Monday’s financial news was filled with fantasies about how Tuesday’s CPI report would be as boring for the stock market as watching the paint dry on Fed QT, but all that falderal didn’t even age one day without putrefying to a level of rancidness that would curl the nose hairs of most investors by Tuesday morning.

Investors had almost all moved in their collective wisdumb to the low side of the boat to position themselves for the anticipated likelihood that another dip in inflation would lift that side of the boat, proving the market’s recent head-fake rally was actually a new bull-market rally foaming up from the deep. It was a head-fake in the sense that heads that believed in it clearly were all believing fake news.

Only weeks ago, the arrogance and delusional hope of this stock market led it to believe — because it wants to — that inflation will fall quickly. That is not surprising in a world where men believe they can be women because they want to be, regardless of what their chromosomes will keep whispering throughout their bodies all their lives long. But I digress. That, in turn, caused investors to believe in lockstep, like a bunch of goose-stepping Nazis, the Fed would pivot. So, the market fell hard when Jeromy set it straight by telling it unequivocally what anyone who knows anything about the Fed knows: NO PIVOT!

Inflation is the Fed’s only mandate right now.

Then arrogance upon arrogance caused the market to return to believing the Fed will pivot anyway, just like a dog returns to lap up its own vomit. The market doubled down on the pivot drivel, choosing to fight the Fed head on, as in even against Powell’s staunch warning that said multiple times “We will not turn!” While the pivot prattle was obviously delusional all along the way, the bullheaded bulls tried to push stock prices up again to prove they can do anything. So, now they are more than deservedly getting their collective face punched in.

Learn the lesson about the path of denial clearly:

- Inflation, which the market believed was transitory because the Fed said so, is scorching hot.

- Inflation does not go down without a fierce fight once it gets rooted in like this.

- Supply chains remain broken all over the world, and the Fed cannot do anything about that.

- Shortages abound, and the Fed cannot change that major contributing factor to inflation.

- Sanctions and droughts are making shortages even worse.

- The economy IS in a recession.

- The economy HAS BEEN in a recession since the start of the year, and GDP is screaming that in everyone’s face, though nearly everyone is still denying the obvious.

- The Atlanta Fed just revised its GDP Now forecast down for the second time this month, just like it did going into the negative GDP numbers in each of the last two quarters.

- The entire financial media and investors refuse to believe any of this because they all believe the Fed’s song that the labor market is strong, so the economy has to be stronger than GDP says.

- The labor market is truly and deeply sick!

- Therefore, the economy is UNABLE to deliver higher production.

- That means the Fed is tightening into a recession, which will take production down even more.

- And an extended fall in production is exactly the definition of a recession.

- So, we will soon complete our third quarter of declining GDP while denying it matters all the way to the bottom of one massive recession chasm, made massive by the fact that we denied it all the way to wherever the bottom lies, which is someplace after denial ends.

I’ve revealed all of this for my Patrons, and I will be releasing the Patron Post that explained the labor delusion for all readers in order to try to break through the opiated fog that circles the heads of these stock-market whores.

This is all peak arrogance coupled with delusions that are desired by all the investors who eagerly inhale the opium smoke because they want to keep feeding their highs in the market, which is to say “feed the greed.” When things get this far out of whack with reality, we see the kind of gut-punch back to reality the market is taking this morning when inflation MERELY CAME IN AS IT SHOULD WELL HAVE BEEN EXPECTED TO! The market is getting hammered in a single day by a minor dose of fairly likely reality!

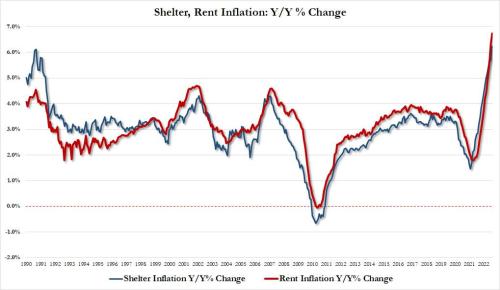

Blistering inflation doesn’t just bow its head and slink away, especially when some things like housing are VERY SLOW to creep into the statistics, meaning the housing facts that failed to impact CPI a year ago are now starting to flow into the CPI data when they could be expected to.

Housing inflation has months of rises already in the pipeline to price into CPI

You may remember reading the following here about how housing prices its way through to CPI reports:

I believe reported housing prices will be catching up [in CPI reports] with real-market changes in the months ahead until the Fed crashes the housing market…. The BLS believes housing prices have peaked…. So, of course, the BLS increased housing’s weight since they saw the [CPI] rate would still slip back down a notch even with the increase in weight. That way housing’s decline, which they believe is starting, will help pull down CPI in the months ahead. So, that was a smooth move on their part for January based on what they expect to happen….

It will, however, backfire on them if I’m right about where housing is about to go as past housing price increases slowly work their way into the CPI survey due to the delays I’ve argued are built in. If the BLS is wrong about how housing will pass through via “Owner Estimated Rent,” CPI will be made worse in the months ahead by their change in weight since their own policy only allows them to change weights every two years….

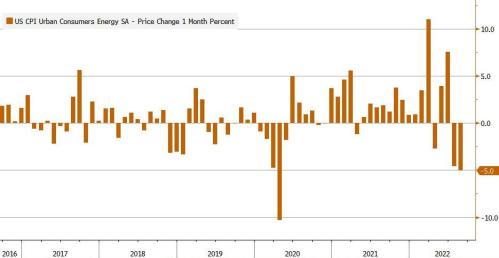

At the same time, they reduced the weight of energy a lot as if energy somehow matters less to all of us now that it costs more for all of us.

“Government Statistics at it Again: They Adjusted Your Recession from Hell to Heaven!“

That was back in February right after the BLS tailored its numbers to make things look better because that saves the government a fortune in cost-of-living increases for its employees and for Social-Security beneficiaries. Now, when energy is going down for awhile and housing inflation is finally working its way into the numbers, that re-weighting isn’t helping like it was supposed to.

But what were those delays I said I laid out as to why CPI is slow to reflect housing inflation?

A year ago, October, I gave the following explanation for what would be coming late down the pike for CPI:

While housing counts for about 30% in the consumer price index, it has barely begun to show up in the official CPI numbers because it is based on homeowner guesses about equivalent rental rates, not actual home prices, and it is inputted in a way that causes a large lag time. According to Apartment List, rents this year have gone up nationally by 16.4%, and they are still rising faster than they rose before the pandemic, but CPI reflects very little of that … so far.

“Shortages and Inflation Are Ripping the World’s Face Off“

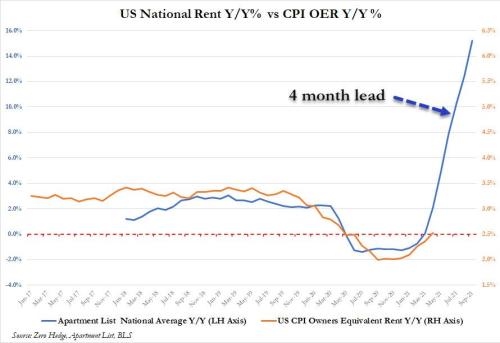

I used the following graph to point out how CPI’s housing inflation tends to track almost exactly with housing prices with a four-month lag, but also how you could see, that adjusting for that lag, the CPI data still had a LONG way to go to catch up to where housing prices had already gone:

The CPI data had put in the turn right in synch with apartment rents putting in their turn, if the lag was adjusted for, yet were far from as severe, meaning thee was a lot more to come. I stated that …

relief for housing prices will not come in time to make any difference on what is already waiting in the pipeline to be reported as establish inflation facts for, at least, another six months.… It is also possible that most homeowners will become more aware of the rise in housing costs as they refinance at the end of forbearance and start giving higher estimates to the BLS as to what they estimate their house would rent for. Part of the lag between actual rent increases and CPI is due to how long it take homeowners, who are not paying rent, to realize what is happening in rents around them, which they never do, as a group, fully realize.

It is also reasonable to extrapolate that those owners who do not come current on their mortgages and who are eventually forced out of their homes will increase rental demand, pushing rents even higher even faster.

Even if none of those likely possibilities play out, one thing is certain: the past four months of rent increases were the worst by far, and they are just about to start getting reported in CPI in the months ahead, and rents are still rising twice a quickly as normal.

I figured it would take, at least, six months for that to start to show up and later quoted another person who laid out a case for how the lag typically takes a year. So, my estimate of the long lag time may have been conservative based on the data that person provided. Of course, actual housing prices continued to rise well past October when I provided that graph. They rose all the way up to this summer. So, there is a LOT more housing inflation to work into the reports in the months ahead, whether it comes along with a four-month lag, at minimum, or six as I was thinking likely, or twelve at most, and housing is the major component of CPI!

If you read all of the above over the past year, you knew that CPI had a lot more in store. The only thing that saved CPI from punching its head through the roof when it showed the highest rates in decades only a few months ago was the recent big downturn in energy prices that was weighted higher at the start of the year. That means, if fuel prices also go back up this winter due to continued shortages in the face of heating needs — especially if the climate is as unkind in the winter direction as it was in the summer direction — then LOOK OUT BELOW! And sometimes the annual climate pendulum does swing hard the other way.

The guts of CPI were ugly, but no uglier than should have been expected

Headline CPI fell a tick less due to housing than the market was expecting it to fall. That’s all it took to send markets over the cliff. It fell but just a tenth-of-a-percent less than it was expected to. The internal data, once you think your way through it, was lousy, as should have been expected; while the housing data is going to get worse as it continues through the number-crunching pipeline.

Here are some of the other facts about that data:

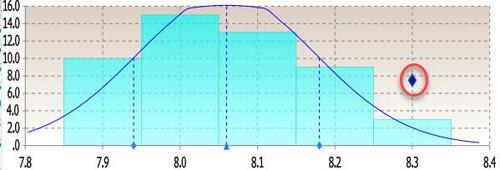

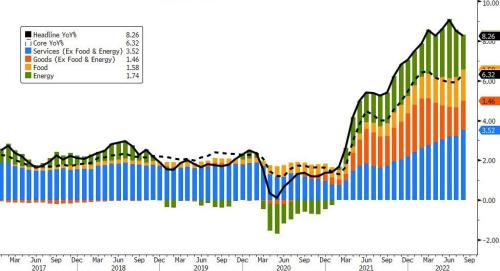

Goldman Sucks predicted the headline number for CPI today would likely show a little disinflation and thought the data would, therefore, not move markets much; but they noted a small likelihood it would drop down to the 7-point range, in which case it would blow the caps off soaring markets. The actual overall number came in at 8.3. That was still a downtick that looked like this:

Just that tiny bit less of a downtick than was expected (or tiny bit higher of an actual number) threw the markets into reverse because they were so certain the number would actually come in below expectations, rather than a single, minuscule notch above. Instead, we only got back down to the same level from which we had bounced back up only a few months prior.

The majority of investors were in the Goldman camp of, to paraphrase, “expect some disinflation, but it won’t send the market UP unless it goes as low as 7.x.” In other words, they expected any disparity between the anticipated and the actual to be an improvement in inflation that would send the market UP. JPM, also delusional, believed a 7-point-something handle was a possibility but didn’t have much to say about what would happen if CPI actually landed a tick higher than the expected drop, even though that was a tick below where it had been the month before. How dare CPI be the most tiniest bit above expectations! But that is how arrogant the market was in its belief that it had inflation all figured out so that Papa Powell’s great Fed pivot could actually still happen.

If a market is this overreactive to the tiniest of ticks, then it was clearly way overconfident. Not just irrationally exuberant, but delusionally exuberant to where everyone was on one side of the boat. When the boat barely moved, they were leaning so far into the waves, it swamped them, and they all fell overboard. (At least, mid-day as I’m completing this when the Dow is down over twelve-hundred points.) Here were the inflation expectations or the economic prognosticators, and you can see hardly anyone was in the right position, but to make it all worse everyone was talking as if any move away from expectations would clearly be much to the downside for inflation:

Energy fell like this for the second month in a row, wiping out over those two months about 40% of its earlier price gains for the year: (Down 5% MoM)

The scary part of the report for delusional markets was that the Fed’s preferred metric — core CPI — shot back up 0.6% overall MoM:

As you can see, that was no worse than many other months this year, but for markets insanely expecting solid improvement, it was truly frightful. So, it must have just been the fact that there was no “core” improvement yet in the direction inflation is headed, in spite of the Fed’s sturdy efforts and big words about being the inflation fighter.

Core services were the major component in that rise, and people were already expecting more inflation in services than in production. Therefore, another big shock came in the production area the Fed likes to remove from its core figures, which impacts all of us the most:

The big shock was the food index which increased 11.4% over the last year, the largest 12-month increase since the period ending May 1979, while the food at home index rose 13.5% the largest 12-month increase since the period ending March 1979.

Yes, the highest food inflation in over forty years. That, however, is no surprise to the real people who actually go to a grocery store, who spend their lives with their heads poking among shelves and into refrigerators, rather than through financial media. Good thing the Fed ignores food as if it doesn’t count, or imagine how much core inflation would have climbed and how much harder the Fed would have to crank up interest rates and crush the economy for the greater benefit of mankind in order to offset its mistake from months of creating too much money flow even as supply shortages were the one thing that was already abundantly evident!

Even so, as noted, the biggest driver for both core inflation and overall CPI was services:

Digging deeper beneath the surface, the rise in shelter costs also went back to the inflation of the early eighties …

… but keep in mind there are still several months of rising home prices to keep pricing into CPI. They may not cause that component to rise any faster than the rate at which it has been rising, but they are sure to keep CPI up in this stratosphere because food prices are likely to get worse when actual food shortages due to droughts and fertilizer shortages and wartime transportation jams and sanctions all arrive when we find out how much the harvest was down this fall and then face those shortages this winter … and as fuel prices rise again when winter heating oil and gas start to show up short. All of those things are likelihoods, even if not certain. So, why would you bet against that overwhelming likelihood unless you’re insane or just stupid?

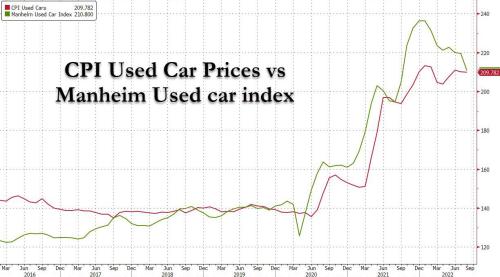

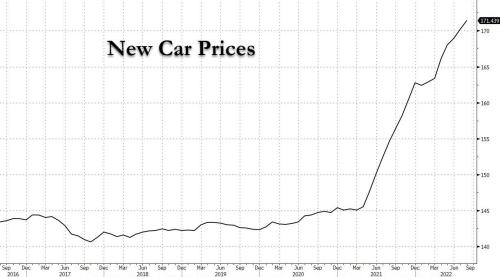

And, meanwhile, new-car prices continued to rise even as used car prices continued to notch lower:

But, hey, at least your wages are not keeping up; so, why on earth would anyone expect a hard recession when the consumer is so obviously strong? (At least, in Mad-Hatter land where up is down and bad news is good news.)

“No good news across this report”

Oops.

Those of us who lived through the seventies’ battle with inflation, remember that it is not easy to knock inflation back down! It’s like playing whack-a-mole. So, we know no one should have been surprised, in the least, to find out inflation’s fever was holding on pretty tight to the top of the mercury, in spite of all the Fed’s cold deluges of interest-rate hikes and QT. It took a few years to get the fever fully back under control with extreme interest rates back then. It won’t take those that much ice in interest rates now because the economy will completely disintegrate if we even get to rates HALF as great; but that’s the point — economic disintegration is what the Fed is aiming for without realizing it.

Here are a few summary comments from the marketeers of madness:

“We saw this tug of war between goods moderating and services remaining strong. This is not a tug of war. They both moved up. .. Right now I think the Fed is going to be looking at this with a lot of concern. There is no good news across this report.” — Robert Dent, Nomura

“It’s been a reality check. Markets were, again, ahead of themselves. The Federal Reserve will not step on the brakes before year end, so we can expect more rates hikes.” — Guillermo Hernandez Sampere, head of trading at asset manager MPPM GmbH

“The recent bounce in equities looked incredibly ill-judged and premature. That CPI number is very strong relative to consensus and will not be what the Fed wanted to see at all.” — James Athey, investment director at Abrdn

“The US equity market was simply overly optimistic….” — Sebastien Galy, senior macro strategist at Nordea Asset Management

“Prices that have been bubbling over take time to cool and markets have been a little over enthusiastic in the last few days about the prospect of less aggressive rate hikes from the Fed in the near future. The reality is that whilst most things seem to be going in the right direction, there are still significant headwinds when it comes to things like electricity and gas supplies and simply keeping a roof over people’s heads. Realistically, there’s nothing in today’s figures to convince central bankers to switch tack….” — Danni Hewson, financial analyst at AJ Bell

“[The Fed] will stay higher for longer, so no pivot is coming.” — Esty Dwek, CIO at Flowbank SA

Of course.

It all seems so evident now.

It should have seemed that evident and remained that evident after Powell’s last symposium.

Those who live through the seventies remember that the Fed HATES high inflation and that, once it knows it screwed up badly on inflation, it will battle the blazes out of it, whatever it takes. As a result of the seventies, those old banksters that sit in a circle at the Fed’s FOMC meetings have a gut-level fear of repeating what the Fed did in the sixties and early seventies that caused inflation to get out of control. Yet, that is exactly what they just did again last year and the start of this year, and they know that now! So, you had better believe the Fed is going to fight inflation “until the job is done!”

The Fed is belaboring the labor market

That is especially true since the Fed also falsely believes that today’s labor market is strong — a huge misbelief that I’ve explained several times on my own blog, but in my last Patron Post I also explained why the labor market is actually very weak. Grasping that dismal reality about the true condition of the labor market is key to understanding how bad this recession is going to become because of how chronic the labor situation will prove to be and because the Fed will keep tightening hard when we are already knee-deep in a recession that the Fed doesn’t even believe in! And we have been in it for half a year!

The idiocy and blindness in the financial media is mind-boggling because the truth is just not that hard to see and figure out. Belief that the labor market is strong, leaves the Fed no excuse or reason to loosen the economy as the ONLY active mandate it believes it has right now is to tighten against inflation. Yet, the Fed and all financial media could not be more wrong about the “strength” of the labor market, just as they have been all along about inflation. The labor market’s decline is the most serious threat to the entire global economy right now, and they don’t get it!

I will release that Patron Post to the general public ahead of the Fed’s next meeting so everyone of my readers can see why September’s meeting will be a dire miscalculation about the economy and and overcorrection against inflation in that the Fed will be completely unable to stop this inflation without severely damaging personal finances and business finances because the economy is actually so weak as to be called “disabled,” and the labor market assures longterm shortages to where the more the Fed hurts labor, the more it increases shortages! While Patrons already have full access to that info at “A Recessional for the Recession: Everyone Sings the ‘Strong Labor Market’ Tune in Unison, and They’re All Wrong!” I’ll release it late this month for everyone.

If you don’t understand why the Fed and just about everyone else is dead-wrong right now about the the labor market being strong and about the labor market’s supposed strength being proof the economy is “not in recession,” then you don’t have the key to understanding why the Fed’s upcoming FOMC meetings will assure this recession becomes a new hole at the bottom of an existing hole as the misguided Fed keeps digging!

Liked it? Take a second to support David Haggith on Patreon!