Some of the major points I made in the last two “Deeper Dives” hit the news headlines today, as global debt worries mount into what is seen as another brewing financial crisis. And the concern is not for the debts of nations that are considered emerging markets, but for the big nations of the world:

Record debts, high interest rates, the costs of climate change, health and pension spending as populations age and fractious politics are stoking fears of a financial market crisis in big developed economies.

The warning I gave in my Oct. 9 “Deeper Dive” was …

The cost of all that chaos is that the US debt it rapidly moving from being unREpayable to just being unpayable at all, as in we won’t even be able to service the interest on the debt without taking out debt to cover the interest. The US will be a zombie corporation. In other words, we are on a path to having our own sovereign debt crisis in not that many more years. Maybe sooner than we think because the bond vigilantes are now getting serious about taking the interest on the national debt up higher, even if the Fed stops raising rates.

Certainly the inability to form a government that can actually govern doesn’t help. The Fed’s rolling off of government bonds, hugely exacerbates the situation, while funding war in Ukraine (and now Israel) adds to the burden, too. So does stimulating an economy that the Fed and the Biden Administration keep telling us is strong. (Then why does it need stimulating?)

So, the interest rates rise and rise even as the aggregated heap of debt rises and rises, delivering the nation a double debt whammy.

That “Deeper Dive” laid out the data to support those big claims.

You may think of all that debt as only a threat to you if the nation has to repay it, or only an extra cost in taxes, but I explained how it is far more than that:

The insidious (unseen) part is that it’s all costing YOU, and by that I do not just mean in the taxes that we’ve all given up any hope of ever using to pay down the debt, but it costs you on the cost of your house and anything you buy on credit because the government is devouring so much credit it is your worst competitor in the financial marketplace, driving up interest rates with all its competition because, when the interest rate on government debt rises (especially the 10-Yr Treasury), then interest on everything else rises proportionately. It’s costing you because the government is competing against you with all that debt it raises to buy more stuff to build all its projects, which also drives up your price of stuff by competing for goods and services.

The article from Reuters today lays out some of the same risks I did in that “Deeper Dive” as well as other risks that are real for all of us. In this past weekend’s “Deeper Dive” (“The Return of Inflation and other Monsters Created by the Fed and feds”) I also forecast …

High US debt piled up because that money printing made it easy for government to get fat. Now that heap of debt has risen into such a monstrosity alongside inflation that it makes the Fed’s job of fighting inflation almost impossible because the fight will cripple the nation under the rising interest burden of all that debt, creating a sovereign-debt crisis.

If we really want to look at monsters the Fed and feds co-created, we have to look at the national debt….

This monstrosity has been growing like a creature made of nothing but cancer cells. It’s not hard to see why when we look at the Fed’s balance sheet, almost of of which was used to hose up debt, most of it the government’s, at very, very low interest that the Fed is now rapidly engineering higher in order to fight the inflation monster it helped create (shortages also contributing their half of the bargain, which the Fed can do nothing about)….

There is a lot of damage coming to financial markets in the days ahead due to this massive repricing:

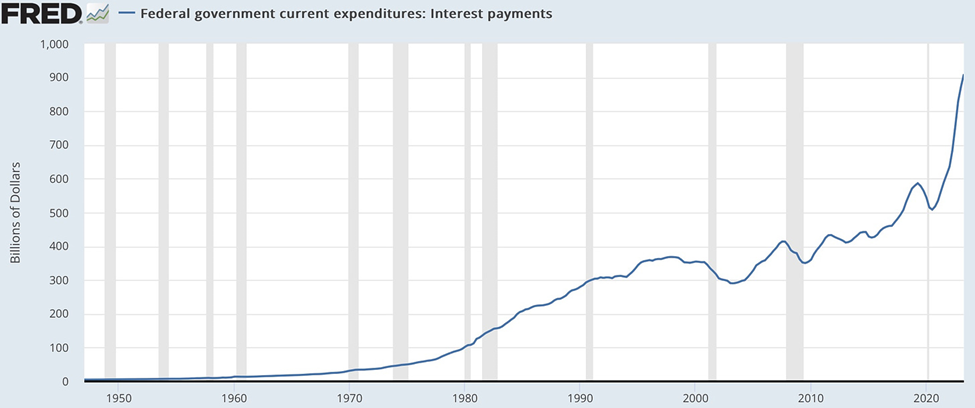

Showing a graph of just the government interest payments, that “Deeper Dive” presented a picture of the towering mountain of costs just for servicing the debt that has truly grown exponentially:

In total dollars being paid out, interest payments on the total government debt have spiked 50% higher than what they were in the worst of years before Covid, even though most of the debt has not yet rolled over to the higher interest rates, which are also still rising. Anyone see another towering monster here? Sovereign debt becomes a sovereign-debt CRISIS when the interest becomes so high that you cannot even pay the interest with the taxes you collect, so you have to keep raising debt just to keep paying the interest, let alone all the other essential costs of government.

Another article in the news below now claims, as I’ve been saying would be the case since the start of this year when China reopened from its Xiro Covid lockdowns and everyone was expecting a big economic recovery, that China’s global dominance is now over. Even the IMF is now warning of the “Japonization” of China, which I have used this year as the model for understanding the future we can really expect for China. Just like when everyone in the US feared the US would be economically overrun by Japan in the early 80s, so it will be with China today. The growing giant panda would burn out like Japan did. In China’s case it would be from two much central planning, which never ends well.

Another thing I wrote about in this past week’s “Deeper Dive” was a year-long adjustment in the healthcare component of CPI that turned an actual massive spike in health care costs all year long into a negative, stating how the end of that adjustment has now come, so the next CPI report will show huge inflation in health care that has been buried by the government for a year:

Imagine how much worse Core CPI, the component the Fed is most interested in, will look next month without that artificial adjustment, which was ostensibly to correct previous years’ mistakes. Those mistakes may have needed correction, but doing it every month for a year just made every month look better and better for the inflation battle, and was due to nothing more than data correction. That now ends, and the truth will begin to show through.

I’ve covered the truth about that healthcare revision here in a recent “Deeper Dive” if you were not subscribing back then and want to get the full skinny, but very few people are probably even aware of the truth because the mainstream financial media has been mute on the subject….

The reason it will be spiking will be because healthcare costs have been soaring all along, but were getting the benefit of hiding under that huge downward adjustment. Now everyone will be seeing what health expenses have been doing all along.

And here is what is going to show through that has been happening all year long: Today, the Wall Street Journal reported,

Surge in Health-Insurance Costs Pose Next Challenge for Finance Chiefs

Healthcare costs are rising at the steepest rate in years, leaving CFOs to manage the price tags….

Health-insurance costs, which are among the largest expenses for many U.S. companies, are projected to rise around 6.5% for 2024, according to consulting firm Mercer.

So, health care will go from having a (fake) negative impact on CPI all of the past year to having a positive 6.5% impact. As my own article laid out the degree to which inflation has been rising for three months in a row now, establishing a clear new upward trend, imagine what it will do now that healthcare goes from being net negative in CPI to strongly net positive.

That latest “Deeper Dive” also said a lot about the rising price of fuel as a serious driver of future higher inflation, and today in the news, we read that the price of oil is stabilizing around $90 a barrel, well up from where it started the year, and we read about the strong possibility of it going much higher if the Israel-Hamas war spreads in other parts of the Middle East, as today’s news also makes clear is happening. There is a lot of news about that today in the headlines (subscribe to The Daily Doom below.)