about what happened back then. That makes for a convenient way to bury the truth about a weak labor market. I’ve also noted how I’ve seen the BLS revise December’s raw job numbers up by 300k or more due to unusually bad weather in one year, only to revise the next December up again by the same amount due to unusually good weather.

Moreover, since September, I’ve been saying the labor market is the worst blind spot the Fed has ever exhibited. Its misbelief that the labor market is strong is causing it (and everyone who parrots whatever the Fed says as gospel truth) to be blind to the recession we are already in (on the basis that our negative GDP numbers this year just HAD to be wrong, given how tight and hot the labor market is).

More importantly, I noted in my last article how the Fed said more clearly than ever that it will not stop tightening the nation’s financial system until it sees the labor market loosen up with a rise in unemployment. That affirmed what I’ve said since September is the most important thing for you to keep your eye on if you want to understand what’s about to befall us — that the Fed will over tighten during a recession it does not see because of its gross minundertanding of the labor market, which is far weaker than the Fed admits.

Yesterday we got the biggest mea culpa of all time regarding the government snow-job world of job estimating and Fed complicity in the falsehood. Zero Hedge reported, “Here Comes The Job Shock: Philadelphia Fed Admits US Jobs “Overstated” By At Least 1.1 Million“:

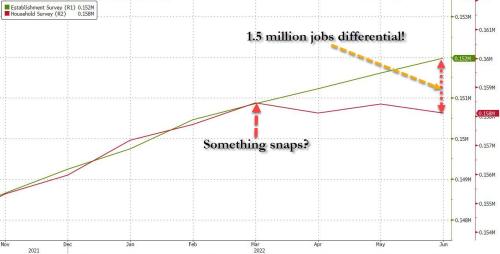

Just a little over a million? I’m sure that’s a Fed rounding error. ZH started by noting the two government labor reports put out by the BLS have spread in greater and greater disagreement with each other since last March.

It was only a matter of time before we would see which would catch up or down to the other, and ZH had been putting its money where I would, which is that the lower number in these recessionary times is clearly right, while the higher number is the one with the past of being grossly overestimated then revised down.

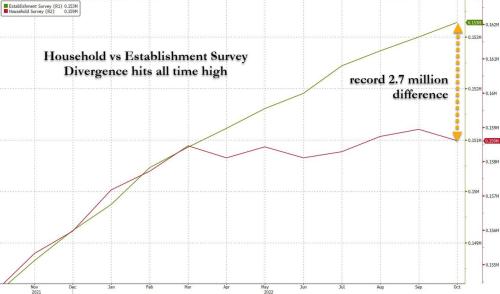

However, that was their old chart. The divergence in the monthly continued to accumulate until it looked like this:

You would think, if there were any concern about honesty and accuracy, the government would have noticed the huge divergence in its own estimates, especially since both reports are made by the same agency. From there, you would think they would have delved into it and corrected the problem long before now, but that would be to NOT think that this was an election year, so why would they do that?

Apparently, with the election past, someone is now allowed to come clean.

Oh, those seasonal adjustments! How much room they have for packaging up lies. They must be lies because you just cannot make stuff up like this, AND you just cannot miss noticing that something’s clearly wrong with your statistics with a gap big enough to drive an ocean liner into. If you were a bank or something accountable for its accounting, you would quickly have your comptroller chase down to the last penny where the error is occurring because a single penny can be a million-dollar error one way offset by a $999,999.99 error the other, and you want to find out why things are not adding up because it could be the sum of multiple problems.

At least, so a friend of mine who was a comptroller for a major bank once told me. He said the department he led would spend days chasing “a single penny” to find out what was wrong when their numbers didn’t reconcile, not because they couldn’t write off the penny but because they needed to know what was wrong. A penny that couldn’t be reconciled could be evidence of something far worse. A drip of water who cares? However, if you’re in charge of managing the dikes of the Netherlands, you better find out why the dike is dripping.

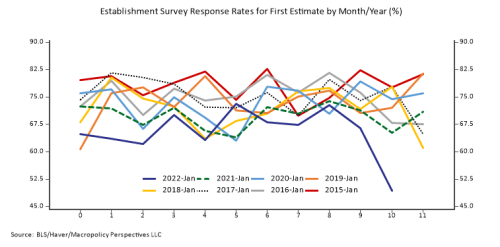

The discrepancies could be because the response rate to the government’s over-reporting survey truly fell off a cliff this year compared to other years, making it highly inaccurate because it came from an unusually small sampling:

If that is the case, it would also mean the Fed is going to determine its stopping point for tightening based on the most inaccurate reportage of labor statistics in the past eight years! That doesn’t give me a high level of confidence they will not overshoot. So, it the Establishment Survey could be off due to under sampling …

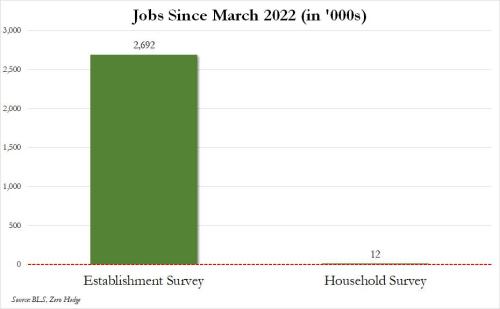

… or some other reason, perhaps including the Biden admin tapping certain Bureau of Labor Statistics officials on the shoulder and advising them to show strong numbers if they want to keep their… well… jobs, we did not know, but we did know that according to the Household Survey, just 12,000 jobs were created since March, while according to the Establishment Survey – which moves markets and sets Fed policy – the increase in jobs over the same period was 2.692 million!

What if the 12K is the accurate number? If the numbers don’t shock you, perhaps a graph of the jobs added by both monthly surveys up to the present date will:

Unfortunately, the Fed now says the accurate graph for the number of new jobs added since March of this year is the one on the right!

Oops!

Moreover, the Philadelphia Fed says it has had the more accurate numbers all along and that it recognizes them as more accurate.

On Dec 13, the Philadelphia Fed published something shocking: as part of the regional Fed’s quarterly reassessment of payrolls in the form of an “early benchmark revision of state payroll employment”, the Philly Fed confirmed … that US payrolls are overstated by at least 1.1 million, and likely much more!…

As the Philly Fed notes, “estimates by the Federal Reserve Bank of Philadelphia indicate that the employment changes from March through June 2022 were significantly different in 33 states and the District of Columbia compared with current state estimates from the Bureau of Labor Statistics’ (BLS)

Now you know why I, with merited impunity, regularly refer to the BLS as the “Bureau of Lying Statistics.”

And here is why I say the Fed is complicit in this error:

Our estimates incorporate more comprehensive, accurate job estimates released by the BLS as part of its Quarterly Census of Employment and Wages … program to augment the sample data from the BLS … that are issued monthly on a timely basis.

Federal Reserve Bank of Philadelphia

Well, then, why don’t they use their more accurate estimates and stop saying the labor market is strong? A labor market that only added 12,000 jobs nationally in the last eight months is far from strong! Maybe the Fed just hates listening to itself. The difference was stated in the central bank’s reports:

In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states [or] the U.S. CES estimated net growth of 1,047,000 jobs for the period.

Federal Reserve Bank of Philadelphia

To use the term they applied, payroll jobs remaine essentially “flat” from March through June. Wasn’t that period the second quarter when we had negative GDP growth, which the Fed stated could’t have been a true second quarter of recession because the labor market was strong? We were told, “Don’t look at those negative GDP numbers, Folks. They are definitely off because you cannot have such a strong labor market when GDP is declining into recession.” We were told that everywhere again and again.

Now, I said all along it was this understanding of the labor market as being tight that was wrong, not the GDP numbers. So, why are not the financial media climbing all over this new report by the Fed to dig in with questions and ultimately to admit they were all wrong for having taken the Fed’s anti-recession argument as gospel truth all along? (That will never happen.)

Now, that is just the Phily Fed’s latest report, which runs through June. While we don’t have a current Fed report, we can look back at which job numbers were right from the BLS back in that March-June report and see it was the Household Survey which was lower by 1.5-million jobs back then and almost dead, similar to the difference the Phily Fed noted. Since the Household Survey is now lower by 2.6 million, as in still “flat,” I think we can figure out the economy remained dead in the third quarter, too, so that Q3 positive GDP number really was likely a fabricated Pig as I wrote in another article: “Dissecting the Gross Domestic Pig (GDP).”

Believe the Fed if you want to about the “strong labor market,” but part of the Fed doesn’t even agree with itself when it makes that claim — that or it just cannot wrap its head around the numerical discrepancies.

Zero Hedge sees it the same way:

It is safe to say that the job “overstating” which was 1.5 million in June according to Zero Hedge and 1.1 million according to the Philly Fed, has almost doubled to 2.7 million from March to November.

The Fed’s “strong jobs market” belief would seem to be fabricated out of the higher number, not the totally dead number, even though the Philly Fed said the lower number is, by the info available to it, the clearly superior number for accuracy.

An even bigger question is when does the BLS realize (or rather admit) what is going on and engages in a shotgun backward revision of data? The most likely answer is that the BLS will simply wait until one of its annual historical data revision periods, when the Bureau of Labor Statistics quietly admits that historical data was higher by a few million, and re-benchmarks current months going forward as if nothing had happened

But the severe risk here is, as I wrote in my Dec. 14 article, “Papa Powell’s Peril Lies in the Lanquishing Labor Market“:

The Fed is shaping monetary policy using the clearly flawed assumption that the US labor market is “hot”, “tight” and “strong”

Only this time, that quote was not me saying it as I have for months, but ZH.

Since Powell appears to be running by the grossly overinflated jobs data, he will do exactly what I said he will do:

Still think the Fed would be hiking 75bps this summer if instead of an average monthly job gain of 350K, Powell was seeing zero monthly payroll increases?

That, too, was ZH this time.

And even more importantly, now that the cat is out of the bag and the Philly Fed has introduced this huge credibility issue in all recent payrolls data, how long until this becomes a political issue, and how long until Republicans – who take control of the House in January – start hearings to demonstrate to the US that the collapse in the labor market did not start with the Republican takeover but was well in place last summer.

Also ZH. I don’t care about the political outfall of it. What I care about is the observation that this creates a credibility issue with the Fed that is as major as hing a “collapse in the labor market!”

And finally, how long until the Fed – which made it clear that it is no longer focused purely on inflation numbers … but will also be looking at clearly wrong jobs data – makes it a point that the US labor market is in far worse shape?

All the things I have been saying, but now said by someone else. I’ve been pounding that question since September. Only my way of putting it has been to state and restate that this blind spot by the Fed in believing the labor market is strong is not an error it appears willing or able to admit. Not only have there been almost NO jobs created in the past half year, but the Fed, as I’ve written about, has failed to realize that a seriously sick and diminished labor force that is, at least, down 4-million able-and-willing workers, is the exactly opposite of a healthy and strong labor market. It’s a market that cannot even manage to fill the extremely limited new jobs created in this market where we now know new job growth has all but died.

That is a seriously perilous situation. It means the Fed’s misunderstanding about the strength of the labor market will cause the Fed to overshoot by tightening an economy that is already in recession, which the Fed also doesn’t see due to this same blind spot. It clings to its belief that the GDP numbers for the first half of the year were wrong, and not that its view of a strong labor market is dead wrong.

Worse still, since the recession and inflation are tied part-and-parcel to ongoing part-and-product shortages, additional layoffs will reduce production even further, which means worse product shortages so that we could wind up in a deep stagflationary recession, rather than see a recession that tames inflation. In other words, we could wind up with such scarcity due to this gross misunderstanding of the strength of the labor market and our collective disbelief in falling GDP, also based on that misunderstanding of labor, that increased rarity will drive prices even higher. If that happens, we will have the worst of both worlds.

Then, when the Fed realizes its error because the economy has crashed into dust, and if the Federal government joins the Fed as it did in 2020 to hand out new money to rescue the crashed economy, you will really see hyperinflation as the people who are not producing will be flush again with cash and will apply all that money toward bidding up the prices of rare goods and services.

I’m not predicting those things WILL happen just yet, but I am saying to keep an eye on them, as I warned people to keep an eye out for inflation almost two years ago. Whether they happen will depend on whether the Fed realizes its serious error in perception soon enough to avoid tightening longer into a recession they do not acknowledge and whether Fed and Feds join again in printing and distributing money, which will be much less likely this time due to inflation and the higher cost of government debt. So, we may just get economic collapse without the hyperinflation.

Just keep your eyes open, and to do that, let me again recommend subscribing for free to The Daily Doom.

https://thegreatrecession.info/blog/snow-job-fed-admits-gross-errors/

Liked it? Take a second to support David Haggith on Patreon!