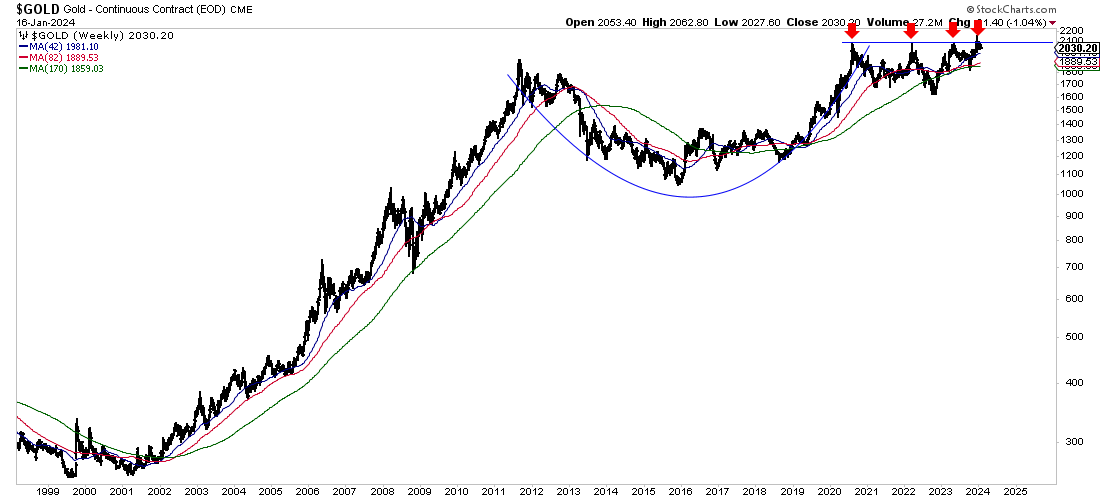

I have been writing about Gold’s super bullish cup and handle pattern since 2021.

The pattern is super bullish because the handle consolidation of the past few years has transpired above the 38% retracement (around $1675/oz), and the peaks are above the peak from 2011 at the start of the pattern.

The cup is nine years long, while the handle is a month away from a length of three and a half years. The handle would need to continue for another year or so before we become concerned about the viability of the overall pattern.

Gold closed December, making weekly, monthly, and quarterly all-time closing highs, but its upside momentum failed to materialize.

Gold may need to close above $2,100/oz to generate upside momentum.

Or, perhaps Gold can only achieve that escape velocity once the stock market cracks and capital flows out of equities and into Gold.

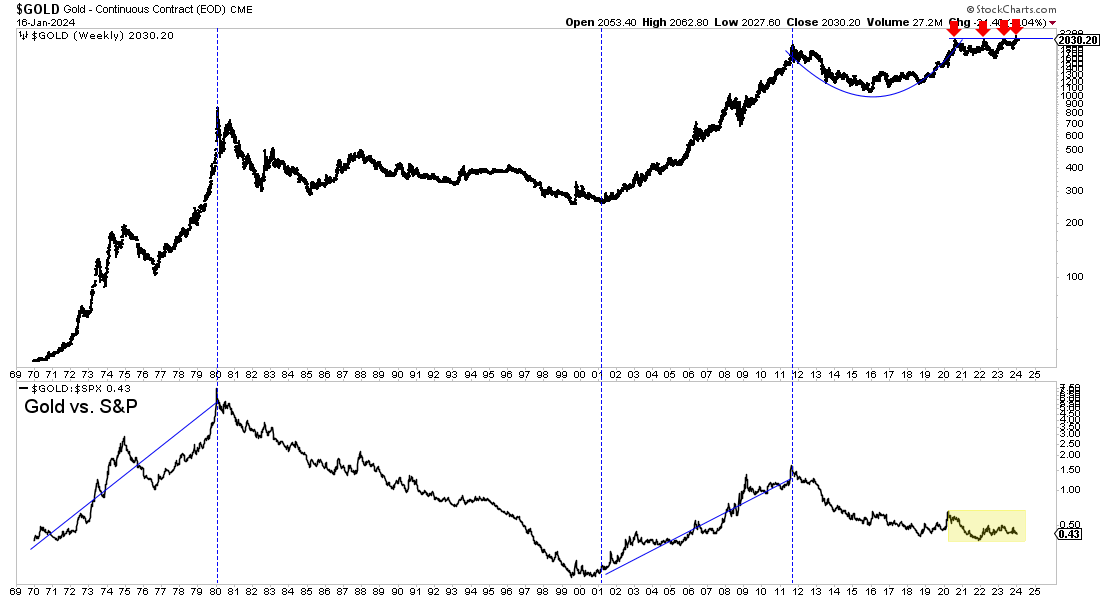

We can see below that Gold's bull markets in the 1970s and 2000s were accompanied by strong outperformance against the stock market. The same was true during the cyclical bull from August 2018 to August 2020, in which Gold surged almost 80%.

Unfortunately, Gold remains weak against the S&P 500. The ratio closed Wednesday at its second-lowest level of the last 14 months!

If there is some blowoff move in the stock market that rekindles inflationary concerns, Gold could climb to $2300 before the recession and bear market.

However, the cup and handle breakout and that huge move in Gold to $3,000/oz and $4,000/oz will not materialize until the stock market cracks and capital flows back into Gold. Otherwise, there is a limited pool of capital buying Gold, and that is why it has yet to generate the momentum needed for an explosive breakout.

As a result, I have focused on finding high-quality gold and silver juniors that can perform in a static metals environment but have 500% to 100% upside after the bull market begins. To learn more...