Suddenly everyone is getting on the same boat I shoved off on by myself months ago, and I find myself keeping some odd company. Even former Treasurer Larry Summers, whom I care for about as much as a harsh sneer, now says the Fed’s next move is likely to be a rate hike. The CPI report, he says, clinches it.

“You have to take seriously the possibility that the next rate move will be upwards rather than downwards,” Summers said on Bloomberg Television’s Wall Street Week.

Well, OK, he only places that at a 25% chance, but he says that is more likely than a move in the other direction. The most likely move is that the Fed holds for now. I agree with that, too, except I’d add that is only because the Fedheads are too afraid to tighten more, not because inflation will let them get away with doing any less. The Fed’s most likely move at its next meeting will be to try to play out its new “inflation is transitory” narrative and hope inflation cooperates. Or as they now put it, “Inflation is just a bump.”

Uh, OK, go with that guys and watch it rise faster. It worked so well for you and all of us last time around. It ought to be a lot of fun to take that for another spin around the block.

According to Larry,

On current facts, a rate cut in June it seems to me would be a dangerous and egregious error comparable to the errors the Fed was making in the summer of 2021.

What he said. Again, we agree, which is making me nervous.

It makes me less uncomfortable to see that Zero Hedge, formerly (and oddly) pivotheads for the better part of two years, finally agrees with me, too:

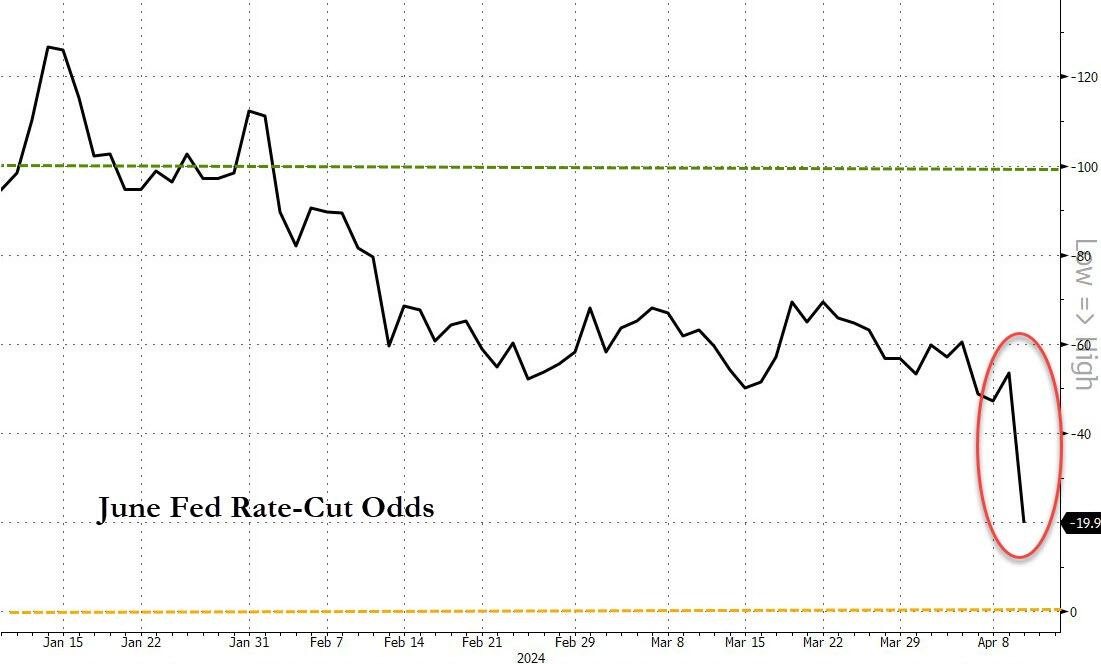

The odds of a June Fed rate-cut have been eviscerated by this morning's narrative-crushing CPI prints with the market now pricing a less-than-1-in-5 chance of a cut.

And here is how they show those rate-cut odds having been wiped away as the market suddenly got religion or something:

Whoa! Delusions broken. At least, for now, but give investors a wisp of faint hope tomorrow, and greed may go from free fall to free floating again.

As I predicted we would see, we are now seeing even from the big banks like JPM:

The upside surprise in core CPI is moving the inflation data further away from the convincing evidence the Fed needs to start cutting in June. Dependent on the PPI data tomorrow, this print tilts the Fed toward a later start to the cutting cycle than our current forecast for June.

Yes, June is quickly passing out of style. Some, however, have been slow to get religion or whatever it is one calls it when something strong enough to break calcified denial finally breaks it. The following big gambler yesterday is probably rubbing his greedy the-market-always-goes-up wounds because that is the ultimate cost of denial I’ve been trying to warn people away from:

Yeah, that didn’t time out well for anyone going long on the short end of inflation. Ah well, I’ll save my sympathy for those with brains. It hasn’t been hard to see the certain rise of inflation coming, though few seemed capable, and the report merely took the fuzziness off the edges of the picture … apparently for almost everyone at once … for now.

So, stocks fell off the ledge. Gold settled back down, which was something I warned about on Goldseek Radio a few weeks back but then gave up on myself as gold kept fearlessly rising anyway, and I wished it well for the long haul. Overall, I said the future is shiny and bright for gold, but in the immediate term, I warned, the Fed will have to go back to raising rates, which would likely cause problems for gold in the months ahead; however, there is not much further the Fed can raise rates until it breaks everything. It’s limited by how much interest the low-to-no-interest-addicted markets and general economy can bear, which is not much after years of poolside lounging while dining on low-hanging financial fruit.

As gold dropped, the dollar spiked. That, of course, is pretty clear evidence that markets are seeing that, yes, the Fed has another rate hike or two in store — the limit not being what will break sticky and even resurgent inflation, but what will break the economy on all fronts. After all, mortgage interest popped again, too, leaping past 7%, making highly inflated houses all the more unaffordable. Something surely has to break there at some point in the direction of helping people locked out of affording a home, not in the direction of retaining value for those who already own. (But if you’re there to stay, you needn’t care about that.)

Bond yields also exploded higher with the 10YR busting past 4.5%, but it still has a ways to go to get back to the inflation-defeating 5% bar it held before Powell decided to blow up his own inflation war with soft talk last November, which markets were only too eager to mistakenly understand as some sort of dim clue that the Fed would pivot in March. Gone are those days! The 2YR yield is now getting very close to 5%. At those levels Treasuries will be seriously sucking money out of stocks for the practically free ride of doing nothing but sitting home with zero risk and clipping interest coupons. Those days won’t be long in coming.

This resulted in the long-inverted yield curve turning back toward deeper inversion. I’ve always said, “Don’t expect this yield curve to fully revert ahead of the coming recession, as it has always done in the past as the most precise signal of recession. The bond market has been so distorted by the Fed for so long that gauge is likely broken this time, just like the Fed’s labor gauge.” So, here, the curve became more inverted, even as the prospects for recession rose.

Another article affirms that aspect of the CPI Report:

With inflation back up, the long-predicted storm clouds in the economy may actually be forming

Progress on inflation is moving in the wrong direction. The latest Consumer Price Index, released Wednesday, showed that annual inflation ticked up to 3.5% in March from 3.2% in February. That marked the largest annual gain in half a year.

And, of course, it has been for more than half a year that I have been pointing out the incremental gains. We’re now almost at ten months where I’ve been showing inflation insidiously crawling back upward—first in the buried numbers behind the numbers, then in the monthly changes, now finally showing up, as I warned was inevitable after you get enough monthly increases, in the year-on-year numbers, which is where it finally all got real enough to scare the larger crowd into possibly seeing the light.

Here, too, another financial writer finally got religion, saying that the recent CPI report,

signifies the highly anticipated rate cuts investors were banking on may not come this year. Now, instead, they may need to brace for another rate hike as interest rates stand at a 23-year high.

No, those cuts won’t come this year (unless the economy and/or banks blow to bits), and most likely we will have to brace for another hike to knock inflation on the head as well as to tap down the rambunctious greed of all those gamblers in markets who denied the clear truth that inflation was back on the rise for months. They don’t see what they don’t want to see.

This could mean that the many influential leaders and economists who long predicted storm clouds and a hurricane hitting the US economy may finally be right.

Indeed, it could … and will … but where exactly will you find “many” of those? I’ve hardly heard any.

JPMorgan’s Jamie Dimon is getting credit for seeing this coming, as I said he probably would. So he is one “the many,” and he’s coming out smelling like a saint, as I indicated would happen yesterday, and not like the horned demon that his name, when appropriately pronounced, suggests he is, as he waits like a vulture to get a cheap diet of greedy banks gone bust. It’s always a little rough, but never unexpected, to see Dimon highly praised for his wisdom while the bulk of the world never knows I even exist, though I’ve been sounding that warning far longer. However, many of us get to feel that way in life. It is the way of the world … to honor the rich. You do all you can to warn the world, and then watch the banksters take all the credit for speaking up at the last minute! At least, he was about the only bankster willing to cough up the clear truth about what would be shortly coming down upon the economy, markets, and banks.

Governor Bowman of the Federal Reserve is being quoted again for being the first bankster at the Fed to come right out and admit the Fed may have to raise rates. Good on her. She made her statements after the Fed’s favorite inflation gauge—the Personal Consumption Expenditures price index—accelerated in its latest report.

“In one word, the report was discouraging for the Fed and the prospects of a June cut,” Bank of America economists said in a note published after Wednesday’s CPI report. “Inflation is proving sticky.”

No kidding!

Still, even those who seem to be getting it are slow to get what they think they are now getting:

They [BofA] still feel a June cut will happen but have “low confidence.”

I would have very low confidence in that prognostication if I were them. They’re just reluctant to admit their error.

The article goes from there to indicate signs of the economic slowdown that is already starting to form.