Gold and silver have hogged the spotlight; however, the platinum group metals (PGMs) have had a breakout year as well.

Platinum has surged by 92 percent in 2025, and palladium has gained 65 percent. Meanwhile, the price of rhodium (A rarer PGM used in catalytic converters and in anticorrosion applications) surged by 79 percent.

Six rare metals make up the platinum group: platinum, palladium, rhodium, ruthenium, iridium, and osmium. The metals share similar chemical properties, including high melting points, strong corrosion resistance, and catalytic power.

PGM demand primarily flows from industrial applications. Platinum and palladium are integral inputs in the production of catalytic converters for both gasoline and diesel-powered engines. They are also used in chemical and petroleum processing, electronics, and specialized medical and industrial equipment. Platinum is popular in jewelry, and both platinum and palladium garner physical investment demand.

What is behind the meteoric rise in the price of PGMs in 2025?

Many of the supply and demand dynamics that have driven silver higher are also at play in the PGM markets. They are in structural deficits with very tight supplies.

For instance, the global platinum market charted its third straight significant structural deficit last year, and we should expect these supply shortfalls to continue into the foreseeable future, according to the World Platinum Investment Council (WPIC).

Platinum demand outpaced supply by 995,000 ounces last year. That was 46 percent higher than forecast.

The WPIC expects a market deficit of around 848,000 ounces in 2025.

Like silver and gold, the PGM markets also experienced a displacement of metal due to tariff worries. They are also getting a boost from looser monetary policy and dollar devaluation.

The 2025 PGM market played out in two distinct phases.

PGMs began the year with range-bound trading, continuing a multi-year trend. As Metals Focus described it, platinum, palladium, and their cousins traded in “narrow, orderly ranges.”

“Persistent deficits, thinning liquidity and muted secondary supply shaped conditions.”

During the first quarter, platinum’s 30-day annualized volatility hit the lowest level since 2018, reflecting the sense of stability in the PGM market.

However, underlying market tightness already existed, and pressure was building.

Flooding in South Africa disrupted mining operations and added to the supply pressure. The country supplies more than 70 percent of global primary platinum and over 80 percent of rhodium, ruthenium, and iridium.

Russia is another significant supplier of PGMs. Its economy has been crippled by sanctions.

Supply disruptions were combined with persistent weakness in secondary supply, driven by subdued recycling activity.

This supply pressure began to manifest first in rising prices for two PGMs. Rhodium rose by 25 percent through Q1.25 to $5,700. Ruthenium gained roughly 35 percent to $630, aided by improving chemical and electronics demand and strong speculative interest in China.

However, despite tightening fundamentals, the platinum and palladium markets remained relatively subdued, with both gaining about 8 percent by the end of March.

Tariff worries set off the breakout for the other PGMs.

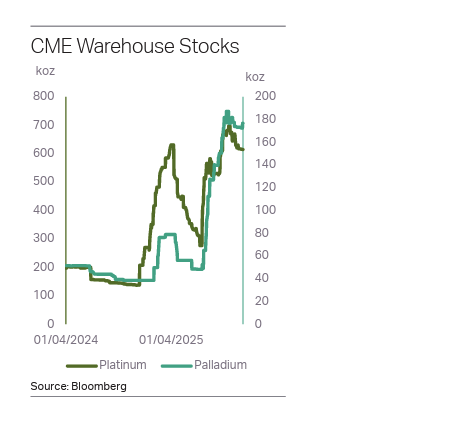

As was the case with silver, large amounts of metal moved from overseas into CME vaults in New York in an effort to get ahead of potential tariffs. Both platinum and palladium stocks in CME warehouses surged.

As Metals Focus explained,

“Once it became clear that the tariffs would not apply to platinum and palladium, and as the outlook for the auto sector weakened, metal began to leave CME warehouses and inventories declined through April and May. While these shifts did not initially drive price action, they framed the volatility that followed.”

Gold’s spring rally created further tailwinds for the PGMs. A series of all-time highs incentivized some investment rotation into platinum and palladium, particularly in China. Rising gold jewelry prices also sparked renewed interest in platinum jewelry.

PGM imports into China and Hong Kong rose sharply, and prices responded accordingly. Platinum surged by 47 percent to around $1,335. Palladium approached $1,100, a 20 percent gain, and ruthenium climbed by close to 50 percent.

Prices got another boost in July when tariffs levied on copper reignited worries that the PGMs would also fall under the tariff axe. This restarted the movement of metal to the U.S.

Regime uncertainty created by unpredictable tariff policy was exacerbated by a Section 232 investigation involving PGMs. The U.S. Department of Commerce runs these investigations to determine whether imports of a specific product are entering the U.S. “in such quantities or under such circumstances” that they threaten national security.

Metals Focus explained the implications.

“As the inquiry includes PGMs under the U.S. Geological Survey (USGS) critical-minerals framework, it introduced a durable uncertainty premium. Aside from COVID, PGM flows have never redirected so sharply, and this shift stemmed from policy rather than fundamentals.”

While gold was hogging the headlines, platinum ended H1 as the best-performing commodity, rising by almost 50 percent through the first six months of 2025.

The metals got another boost early in the third quarter when petitions were filed against Russian palladium imports into the U.S. The U.S. International Trade Commission (USITC) issued a preliminary injury finding in late August, and prices rose accordingly. Platinum surged to $1,563, and palladium climbed to $1,255.

The launch of physically delivered platinum and palladium futures on the Guangzhou Futures Exchange in late November provided Chinese industrials and traders with an onshore hedging mechanism and strengthened China’s role in price discovery. This, coupled with more monetary easing, further boosted demand as we headed into the final months of the year.

Looking ahead, Metals Focus sees a continuing bullish setup.

“As 2025 closes, the PGM complex remains shaped by structural deficits, constrained recycling, geopolitical risk and increasingly regionalized liquidity. Liberation Day acted as the catalyst for some of the year’s most abrupt moves, but deeper supply and investment forces sustained the rally.”

Metals Focus projects prices will likely hold around current levels with some upside still possible, “supported by ongoing tightness and the behavioral imprint of a year in which market rules briefly shifted, and their consequences echoed long after the events.”