As I’ve written about extensively, we know the Federal Reserve has painted itself into a corner where it is now pressured to start tapering its quantitative easing earlier than it had been indicating. Now we are seeing signs that the bond market isn’t liking the news out of the last FOMC meeting, which hinted strongly that the Fed will start to taper its massive purchases of US treasuries this year.

US bonds soon to be released from Fed bondage

US treasury auctions roiled with signs of trouble today. The 30YR UST spiked above 2%, it’s highest yield since mid-summer; but, more importantly, the 10YR did a similar move, rising to its mid-summer high above 1.50%, while the 2YR hit its highest level since March of 2020 when the COVIDcrash began.

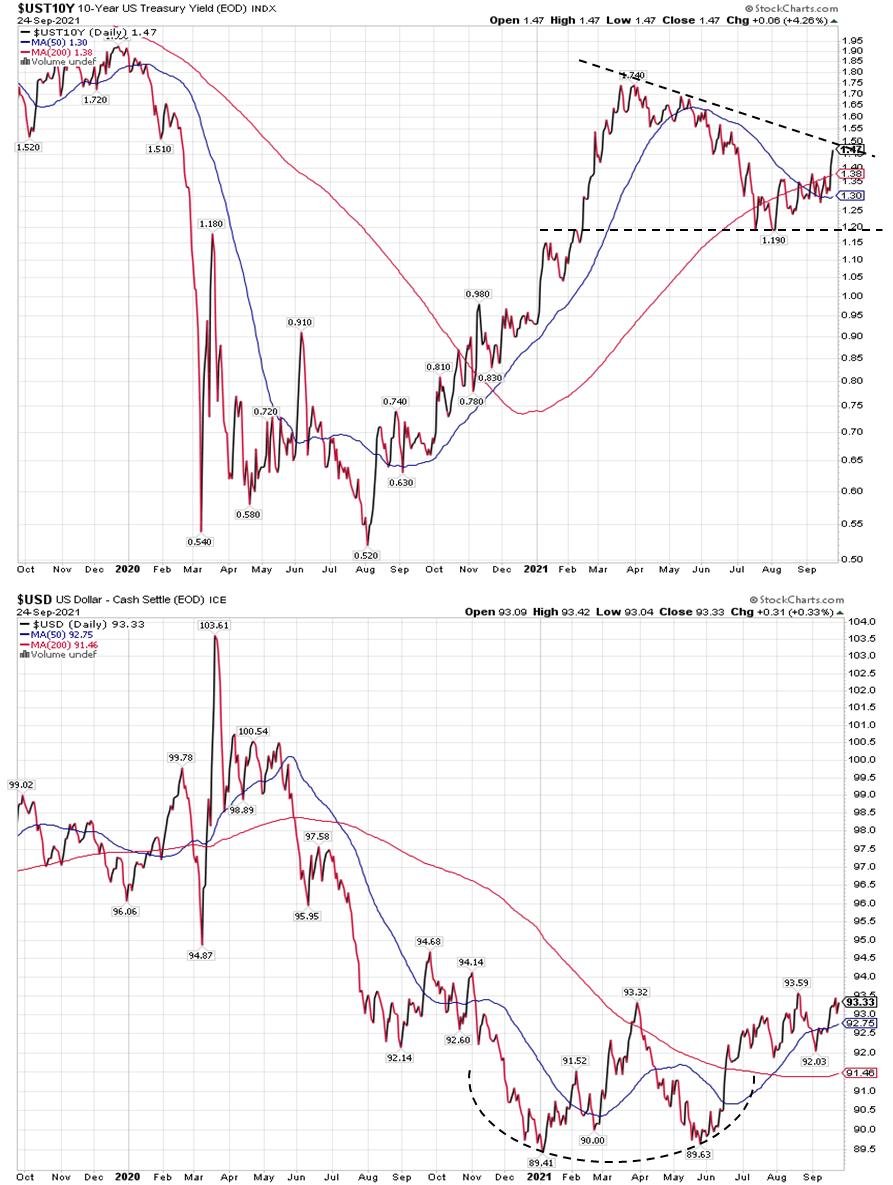

At 1.5%, you can see (in the top graph below from three days) that 10YR treasuries have today just poked their head above the upper bound of their recent trading range, indicating a possible breakout:

These bits of bond turmoil are minor foreshocks of what will come in the months ahead. While they are not the real bad news that my next article will be laying out. the biggest bit is that bid-to-cover in the 2YR auction crashed from 2.649 to 2.28, which is the lowest it’s been since the Lehman collapse in December of 2008! (The ratio by which the number of bonds bid exceeded the number of bonds issued.)

As a result, primary bond dealers were left holding a third of the whole issue, which is the worst in almost a year for dealers. This sudden flight in demand suggests fears are setting in about Fed tapering (not even tightening yet), which will cause bond yields to rise more, making today’s bonds worth less down the road.

While bonds already have a long way to move just to properly price in today’s inflation, they have much further to move to price in tomorrow’s. However, as I’ve pointed out before, the Federal Reserve currently owns (as in controls) the yield curve of bonds (the curve along which treasuries of different maturity dates price their yields) because it has been soaking up more than half of all US treasury issuances as soon as the primary dealers buy them.

That, however, will slowly change as the Fed starts to taper back its purchases, leaving it with less and less control over yields with each targeted reduction in purchases until it has none (if it gets to the point of fulfilling its taper promises). The Fed has hinted it intends to be out of purchasing bonds by the middle of next year. So, you can expect bonds to become more realistic in what they telegraph about inflation expectations as pricing starts to become market driven and not entirely Fed controlled (in that he who continually buys and holds half of any market is the market price setter).

In other words, bonds (especially US treasuries) in the months ahead are about to escape their Fed bondage. That untethering will leave them increasingly free to price to real market concerns. Currently, that means old-school analysts who try to gauge inflation based on what bonds are doing have completely missed the train because the bond market currently allows zero price discovery so contains no inflation pricing information at all. (I explained all this here back in July for those who have no idea how the Fed has erased all price information from the US treasury market.)

The US treasury market prices wherever the Fed decides it will at each point along the maturity curve because the Fed controls how much of each maturity it will buy and is buying full-spectrum. When you are soaking up half of all government issuance, that’s a lot of price control. Want lower yields at one part of the curve? Buy more at that maturity date and less along other parts of the bond maturity spectrum.

Therefore, even the idea that the yield curve has to flatten to reveal a coming recession has nothing to do anymore with current or even future reality due to the Fed’s intense yield-curve-control, which I warned my patrons more than a year ago we’d see coming as part of the COVID interventions. You have to learn how to think outside the box when the Fed is taking actions that are completely outside the range of anything ever seen. Yield-curve control has been here since COVID was just getting started, and still no one is talking about it. It’s actually impossible that a single entity can buy up half of all treasuries issued and not have a major suppressing effect on treasury yields. So, where you buy along the curve sets the curve.

The market appears to be trying to price the inevitable asset adjustments in ahead of the Fed’s moves, but keep in, mind, the Fed is still wrestling the treasury market to where it wants it to be, and will only gradually release its grip. No actual change in Fed actions has happened, but the market appears to be starting to anticipate the moves … maybe (as everyone seems a little slow to figure this out).

Stocks may enter bondage to the bond market

As the Fed does start relaxing its white-knuckle grip on the treasury market, you can expect to see stocks struggle more against the current of money that will eventually flow into bonds with higher yields. We may be seeing a hint of those worries pricing in now, too. That’s just one way inflation will eat into the stock market this time by forcing the Fed’s hand. We haven’t seen anything like this because we have not seen any situations where the Fed was already engaged in massive easing as the economy began to collapse and the Fed began to withdraw support from a dependent market just as the collapse began because its hand was forced by relentless (and growing) inflation. (My next article will deal with how the shortages that are part of the inflation equation are about to get MUCH worse. They are not transitory by any means.)

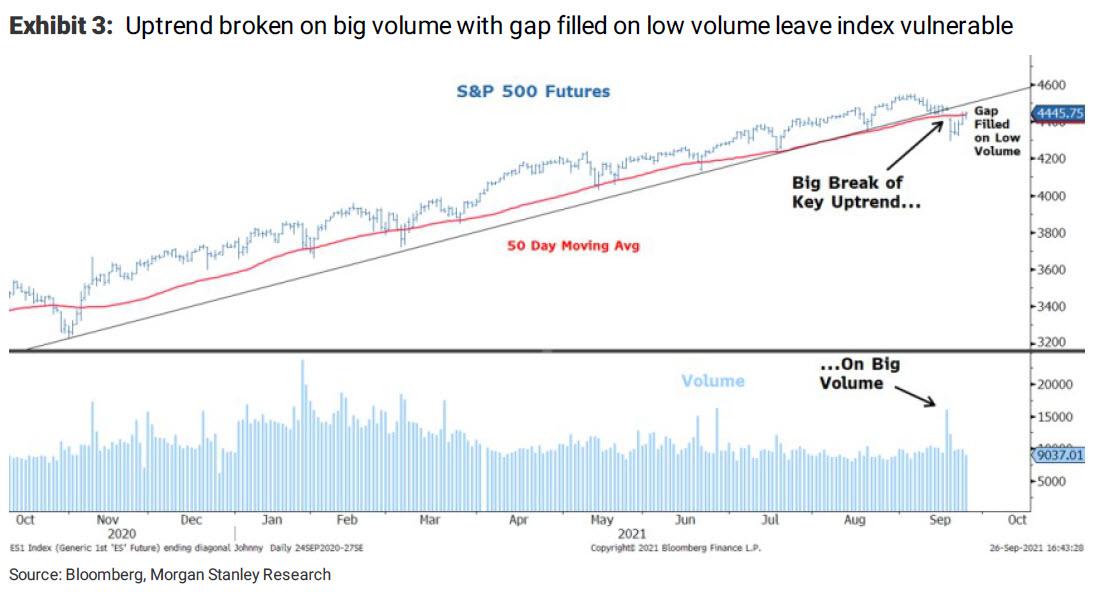

Stocks did better last week than ignore the Fed’s gentle bond tapering hint, but the bliss that comes from momentary relief seems to have been short-lived. Today, the market began to struggle as bonds began to show an attempt at wresting themselves free of Fed control. No big action, and this isn’t the big news of the day or the disintegration of the stock market I said inflation would eventually bring, but market breadth (number of stocks moving upward v. downward) has been deteriorating for months as concerns gnawed away at the market over how inflation might not prove so transitory (it hasn’t) and might push the Fed’s tapering forward (it has). That continually decreasing breadth indicates fewer and fewer investors are participating in or believing in the bull, and that makes each attempt at a new climb more difficult.

Stocks made another slight dip again today.

The S&P has been struggling throughout September with worries appearing in frequent headlines from analysts about how inflation will force faster Fed tapering. So the market was worried something worse than the Fed actually announced might be forthcoming. As you can see, it struggling two weeks ago to find its way back toward 4550, and failed, and it looks like its latest attempt last week failed at a slightly lower level:

Put another way, that looks like this:

Not favorable.

Because the Fed was as dovish as it could possibly be in how it presented its tapering news, the market, at first, appeared calm and took some lift from the fact there were absolutely no surprises from the Fed. However, a little reality may be denting delusional sentiment, and there is a whole LOT of bad reality to come in the month’s ahead, as I am writing starting to write about now.

Again, to be clear, I am not saying this it the point at which the market will fail due to inflation forcing the Fed to tighten, as tapering is still a long way short of tightening. However, we continue to have clandestine tightening going on in the background.

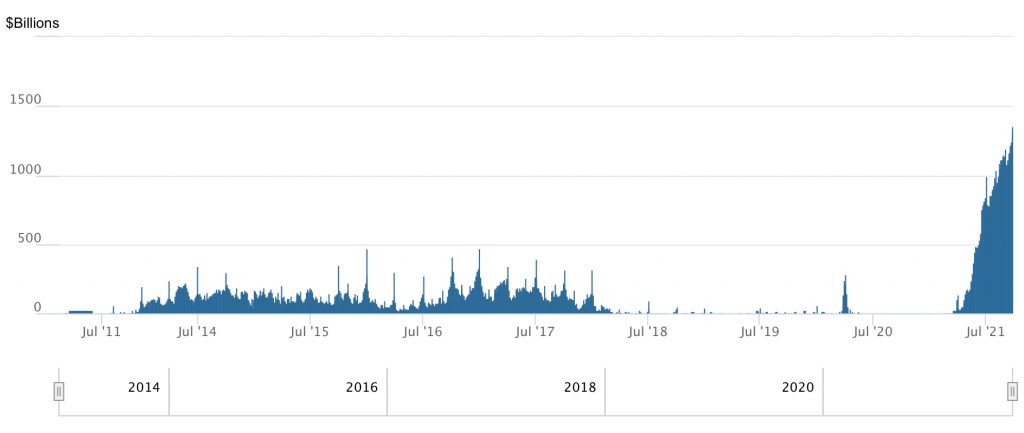

Reverse Repo Crisis Building

Because the Fed is injecting too much liquidity into financial markets in order to keep funding the government’s extraordinary stimulus, such as those checks now going out to families with children, it has had to secretly suck money back out of the system via reverse repos on the banking reserve side where “money” was forming a logjam. (See where I wrote about this secret sucking here.) This is the exact opposite of the Repo Crisis that I warned of in early 2019 and covered extensively when it finally started to unfold in the second half of 2019.

I don’t think the risks from the Reverse Repo Crisis are as crisis-like as what we saw in 2019 in that the historically extraordinary level of reverse repos should start to back down when the Fed finally starts backing off its tapering. Rather, I present them as solid evidence of just how much the Fed’s money printing is not needed in the financial system and has nothing to do with setting financial policy, and how the Fed is being forced to tighten (even if out the back door through Reverse Repos). The Fed is having to mitigate the negative side effects of “financial policy” that has been running way too loose for way too long because the Fed fears backing off, lest it crash stocks, bonds and, as a result, the economy and the everything bubble and causes the government to pay more interest than it can manage.

Think of reverse repos as back pressure. The Reverse Repo Crisis is one of the ways in which we can see the Fed is being forced to taper, and here what that evidence now looks like:

Federal Reserve Bank of New York

Federal Reserve Bank of New York

That mountain that is pushing rapidly toward 1.5 TRILLION dollars that the Fed is sucking out of the financial system EVERY DAY (as in rolling it over and seeing it build) is a good proxy for how much extra liquidity they have sloshed into the system. These are funds banks don’t want to keep in reserves. You can see there were almost none of these operations happening when the system was too tight in 2019 and were only a small amount by comparison in prior years, but I suspect we’ll easily hit 2 trillion dollars in overnight money-sucking by the end of the year before tapering begins to dwindle this back down sometime in 2022.

Those overnight repos are, in essence, tightening that is happening down in the Fed basement (see referenced article) as the Fed keeps adding in money at the other end of the system. It is money banks can’t even find a way to loan out at today’s extremely low interest rates. If the Fed didn’t suck it out, the Fed’s primary interest rate would actually go negative, something the Fed wants to avoid.)

They may also be a way the Fed is preparing to ease the shock of tapering, as it can reduce its reverse repos as it tapers the liquidity injections of its bond purchases, keeping net liquidity constant for awhile, but I am not counting on that being as “boring as watching paint dry.” Not in this acid environment that I will be describing later this week.

Liked it? Take a second to support David Haggith on Patreon!