As the richest nation and the world’s largest economy, it is hardly a surprise that the United States holds the most gold.

What is surprising is where the gold isn’t: the United States Federal Reserve, known colloquially as the central bank.

Mainstream media dutifully reports that the American central bank is number one out of the top 10 gold depositories in the world. Its 8,133 metric tons are worth a staggering $630 billion at USD$2,2200/oz*

Editor's note: *Price of gold as of this writing; gold hit a new record last week of over $2,500/oz.)

Most of this gold, primarily in bar form, is held in “deep storage” in Denver, Fort Knox and West Point. The rest is used to mint coins.

Yet according to Board of Governors of the Federal Reserve System, “The Federal Reserve does not own gold.”

If the Fed owns no gold, how can it hold it as a reserve asset?

Here is where it gets interesting.

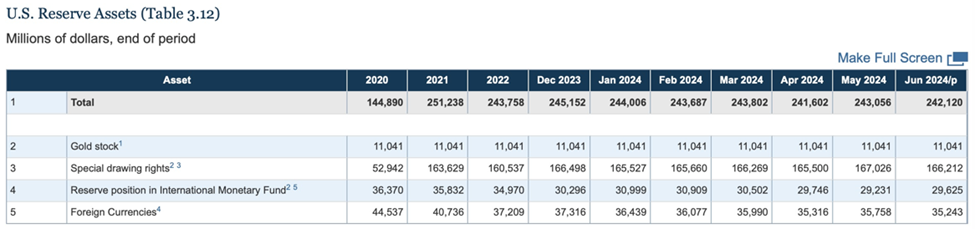

Not included in the gold stock of the United States is gold held “under earmark” at Federal Reserve Banks. This gold is only valued at $42.22 per fine troy ounce, according to the Board of Governors of the Federal Reserve System.

What is this mystery gold? And why is it valued so low? A clue to the answer is the rest of line 2 in the table below. The $11,041 million value doesn’t change, because the gold is consistently valued at $42/oz.

Source: Board of Governors of the Federal Reserve System

Source: Board of Governors of the Federal Reserve System

To understand why, we need to give a little history lesson.

How the Fed lost its gold

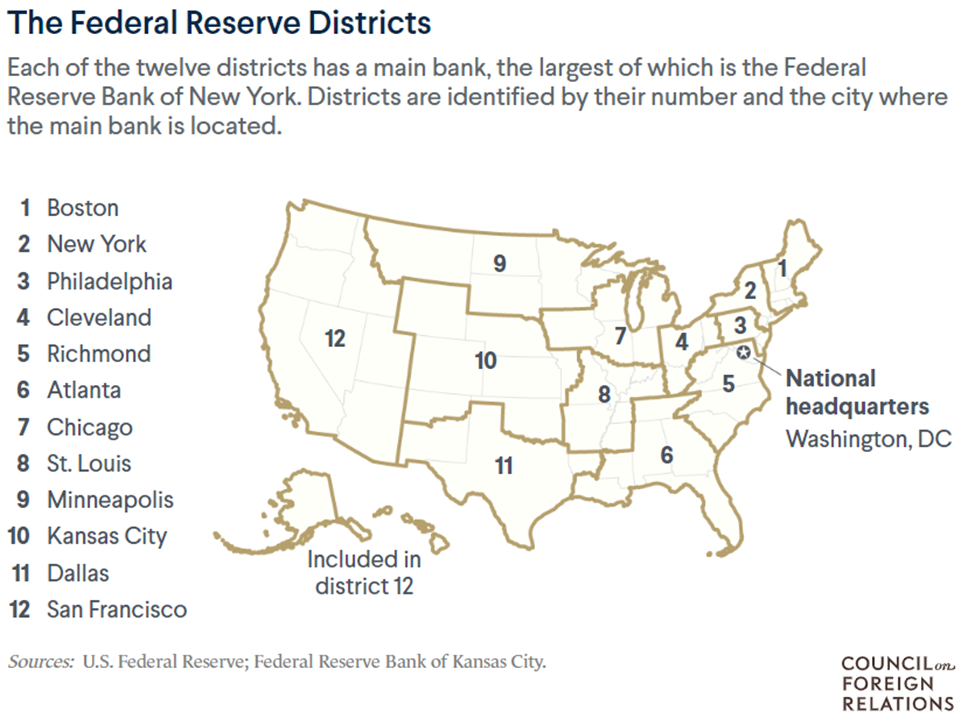

In 1913 President Woodrow Wilson signed into law the 1913 Federal Reserve Act.

Each of the federal reserve Districts has a bank which is an independent corporation with its own corporate charter and board of directors.

These entities are legally banks, and each piece of paper currency has to tell you which bank is liable for it.

– ‘Why are Federal Reserve regional banks listed on U.S. currency?’ Marketplace July 7, 2023

This explains why, on every $1 and $2 bill, we find a seal with the name of the regional Federal Reserve Bank that distributed it. On other denominations, there is a letter-number combo that represents the regional bank.

Source: Marketplace

Source: Marketplace

Before 1934, a US citizen could walk into a Federal Reserve regional bank and convert their dollars into gold. The banks were required to keep in their vaults at least 40% of the gold they owed to the holders.

For example, if the Dallas Fed had a million dollars in circulation, it would have to keep $400,000 worth of gold.

In 1933, during the Great Depression, there was a banking crisis that caused people to pull their money out of banks and convert it into gold. The Federal Reserve Banks started running out of gold because of the “40%” rule.

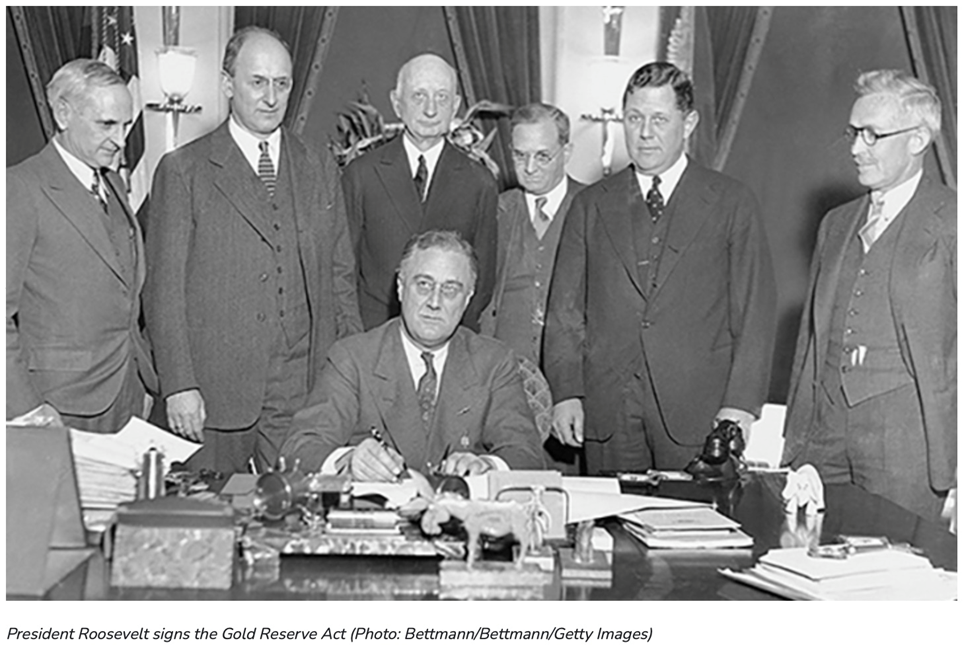

When President Franklin D. Roosevelt took office, he declared a bank holiday which stopped all banking transactions. The public was asked (their gold was not confiscated) to redeem all gold coins and gold certificates worth more than $100 for paper money. (numismatic coins were exempted)

Early the next year, Roosevelt signed the Gold Reserve Act into law, which transferred ownership of US gold from the Federal Reserve System to the US Treasury.

The Treasury and financial institutions were also banned from converting paper dollars into gold. Nowadays, the Federal Reserve regional banks are generally backed by US government bonds, states the Marketplace article.

Source: Federalreservehistory.org

Source: Federalreservehistory.org

To be clear, the Fed has owned no gold since 1934, when it handed over all its gold in exchange for gold certificates. This is how the Fed’s Board of Governors summarizes the situation:

The Federal Reserve does not own gold.

The Gold Reserve Act of 1934 required the Federal Reserve System to transfer ownership of all of its gold to the Department of the Treasury. In exchange, the Secretary of the Treasury issued gold certificates to the Federal Reserve for the amount of gold transferred at the then-applicable statutory price for gold held by the Treasury.

Gold certificates are denominated in U.S. dollars. Their value is based on the statutory price for gold at the time the certificates are issued. Gold certificates do not give the Federal Reserve any right to redeem the certificates for gold.

The statutory price of gold is set by law. It does not fluctuate with the market price of gold and has been constant at $42 2/9, or $42.2222, per fine troy ounce since 1973. The book value of the gold held by the Treasury is determined using the statutory price.

Why central banks buy gold

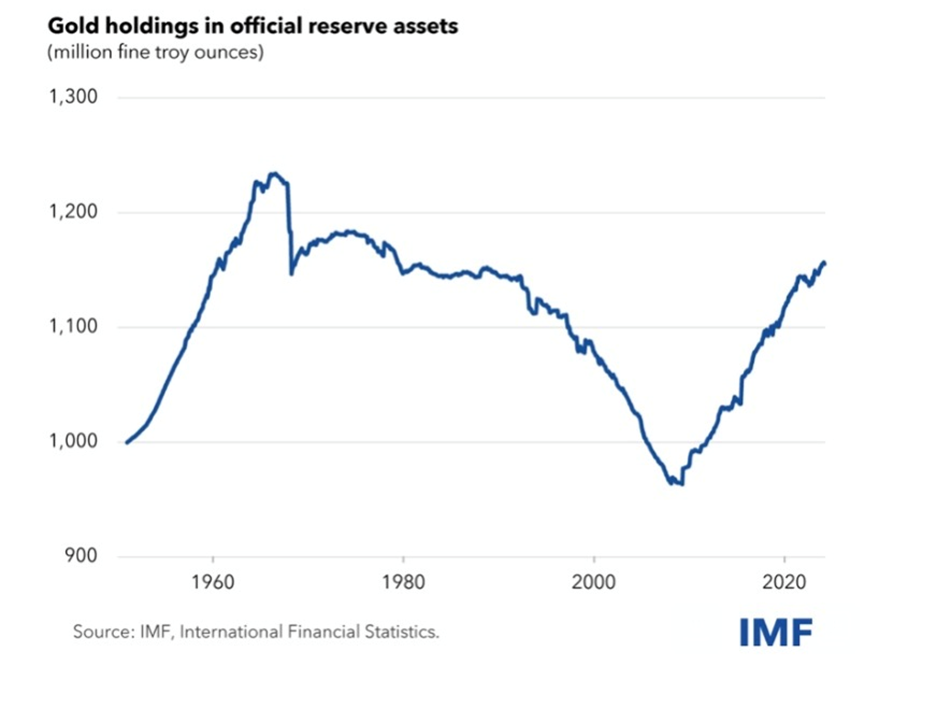

Back in the early 1990s and 2000s, central banks were continuously selling off gold as strong economic growth during that time rendered bullion less attractive than currencies in many places. Some, such as those in Western Europe, were even selling hundreds of tonnes a year!

Then the 2007–08 financial crisis came, triggering a complete 180 in the official banks’ approach to gold. From 2010 onwards, central banks have been net buyers on an annual basis. About 80% of central banks currently hold gold as part of their international reserves.

Bullion holdings are included in “reserve assets” of central banks. After decades of shedding their holdings, CBs are rebuilding them. According to the IMF, they’re currently at 1.16 billion troy ounces —roughly $2.7 trillion of $12.3 trillion in foreign exchange reserves.

Global central banks own about 17 percent of all the gold ever mined, with reserves topping 36,699 metric tons (MT) as of year-end 2023. They acquired the vast majority in the last 14 years after becoming net buyers of the metal in 2010. Top 10 Central Bank Gold Reserves

Central banks like gold because the metal is expected to hold its value through turbulent times and, unlike currencies and bonds, it does not rely on any issuer or government. It also enables central banks to diversify away from assets like US Treasuries and the dollar.

INN adds Central banks purchase gold for a number of reasons: to mitigate risk, to hedge against inflation and to promote economic stability. Increased concerns over another global financial crisis have as expected led central banks once again to build up their gold reserves.

A Bloomberg opinion piece says central banks are buying it for the long term to hedge political risk; to underpin their own currencies; to offset any decline in the value of the dollar; and in place of US government bonds, which given the rate at which the US is accumulating debt ($1 trillion every 100 days, says Bank of America Corp.) are no longer deemed to be free of risk.

Obviously the US central bank (the Fed) is not among banks that buy gold for the purpose of “de-dollarization”.

(This brings up another interesting point. If the US doesn’t need to buy gold, because the USD is the reserve currency and the US government can simply print more dollars or issue US Treasuries to finance its debt, why doesn’t it sell its gold, like Canada and British (foolishly) did? Clearly the United States believes its gold is valuable — either because it thinks gold is going higher, or to my mind, it’s more because egregious money-printing throughout the Western world has devalued currencies. It certainly tells you something about gold, when the country with the reserve currency is hoarding 8.13 metric tons of it.)

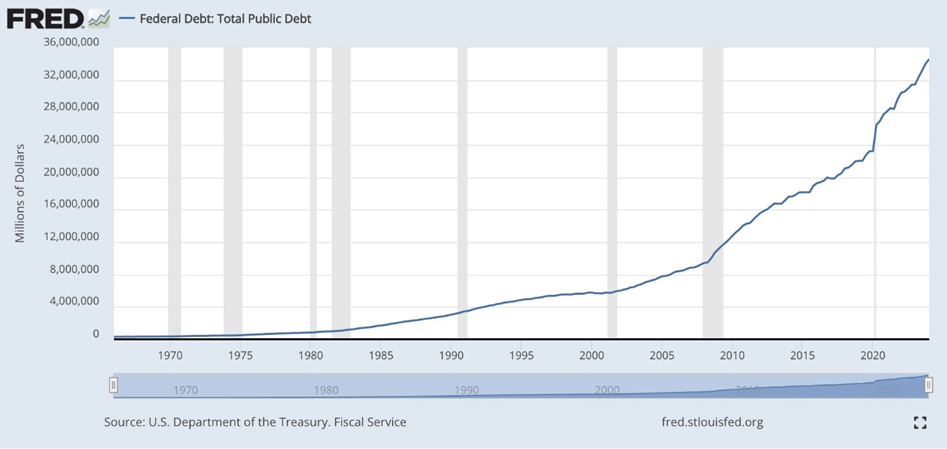

Excessive borrowing and money-printing has caused the US debt to balloon to $35 trillion. The currency of every empire since the Romans, and their denarius, has eventually become worth less.

Source: FRED

Source: FRED

It’s no surprise then to see Russia and China being the most aggressive gold buyers in recent years, accounting for about half of the total tonnage bought worldwide over the past two decades.

The rationale behind these purchases, according to industry experts, is to protect against foreign seizures, as many of these banks want to hold more bullion as a buffer against any current or future sanctions. The Central Bank of Russia, for example, can use gold to replace the USD (i.e. “de-dollarization”) and circumvent Western sanctions when it comes to international trade.

“We think this trend of central bank buying is likely to continue amid heightened geopolitical risks and elevated inflation,” UBS said via a Business Insider report. “In fact, the US decision to freeze Russian foreign exchange reserves in the aftermath of the war in Ukraine may have led to a long-term impact on the behavior of central banks.”

In short, there’s an added layer to the motives behind most of the gold buying by today’s central banks.

Forbes Finance Council’s Sanford Mann describes the distinction perfectly: “Where US, European and Asian banks tend to see gold as a historical legacy asset, EMDE banks tend to see it as a strategic asset.”

“As globalization accelerates, the non-G-10 nations are expected to ‘re-commoditize’ and ramp up gold holdings,” Nicky Shiels, head of metals strategy at MKS PAMP, mentioned to Forbes.

Notwithstanding their motivations for buying gold, the importance of central bank gold holdings cannot be understated. CBs hold about 17% of all gold ever mined, with reserves over 36,699 tonnes as of Dec. 31, 2023.

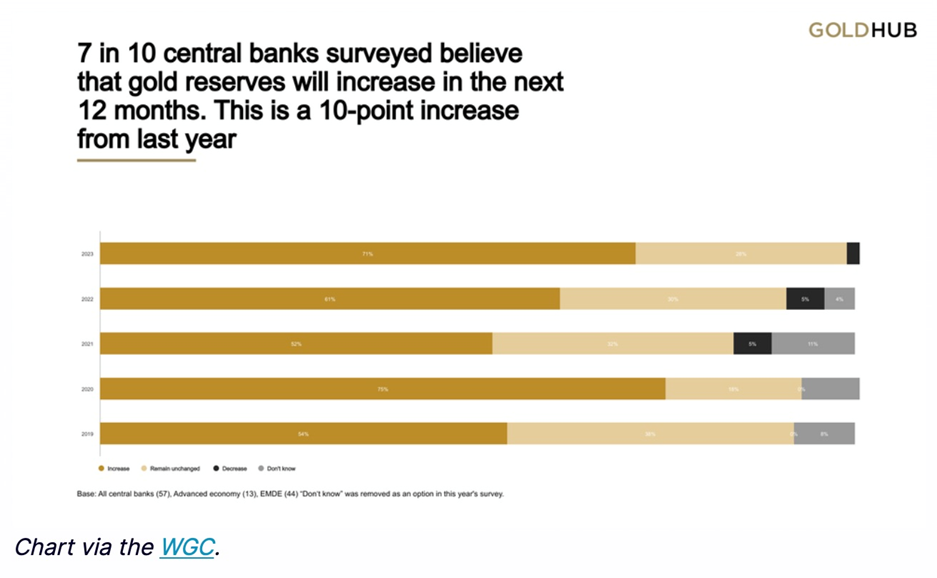

According to the World Gold Council, in mid-2023, 70% of central bankers polled in a survey said they expected global gold reserves to increase over the next 12 months. Central banks added 1,037Mt of gold to their vaults in 2023, the second year in a row they exceeded 1,000Mt. In the first quarter of 2024, CBs bought another record 290 Mt, of gold, reports the WGC.

Source: Gold Hub

Source: Gold Hub

Conclusion

A “Minsky Moment” refers to a point in time when a period of bullish speculation leads to a spectacular market crash.

Named after economist Hyman Minsky, the theory centers around the inherent instability of stock markets.

“Minsky held that, over a prolonged period of prosperity, investors take on more and more risk, until lending exceeds what borrowers can pay off from their incoming revenues. When over-indebted investors are forced to sell even their less-speculative positions to make good on their loans, markets spiral lower and create a severe demand for cash — an event that has come to be known as a ‘Minsky moment.”

– The Levy Economics Institute of Bard College

AOTH asks, “Is the current US stock market, and global economy, approaching a Minsky Moment?” If so, precious metals gold and silver will surely go ballistic in the aftermath of the collapse.

The intellectual challenge is identifying the metaphorical pin that pops the bubble, which investors, banks and governments have been happily inflating.

I’ll pinpoint some catalysts that could lead the global, and US economy down a road of economic ruin:

- A collapse in ocean freight shipping rates;

- “Fake” good news that is masking serious problems in the US economy, like a lack of business investment;

- Record share buybacks that enrich management not companies nor their shareholders;

- Any number of “white swan” geopolitical risks – hotspots that could at any time boil over into a conflagration that destabilizes the fragile global economy;

- US tariffs on all the products its domestic industries can’t compete against;

- US loses its “exorbitant privilege” as the reserve currency.

The truth of the matter though, is these are all symptoms of a bigger, much more insidious disease, and that is paper money — more specifically, piles and piles of consumer, business and government debt that has been allowed to accumulate, without consequences, under our fiat/ paper monetary system.

Gold’s Minsky Moment will come when everyone realizes that the paper monetary system, and its reserve currency, the US dollar, has no intrinsic value, and therefore can no longer be trusted — when money is worth nothing but the paper it’s printed on, and previously rejected gold and silver re-emerge as currency backstops.

Perhaps when that happens, the Federal Reserve will try to get its gold back.