Sound money is a concept that refers to money that retains its value over time and provides a stable foundation for economic transactions. It is a form of currency that people can trust to preserve purchasing power, resist inflation, and facilitate trade.

Sound money is often associated with gold and silver, but it can also refer to any currency that maintains stability through limited supply and widespread acceptance.

In modern markets, the stability of sound money can be contrasted with the volatility of paper money, which can lose value due to inflation and debt accumulation.

When Did Sound Money Begin?

The idea of sound money dates back thousands of years. It began when ancient civilizations, such as the Lydians and Egyptians, started using precious metals like gold and silver as a medium of exchange. These metals were chosen because of their key qualities—durability, divisibility, and rarity—that made them suitable as money.

The first coins made of precious metals appeared around 600 BC in Lydia (modern-day Turkey), marking the beginning of sound money in a more formalized way. This innovation introduced a new category of financial tools, easing trade and economic transactions.

Where Did Sound Money Begin?

Sound money began in ancient civilizations where trade and commerce required a reliable medium of exchange. The use of precious metals as money can be traced back to ancient Mesopotamia, Egypt, and Greece.

However, it was in Lydia that the first standardized coins were minted, giving rise to a more formal system of sound money. The use of sound money spread throughout the ancient world, influencing the development of economies across Europe, Asia, and the Middle East.

Coins created a stable way to account for value, much like modern paper money, but without the risks associated with inflation and national debt.

The Philosophy Behind Sound Money: Who and What

The term "sound money" is sometimes mistakenly believed to originate from the sound that hard money, or specie money, makes when struck.

However, according to writer Joshua D. Glawson of Money Metals Exchange, "sound money" actually derives its name from philosophy. The "soundness" of money refers to its validity and reliability, much like a sound argument in logic. Just as a logo can symbolize trust and integrity for a company, sound money represents reliable value in financial systems.

Deductive reasoning is a form of logical thinking in philosophy that involves reaching conclusions based on established facts. In deductive reasoning, an argument is considered sound if it is both valid in form and has no false premises. This means that the conclusion of a sound argument must be true if the premises are true.

Similarly, sound money is money that is valid and true in its premises. When money is made from a commodity, such as gold or silver, its value is tied to the marginal utility of that commodity. The further money is removed from this true value state, the less sound it becomes. Just as a valid argument can be unsound if its premises are false, money can lose its soundness if it is not backed by a stable, real-world asset like gold or silver.

In contrast, modern paper money often struggles with maintaining this underlying marginal utility value, leading to wild fluctuations in prices and economic instability.

Who Were the Main Philosophers and Proponents of Sound Money?

Throughout history, many philosophers, economists, and deductive thinkers have advocated for sound money. Some of the most notable proponents include:

- Aristotle: The ancient Greek philosopher discussed the qualities that make a good form of money, emphasizing durability, divisibility, and marginal utility.

- Nicole Oresme: A 14th-century French philosopher and theologian, Oresme is one of the earliest proponents of sound money. In his treatise De Moneta, he argued against the debasement of currency and emphasized the importance of maintaining the value of money, making him a key figure in the history of sound money.

- Richard Cantillon: An 18th-century economist, Cantillon is often considered one of the precursors to modern economic theory. His work, Essai sur la Nature du Commerce en Général, highlighted the effects of inflation and the importance of sound money in maintaining economic stability - this is known as the Cantillon Effect or the Cantillon-Hume Effect. Cantillon's insights into how money circulates in the economy and how unsound money leads to wealth redistribution are foundational in understanding the impacts of monetary policy.

- David Hume: The Scottish philosopher and economist argued that sound money is essential for economic stability and growth.

- Adam Smith: In his seminal work, The Wealth of Nations, Smith highlighted the importance of sound money in fostering trade and economic development.

- Carl Menger: A founder of the marginal utility theory, Menger explained how money naturally evolved as the most marketable commodity, leading to the adoption of gold and silver as sound money.

- Ludwig von Mises: A prominent economist, Mises argued that sound money is crucial for a free and prosperous society, advocating for a return to the gold standard.

- Friedrich Hayek: F.A. Hayek, a Nobel laureate, emphasized the role of sound money in preserving individual freedom and preventing government overreach in monetary policy.

Why is Sound Money Important?

Sound money is important for several reasons:

- Economic Stability: It provides a stable store of value, preventing the erosion of wealth through inflation and ensuring that money retains its purchasing power over time. This financial stability is crucial in preventing debt crises and maintaining healthy markets.

- Trust in the Economy: Sound money fosters trust in the monetary system, encouraging people to save, invest, and engage in trade without fear of sudden devaluation or hyperinflation. In the context of America, where the economy plays a pivotal role on the global stage, maintaining sound money is essential for both domestic and international economic confidence.

- Protection Against Government Overreach: By limiting the ability of governments to print unlimited amounts of money, sound money acts as a check against reckless fiscal policies and ensures that monetary policy remains disciplined. This discipline is crucial for maintaining financial stability and protecting the value of personal and national assets.

- Long-term Planning: Businesses and individuals can plan for the future with confidence, knowing that the value of their money will not be undermined by inflation or currency manipulation. A stable financial environment, supported by sound money, encourages wise investment strategies and secure savings.

Ultimately, whether dealing in paper money or coin, the principles behind sound money remain a key ingredient in ensuring financial health and stability across all markets and categories of economic activity.

The Analogy of Plato's Cave and Sound Money: How it Affects Perception

Much like Plato's Cave allegory, where prisoners mistake shadows for reality, the further money gets from its true soundness—grounded in commodities like gold and silver—the less real its value becomes in the marketplace. This distorted perception can lead to economic disillusionment.

The invisible but destructive effects of monetary inflation, much like the shadows on the cave wall, become increasingly felt and seen like a destructive invisible fist across the market that uses such unsound money.

This analogy emphasizes the importance of maintaining sound money to ensure that the economic reality remains clear and stable, fostering trust in financial systems and secure banking practices.

The Seven Key Qualities of Sound Money: How Sound Money is Defined

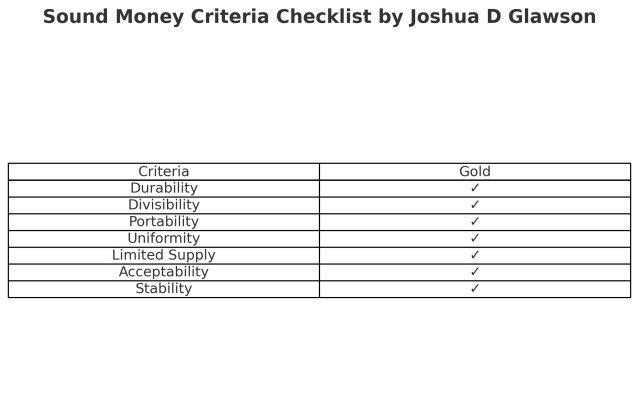

In his article "Austrian Economists and the Value of Gold as Sound Money," Joshua D. Glawson outlines the essential qualities that define sound money. These seven key qualities ensure that sound money effectively serves its roles, providing a foundation for secure and reliable financial transactions.

- Durability: Sound money must withstand the test of time without deteriorating. Gold, for instance, does not corrode or degrade, making it a durable store of value, a fundamental ingredient in a stable economy.

- Divisibility: Sound money must be easily divisible into smaller units to facilitate transactions of varying sizes. Gold can be divided into smaller quantities without losing its value, which is crucial for its use as money and for maintaining a stable credit system.

- Portability: Sound money should be easy to transport and transfer from one person to another. Gold’s high value relative to its weight and volume makes it portable and convenient for trade, adding to its reliability as a secure financial reserve.

- Uniformity: Each unit of sound money must be the same as every other unit. Gold coins and bars can be standardized in terms of weight and purity, ensuring uniformity and trust in the medium of exchange.

- Limited Supply: Sound money should have a limited supply to maintain its value. Gold’s scarcity ensures that its supply cannot be easily increased, protecting against inflation and securing long-term financial information integrity.

- Acceptability: For money to be sound, it must be widely accepted in trade. Gold’s long history of use in various cultures and economies has established it as a widely accepted medium of exchange, making it a reliable asset in the financial world.

- Stability: Sound money should maintain its purchasing power over time. Gold has historically been seen as a stable store of value, protecting against the erosion of wealth through inflation, and providing a secure basis for investments.

Differentiating Between Sound Money, Stable Money, Hard Money, Specie Money, and Fiat Money: What Types of Money Exist?

Understanding the different types of money can help in grasping the nuances of sound money:

- Sound Money: Philosophically valid and tied to a commodity like gold or silver, ensuring long-term purchasing power. Its value is tied to something real and tangible, making it resistant to inflation and devaluation, thus providing a secure financial position.

- Stable Money: Focuses on maintaining consistent value but may or may not be commodity-backed. Stability in value is often managed through careful monetary policy, aiming to control inflation and avoid sharp fluctuations, which is essential for long-term financial planning and secure savings.

- Hard Money: Sometimes referred to as “hard currency,” this form of money is either physical specie money or directly backed by a physical commodity, making it difficult to produce or increase in supply. This resistance to inflation and devaluation makes hard money valuable over time, much like a secure financial reserve. Typically, hard money is an interchangeable description for specie money.

- Specie Money: A specific type of hard money that consists of coins made from precious metals like gold and silver. The value of specie money is directly derived from the metal content of the coins, making it a tangible and universally accepted form of money and a stable financial asset.

- Fiat Money: Currency that has no genuine value and is not backed by a physical commodity. Its value comes from the faith, trust, and authority of the government that issues it. Fiat money can be created in unlimited quantities arbitrarily by governments or central banks, which can lead to inflation if not managed carefully, sometimes resulting in a less secure financial environment.

Conclusion

Sound money is a foundational concept in economics, representing a stable and reliable form of currency that holds its value over time, making it essential for individuals and businesses to conduct transactions with confidence and avoid the risks associated with fluctuating digital currencies or unstable cash systems. stable, reliable form of currency that retains its value over time. It began in ancient civilizations with the use of precious metals and has been championed by philosophers and economists throughout history. Today, sound money remains essential for economic stability, trust, and long-term prosperity. Whether implemented through gold standards, cryptocurrencies, or disciplined monetary policies, sound money continues to play a vital role in ensuring a stable and prosperous economy.

By understanding the principles of sound money—its who, what, where, when, why, and how—individuals and businesses can better navigate the complexities of modern finance and protect their wealth for future generations.

Knowing the key factors such as the number of assets, the importance of sound money in preserving their value, and the role of sound money in secure banking and financial planning can significantly enhance financial stability and security.