Excerpted from this week’s edition of Notes From the Rabbit Hole, NFTRH 747, a look at two currently positive macro market signals. When they turn it will be time for change. Meanwhile, the Q4-Q1 broad rally continues:

Two positive macro market signals

Last week we noted two market leadership signals, one positive (Semiconductor and Tech leadership) and one potentially negative (Healthcare relative to the broad market). The potential bottom in the XLV/SPY ratio looks like less of a potential one week later (positive for the markets) as the would-be low got bent out of shape, and Semi and shorter-term Tech leadership are still intact.

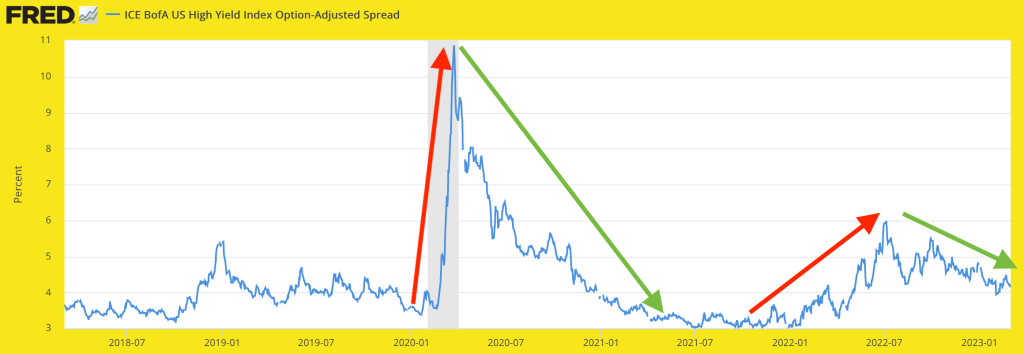

This week let’s look at a signal showing that the stresses of 2022 continue to ease in 2023. Very clearly high yield bond spreads are not indicating a rush to safety or liquidity crisis of any kind yet. In other words, from this vantage point the Q4-Q1 rally theme lives on. The 2020 spike in the spread logically came with a deflation scare and the 2022 bear market began in conjunction with a grind higher in the spread. Currently it is one tool telling us that it’s still okay to speculate long and not yet okay to speculate short unless you, unlike I, have the stomach for shorting against an intermediate bull trending market with intact signals like this.

High Yield spread, St. Louis Fed

High Yield spread, St. Louis Fed

Back in November I labeled the projected broad rally the “Q4-Q1 rally”. It was projected and born of wildly bearish sentiment, projected inflationary relief and by extension Fed hawk relief, and the post-election pattern, which is positive on average over the next year. What we’d want to do is use a picture like the above to a) realize that an unbiased view of the situation shows an intact and beneficial backdrop from an important macro indicator, and b) to be on alert for any changes in status of this and other indicators (one biggie that comes to mind would be a future reversal from inverting to steepening of the 10-2yr and other yield curves).

Bottom Line

The High Yield Spread indicator is currently beneficial to the US based components (at least) of the broad stock rally. If this and other beneficial conditions endure, the rally should endure. And just because I labeled it the Q4-Q1 rally months ago does not mean it cannot extend beyond March. But we’ll let a host of indications (e.g. technical, sentiment, macro) guide as usual.

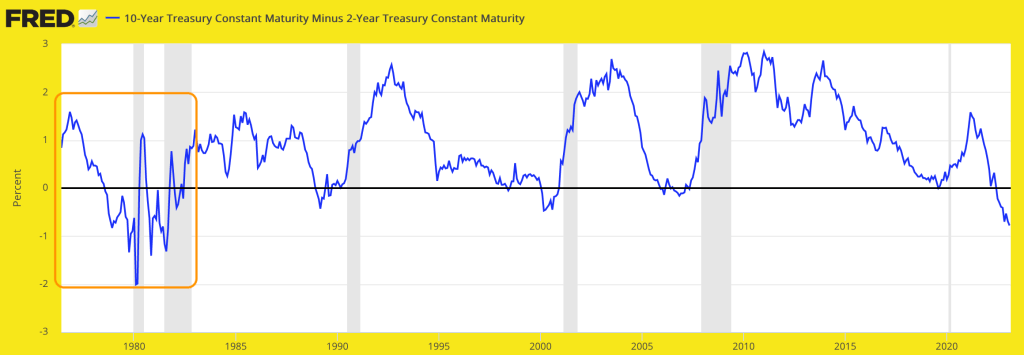

Meanwhile, speaking of the yield curve, let’s leave the segment with the long-term view shown last week. The curve is inverting ever deeper and it is not usually the inversion phase when the fun* begins; it is when the next steepener begins that we will see upheaval in all the pre-programmed thinking by today’s market players; man, woman, machine, Ma, Pa & casino patron alike. So this line burrowing southward can be interpreted as aligned with the gentle downtrend in the High Yield spread above. It’s when they conclude their downtrends that the action starts.

10-2yr yield curve, St. Louis Fed

10-2yr yield curve, St. Louis Fed

* Fun defined here as mayhem, which may well be fun for some who’ve prepared the right way, but will be painful for many more.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.