Forget bond pricing as a way of gauging what inflation is going to do. The Fed is still buying the lion’s share of the bond market. So, while bonds have begun pricing in inflation, they have a lot more to price in over the next couple of months as the Fed continues to relinquish control over the bond market, as I wrote about in “Stocks and Awe: The Federal Reserve Regime Change is Here!”

My prediction that inflation will kill the stock market never relied on bond pricing as a measure of inflation expectations because it was so clear that bonds had no possibility of pricing in anything while the Fed was exercising covert yield-curve control; i.e., obvious yield-curve control while simply not calling it that … sort of like it was doing obvious QE at the end of 2019 while calling it “not QE.”

Because so many analysts and economists and even commenters on places like Zero Hedge still write as though they don’t understand this, I’ll say it again: When the Fed is buying more than 50% of all treasuries, it wholly owns and controls the treasury market. It IS the whale. BUT bonds will price all of this inflation in as quickly as the Fed steps out of the market, and that WILL will kill (and now IS killing) the stock market. This is “the big blind spot” I have been writing about now playing out as I expected.

The reason I am saying that again in this article is that it means the market’s demise is dependent upon inflation continuing to do the dirty work I said it would — of burning up the Fed’s backside so that it cannot retreat from its new financial tightening regime. If inflation backs off, the Fed can quickly reverse itself, losing face but possibly restoring market calm; however, if inflation stays hot, there is no way the Fed can easily back off as the Everything Bubble bursts, and this IS the bursting of the Everything Bubble now, spreading from bonds to stocks and real estate as the Fed relinquishes its death grip on bond pricing so that inflation starts pricing in.

So, I’m writing this article to demonstrate WHY inflation is not going to back off in time to ease its hot pressure on the Fed and, therefore, WILL kill the stock market. To show that, I go back to the kinds of measures by which I said inflation was going to become intense well before it was an established fact on the Consumer Price Index, well before the Fed admitted inflation was not transitory, and well before all the marketeers stopped parroting the Fed’s claim that inflation was transitory. I go back to that line of reasoning because it was dead-on about what actually proved to be true with inflation.

Too much money chasing too few goods

That the Fed has created too much money so that it now needs to reduce money supply (half the inflation equation) is already a done deal. It has to reduce money supply by taking back what it put in, which it cannot do without unwinding everything it accomplished (as we saw in 2018) and slow the flow of money (velocity) by raising the “price of money” — interest — but, as the article referenced above clearly lays out, the bond vigilantes are already starting to do that for the Fed so that, really, the Fed is just going to be running to catch up with its interest targets to where the market is already taking interest in order to preserve the illusion that the Fed has interest under control.

So, money supply is going to be tightening; but, if shortages of goods and services goes away, the inflation pressure on the Fed will start to ease off, too, because goods will be less scarce and won’t get bid up as much. Then the Fed won’t have to tighten money supply as much and can ease back into easing to calm markets. So, the focus now is on what is actually going to happen with the shortages of goods and services.

The supply chain chaos is not going away right off even if COVID ends today. The damage is already in, and it will take years to repair. As Jim Rickards explains,

Even if stores were fully staffed, there would still be shortages and delays due to everything from a shortage of truck drivers, late container cargo shipments from Asia, manufacturing delays due to lack of inputs, energy shortages and many other impediments.

That’s the point.

Commodity inputs are scarce, partly due to energy shortages at mines. Manufacturing is behind due to lack of commodity inputs. Deliveries are behind due to manufacturing delays. And finally, shelves are bare due to nondelivery of orders and a worker shortage.

It’s all connected and it’s all collapsing at once. So don’t believe the happy talk about a “temporary” supply chain crisis….

The China syndrome

China is in such a meltdown of its own and is such a critical player in the global economy that it gets a subheading of its own under the supply-chain/shortages category.

First off, we can clearly see how many of these product stoppages have happened due to factory and port closures in China. Last time we had a crisis, China’s growing economy helped pull the world out of it. Now China has had to revert to its own easing to try to keep its economy from completely crashing, BUT it is still locking down entire cities and ports. That problem will ease if COVID evaporates, but it would still take a few months to get things up to speed in China and to clear the backed-up ports, which at this point keep getting worse, AND we know COVID isn’t going away that quickly and easily anyway. That’s a best-case fantasy. But, even if it did, it would take a few months to get all factories up to speed, traffic moving and ports cleared. That won’t be in time to keep the Fed from killing markets.

For now, China is even going to kill its Olympic-Games hopes by locking things down so tightly that even some athletes might not be allowed to compete. China’s total lockdown policy — zero COVID tolerance — will continue to crush its economy for months to come. Maybe by summer COVID will be diminishing, but that still leaves a lot of NEW damage to come.

Beijing has emerged as the latest COVID hotspot after China’s health authorities scrambled to contain the spread of the omicron variant in Tianjin, a coastal city near Beijing, and weeks after they locked down Xi’an, a western Chinese city of 13MM that has been locked down since just before Christmas.

Containers are stacking up at the already backed-up Shenzhen port in China as congestion in the U.S. and Europe ripples back to Asia, delaying ships picking up goods from the manufacturing and technology hub.

For now, crews are confined to vessels, whether they have COVID or not. This leaves crews with no shore-leave after months at sea, which gives shipping operators reasons to try to skip Chinese ports, some of which are closed to business anyway, or they risk losing their crews who do have the freedom to walk at some point when they touch the shores of home.

China’s major New Year break, which begins in the coming week will only exacerbate the shortages as the nation takes a loooong holiday.

Goods are stacking up as ships coming to pick them up have in turn been delayed by congestion in the U.S. and Europe.

We keep hearing that the clogging up of shipping lines is going to clear. We’ve been hearing this for months. Then why haven’t they. They just keep getting worse, especially in China, the COVID epicenter. (These are the kinds of statement that have gotten my articles banned at a couple of major publishers, but they are the truths that need to keep getting told, regardless.)

Ships arriving to the Yantian terminal are delayed by an average seven days and the number of ships arriving from Europe and the U.S. has fallen more than 40% in the past two weeks, the terminal said in a customer advisory Wednesday. That comes on top of the problems Shenzhen port was already facing, with a viral outbreak earlier this month leading to lockdowns of districts, testing of workers and trucking delays at the Yantian and Shekou container terminals.

There is no way all of that fades away in time to help the Fed any at all by alleviating the supply shortages that the Fed was once saying were “transitory.” Yes, Mr. Powell, they are transitory, but only in the sense that you are also transitory, and so is the earth itself on a long enough timeline.

As it turns out, even recent reports that ships backed up in port were down in number did not mean the hope some might have thought. Ships have simply given up on aching at those ports, so they are waiting out at sea or making port elsewhere.

“Delivery times lengthened significantly in 2021, and January 2022 began with many companies reporting severely constrained output, input costs rising faster than at any point in the decade prior to the pandemic, and Omicron causing fresh uncertainty,” Chris Williamson, chief business economist at IHS Markit Ltd said in a recent report.

Does that sound like supply shortages will be easing in time to curtail inflation and help the Fed avoid fighting a war against inflation?

“It’s not just China, all shipping operations have been affected world-wide,” said Mark O’Neil, chief executive officer at Columbia Shipmanagement Ltd. “It’s almost certain that we will see more delays to shipping because omicron is a short, sharp step backwards.”

We were already in a bad place, so we cannot afford a step backward. It means, the delays that are part of the cause of global shortages just got longer! Things are not moving in the direction the Fed needs in order to have room to back away from its new tightening regime when it finds, as it certainly will, that the new tightening is crashing markets all around it. If the Fed were to back up, it would only make inflation worse and bear the public’s wrath. We don’t like rising prices and emptying shelves. That’s scary business when you start to see it show up.

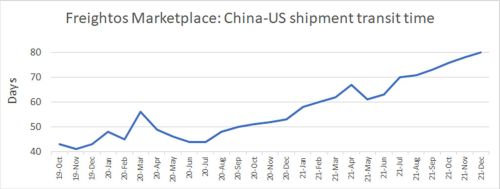

How bad is it?

According to multiple sources, average transit times have risen to double pre-COVID levels — and they’re still increasing…. With every passing month, more vessels, container equipment and goods inventories are getting waylaid in the Pacific…. Flexport’s Asia-U.S. OTI [Ocean Timeliness Indicator] reached an all-time high of 114 days last week. That’s 41 days or 57% higher than at the same time last year, and 63 days or 125% higher than at the same time in 2020, pre-COVID.… “This is intended as a straightforward and transparent measure of how severe the crisis is.”

That doesn’t sound like a plug that is being cleared out. That sounds like a lot of inflationary pressure continuing to build up on the supply side of the inflation problem. I like a straightforward and transparent measure that cuts through the Fed’s fog and the government’s fog and all the market analysts’ fog, who have stocks to sell, and through the delusions of investors who want to believe their parade is going to continue.

“You see a lot of things that jump around and other fleeting measures. You might say, ‘Hey, I got a great spot rate out of Yantian so I guess the crisis is over’ or ‘There was stuff on the shelves when I went shopping yesterday so I think we must be OK.’ But the OTI is something that is fairly consistent, you can see it over time, and you can see the degree of variability over time. You can see that these are dramatically longer times than we’ve had before — and they haven’t backed off yet.

“Let’s suppose the supply chain fairy waved a wand and solved all of these problems and we went right back to the old shipping times of the pre-COVID era again. What would the ‘all clear’ look like? You wouldn’t see an immediate drop because it would take awhile for things to sort out [due to the OTI’s retrospective nature]. But you should start to see this trending down as each stage [Asia factory to ships/ocean/U.S. port] moves faster. And we haven’t seen that yet. If this resolves, you should see something very different here.”

While China goes into its New Year holiday, the rest of the world does not, so the shipping logjam around China will only get worse. China will continue to exacerbate shortages for months to come as will problems along other freightways. There is a lot of clog to clear:

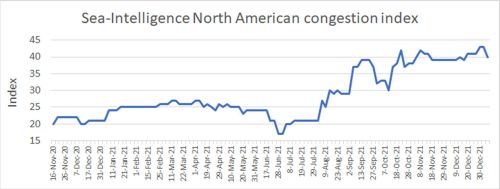

While the above chart measures how bad the plug is in terms of time delay, the following chart quantifies it by indexing how congested ports are around America:

“It seems that there is no sign of imminent improvement. All available data shows that congestion and bottleneck problems are worsening.”

There is not even the slightest room for doubt that this clog is going to take a significant amount of time to clear even if Omicron goes away today. There is no hope here to maintain a fantasy delusion that this problem will clear up before the Fed is forced to raise interest rates and then raise them faster just to keep up with the newly empowered bond vigilantes.

Labor crisis

Omicron is doing all of that in the US, too, of course — diminishing labor at US ports and among US truckers and other shippers but also at US factories and warehouses and at stores where shelves need to be stocked, etc. However, all of this was baked in months ago to where Omicron is only making it worse and more evident.

So long as labor is in short supply, these shortages in goods and services will continue, and labor is not coming back anytime soon, even if Omicron evaporates from the face of the earth tomorrow because much the labor supply has packed it in and left for good.

With gas prices already topping $4 a gallon in many places and shelves already starting to appear bare here and there (read “Food Shortages Punching the Populace in the Gut“), Joe Biden may have to soon go far beyond the courts in backing away from his own BMs (Biden Mandates). He may have to mandate that everyone he fired go back to work, even if they are sick, to help resolve a national labor shortage his mandates have made worse.

Think not? Believe it or not, we are already seeing this in hospitals where, to alleviate extreme staff shortages, wretchedly sick doctors and nurses are being ordered to go back to work where they can cough over their patients so long as they have been vaccinated, while perfectly healthy people who have not been vaccinated are forced to stay away from work, adding to the staffing shortages. Apparently an unvaccinated person who is perfectly healthy is far more dangerous to patients than someone who has COVID and is coughing and sneezing over their bed. (Read: “Peak Stupidity is COVID’s Number-One Symptom.”)

We are already seeing this kind of forced labor in Australia, home of the most draconian COVID lockdowns, where now citizens are being FORCED to restock shelves in stores if they want to keep their government benefits coming in. We might call this a labor DRAFT. Biden may have to draft labor by such measures, too, if he wants to make up for the loss of workers, exacerbated by his own BMs hitting at the same time as Omicron sick leave.

Here’s the thing: Even if Omicron completely backs off and all forms of COVID suddenly go away, Joe Biden is faced with a labor pool that is about 10,000,000 people smaller than what we had before the COVIDcrisis happened. When we locked down, we destroyed our economy. As I noted in the summer of 2020, we would not know how badly we damaged our economy until we finally saw how much didn’t come back, and a big part of what didn’t come back was labor.

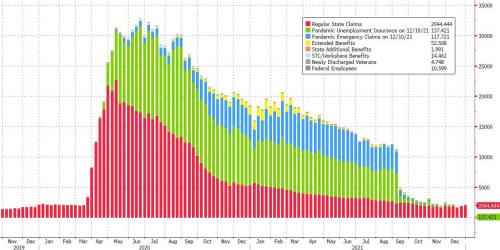

We live in a government masquerade, as I explained in this article several months ago: “Media Slavishly Praise Strong Jobs Market as Being Saved by Vaccines.” In that article, you can see how unemployment appeared to fall off a cliff in a massive instant recovery as soon as extended unemployment benefits were terminated. For some, this fit their predictions that people would return to work when all the government rewards for not working were ended.

Not so. As that article lays out, all of those people dropped off the unemployment roll for one very simple reason. Once you are not eligible for unemployment benefits, you are no longer counted in the official unemployment numbers even though you remain unemployed. These people did not rush back to their jobs. If they had, the labor crisis would have immediately ended, but the labor crisis continued to get worse every month after that. No, many of these people simply dropped out of the labor force for good.

They said, “Screw it! I’m sick of being underpaid. I’m sick of being told I will have to vaccinate in the months ahead in order to get paid. I’m sick of wearing masks all day. I’m close enough to retirement, that I’ll just take early retirement.” They’re gone. Jumping’ Joe isn’t getting them back, and they are not even recognized as having quit due to the vaccine mandates because they were already NOT working when covered by extended benefits, and some of them just continued to be not working, knowing they weren’t going to take what was coming down the pike.

About 10,000,000 people evaporated from the labor force, so Joe will either have to draft people to force them to work or open the borders to flood in more cheap labor.

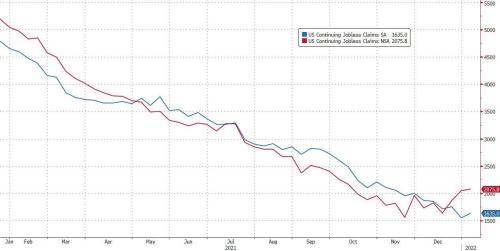

And now, perhaps due to Omicron, perhaps due to the BMs that the Supreme Court left in place, even the official unemployment rate is rising again.

New jobless claims are on the rise and considerably beat economists’ expectations:

On a seasonally-adjusted, initial claims unexpectedly soared from 231K to 286K, a huge miss to expectations of 225K, the highest print since October 8 and the latest confirmation that the economy is slowing rapidly.

Continuing claims have also risen:

Some will say this rise in unemployment will give the Fed the excuse it needs to back down on its new tightening regime because clearly in the Fed’s view the economy may need new stimulus to get jobs up. The Fed, however cannot use that excuse. It ignores the fact that everything in these charts is worse for supply shortages, which the Fed has said are a big driver of inflation. So, the Fed is going to feel crushed from both sides by these employment stats, and is more likely to experience analysis paralysis. While one Fed mandate kicks in here that says the Fed must boost employment, the other mandate says it must curb inflation, which unemployment will make worse by causing more shortages of goods and services. The Fed can’t win here. These stagflation numbers say both unemployment, which exacerbates shortages, and inflation are getting worse together.

Thus, the Fed cannot help itself out by trying to deploy the labor excuse as a reason to retreat from tightening during a severe labor shortage that is driving up the cost of labor AND limiting the availability of goods and services at the same time — a one-two punch that makes inflation hotter — because retreating from its tightening path also means high inflation.

As I’ve said, the Fed was creating a situation where it would find itself trapped. It’s checkmate Fed, so inflation will do its dirty work one way or the other.

Those employment changes are now starting to trickle into the total unemployment number:

And there you see that cliff dive back in September where unemployment numbers plunged the second unemployment benefits expired, but it wasn’t because people went back to work that quickly. How could everyone get back to work that quickly? For many of them, the jobs they had didn’t even exist anymore, thanks to our COVID lockdowns back in 2020! You cannot retrain and relocate to new jobs in a week. Clearly, the they just fell off the roll.

Inflation that is still in the pipeline

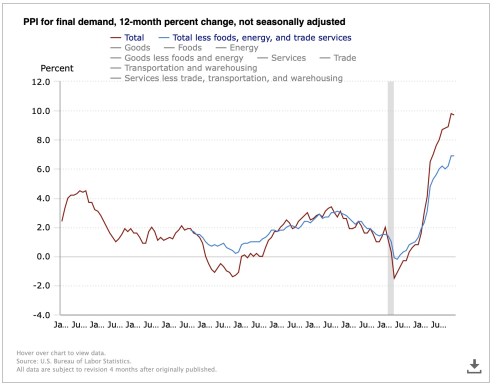

The other major factor in my prediction that inflation would become the thing that kills this bull market in stocks (and all other markets) by forcing the Fed to tighten was my readings on the inflation that was already happening on the producer side, which would eventually play through on the consumer side (which is measured by CPI). Here there is not much good news to ease the sleep of central bankers either.

When we look at inflation already in the pipeline, one of the things we look at is the cost of materials that are being bought today to do into the products of tomorrow to be shipped even later than that and then stocked and sold. These are the material costs that will be impacting the Consumer Price Index months from now when finished products finally making it through all the shipping congestion above to land on store shelves or inside Amazon warehouses.

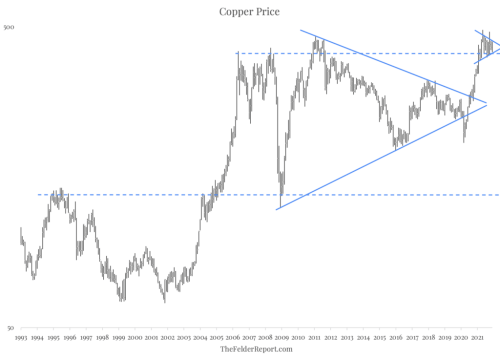

One of the materials/resources seen as most predictive of future inflation is copper, often referred to as Dr. Copper for its prognostic capabilities due to copper going into so many products.

Dr. Copper sits at an all-time high right now, and it’s price action has moved into a flag pattern that can break either way. We see in the image below how last time it broke to the downside but, then, still leaped far to the upside:

While we can’t tell which way it will break, we can tell that copper prices that will be affecting tomorrow’s products are already at their highest. If copper breaks lower, that will start to help products being produced in the future, but it won’t help products being produce in the weeks ahead with copper bought now that will be selling in the months ahead. So, best case scenario is that today’s copper prices continue to push up tomorrow’s prices for many more months (as cost increases that are already baked in); and, if copper breaks again to the upside, it all gets worse.

The baked-in part already says inflation get worse for the Fed for a number of months to come. No room for reprieve from Fed tightening when stocks have crashed 20%.

As you can see, the Producer Price Index has also been doing nothing but skyrocketing and has only, at last, taken a wee bit of a rest, like a rocket petering out at the top of its flight, but nothing that amounts to a drop in its own rate of inflation:

CPI measures prices paid by consumers at the final stage of the retail process. PPI for final demand measures prices paid by retail stores to the producer. So, it is one step back from CPI. (PPI for intermediate demand measures producer price increases on goods or resources produced that sell to other producers, such as the price of leather that then goes into furniture. So, “final demand” PPI is is the measure that is one step back from the consumer’s price.)

Again, while there is a sign that the rate of rise in producer prices may be topping, that’s not prices topping, but the rate of rise, meaning things on the consumer end just a little further down the pipe will be pressured to keeping rising at that year-on-year rate, too. To the extent retailers pass on their cost increases from producers, there may be a miniscule dip in the inflation rate around the next bend for consumers, but not enough to be material or to help the Fed any, not based on what we see here. The best-case scenario here would be that the inflation rate stabilizes around 8% year-on-year — a level the Fed is forced to battle back down.

As shown in my last article, it takes the Fed a long time at very high interest to win that battle.

That gives a view of what is already in the pricing side of the pipeline to the consumer, but what about what is in the pipeline for supply (i.e., shortages)? There we look to the something like the Empire State Manufacturing Survey, which has already dropped into its recessionary range:

This is the 3rd biggest MoM drop in history (with only March and April 2020 worse)…

Here is a different measure of industry, showing the same phenomenon:

Due to labor shortages and inability to obtain those products that go into other products or to get raw resources and due to shipping delays, US manufacturing is in retreat, reinforcing my prediction that we would be entering 2022 sliding into recession. Whether we hit recession or not, this survey indicates that, at least in New York, manufacturing is in decline, which means shortages of domestically produced goods are likely on the rise. (Shortages are, of course, the gap between supply and demand, so this drop in supply does not necessarily translate into a shortage in the event that demand falls along with it.)

This is the second biggest miss against Bloomberg consensus in history.

“After eighteen months of positive readings, the general business conditions fell a steep thirty-three points to -0.7,” the New York Fed said

For the consumer — and, hence, for the political pressures the Fed will be facing — all of the above looks like this:

Grocery-store shoppers are sporadically encountering portions of a shelf that is suddenly empty when a week earlier there was plenty of product. There are again social-media “reports” of purchase limits of some items, such as toilet paper (why is it always toilet paper?) at some Costco, or pasta at some Walmart, or beef at some Safeway, or whatever. You can buy all kinds of stuff, but you might not be able to get one or two items that are part of your normal list.

In Washington, D.C., that recently looked like this: “Food Shortages Punching the Populace in the Gut.”

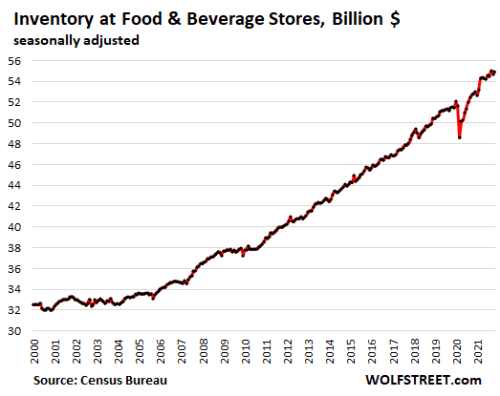

How do we get a quantitative lock on this nationally? As Wolf Richter points out in his article, measured in dollars, inventories look they have fully recovered from the COVIDcrisis:

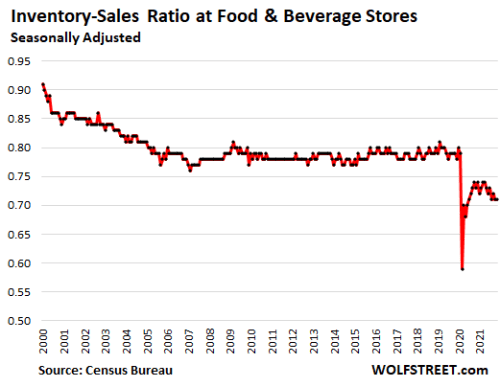

But here is where things get tricky, and where you are going to have to pay attention to all reports like GDP now that inflation is burning a hole through statistics, too: That inventory is measured in dollars, and with inflation running around 7%, there would b a 7% increase in the dollar value of inventories even if the actual number of products in inventory had held flat. So, measured in a manner that cancels out inflation, that looks like this:

A sad picture that looks to be in need of Viagra.

The economy is impotent.

And, while the supply of goods in your store is slowly diminishing in ways that you might be able to see, the cost of getting those goods to the store has gone up astronomically:

Growers of perishable produce across the West Coast are paying nearly triple pre-pandemic trucking rates to ship things like lettuce and berries before they spoil. Shay Myers, CEO of Owyhee Produce, which grows onions, watermelons and asparagus along the border of Idaho and Oregon, said he has been holding off shipping onions to retail distributors until freight costs go down.

Reuters via Yahoo!

Embedded in that, you can see how the rise in shipping costs is also contributing to the shortage in goods as producers (here noted by way of onions) sometimes hold back on shipping with less perishable items, hoping the shipping costs improve. This is the inflation feed-back loop or vortex I’ve described in the past where inflation feeds shortages, which create more inflation as people bid up the price of goods that are more scarce.

At first, it shows up here and there in spurts:

Shoppers on social media complained of empty pasta and meat aisles at some Walmart stores; a Meijer store in Indianapolis was swept bare of chicken; a Publix in Palm Beach, Florida was out of bath tissue and home hygiene products while Costco reinstated purchase limits on toilet paper at some stores in Washington state.

As Wolf wrote, it’s not that the stores will be bare but that you never know what thing you want or need might not be there at any given time. You’re likely to see more and more of those sporadic shortages.

The consumer-packaged goods industry is missing around 120,000 workers out of which only 1,500 jobs were added last month, she said, while the National Grocer’s Association said that many of its grocery store members were operating with less than 50% of their workforce capacity…. U.S. retailers are now facing roughly 12% out of stock levels on food, beverages, household cleaning and personal hygiene products compared to 7-10% in regular times.

That doesn’t sound like a situation that is going to help the Fed out between now and its next couple of FOMC meetings. And demand is not abating in order to avoid turning the supply decrease into shortages:

SpartanNash, a U.S. grocery distributor, last week said it has become harder to get supplies from food manufacturers, especially processed items like cereal and soup.

Consumers have continued to stock up on groceries as they hunker down at home to curb the spread of the Omicron-variant. Denis said demand over the last five months has been as high or higher than it had been in March 2020 at the beginning of the pandemic. Similar issues are being seen in other parts of the world.

So, it’s global, which also means the Fed can’t solve it. Out of the Fed’s jurisdiction, so to speak. So, no reprieve in sight for the consumer. Therefore, no reprieve from inflationary heat for the Fed. So, don’t expect the Fed to just rush back in and save crashing markets as it has so easily done in the past.

I keep reading people who are confident the Fed will do that this time as it has in past times. It cannot do that without fueling the inflation death spiral. That is why this time is altogether different. Trying to save markets that cannot withstand the tightening the Fed now must do because inflation is forcing the Fed’s hand, would mean we would be starting down the hyper-inflationary path toward the Zimbabwe dollar. It’s not likely the Fed wants to see its money burn up like that.

Liked it? Take a second to support David Haggith on Patreon!