The Fed’s fight has become much more complex this month. Inflation is fighting back harder all of a sudden, while the US debt ceiling is putting bond markets and banks at considerable extra risk by driving bond yields up even faster than the Fed was doing. This extra thrust is happening just as the Fed was trying to end its rate increases and even as additional banks are poised to collapse from the already-high bond rates. The situation appears to be cascading into a nuclear market meltdown.

When I published The Daily Doom two days ago, the headlines in that edition seemed to call the latest inflation report two ways, some highlighting that inflation is down a little, some saying it is up. The truth depends on what individual components you look at, which finely parsed indices of inflation, and whether you are looking at month-to-month or year-on-year. So, I’ll sum the real inflation situation and banking situation up simply in this intro and then analyze the overall crisis in more detail in the following sections because you have to understand how serious inflation is first in order to understand the critical situation the Fed (and all of us thanks to the Fed) is facing. (Patrons who get access to The Daily Doom, may want to drop straight to the next section because they already saw most of this intro as the opening editorial on the 10th unless they want a refresher.)

The bottom line is that inflation is a tiny bit less significant overall than it was a month ago, but the rate at which inflation has been dropping has also almost stalled. That is a not what the Fed (or any of us) wants to see. What you see in many of the measures of inflation that were given in this Wednesday’s report is a tiny blip downward in CPI for the month of April that is nowhere near as significant as the drops we have been seeing in prior month’s.

Nevertheless, I think the Fed is likely to pause in its rate hikes, at the next meeting for the simple reason that we are now in exactly the month at which I have believed the Fed would pause since the start of the year. That is because, months back, the Fed telegraphed the likelihood of three more 25 basis-point hikes and then a pause, and those hikes are finally now all in with the Fed’s last meeting on May 3rd. Meanwhile, the Fed is assuredly far more concerned about the banking crisis it has created than it is about to let on because the Fed’s fears, when expressed, become self-fulfilling prophecies.

While the majority of mainstream financial writers did not believe the Fed would even stay the course with its telegraphed plan, I was certain the Fed would because inflation would not move close enough to its target during the first four months of this year for it to do any less. Now we know that as an historic fact. I doubted the Fed would be able to go further than that, however, before serious trouble began to surface, as has also now become historic fact. I’ve said, for at least a year, the Fed will tighten until something really bad breaks, and with three banks down and out and another (PacWest) in the running, clearly something really bad has broken.

Not doing its final telegraphed hike at its last meeting, however, would have indicated the Fed was scared enough that its policy was causing damage to force it to change course; therefore, it would stay the course on doing all it had indicated was likely and then step back as it had forecast because another 25 basis points wouldn’t add much to what they have already done anyway. That allows the Fed, at its next meeting, to do nothing and say, “This is the point where we have been telling you we would likely pause” (with the usual “data-dependent” phrase thrown in there somewhere). Their mantra about fine, upstanding banks of robust solvency will continue so the Fed doesn’t lurch people into doubting their entire policy of the past year(s). Their position, in other words, will be that everything is going according to plan!

With some banks actually crashing while others lean in on cue because of Fed policy and GDP resting on the threshold of a second dip into “technical” recession and Fed policy lagging by, at least, six months, I think they’ll take a breather and hope their plan works. (That raises the question of whether the plan always included the casualty of blowing up a few banks, which is a little like the military saying, “We meant to blow up a few of our own forts for the greater good of the cause.” Umm … Ooookay. But these forts — these banks — had a lot of people in them.)

However, the big slowdown in the rate at which inflation is falling means the Fed’s battle with inflation is actually far from over, so there is just about zero chance the Fed will start to lower its interest target even in a full crisis. Investors need to forget the Fed pivot — pure market fantasy by completely self-deceived and delusional investors, which has endured for almost a year. In spite of how that mirage has always failed to materialize, nothing I’ve written to any one of the pivot prognosticators on Seeking Alpha has cleared the swirls of opium smoke from around their heads.

My own mantra has been that a move to lower rates was never going to happen until the economy is destroyed to the point where lowering rates won’t help stocks anyway, which also means even more banks will be blowing up. (And a stop now in rate hikes with an eventual lowering of rates someday down the road is not a “pivot” even when that drop comes. Not even close.)

Once the economy and banks lie in greater ruin, the Fed will face the start choice of which of its two children it wants to kill. It will have to decide between 1) crashing its economic recovery and its banking system into utter rubble by holding rates where they are, throwing more rubble on the heap, or 2) throwing gasoline on hot inflation by lowering rates to try to “save” the economy and bail out banks, thus incinerating the value of their own money and public trust by taking the first big step down the path to hyperinflation.

Either choice is a wicked path, and I don’t know which they will choose; but that is precisely the trap the Fed began laying in for all of us with its extreme inflation policy of the past decade wherein it tried to fix a debt-based crisis during the Great Recession by doing all it could to make debt cheaper, enticing as many people down into deeper caverns of debt as possible before burying them alive with inflation. All of that was done as a cheap fix for the last crash to avoid the hard work of rethinking and resetting our economic fundamentals that are a disaster in numerous ways that are now closing in on us. You cannot live on a diet of pain pills.

The worst effects of Fed policy accumulated when the Fed continued massive money printing at the government’s behest (while pretending it is independent from the government it serves and whose congressional charter gives the Fed all its power) in order to keep funding government Covid stimulus programs for far too long, even as it kept telling the world the US economy was “strong and resilient.” If “strong and resilient,” why on earth the need for more stimulus?

That was an immediately apparent self-contradiction. Those who can think — such as readers here who inquire beyond the regurgitated pablum of mainstream financial writing — knew the cognitive dissonance in that policy was a railroad bound for high inflation. It likely was driven by pressure to enable the federal government to continue its absurd supersized, deficit, stimulus spending.

The result we see, as the Fed now tries to back out of its massive mistake by raising interest to fight the inflation it fueled, is that banks are going insolvent here, there, and everywhere. Sure, only three have popped like nasty pimples on Powell’s face, with a couple more starting to redden and swell; but the deeper truth — as several commentators laid out in The Daily Doom headlines on Wednesday — is that thousands of US banks are technically or “potentially” insolvent, meaning the only thing saving them from deep trouble is the Fed’s determination that they will not be required to mark the value of their assets or collateral down to market (as they would have to do in an honest banking system in order to treat them as real — i.e., drawable — reserves).

Given the long lag between Fed policy changes and the effects of those changes, however, more banks will collapse, as the problem of devaluation in assets and collateral will get worse for several more months, even if the Fed stops in its tracks.

Worse than that technical backdrop, which becomes a existential problem for those banks only if they face a run on deposits that they cannot meet, is that deposits keep fleeing from smaller banks to the top-tier banks that the Fed and feds have chosen to protect with infinite deposit insurance that is not available to banks that are generally good banks but are not in the privileged too-big-to-fail bankster category. This Fed policy assures the too-big-to-fail banks will grow much bigger by design as they 1) scavenge depositors away from smaller banks and 2) devour those smaller banks at bargain rates when they fail because of that scavenging.

Within this cannibalistic realm of soon-to-crash smaller banks and overindulged behemoth banks that are supported by the new insurance policy of Fed & Feds, Inc., a new crisis is forming around the nation’s national debt.

(Headlines supporting what was said in this intro were contained in The Daily Doom on Wednesday when the CPI report came out, so supporters of my writing got the first summary view.)

Banks will keep busting

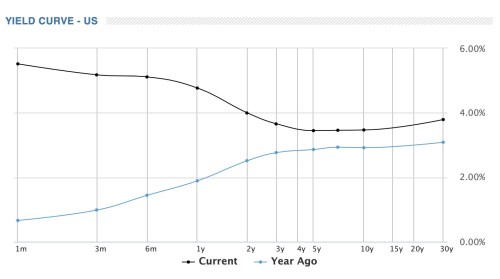

Let’s start by getting up to date on how bizarre the yield curve has become, which should look something like the bottom line that existed in the graph when the Fed first started raising rates, but now looks like the top line:

It has completely blown out to where everything is the extreme reverse of what it should be — like a mirror image — and the gap between this year and the start of Fed tightening last year is the worst it’s been to date. This inversion was initially due to Fed policy, but it blew up in in the last couple of weeks due to government brinksmanship over the debt ceiling:

Yields were crazy – I mean, not crazy, they were very rational, given the risk of a US default at around the time the bills would mature. Remember, the one-month yield had plunged to 3.4% on April 20. By May 3, Wednesday, the day before the auction, it had re-spiked to 4.7%. Thursday evening, following the auction, the one-month yield closed at 5.76%! In the span of two weeks, the one-month yield had spiked by 240 basis points.

In the bond world, that is a massive blowout. This is already more volatility in bond yields than was last seen during the Lehman Bros. collapse, and the crisis these bond investors are pricing in may be even more immediate than is currently feared. As I stated back in 2011 when this kind of brinksmanship over the US debt ceiling was this bad just before I started writing this blog, one does not have to wait for what is now being called “X-day” — the day the US government actually runs entirely out of cash and has to start defaulting on its obligations — for the brinksmanship to impact markets, especially bonds because of what said brinksmanship can do to credit ratings on those bonds BEFORE default. (It would be poetically be called “D-day” for “default day” if I had my druthers.)

That proved devastatingly true (requiring another promised Fed rescue) when I predicted it as a near certainty back then, and it easily could now, though S&P may be a little more reluctant to be the first to jump, since it got roundly criticized last time for being the only agency to jump. Credit agencies, if they are worth the dust that has settled on them from that blowup, downgrade credit BEFORE default happens. So, the US government does not have the remaining two-three weeks Yanet Yellen says it has because (if her date of cash exhaustion is not a political construct, as it may well be since she has a head full of bats anyway) the downgrades are supposed to come before default as risk warning (as we saw in 2011).

A credit downgrade will kick all US bonds up higher in interest without the Fed’s help, as the mere concern about a possible downgrade is already doing! Bonds will run ahead of Fed policy and pile even more trouble on beleaguered banks because higher yields mathematically mean lower bond values if the bond must be sold before maturity to raise cash to pay off exiting depositors. The timing couldn’t be worse. The next bank crash could some as early as this weekend with PacWest, which is clearly teetering on the edge. It won’t take much to push it over.

This present rapid repricing of bonds couldn’t be more easily anticipated (or poorly timed in light of the banking crisis) because the raising of zero interest up to 5% interest on the Fed’s target rate has hugely increased the cost of US debt, which also expanded hugely when our politicians were traveling the road of easy Fed money without looking down the road. (They talked all the time about kicking the can down the road, but they didn’t look up to see how soon the end of the road would get here.) Naturally, rising interest on expanded debt means the US budget deficit troubles are rapidly getting worse, now raising desire that didn’t exist among Republicans back in the Trump days to keep costs down (and still does not exist among Democrats during the Biden days).

As I always say, both parties are willing to spend the nation into an abyss of debt; the only difference is what they will spend the money on. That is true all the way back to Ronald Reagan, who blew out the deficit he said he was going to fix with massive military spending.

As Jamie Dimon, CEO of the nation’s largest bank, also warned in Wednesday’s headlines,

Markets will be gripped by panic as the U.S. approaches a possible default on its sovereign debt. An actual default would be “potentially catastrophic” for the country, Dimon told Bloomberg in a televised interview.

“The closer you get to it, you will have panic” in the form of stock market volatility and upheaval in Treasurys, he said…. “If it gets to that panic point, people have to react, we’ve seen that before…. It could affect other markets around the world…. Such an event would ripple through the financial world, impacting “contracts, collateral, clearing houses, and affect clients definitely around the world,” he said.

So, markets will soon be “gripped by panic” just from approaching that now imminent day, and hit by “potential catastrophe” if the day actually comes. How seriously is Dimon taking his own warning of “potential catastrophe” as D-day is now, according to Yellen, less than a month away while CD-day (credit downgrade day) is unknowably closer?

The bank’s so-called war room has been gathering once weekly, a rate that will shift to daily meetings around May 21 and then three meetings daily after that, he said.

“I think we have to assume there’ll be a little bit more” to the regional banking crisis, he said.

“A little bit more” is putting it mildly, lest his own words, because of the weight they carry with many listeners, create more than a little bit more. Of course, while Dimon & Co. are meeting frequently to stay on top of the concerns market pressures will bring to their own bank to make sure their bank stays on top of all the troubles now brewing, they are also meeting to figure out what failing bank they can swoop down and capture at a cheap price for easy eats. They’re doing their calculations ahead of the availability of the next new captive as best they can to be ready with an offer for the next weekend Fed-fest. JPM, remember, fed on the carrion of the last bank to fail in this clearly ongoing collapse, First Republic.

Here’s a good summary of how seriously bank problems are increasing due to interest rates and how the Fed has trapped itself by Bob Moriarty:

This banking/bond crisis will explode into a mushroom cloud if credit downgrades start rolling in ahead of D-day during the next couple of weeks.

The inflationary inferno has engulfed the Fed

Where I am leading with all of this is to what the Fed will do when it faces even more bank collapses while contained in the fires of inflation. It will, naturally, want to start pushing down interest rates if a credit downgrade causes bond yields to spike higher than the Fed has intended … as they are already doing. It will also want to print more money to buy up the devalued bonds the banks are holding. The plate spinner is going to be busy keeping up a lot of plates.

However, we live in a time where we can see from this week’s inflation report that inflation is still burning up the Fed’s backside. It is not about to cut the Fed any slack, so the Fed cannot reverse its policies as it has in the past to save a crashing stock market, crashing bond markets and especially to save an increasing slew of its member banks that will be failing, not to mention the coming problems for banks from commercial property loans that are defaulting due to the Fed’s higher rates.

It cannot do any of that without shoving inflation even higher than it was in early 2022. If you think inflation got to be hot last year, wait until you see how hot it goes if the Fed makes it clear it is giving up the battle. When you create an everything bubble, this is how it all blows up.

Wolf Ricther calls the Fed’s new game “inflation whac-a-mole.” Here is a summary of the bad news that the stock market refused to see in Wednesday’s CPI report:

The Consumer Price Index (CPI) for April, released today by the Bureau of Labor Statistics, was marked by a very unwelcome reversal in durable goods prices which suddenly jumped again month-to-month….

Services inflation remains red hot, but was somewhat moderated by a sharp drop in airline fares, rental cars, and by the infamous and huge adjustment of the health insurance CPI that started in September 2022 and will continue to wreak havoc with services CPI through September 2023.

This combination of the month-to-month jump in durable goods and the slight moderation in month-to-month services caused the “core” CPI (overall CPI minus food and energy) to remain stuck for the fifth month in a row at around 5.5% — it’s now higher than overall CPI.

Inflation, once it reaches this level, is a game of Whac A Mole. As you hammer one category down, another one re-pops up.

Wolf also noted that the base effect that comes from last year’s inflation when looking at year-on-year rates has been helping to suppress this year’s numbers so far, but that base effect will reverse in July to start putting upward pressure on rates for the remainder of the year because we start comparing to months where the Fed’s inflation fight first became significantly effective, dropping the US from about 9% annual inflation to about 7%.

If you want the nitty-gritty detail beneath the headline inflation numbers with myriad graphs and data, see Wolf’s full article. Otherwise, let it suffice for the purpose of this article to say the road ahead for the rest of this year is a tougher inflation fight, not an easier one. That is why the rate of descent in inflation appears in my estimation to be bottoming out and leaving the Fed no room to relax. Can you imagine how hard it would be to announce you are reducing interest rates when the public sees inflation is back, admitting you have completely lost the battle and are giving up!

This squares with my own prediction for the year that we would likely see inflation start to rise again. Whether it does or not, it certainly is not going to give the Fed room to rescue banks or the economy via rate cuts or money printing. That means the ride through this crisis is going to get rougher than the world is used to. Bring in the black swan everyone could actually see coming months ago of a US credit downgrade if the brinksmanship continues, as it seems to want to do, and you understand why the top bankster among all US banks says a default could be ““potentially catastrophic.”

Actually the downgrade that will precede the default that Yellen says is likely only 2-3 weeks away now could be catastrophic for all the same reasons because a downgrade of government notes, bills and bonds over brinkmanship will force the yields of those instruments to rise as surely as a downgrade over actual default will. After all, it is the response of credit-rating agencies to a default that creates the market turmoil. It is just a question of whether we need the full push over the edge to start round two of the US banking crisis or if a mere nudge over the edge will suffice.

(Become a Patron at the $10 level and never miss a drop of The Daily Doom. Get the news and commentary as it happens each weekday morning.)

If you value this writing, please take a second to support David Haggith on Patreon!