I am often asked about my perspective regarding fundamentals, and why I see value in some fundamental perspectives and not others.

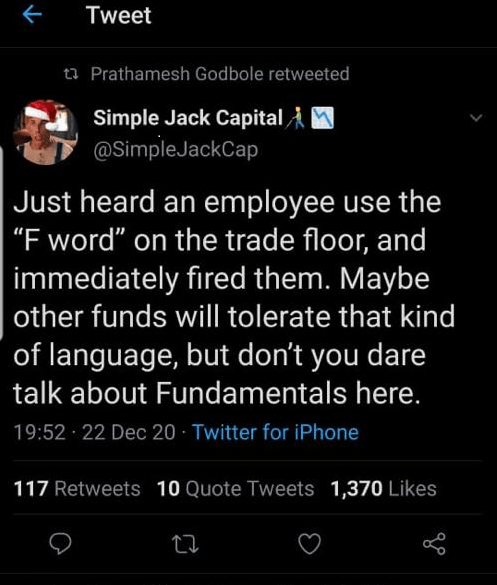

Let me start by posting a tweet by a money manager, which I thought was quite funny, and gave me the idea to write this article.

Source: @SimpleJackCap/Twitter

Now, let me start by saying that there are very few fundamental analysts that I think are any good. The best of the breed that I have seen is someone we all read and respect, Lyn Alden Schwartzer. So, I am quite proud that she is a leading analyst on our StockWaves team.

But, allow me to explain where I see the role of fundamentals, and when I think they should be discounted or looked at as a secondary or coincidental factor.

For those that have read me through the years, I have addressed this issue many times. When it comes to the overall market, fundamentals do not matter to me, as the market as a whole is driven by biological responses within our limbic systems and not by reason. And, recent studies into the market have been proving this concept:

For example, in a paper entitled “Large Financial Crashes,” published in 1997 in Physica A., a publication of the European Physical Society, the authors, present a new understanding as to what drives financial markets:

Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an “emergent” behavior not shared by any of its constituents. In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.

This truth was even recognized by some astute investors well before these studies were conducted. For example, Bernard Baruch, an exceptionally successful American financier and stock market speculator who lived from 1870-1965, identified the following long ago:

All economic movements, by their very nature, are motivated by crowd psychology. Without due recognition of crowd-thinking ... our theories of economics leave much to be desired. ... It has always seemed to me that the periodic madness which afflicts mankind must reflect some deeply rooted trait in human nature - a trait akin to the force that motivates the migration of birds or the rush of lemmings to the sea ... It is a force wholly impalpable ... yet, knowledge of it is necessary to right judgments on passing events.

Moreover, fundamentals often lag the market, if you understand how they truly work.

During his tenure as chairman of the Federal Reserve, Alan Greenspan testified many times before various committees of Congress. In front of the Joint Economic Committee, Greenspan noted that markets are driven by "human psychology" and "waves of optimism and pessimism." In fact, he provided us his insight as to when declines complete when he noted that “[i]t's only when the markets are perceived to have exhausted themselves on the downside that they turn.”

In fact, Greenspan went so far as to note, “I always believed in animal spirits. It's not their existence that is new. It's the fact that they are not random events, but actually replicate in-bred qualities of human nature which create those animal spirits.”

And, what may be most surprising to many, Mr. Greenspan even declared, “[I]t hardly makes any difference who will be the next president. The world is governed by market forces.”

Ultimately, as Greenspan correctly recognized, it is social mood and sentiment that moves markets. I believe this makes much more sense when deriving the causality chain for market movement.

During a negative sentiment trend, the market declines, and the news seems to get worse and worse. Once the negative sentiment has run its course after reaching an extreme level, and it's time for sentiment to change direction, the general public then becomes subconsciously more positive. You see, once you hit a wall, it becomes clear it is time to look in another direction. Some may question how sentiment simply turns on its own at an extreme, and I will explain to you that many studies have been published to explain how it occurs naturally within the limbic system within our brains.

When people begin to subconsciously turn positive about their future (which is a subconscious – and not conscious – reaction within their limbic system, as has been proven by many recent market studies), they are willing to take risks. What is the most immediate way that the public can act on this return to positive sentiment? The easiest and most immediate way is to buy stocks. For this reason, we see the stock market lead in the opposite direction before the economy and fundamentals have turned. In fact, historically, we know that the stock market is a leading indicator for the economy, as the market has always turned well before the economy does. This is why R.N. Elliott, whose work led to Elliott Wave theory, believed that the stock market is the best barometer of public sentiment.

The most recent example of this is when the SPX bottomed at 2200SPX, and began a rise that has almost seen a double in price despite the worst news of Covid deaths, record high unemployment, and economic shut downs being reported during the heart of the rally off the low.

Source: CNBC

Yet, economists still view us as being in a recession today! Do you see what I mean?

Let's look at the same change in positive sentiment and what it takes to have an effect on the fundamentals. When the general public's sentiment turns positive, this is the point at which they are willing to take more risks based on their positive feelings about the future. Whereas investors immediately place money to work in the stock market, thereby having an immediate effect upon stock prices, business owners and entrepreneurs seek loans to build or expand a business, and those take time to secure.

They then put the newly acquired funds to work in their business by hiring more people or buying additional equipment, and this takes more time. With this new capacity, they are then able to provide more goods and services to the public and, ultimately, profits and earnings begin to grow - after more time has passed.

When the news of such improved earnings finally hits the market, most market participants have already seen the stock of the company move up strongly because investors effectuated their positive sentiment by buying stock well before evidence of positive fundamentals is evident within the market. This is why so many believe that stock prices present a discounted valuation of future earnings.

Clearly, there is a significant lag between a positive turn in public sentiment and the resulting positive change in the underlying fundamentals of a stock or the economy, especially relative to the more immediate stock-buying activity that comes from the same causative underlying sentiment change.

This is why I claim that fundamentals are a lagging indicator relative to market sentiment. This lag is a much more plausible reason as to why the stock market is a leading indicator, as opposed to some form of investor omniscience. This also provides a plausible reason as to why earnings lag stock prices, as earnings are the last segment in the chain of positive-mood effects on a business-growth cycle.

It is also why those analysts who attempt to predict stock prices based on earnings fail so miserably at market turns. By the time earnings are affected by a change in social mood, the social mood trend has already been negative for some time. And this is why economists fail as well – the social mood has shifted well before they see evidence of it in their "indicators." In fact, I want to again ask: Are we not still technically in a recession?

Now, to those who claim that I have this perspective because I have to have this perspective, as I provide predominantly technical analysis – you clearly do not know my background and history.

For those who may not know my background, allow me to explain the qualifications with which I initially approached the markets. I graduated college with a dual major in both economics and accounting. I went on to pass all four parts of the CPA exam in one sitting, something that only 2% of those taking the exam are able to achieve. I then went on to complete law school in two and a half years, and graduated cum laude and in the top 5% of my class. I then went on to NYU for a Master of Law in taxation. I became a partner and national director at a major national firm at a very young age, where I worked to organize very large transactions. So, when I tell you that I understand the fundamentals of economics, business, and balance sheets, you can believe me.

Yet, when I approached investing in the market with all this background of understanding businesses, economics and balance sheets, I was no better than the average investor, and sometimes even worse. It was not until I learned more about the psychology of the market that I began to learn how to maintain on the correct side of the market the great majority of the time. In effect, I had to ignore everything I learned about economics, businesses and balance sheets, and predominantly focus upon investor psychology in order to make more sense of the general market action.

And many of my money manager clients with similar backgrounds have noted the same.

With all this being said, I want to now explain why I view fundamentals as important. Remember that market sentiment is the primary driver when we are dealing with investment products wherein mass sentiment is evident. However, this is not an absolute perspective. Rather, it is based upon a continuum of sentiment.

You see, while the SPY is an example of an investment product that presents us with the ultimate in mass sentiment, a microcap biotechnology company may be on the opposite end of that continuum of sentiment. Within the example of the microcap, sentiment can be a factor, but the fundamentals of the company are going to be the primary driver of this stock. And, all products run somewhere within that continuum. The greater the mass sentiment being evident within the buying and selling of that product, the greater probability that sentiment will be the driver of price. And the reverse is true.

Now, that brings me to my last point, which is the common perspective that fundamentals win out in the long term whereas technicals win out in the short term. This perspective is based upon the fact that there are times when a stock is not trading based upon its fundamentals, for when it is well beyond its mean or valuation it is viewed as being driven by “the madness of crowds” and not by reasonable investment principles.

Unfortunately, this is a fallacy. In truth, they are really recognizing that fundamentals are useless when a stock is not trading around its mean or valuation. They then view that as simply the "madness of the crowds" driving that stock to a point of irrational pricing when it is not being priced around its mean or valuation.

But ask yourself: How often does a stock trades around its mean? The great majority of the time a stock is either trading well above its mean during a bull market, or well below its mean during a bear market. Therefore, is the “irrational pricing” not the norm rather than the exception?

So, while this common perspective sounds reasonable, when you actually take it apart, it only bolsters the argument for understanding how market psychology drives stocks well past their mean. It also bolsters the argument as to why understanding how to analyze market psychology is often a more accurate guide regarding the pricing of a stock. And, it again shows how well Bernard Baruch truly understood our markets many decades ago.

I hope this explains why I view sentiment as so important to investors who want to profit in the market, as well as where I see tremendous value for fundamentals as well. It really is all based upon where within the stock market continuum you choose to invest. In simple terms, the greater mass sentiment is displayed within the pricing of a product, the less fundamentals will have an impact. And, the less that mass sentiment is being displayed within the pricing of a product, the greater fundamentals will have an impact. There is a role for both in your investors tool box. But, like any tool, you need to understand where it is most useful.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets.