The gold price didn't do much of anything in early Globex trading overseas, but was then sold two quiet steps lower starting around 1:25 p.m. China Standard Time on their Friday afternoon -- and that lasted until minutes after 10 a.m. in London. Its rally from there ran into all kinds of 'resistance' -- and the short sellers of last resort really got serious at 11:55 a.m. in COMEX trading in New York...engineered it lower until around 3:10 p.m. in after-hours trading. It wasn't allowed to do much after that.

Its low and high tick were recorded as $2,729.20 and $2,759.20 in the February contract contract...an intraday move of exactly 30 bucks. The February/April price spread differential in gold at the close in New York yesterday was $26.30...April/June was $24.50...June/August was $23.40 -- and August/October was $23.30 an ounce.

Gold was closed in New York on Friday afternoon at $2,702.00 spot...down $12.60 on the day -- and 21 bucks off its Kitco-recorded high tick. Net volume was exceedingly light at around 117,500 contracts -- and there were around 40,500 contracts worth of roll-over/switch volume out of February and into future months...mostly April, but with noticeable amounts into June and August as well.

I saw that a further 1,214 gold, plus only 5 silver contracts were traded in January yesterday, so we'll find out how much of that shows up in tonight's Daily Delivery and Preliminary Reports.

The price pattern in silver was mostly the same as gold's until minutes after 10 a.m. in Globex trading in London. Shortly after that, at the 10:30 a.m. morning gold fix over there, it rallied until the noon GMT silver fix -- and then 'da boyz' appeared again...setting its low tick a couple of minutes before 9 a.m. in COMEX trading in New York. Its ensuing rally attempt thirty minutes later ran into 'something' at or minutes after the 10 a.m. EST afternoon gold fix in London -- and it was engineered very unevenly lower until around 3:05 p.m. in after-hours trading. From that juncture it rallied quietly and a bit unevenly until the market closed at 5:00 p.m. EST.

The high and low ticks in silver were reported by the CME Group as $30.91 and $31.64 in the March contract...an intraday move of 73 cents. The March/May price spread differential in silver at the close in New York was 30.6 cents...May/July was 30.1 cents -- and July/September was 28.5 cents an ounce.

Silver was closed on Friday afternoon in New York at $30.305 spot...down 44.5 cents from Thursday -- and 26.5 cents off its Kitco-recorded low tick. Net volume was certainly on the quieter side at 42,500 contracts -- and there were about 6,650 contracts worth of roll-over/switch volume out of March and into future months in this precious metal...mostly into May and July.

The platinum price had a choppy, quiet and broad up/down move that ended shortly after Globex trading began in Zurich. Its rally attempt from there, like gold's, ran into 'resistance' all the way up, with the not-for-profit sellers showing up with a vengeance at or minutes after the 10 a.m. EST afternoon gold fix in London. It was hammered ten bucks lower in minutes -- and its ensuing rally attempt ended around 11:55 a.m. EST. From that point it was stair-stepped quietly lower until the market closed at 5:00 p.m. EST. Platinum was closed at $938 spot...up 5 bucks on the day -- and 16 dollars off its Kitco-recorded high tick.

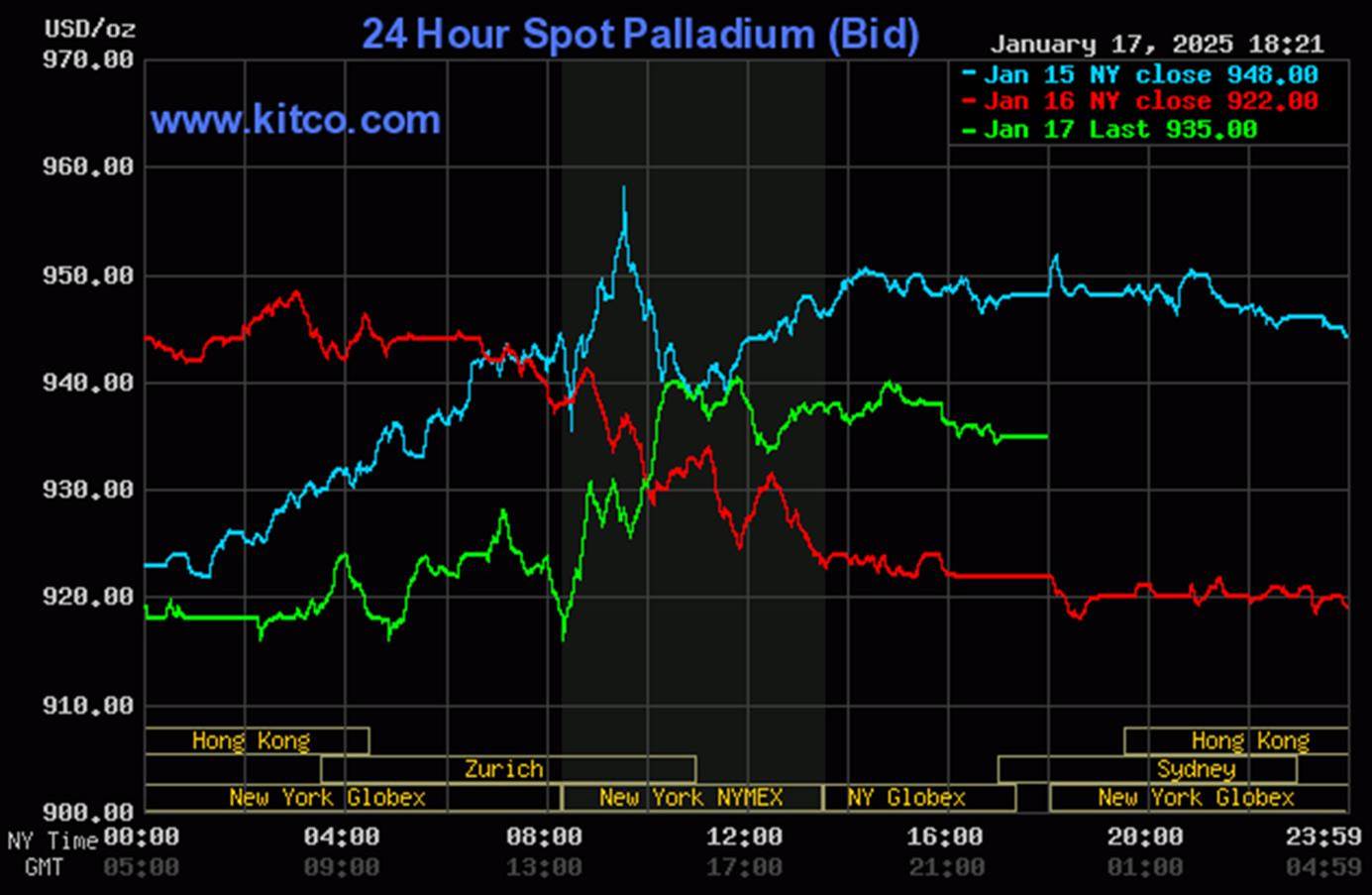

Palladium didn't do anything until Zurich opened on their Friday morning -- and then had a choppy and quiet up/down move that ended at 8:30 a.m. in COMEX trading in New York. It took two steps higher from there until it also ran into 'da boyz' at or minutes after the 10 a.m. EST afternoon gold fix in London. It chopped quietly lower from that juncture until trading ended. Palladium was closed at $935 spot...up 13 dollars from Thursday.

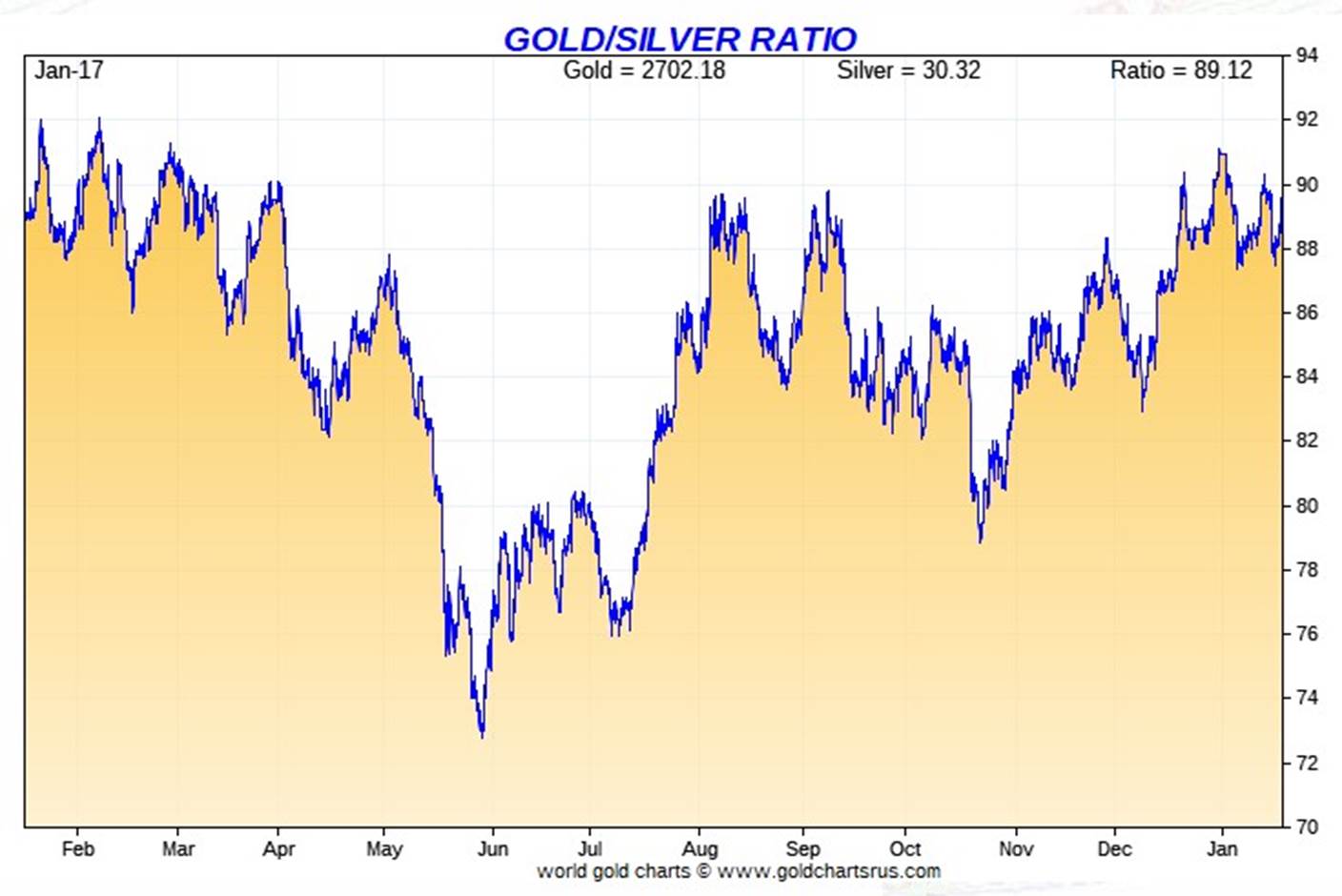

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 89.2 to 1 on Friday...compared to 88.3 to 1 on Thursday.

Here's the 1-year Gold/Silver Ratio Chart...courtesy of Nick Laird. Click to enlarge.

![]()

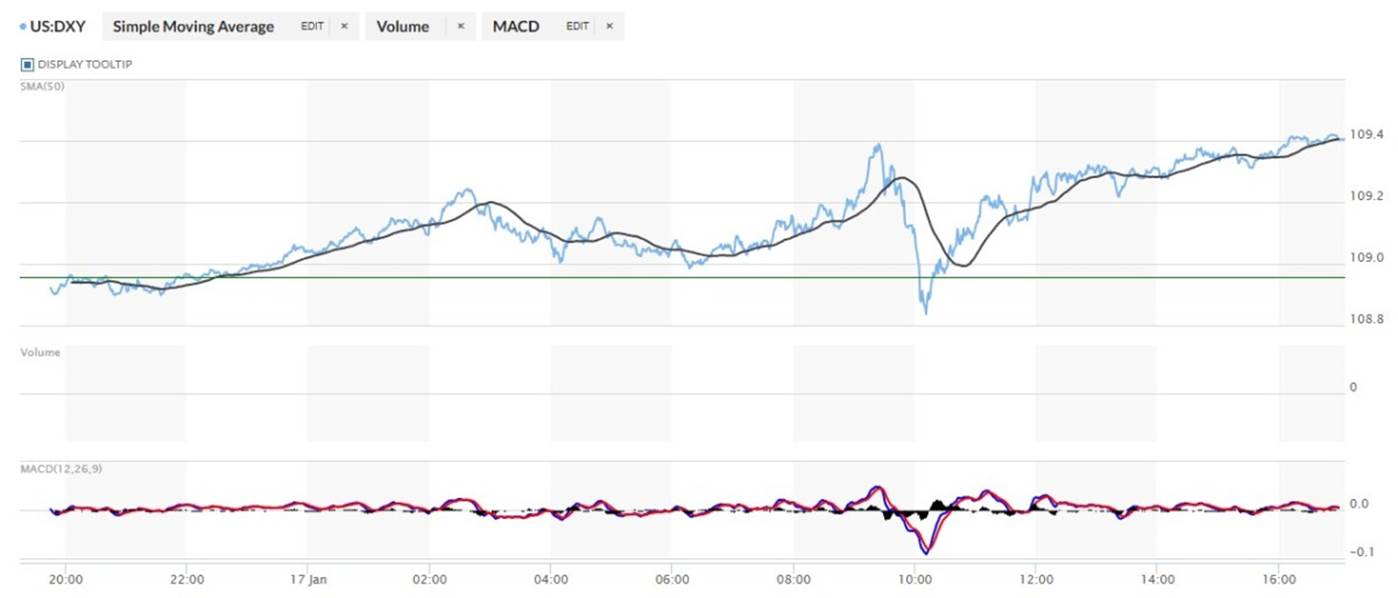

The dollar index closed very late on Thursday afternoon in New York at 108.96 -- and then opened lower by 4 basis points once trading commenced at 7:45 p.m. EST on Thursday evening...which was 8:45 a.m. China Standard Time on their Friday morning. It then traded pretty flat until 10:35 a.m. CST -- and then wandered quietly higher until around 3:37 p.m. CST. It then had a quiet, broad, bit uneven and ascending down/up move that ended around 9:25 a.m. in New York. It was sold down pretty hard from there until 'gentle hands' appeared around 10:10 a.m. EST. From that point it wandered/chopped quietly higher at an ever-decreasing rate until about an hour before trading ended at 5:00 p.m.

The dollar index finished the Friday trading session in New York at 109.35...up 39 basis points on the day -- and 6 basis points below its indicated close on the DXY chart below.

Here's the DXYchart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...109.20...and the close on DXY chart above, was 15 basis points below that. Click to enlarge.

![]()

I certainly didn't see much correlation between the dollar index and gold & silver prices on Friday.

U.S. 10-year Treasury: 4.6090%...up 0.0030/(+0.0651%)...as of the 1:59:51 p.m. CST close

The ten-year closed down 16.7 basis points on the week -- and 20 basis points off its mid-week high tick on Tuesday...thanks to the massive intervention by the Fed that began two hours after that.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

I'll point out once again that the 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023 -- and it's more than obvious from this chart that it will he held at something under 5% until further notice.

![]()

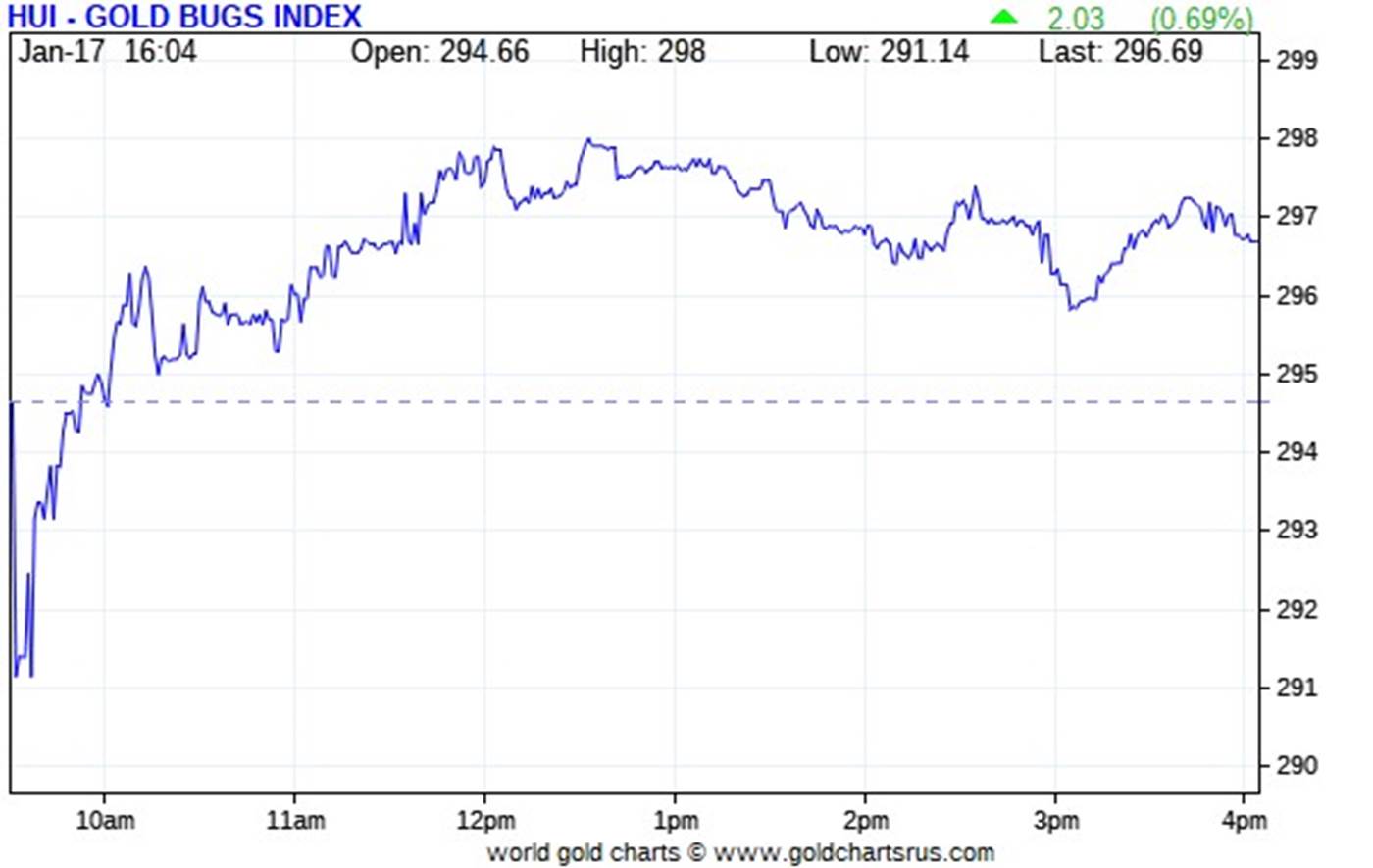

The gold stocks gapped down a bit at the 9:30 opens of the equity markets in New York on Friday morning, but they then began to rally rather smartly at an ever-decreasing rate until around 12:30 p.m. EST. They then wandered quietly lower until 3:05 p.m. -- and edged a bit unevenly higher from that point until the markets closed at 4:00 p.m. EST. Despite gold being down on the day, the HUI managed to close higher by 0.69 percent.

![]()

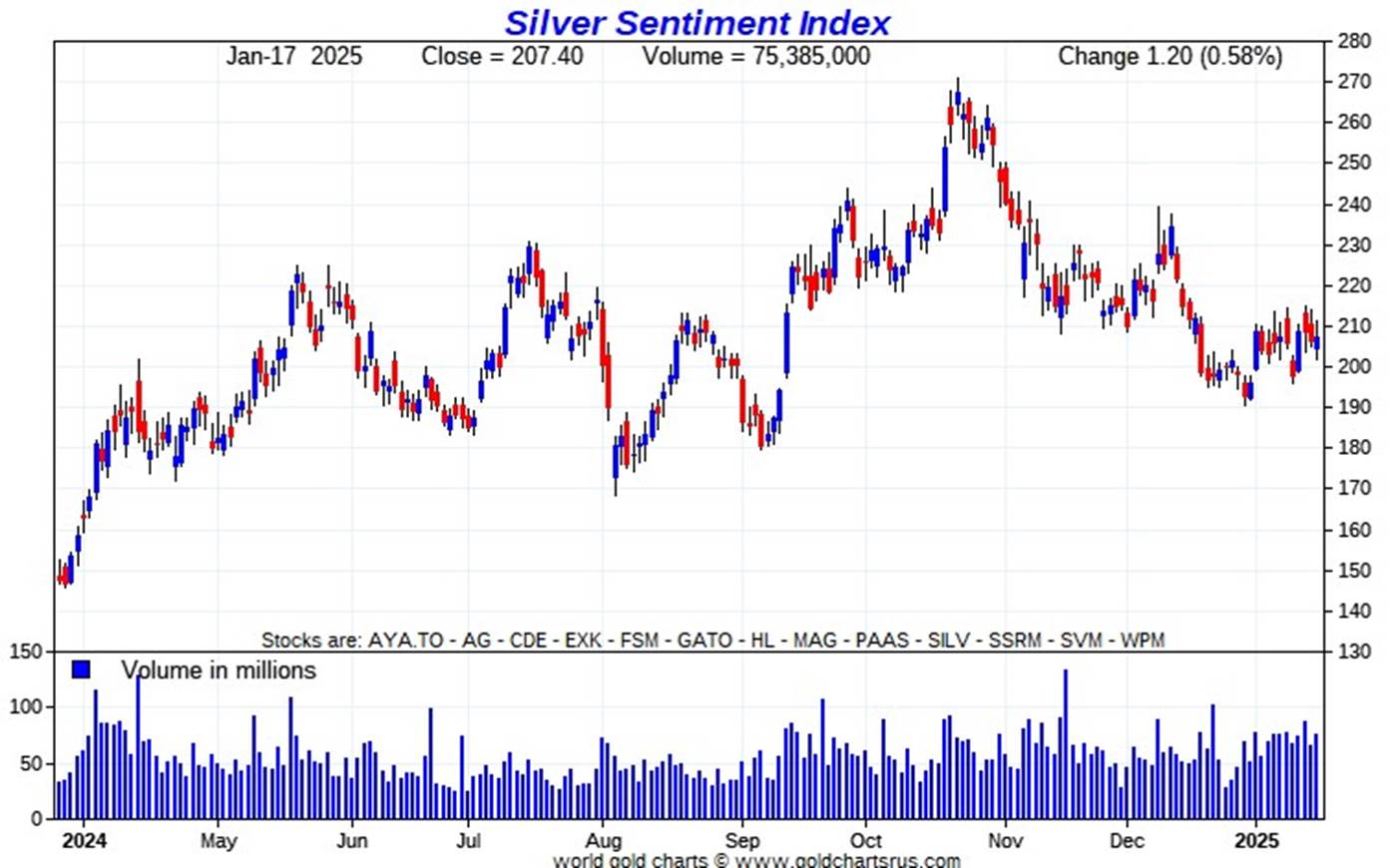

With Nick back in the saddle, here's his 1-year Silver Sentiment Index chart, updated with Friday's data. It closed up 0.58 percent -- and all on the back of the big gain in First Majestic Silver. Click to enlarge.

![]()

First Majestic Silver stole the show yesterday, closing higher by 5.04 percent -- and one has to suspect that with Gatos Silver now in their stable, there was a lot of mutual and hedge fund repositioning going on. The biggest underperformer was Fortuna Silver, as it closed lower by 1.16 percent.

With January options expiry now in the history books, next week should, hopefully, be much better.

I didn't see any news yesterday on any of the other silver companies that comprise the above Silver Sentiment Index.

The silver price premium in Shanghai over the U.S. price on Friday was 8.20 percent.

The reddit.com/Wallstreetsilver website, now under 'new' but not improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

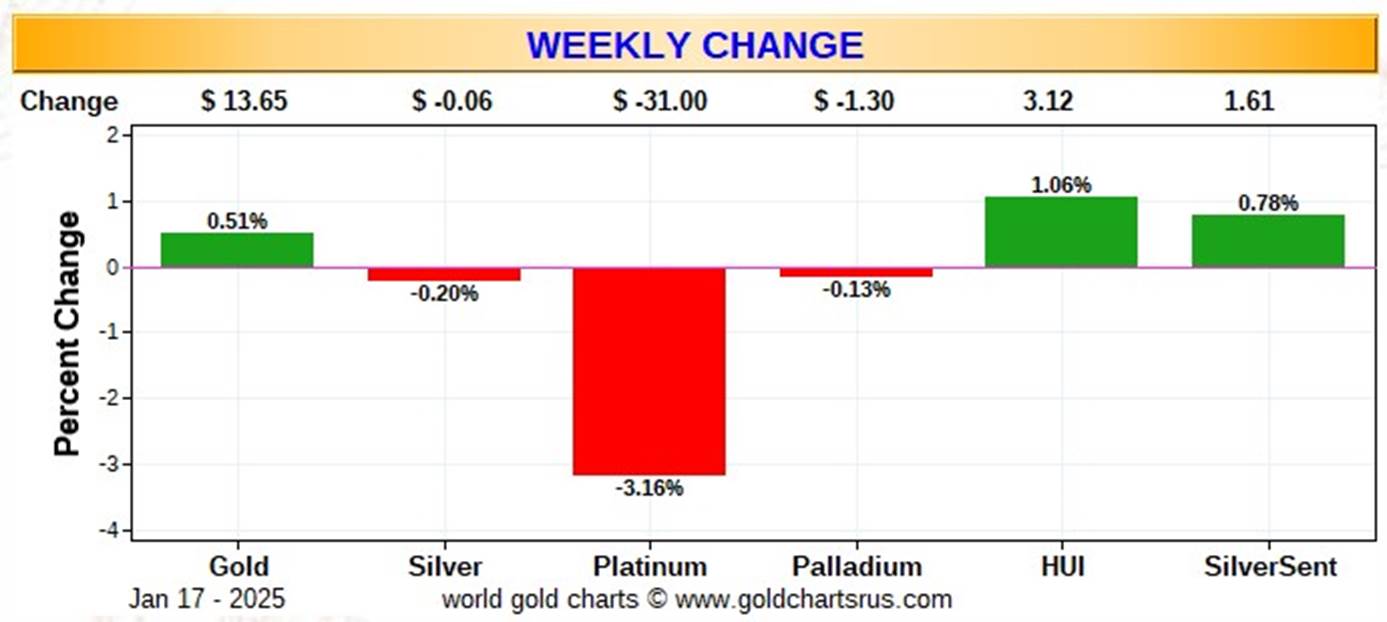

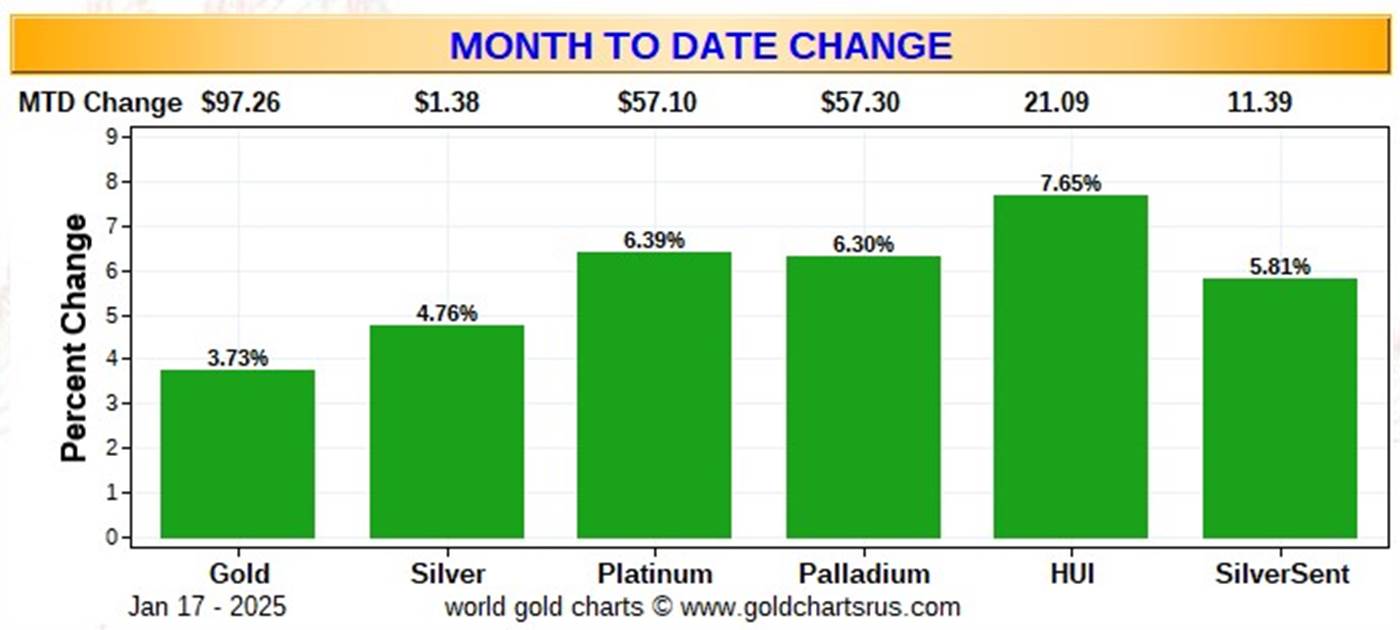

Here are two of the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the new Silver Sentiment Index.

Here's the weekly chart -- and except for the hatchet job on platinum, there's not a lot to see. I'm not prepared to read anything into these numbers. Click to enlarge.

Here's the month-to-date chart, which plays double-duty as the year-to-date chart for this one month only -- and I'm just happy that it's wall-to-wall green for the second week in a row. But with less than a dozen or so trading sessions of the New Year under our belts, I'm not prepared to read much into this data either...although everything gold-related is outperforming everything silver related by a bit. Click to enlarge.

Of course -- and as I mention in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting close to a new all-time high of $50+ dollars an ounce, like gold is close to its new all-time high of $2,800 the ounce...it's a given that the silver equities would be outperforming their golden cousins...both on a relative and absolute basis.

The CME Daily Delivery Report for Day 14 of January deliveries showed that 856 gold -- and and a surprising zero silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the two largest short/issuers by a country mile were British banks Standard Chartered and HSBC...issuing 400 and 320 contracts respectively... the former from their house account. Marex was in distant third place with 68 contracts out of their client account.

The three biggest long/stoppers were British bank Barclays, BofA Securities and Wells Fargo Securities, picking up 522, 196 and 96 contracts respectively ...Barclays for their client account.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been an absolutely astonishing 12,664 gold contracts issued/reissued and stopped. During this past week, there have been an additional 5,215 gold contracts added -- and that's on top of the 3,600 gold contracts that were added in the week prior.

In silver, there have been 1,892 contracts issued/reissued and stopped in January so far -- and in platinum that number is 2,648 COMEX contracts. In palladium...it's 8.

This is the wildest non-scheduled delivery month I've ever seen in gold...even blowing the doors off of October last year. However, it doesn't at all compare with the huge amounts of gold that the COMEX took in back in mid 2020.

The CME Preliminary Report for the Friday trading session showed that gold open interest in January declined by 379 contracts, leaving 1,261 still open, minus the 856 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 1,279 gold contracts were actually posted for delivery on Monday, so that means that 1,279-379=900 more gold contracts were added to January deliveries.

Silver o.i. in January declined by 38 contracts, leaving 111 still around -- and Thursday's Daily Delivery Report showed that 38 silver contracts were actually posted for delivery on Monday, so the change in open interest and deliveries match for once.

Total gold open interest in January rose by a further 5,469 COMEX contracts -- and total silver o.i. increased by 1,348 contracts. I was surprised to see these increases, especially considering the fact that both metals were closed down on the day -- and we're past the time when those uneconomic and market-neutral spread trades are put on.

[I checked Thursday's final total open interest numbers -- and the change from the Preliminary Report in gold showed only a tiny 260 contract decline from the monstrous +16,688 contract increase in the Preliminary Report. We were not amused. There was only a 75 contract drop in total silver o.i.]

February open interest in silver rose by a further 118 contracts...to 1,129 COMEX contracts.

And after three withdrawals in a row from GLD, an authorized participant[s] added a hefty 332,245 troy ounces of gold to it on Friday. There were no reported changes in SLV.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD and SLV activity, there were a net 191,214 troy ounces of gold added -- and a net 703,476 troy ounces of silver were added as well.

And still nothing from the U.S. Mint...or year-to-date, either.

Gold continues to pour into the COMEX from London, as an eye-watering 1,028,659 troy ounces were reported received, the largest amount that I can remember coming in since the big blow-out in COMEX gold inventories back in 2020. There were 64,334.151 troy ounces/2,001 kilobars were shipped out on Thursday.

In the 'in' category, there were six different depositories involved. The largest was JPMorgan, receiving 385,813.000 troy ounces/12,000 kilobars. They were followed by the 214,637 troy ounces that were dropped off at Brink's, Inc. The third largest amount were the 176,830 troy ounces/5,500 kilobars that found a new home over at Loomis International -- and the list goes on and on...

In the 'out' category, except for the 32.151 troy ounces/1 kilobar that left Brink's, Inc...the remaining 64,302.000 troy ounces/2,000 kilobars departed Loomis International.

There was monstrous paper activity, which was no surprise -- and all of it from the Eligible category and into Registered, which was also no surprise...263,078 troy ounces worth...with the largest amount being the 160,690.698 troy ounces/4,998 kilobars that was transferred in that direction over at JPMorgan.

The link to that, plus the rest of the enormous in/out activity in gold on the COMEX on Thursday is linked here -- and it's worth a look if you have the interest.

There was also very hefty silver action, as 1,937,177 troy ounces were reported received -- and 601,626 troy ounces shipped out.

In the 'in' category, the largest amount were the two truckloads/1,166,099 troy ounces that arrived at JPMorgan...with the remaining 771,078 troy ounces showing up at Loomis International.

In the 'out' category, except for the one good delivery bar/1,006 troy ounces that departed Brink's, Inc...the remaining truckload/600,620 troy ounces left Loomis International.

There was a bit of paper activity, as 49,272 troy ounces were transferred from the Eligible category and into Registered over at Delaware.

The link to all of Thursday's big silver activity is here.

There was a bit of activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday -- and all of it happened over at Brink's, Inc. They reported receiving 1,069 kilobars -- and shipped out 69 of them. The link to this, in troy ounces, is here.

The Shanghai Futures Exchange reported that a net 189,497 troy ounces of silver were removed from their inventories on their Friday, which now stands at 40.785 million troy ounces.

![]()

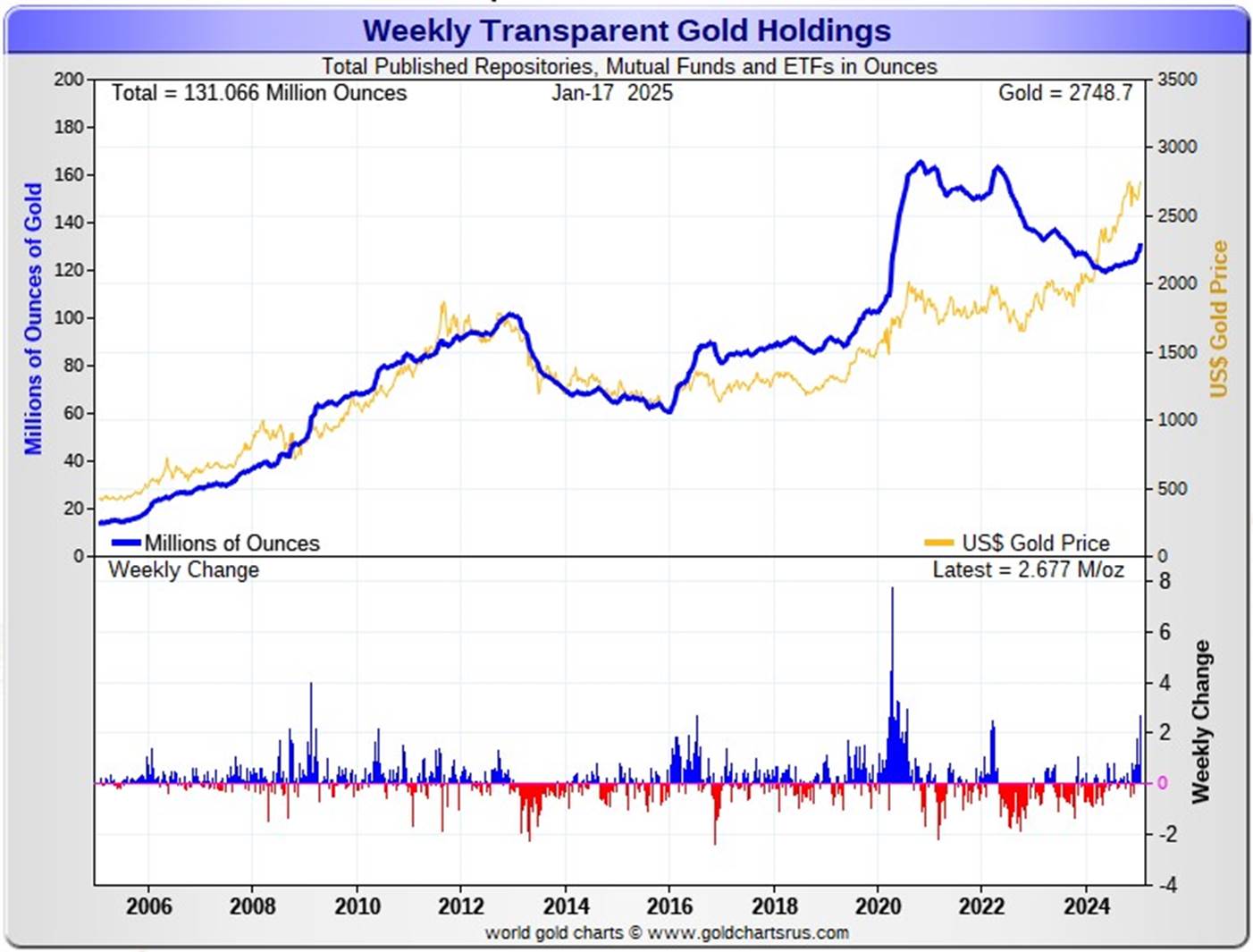

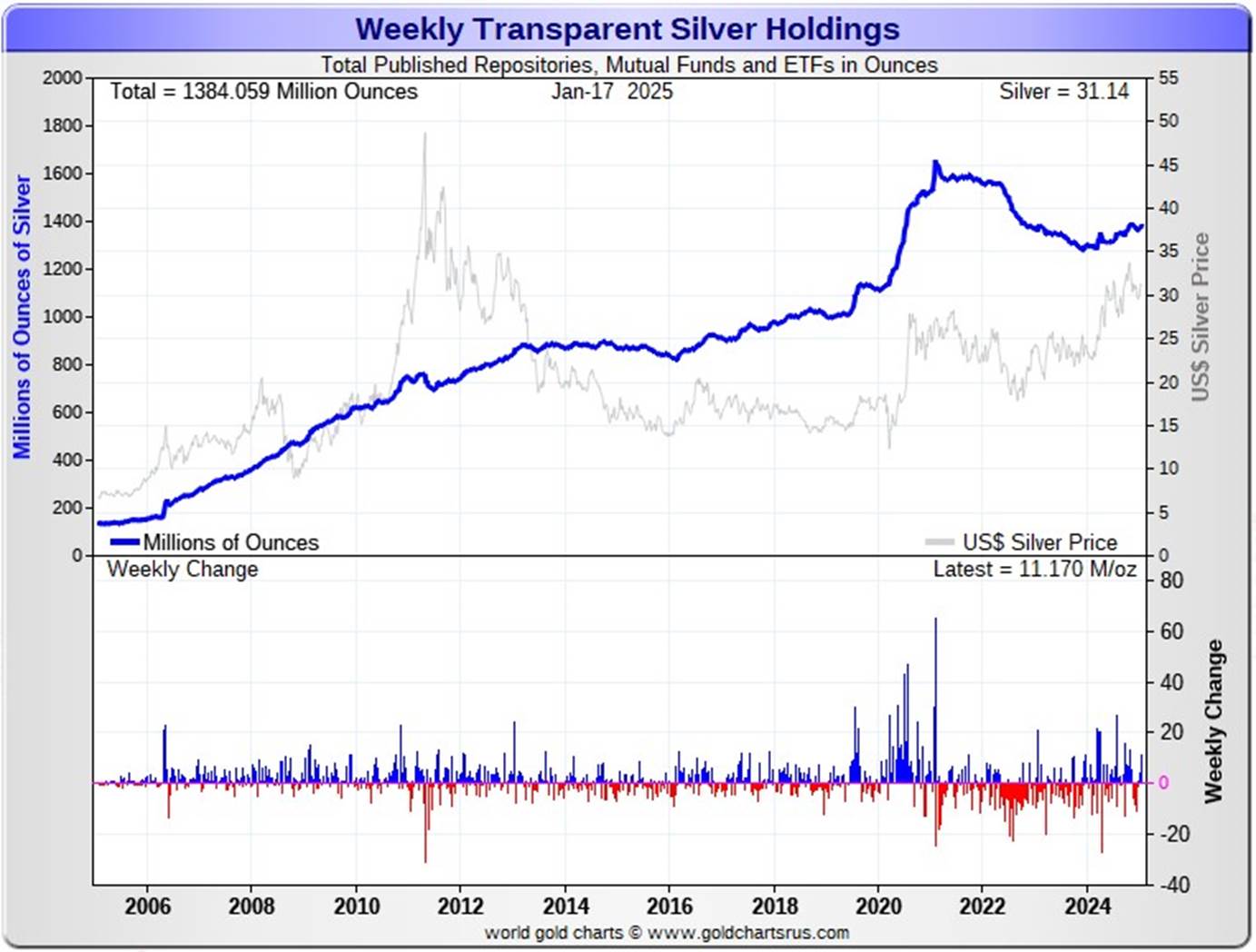

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there were a net 2.677 million troy ounces of gold added...with virtually all of that increase being COMEX and GLD related once again...mostly the former -- and a net 11.170 million troy ounces of silver were also added...almost all into the COMEX. Click to enlarge.

According to Nick Laird's data on his website, a net 6.238 million troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks -- with virtually all of it going into either the COMEX or GLD...mostly the former. And a net 24.815 million troy ounces of silver were were also added during that same time period.

Retail bullion sales, from what I've heard from my sources, is not all that bad. Premiums remain at rock bottom -- and I haven't seen any sign that they've been raising them at all. There are some really great deals to be had out there. It remains a buyer's market for physical at the retail level, but for a limited time only I'm sure.

At some point there will be large quantities of silver required by all the ETFs and mutual funds once serious institutional buying really kicks in -- and there have been a few signs of that this past week.

But the really big buying lies ahead of us when the silver price is finally allowed to rise substantially, which I'm sure is something that the powers-that-be in the silver world are keenly aware of -- and why they're desperate in their attempts to keep it from rising. Their efforts were on full display once again this past week...particularly yesterday...but can't last forever.

And as Ted stated a while ago now, it would appear that JPMorgan has parted with most of the at least one billion troy ounces that they'd accumulated since the drive-by shooting that commenced at the Globex open at 6:00 p.m. EDT on Sunday, April 30, 2011.

They had to supply huge amounts to both India and China in 2024 -- and one has to suspect that this amount of demand will continue in 2025 as well...if not increase further.

The physical demand in silver at the wholesale level continues unabated -- and was beyond ginormous again this past week. The amount of silver being physically moved, withdrawn, or changing ownership continued without letup.

That was on prominent display during the December delivery month, as 40.435 million troy ounces of physical silver were delivered/changed hands -- and the 9.46 million troy ounces of silver already delivered so far in January, continues to confirm that fact.

New silver has to be brought in from other sources [JPMorgan in London] to meet the ongoing demand for physical metal. That's been more than obvious on the COMEX...plus a bit in SLV and elsewhere. This will continue until available supplies are depleted...which will be the moment that JPMorgan & Friends stop providing silver to feed this deepening structural deficit, now in its fifth year.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 180.6 million troy ounces...unchanged for the last three weeks --and some distance behind the COMEX, where there are 330.7 million troy ounces being held...up another 11.7 million troy ounces this past week -- and up 18.3 million oz. in the last four weeks...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 33.7 million troy ounce mark...quite a bit different than the 136.7 million they indicate they have...up 1.2 million ounces on the week.

But PSLV is a long way behind SLV, as they are the largest silver depository, with 463.3 million troy ounces as of Friday's close...up 3.3 million troy ounces on the week.

The latest short report from a week ago [for positions held at the close of business on December 31] showed that the short position in SLV dropped by an unimpressive 7.29% from the 50.79 million shares sold short in the prior report...down to a still eye-watering 47.09 million shares in this latest report. This remains grotesque beyond description.

BlackRock issued a warning several years ago to all those short SLV, that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it...which is most certainly a U.S. bullion bank, or perhaps more than one.

The next short report...for positions held at the close of trading on Wednesday, January 15...will be posted on The Wall Street Journal's website on Monday evening, January 27.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well.

The latest report for the end of Q3/2024 from the OCC came three weeks ago now -- and after careful scrutiny, I noted that the dollar value of their derivative positions were up just under 20 percent on average over the last quarter...the same percentage increase as Q1/2024. I suspect that it was entirely due to the price increases in both gold and silver since the Q2 report came out.

This indicator is flawed for one very important reason, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others...that were card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is hidden...which is certainly the reason that the list was shortened.

![]()

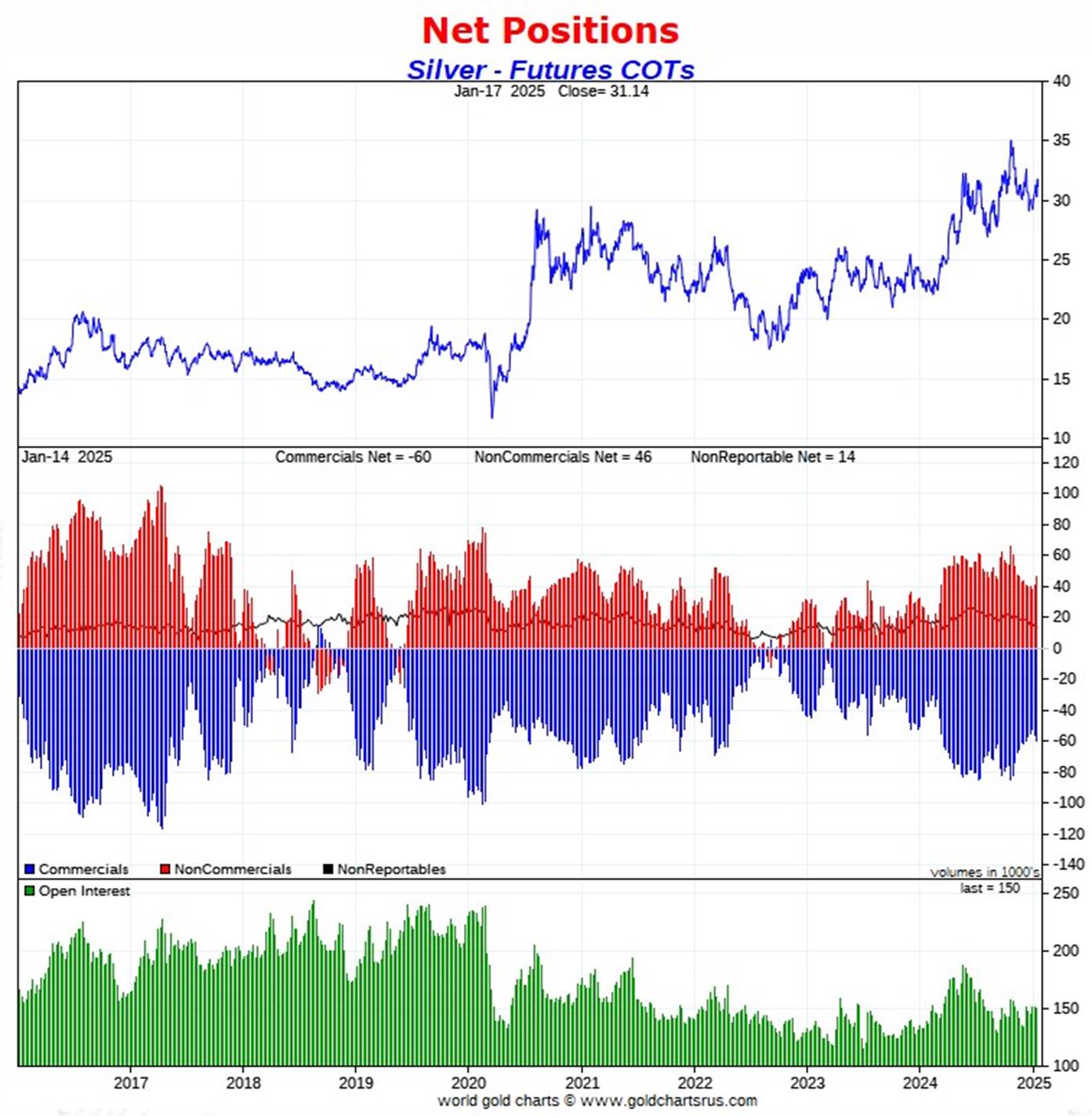

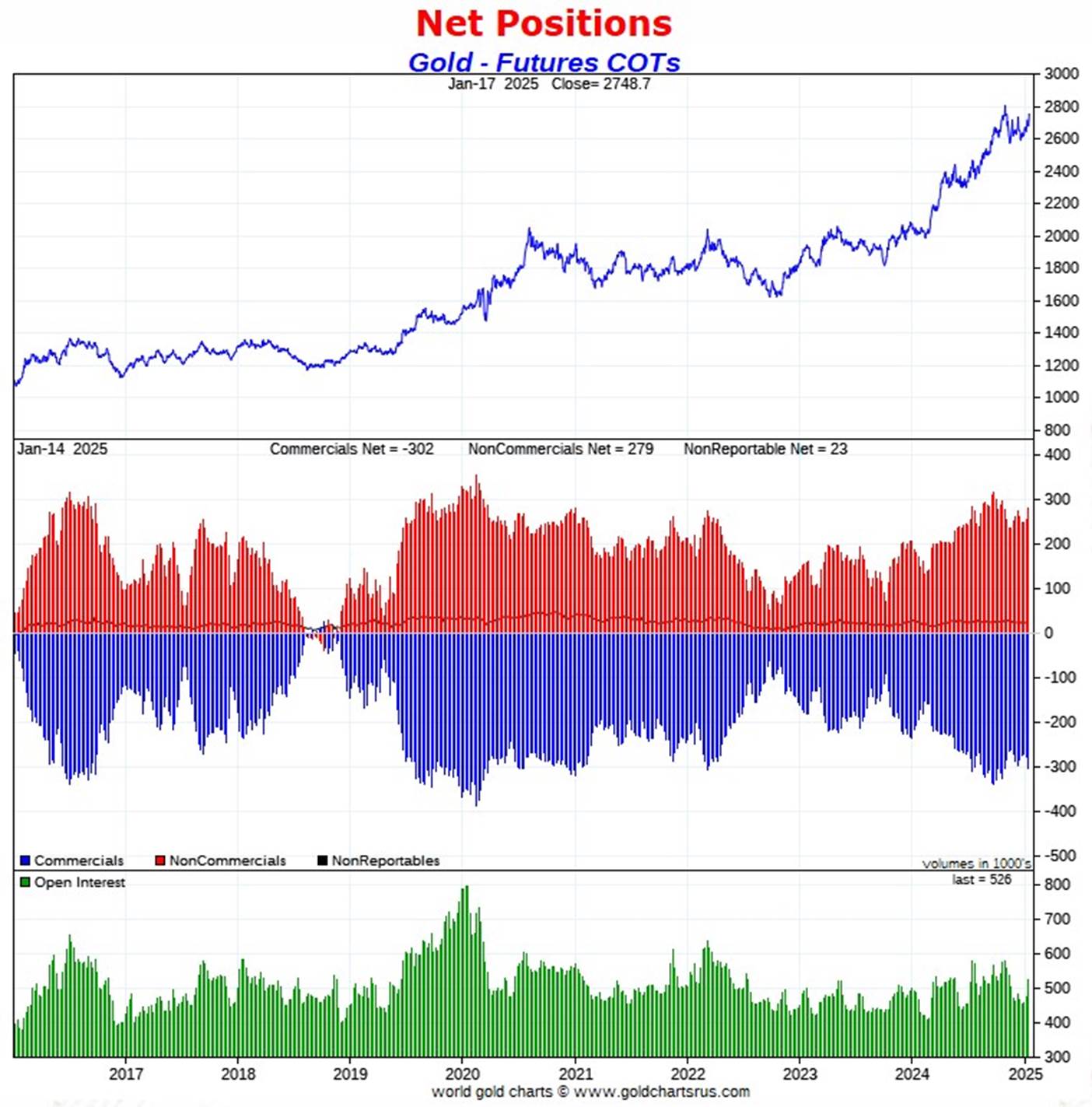

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed a smallish increase in the Commercial net short position in silver -- and a far larger than expected increase in the short position in gold.

In silver, the Commercial net short position rose for the second week in a row...this time by 3,502 COMEX contracts...17.510 million troy ounces of the stuff.

They arrived at that number through the sale of 2,653 long contracts...plus they sold 849 short contracts as well -- and it's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report it was all Managed Money traders, plus a bit more on the buy side, as they increased their net long position by 3,904 COMEX contracts...which they accomplished through the purchase of 3,244 long contracts, plus they bought back 660 short contracts. It's the sum of those two numbers that represents their change for the reporting week.

The traders in the Other Reportables category were also buyers...increasing their net long position by 1,228 contracts...which meant that the Nonreportable/small traders had to be sellers -- and they were...reducing their net long position by 1,630 COMEX contracts.

Doing the math: 3,904 plus 1,228 minus 1,630 equals 3,502 COMEX contracts...the change in the Commercial net short position.

The Commercial net short position in silver now stands at 59,676 contracts/298,380 million troy ounces...up those 3,502 contracts from the 56,174 COMEX contracts/280.870 million troy ounces they were short in the prior COT Report on Monday.

The Big 4 shorts [most likely the Big 1 or 2] increased their net short position by a further 1,987 COMEX contracts...from 51,843 contracts, up to 53,830 contracts -- and hugely bearish. They haven't been this short silver since back on November 1 of last year.

The Big '5 through 8' shorts decreased their net short position for the third week in a row...this time by 622 COMEX contracts...from the 21,071 contracts in the prior COT Report, down to 20,449 contracts in yesterday's COT Report -- and still very bearish.

The Big 8 shorts in total increased their overall net short position from 72,914 contracts, up to 74,279 COMEX contracts week-over-week...an increase of 1,365 COMEX contracts. This is the largest Big 8 short position since November 1...just as it is for the Big 4 shorts.

But since the Commercial net short position rose by 3,502 contracts in yesterday's COT Report -- and the Big 8 only increased their short position by only 1,365 contracts, this meant that Ted's raptors...the small commercial traders other than the Big 8...had to have been sellers -- and they were... decreasing their long position by 3,502-1,365=2,137 COMEX contracts.

That decreased the raptor's long position from 16,740 COMEX contracts, down to 14,603 contracts. In the October 25 COT Report, they were net short silver by 7,356 COMEX contracts...so they've scarfed up a net 21,959 long contracts since then...which the Big 8 commercial shorts would have dearly love to have bought.

Here's Nick's 9-year COT chart for silver -- and updated with the above data. Click to enlarge.

I'm certainly glad I took that Mulligan in silver for this report...as I don't relish being wrong at the top of my voice -- as the five candles of the reporting week were rather ambiguous.

And although the Commercial net short position 'rose' during the reporting week...2,137 contracts of the 3,502 contract increase in the Commercial net short position of Ted's raptors selling long positions...which really isn't an 'increase' at all. So the increase wasn't nearly as bad as the headline number indicated.

The Big 8 collusive commercial traders are now net short 49.4 percent of the total open interest in silver in this week's COT Report, compared to the 48.1 percent they were net short in the last COT report on Monday.

The change in total open interest during the reporting week was down only 1,226 contracts, so it had virtually zero effect on the above percentage calculations.

However, no matter how you slice it or dice it, from a COMEX futures market perspective, the set-up remains extremely bearish.

But nothing has changed with regards to that ongoing and deepening structural deficit in the physical market...which The Silver Institute now estimates to be 282 million troy ounces in 2024. The price action continues to indicate that silver wants to rise to reflect that, but it's not being allowed at the moment -- and certainly wasn't again on Friday. That was all paper trading in the COMEX futures market on yesterday's big options expiry -- and had zero to do with supply and demand.

As it's been for decades, it only matters what the collusive Big 8 commercial traders do...all of which are bullion banks or investment houses. Right now they're sitting there like a lump -- and the cork in the bottle in the silver price. But as Ted had pointed out over the years, some day what the numbers in the COT Report show, won't matter.

![]()

In gold, the commercial net short position blew out by a very hefty 23,806 COMEX contracts...2.381 million troy ounces of the stuff. All three categories were sellers...especially the Big 4 shorts and Ted's raptors.

They arrived at that number by adding 29,401 long contracts...but also sold a breath-taking 53,207 short contracts -- and its the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report the traders in both the Managed Money and Other Reportables categories were the big buyers...with the former increasing their net long position by 17,981 COMEX contracts -- and the latter by 6,471 contracts. The Nonreportable/small traders were net sellers, reducing their net long position by an insignificant 646 contracts.

Doing the math: 17,981 plus 6,471 minus 646 equals 23,806 COMEX contracts...the change in the commercial net short position.

The commercial net short position in gold now sits at 302,452 COMEX contracts/30.245 million troy ounces of the stuff...up those 23,806 contracts from the 278,646 COMEX contracts/27.865 million troy ounces they were short in Monday's COT Report -- and obviously wildly bearish.

The Big 4 shorts in gold increased their net short position for the fourth week in a row, them by 13,170 contracts...from 177,937 contracts they were short in Monday's COT report, up to 191,107 contracts in yesterday's report -- and obviously über bearish. They haven't been this short since October 25 last year.

The Big '5 through 8' shorts also increased their net short position, them for the third week in a row -- and by 963 contracts...from the 60,107 contracts they were short in Monday COT Report, up to 61,070 contracts held short in the current COT Report...which is still a bit on the bearish side for them.

The Big 8 short position in total increased from 238,044 contracts/23.804 million troy ounces in Monday's COT Report...up to 252,177 COMEX contracts/25.218 million troy ounces in yesterday's...an increase of 14,133 COMEX contracts...over-the-top bearish.

But since the commercial net short position increased 23,806 COMEX contracts during the reporting week -- and the Big 8 commercial short position increased by only 14,133 COMEX contracts, that meant that Ted's raptors...the small commercial traders other than the Big 8 had to have been huge sellers during the reporting week just past as well -- and they were. They increased their grotesque short position by 23,806-14,133=9,673 COMEX contracts. Their short position is now 50,275 contracts...up from the 40,602 contracts they were short in Monday's COT Report -- and haven't been this short since November 1 of last year.

Words, as I say in this spot every week, continue to fail me on this issue...as I cannot overemphasize just how grotesque and obscene the raptor short position in gold is on an historical basis -- and there's no way that there's a Managed Money or Other Reportables trader in the Big '5 through 8' category in gold.

Here's Nick's 9-year COT chart for gold -- and updated with the above data. Click to enlarge.

The Big 4 commercial shorts in gold, like in silver, mostly likely are the Big 1 or 2, obviously had to step in during the reporting week to prevent the gold price from taking off...along with a big helping hand from Ted's raptors...as the Big '5 through 8' commercial shorts contributed almost nothing.

As I've been pointing out for the last month or so, back on October 20, 2023 ...the total commercial net short position in gold was only 128,000 contracts. In yesterday's report it was a knee-wobbling 302,452 contracts...well over double that amount.

The reason for that huge disparity...besides the 54,000 contracts more short the Big 8 are at the moment, compared to back then...Ted's raptors were net long 68,933 contracts in gold back on that date...vs. being net short 50,275 contracts in yesterday's COT Report. That's a 119,208 contract swing in the raptor's position...11.921 million paper ounces of gold...plus that 54,000 contract increase in the Big 8 short position.

At some point these short positions have to be covered...especially those raptors -- and will only happen on fantastically lower prices, which isn't in the cards as far as I'm concerned. That's why closing the COMEX remains the only option to save the shorts from Ted's 'Bonfire'.

The Big 8 collusive commercial traders are short 47.9 percent of total open interest in the COMEX futures market...down from the 49.9 percent they were short in the prior COT Report. The reason for that decrease, rather than an increase, was because of the 49,424 contract increase in total open interest, which obviously dilutes the calculation.

But once you add in the 50,275 contracts currently held short by Ted's raptors, the commercial net short position in gold works out to 57.4 percent of total open interest, down a bit from the 58.4 percent they were short in the prior COT Report. This short position remains grotesque and obscene beyond description.

That percentage number would have also been higher [more that 60%] than it was this week if total gold open interest hadn't risen by those just-mentioned 49,424 contracts...which obviously dilutes the calculation. Those were mostly spread trades -- and all will disappear by the end of the month.

Can gold rally from here? Of course...as can silver. But it will only come about if the big commercial shorts allow it -- and that obviously wasn't in the cards again yesterday.

But this eye-opening dichotomy between the huge raptor long position in silver vs. the monster short position held by the raptors in gold...remains unprecedented. For the most part, these small traders are all the same players in both these precious metals -- and what it means for their respective prices going forward, is anyone's guess.

To sum up, from a COMEX futures market perspective, the set-up in gold is back to being wildly bearish. But, as said about silver...at some point, as Ted mentioned repeatedly over the years, what the numbers in the COT Report show, won't matter, as they will be trumped by factors beyond the control of the paper hangers in New York.

![]()

In the other metals, the Managed Money traders in palladium decreased their net short position by 926 COMEX contracts -- but remain net short palladium by a whopping 11,758 contracts...57.8 percent of total open interest. The other four categories of traders are all net long palladium... especially the Swap Dealers in the commercial category.

In platinum, the Managed Money traders increased their net long position by a further 2,191 COMEX contracts during the reporting week -- and are net long platinum by 7,180 COMEX contracts. It was their short covering that caused platinum to blast higher during the reporting week just past.

The commercial traders in the Producer/Merchant category in palladium are meganet short a knee-wobbling 22,771 COMEX contracts -- but the Swap Dealers in the commercial category are net long platinum by 2,427 contracts. The traders in both the Other Reportables and Nonreportable/small traders categories remain net long platinum by very hefty amounts...especially the Other Reportables.

It's mostly the world's banks in the Producer/Merchant category that are 'The Big Shorts' in platinum in the COMEX futures market, as per January's Bank Participation Report on Monday...but are far less short now than they were in the December report.

In copper, the Managed Money traders increased their net long position by a further 8,383 contracts -- and are now net long copper by 14,565 COMEX contracts...about 364 million pounds of the stuff as of yesterday's COT Report ...up from the 154 million pounds they were net long copper in Monday's COT report. Like in platinum, it was Managed Money short covering that drove the copper price higher during the reporting week...just more paper trading -- and nothing to do with supply/demand fundamentals.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 37,201 copper contracts/930 million pounds -- while the Swap Dealers are net long 22,658 COMEX contracts/566 million pounds of the stuff.

Whether this means anything or not, will only be known in the fullness of time. Ted said it didn't mean anything as far as he was concerned, as they're all commercial traders in the commercial category. However, this bifurcation has been in place for as many years as I can remember -- and that's a lot.

In this vital industrial commodity, the world's banks...both U.S. and foreign... are net long 8.4 percent of the total open interest in copper in the COMEX futures market as shown in the January Bank Participation Report...down a tad from the 8.9 percent they were net long in December's.

At the moment it's the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are net long, as pointed out above.

The next Bank Participation Report is due out on this Friday, February 7.

![]()

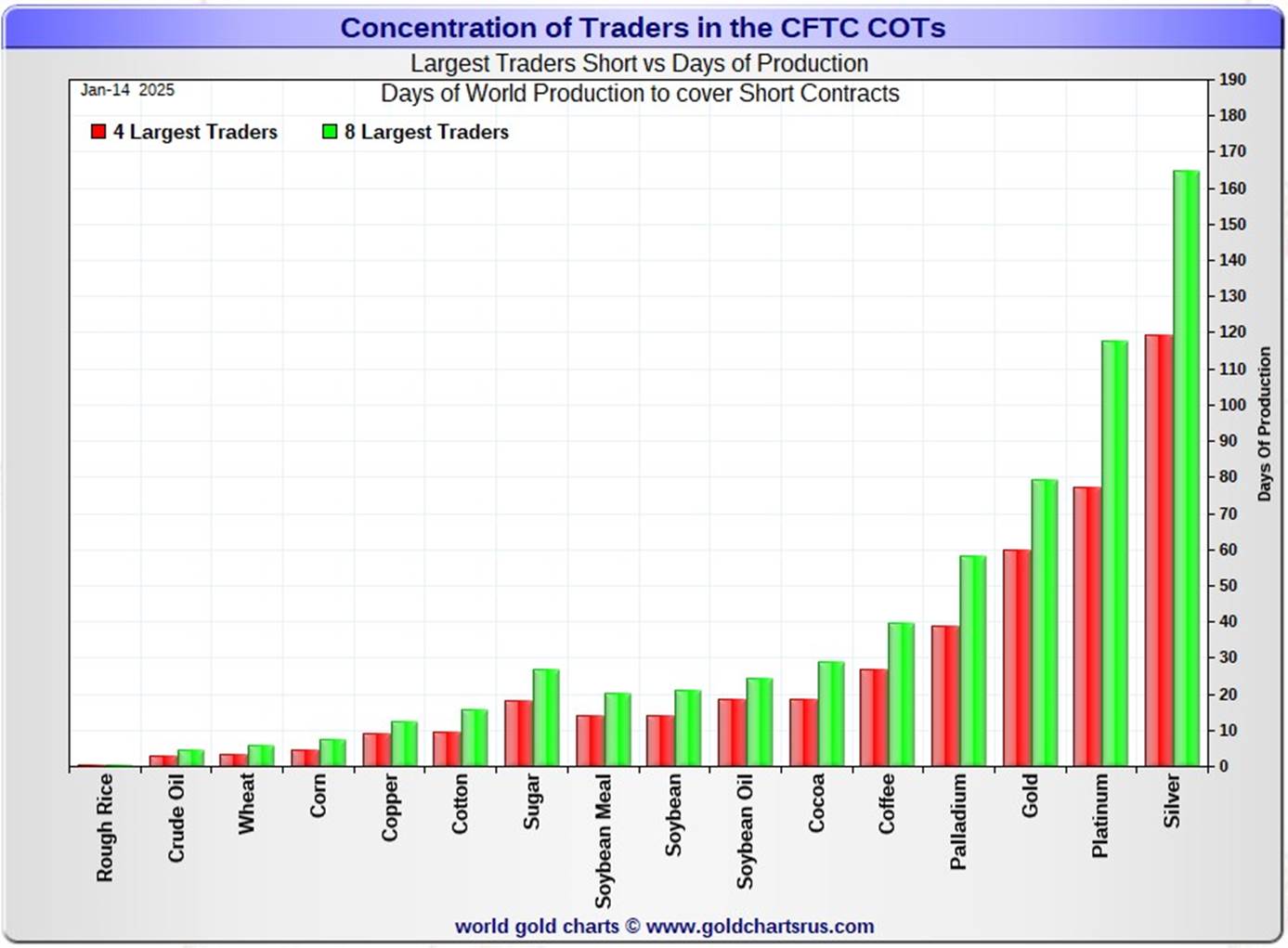

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, January 14. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short 119 days of world silver production...up about 4 days from the prior COT report. The ‘5 through 8’ large traders are short 46 days of world silver production...down about 1 day from the last COT Report, for a total of about 165 days that the Big 8 are short -- and up 3 days from the last COT report.

Those 165 days that the Big 8 traders are short, represents 5.5 months of world silver production, or 371.395 million troy ounces/74,279 COMEX contracts of paper silver held short by these eight commercial traders. Several of the largest of these are now non-banking entities, as per Ted's discovery a year or so ago. January's Bank Participation Report continued to confirm that this is still the case -- and not just in silver, either.

As mentioned further up, the small commercial traders other than the Big 8 shorts, Ted's raptors, are net long silver by 14,603 COMEX contracts...down from the 16,740 contracts they were net long in Monday's COT Report.

In gold, the Big 4 are short about 60 days of world gold production...up about 4 days from the prior COT Report. The Big '5 through 8' are short an additional 19 days of world production, unchanged from Monday...for a total of 79 days of world gold production held short by the Big 8 -- and up 4 days from Monday's COT Report.

The Big 8 commercial traders are net short 49.4 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, up a bit from the 48.1 percent they were net short in Monday's report.

In gold, it's 47.9 percent of the total COMEX open interest that the Big 8 are net short, down from the 49.9 percent they were net short in the last COT Report...but only down because of the huge increase in total open interest, which obviously affects the calculation.

But the total commercial net short position in gold is 57.4 percent of total open interest once you add in what Ted's raptors [the small commercial traders other than the Big 8] are short on top of that...a further 50,275 COMEX contracts. That percentage would be over 60% without all those market-neutral spread trades that infect/dilute total open interest.

Ted was of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He was also of the opinion that they're short 25 million ounces of gold as well. And the latest report from late December [for Q3/2024] shows that their positions are up 20 percent from what they were holding at the end of Q2/2024...with most of that increase most likely being price related. One wonders if Mr. Buffet is done dumping the rest of the stock he has in that company.

The short position in SLV now sits at 47.09 million shares as of the last COT Report, for positions held at the end of December...down a smallish 7.29 percent from the 50.79 million shares sold short on the NYSE in the prior report. This, as you already know, is off-the-charts grotesque.

The next short report is due out on Monday, January 27...for positions held at the close of COMEX trading on Wednesday, January 15.

The situation regarding the Big 4/8 commercial short positions in the COMEX futures market in both silver and gold remains wildly bearish in both.

As Ted had been pointing out ad nauseam, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward -- although the short positions held by Ted's raptors in gold continues to be a Sword of Damocles in its own right.

I have a fairly decent number of stories, articles and videos for you today.

![]()

CRITICAL READS

Last Bear Standing -- Bill Bonner

According to Wall Street lore, a bull market will continue “until the last bear gives up.”

In 2023, famous bear short-seller Jim Chanos gave up. The Financial Times reported:

"One of Wall Street’s best-known bears, Jim Chanos, has told his backers he is closing his main short-focused hedge funds after more than three decades. Chanos is best-known for his bet against Enron, the energy trader that collapsed in 2001... In a letter to investors seen by the Financial Times, Chanos wrote: “It is no secret that the long/short equity business model has come under pressure and interest in fundamental stock pickers has waned.”"

Waned?!

Investors not interested in fundamental research?

Why bother with real research when you can get 25% (the S&P gain, 2024) for not doing it? Nvidia rose 171% last year, while the S&P 500 itself was up 25%. Fundamental research would have steered you away from both. In terms of value, neither looked like a good deal.

And this week, Hindenburg Research — which had revealed the fraud at Nikola — has thrown in the towel too. Reuters:

"Hindenburg Research's founder said he would disband the firm whose reports sparked heavy selling by investors and investigations by authorities, wiping billions from the market values of companies including India's Adani Group and U.S.-based Nikola."

In a normal stock market, some companies do well; their stocks go up. Some don’t do so well; their stocks go down. Researchers try to figure out — in advance — which are which. Good research pays off.

But a normal stock market is fairly stable. As one company earns more, it takes sales from another company, which earns less. As one company cuts costs, it cuts income to other companies. Overall, the stock market doesn’t rise, or fall, very much. Because total purchasing power rises slowly, with GDP... at only around 3% per year. A stock market surge of 25% is unnatural, implausible... and suspect.

But a stock market juiced by the Fed... by hype... by hope... and tech ‘aspirations’... is a whole different thing. Real investors disappear; in come the clowns and gamblers.

This interesting commentary from Bill was posted on his Internet site at 9:40 a.m. EST on Friday morning -- and comes to us courtesy of Roy Stephens. Another link to it is here.

![]()

In Her Last Official Act, Yellen Warns U.S. Will Hit Debt Ceiling One Day After Trump Inauguration

Back in the last week of December, when the stock market was desperately trying to reverse the slump of the Santa rally which prevented stocks from closing 2024 at an all time high, we warned that a bigger threat than a modest 1% market draw-down was looming: the countdown to the next debt ceiling crisis. We quoted Democratic operative - and the only US government official who has personally overseen total debt increase by a staggering $15 trillion under her watch at both the Fed and Treasury - Janet Yellen said the United States would hit its statutory debt ceiling around the middle of January, at which point the Treasury would resort to “extraordinary measures” to prevent the government from defaulting on its obligations.

While it may not feel like it, we are now in mid-January, and late on Friday, Janet Yellen, in what is almost certainly the last ever official announcement of her long and undistinguished political career, said that the U.S. would hit its debt ceiling the day after President Trump is inaugurated, and that the Treasury will launch “extraordinary measures” to stave off the threat of a national default.

After a previous 20-month suspension of the debt limit expired earlier this month, Yellen wrote in a letter to bipartisan congressional leaders Friday she was advising them “of the extraordinary measures that Treasury will begin using on January 21.” That will be a day after the Biden administration leaves office. “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

What 'full faith and credit' is she talking about, dear reader? This Zero Hedge article was posted on their Internet site at 11:17 p.m. EDT on Friday night -- and another link to it is here.

![]()

Thoughts Ahead of Day One -- Doug Noland

It’s an interesting backdrop for talk of unleashing a “new economic golden age.” The Friedman/Bernanke revisionist view asserts that a golden age of Capitalism was brought to a needless end by Federal Reserve policy blunders, while an opposing analytical framework holds the Fed responsible for accommodating Credit excess and an unsustainable historic “Roaring Twenties” Bubble of leverage, speculation, and epic resource misallocation. Surely, Mr. Bessent is familiar with this debate.

There’s no stabilizing this historic Bubble inflation. To believe that consumer price inflation will magically steady at 2% - with Credit, financial markets, and household perceive wealth raging – is fanciful thinking. And now the new administration is determined to use every tool in the kit – while devising some crafty new ones – to crank the boom up a few notches.

As the world waits warily for Day One, China teeters. Increasingly desperate – and incongruent – measures are employed to buttress a deflating Bubble – to stabilize apartment markets, an incredibly maladjusted economy, funding markets and system liquidity – while simultaneously working intently to thwart currency instability. A fragile “developing” world hangs in the balance.

Scott Bessent and Team Trump are keenly aware of China’s current vulnerability. I’ll assume they keep much of their powder dry on Day One, as they prepare for hardball trade negotiations. For now, China could sure use a weaker dollar, declining Treasury and global yields, and lower U.S. policy rates.

Despite all the week’s inflation optimism, the five-year Treasury (inflation premium) “breakeven” rate added a basis point to 2.54% - near highs back to March 2023. The Bloomberg Commodities Index rose another 1.2%, boosting early 2025 gains to a notable 5.0%. Crude is up 8.6% month-to-date, with Natural Gas gaining 9.3%. The precious metals are building on robust 2024 advances. Gold and Silver have started the year with gains of 3.0% and 5.1%.

So many factors these days point to a new paradigm of inflation and bond market risk. Day One will have us – and the world – at the edge of our seats.

This weekly commentary from Doug put in an appearance on his website very late on Friday night PST -- and another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here -- and this one runs for about 27 minutes.

![]()

Three informative and worthwhile videos

1. Trump and American Expansion -- Colonel Douglas Macgregor

This very worthwhile interview with host Judge Andrew Napolitano put in an appearance on the youtube.com Internet site on Thursday and, as always, I thank Guido Tricot for pointing it out. The link to it is here.

2. Congress Protects Israel -- Phil Giraldi

This interesting 27-minute video interview with former CIA intelligence officer Giraldi was also hosted by the Judge...this one early on Thursday morning EST. It's from Guido as well -- and the link to the youtube.com video is here.

3. INTEL Round table with Larry Johnson & Scott Ritter...sitting in for Ray McGovern

This very worthwhile commentary hosted by Judge Andrew Napolitano showed up on the youtube.com Internet site very late on Friday afternoon EST -- and I thank Guido for this one too. The link to it is here.

![]()

‘System Is Broken’: Monetary Collapse in 2025 to Send Bitcoin To $200k | Lawrence Lepard

Lawrence Lepard, Managing Partner of Equity Management Associates, discusses the outlook for the monetary system, inflation, and Bitcoin. Of course he has a lot to say about gold and silver as well. This 48-minute video interview with host David Lin was conducted on January 9...but didn't show up on the youtube.com Internet site until this past Tuesday.

I have all the time in the world for what Larry has to say -- and it's worth your while if you have the time and interest. I thank reader Bob Pace for sending it our way earlier in the week -- and for length reasons I thought it best to save it for Saturday's column. Another link to it is here.

![]()

China’s December copper imports hit 13-month high

China’s imports of unwrought copper and copper products reached a 13-month high in December, rising 17.8% year-on-year to 559,000 metric tons, according to customs data released on Monday.

Imports increased 5.87% from November, partly due to sellers fulfilling remaining volume obligations of annual contracts.

For the whole of 2024, unwrought copper imports totalled 5.68 million tons, a year-on-year increase of 3.27%, the data showed.

The data includes anode, refined, alloy and semi-finished copper products.

Copper prices fell in December, both in China and globally, on a stronger US dollar which makes it more expensive for holders of other currencies to buy US-dollar-priced commodities.

Deliverable copper stocks on the Shanghai Futures Exchange stood at 83,174 tons on Jan. 3, a 17.3% increase from a 10-month low of 70,894 tons recorded on Dec. 20.

For the whole of 2024, unwrought copper imports totalled 5.68 million tons, a year-on-year increase of 3.27%, the data showed.

This Reuters story from Monday was picked up by the mining.com Internet site -- and I thank Roy Stephens for sending it our way. Another link to it is here.

![]()

Trump tariff risks fuel a chaotic hunt for gold in London

The risk that U.S. President-elect Donald Trump will impose universal import tariffs is causing fresh turmoil in the global gold market, with a closely watched barometer of bullion demand reaching historic highs in London.

In recent weeks U.S. prices for gold, silver and other metals have surged above other international benchmarks. That comes as major bullion dealers and fleet-footed investors respond to the risk that precious metals will be caught in the crossfire if Trump follows through with campaign-trail pledges to impose tariffs of as much as 20% on incoming goods from all countries.

Now, a spike in so-called lease rates in London this week signals that an increasingly frenetic global hunt for bullion is under way as major dealers seek to shift metal to the U.S. before any tariffs are imposed.

Lease rates reflect the return that holders of bullion in London’s vaults can get by loaning their metal out to other buyers on a short-term basis. Normally, the returns on offer sit close to zero, but this week they’ve surged to historic levels, with profits on one-month lease rates exceeding 3.5% on an annualized basis.

That’s the highest level since at least 2002, and it signals surging demand for metal in London’s vaults. There have been similarly extreme moves in the silver market, and some analysts and traders warn that there may not be enough freely available metal to meet dealers’ needs.

“The markets are in total dislocation,” Robert Gottlieb, a former precious metals trader and managing director at JPMorgan Chase & Co., the world’s top bullion dealer. “There seems to be a scarcity of available stocks in both gold and silver.”

This worthwhile Bloomberg story from 9:11 a.m. PST on Friday morning was picked up by yahoo.com -- and I found it on the gata.org website. Another link to it is here.

![]()

Argentina ordered to reveal location of central bank gold

New York Judge Loretta Preska has ordered Argentina to hand over information on the Central Bank’s gold reserves per a request filed by hedge fund Burford Capital in October. The discovery order is the latest in the saga of a US$16.1 billion lawsuit it won against the country in 2023 for the expropriation of energy company YPF.

Argentina’s assets are being probed for potential seizure by the Southern District Court of New York to partly pay for the lawsuit. In a letter to Judge Preska, Burford quoted newspaper articles from last July reporting that Economy Minister Luis Caputo confirmed that the Central Bank had moved some of its gold overseas, which certain media outlets claimed would be used for a repo. The government did not provide further information on the matter.

Last week, Argentina wrote a letter to Preska arguing that the Central Bank and the Republic are legally separate entities, meaning that the gold reserves do not belong to the government and their details are confidential. The country, represented by the Sullivan & Cromwell law firm, also said that the Central Bank’s reserves “enjoy special protection from execution under [United States’ Foreign Sovereign Immunities Act] and U.K. law.”

In her order, Preska countered that “regardless of whether the gold reserves are held by [the Central Bank], the Republic shall produce its own documents concerning the reserves.”

The judge further demanded information on government accounts held in the country and overseas, as well as evidence from a separate lawsuit in order to “trace the Republic’s assets.”

On the one hand, Preska argued that Argentina should hand over SWIFT data on its accounts overseas instead of the account summaries it has already provided. She described them as “inadequate substitutes, given they do not identify the counterparty’s specific banking institutions making or receiving payments.”

This interesting gold-related news item showed up on the buenosairesherald.com Internet site on Wednesday -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

India discounts widen to 6-month high, China sees New Year boost

Gold discounts in India widened to six-month highs this week as a rise in domestic prices dampened demand and jewellers awaited the annual federal budget, while physical gold demand in China was solid ahead of the Lunar New Year festival.

The rebound in gold prices has hammered demand, and buyers are now waiting for prices to correct, said a Mumbai-based dealer with a private bullion importing bank.

Domestic prices in India rose to 79,270 rupees ($915.60) per 10 grams this week and were not far from all-time highs, tracking gains in international spot gold rates that hit a one-month peak. [GOL/]

Indian dealers offered a discount of up to $30 per ounce over official domestic prices, inclusive of 6% import and 3% sales levies, up from the last week's discount of $17.

Importers and bullion dealers offered higher discounts as they wanted to clear imported stocks before the annual budget on Feb. 1, when the government could change the duty structure, said Chanda Venkatesh, managing director of Hyderabad-based bullion merchant CapsGold.

"Physical gold demand could face challenges in India as the government considers reviewing the 9% import duty cut it made in July 2024," ANZ said in a note.

The bank expects China's demand to recover after falling in the second half of last year, as a pledge by the country to use easing monetary policy and fiscal expansion to boost economic growth is likely to support physical gold demand.

This gold-related Reuters story from yesterday was picked up by yahoo.com -- and I found it on Sharps Pixley. Another link to it is here.

![]()

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

I stumbled on today's pop 'blast from the past' when I was looking for something else -- and it showed up on the right side-bar at youtube.com. Being a huge Chicago fan, I wanted to see how well Leonid and Friends had covered it and, as always, I was not disappointed.

Not only is this a world-class performance...it show just how carefully crafted and orchestrated that the original composition was. Leonid Vorobyev, the leader and bass player of this group, is a certified musical genius...able to take the recording...for which there is no written/sheet music -- and transcribe it into its constituent parts...then assemble the best musicians that Moscow has to offer...of which there are legion...to perform it.

Then comes the production, the recording, the mix, the video edit that follows...all of which he does mostly on his own. The result is what you see here -- and is more a faithful reproduction of the original, rather than just a cover. It's a work of art in every respect. The link is here. Enjoy!

Of course there's a bass cover to the original song -- and I was always amazed that Peter Cetera...who is now 80 years old, if you can believe it...could play bass and sing lead vocals at the same time. I can barely walk and chew gum. The link to it is here.

Spanish virtuoso violinist Pablo de Sarasate had a huge fan base back in his day...not only with audiences, but also with his fellow composers. Today's classical 'blast from the past' is another work that was dedicated to him... German composer Max Bruch's 'Scottish Fantasy', Op. 46...composed back in 1880.

Despite the dedication to Sarasate, Hungarian virtuoso violinist Joseph Joachim was involved in the fingering and bowing of the solo part.

Although Bruch visited Scotland for the first time only a year after the premiere of the work, he had access to a collection of Scottish music at Munich Library in 1868. In paying homage to Scottish tradition, the work gives a prominent place to the harp in the instrumental accompaniment to the violin.

The Scottish Fantasy is one of several signature pieces by Bruch that is still widely heard today, along with his first violin concerto and Kol Nidrei for cello and orchestra.

One comment about this whole thing is summed by this observer, who stated: "German composer writing Scottish sentiments dedicated to a Spanish violinist who played on an Italian violin using a French bow. Music is pretty awesome."

Yes...it is.

And to make the picture even more international...here's South Korean-German classical violinist Clara-Jumi Kang doing the honours alongside the Seoul Philharmonic Orchestra. Maestro Shi Yeon Sung conducts -- and the link is here.

![]()

With yesterday being options expiry for January, I was ready for just about anything when I switched on my computer at 7:30 a.m. PST yesterday morning -- and I wasn't disappointed.

Although gold closed down 12 dollars or so in the spot market, it closed down only $2.20 in February -- and with First Day Notice for February deliveries only eight business days away. I noted that it was allowed to close above $2,700 by a bit in the spot market on Friday...if that means anything.

Silver spent a bit of time trading below its 50-day moving average yesterday, but closed above it by 20 cents in the March contract, its current front month -- and as a result of that, one has to suspect that a myriad of call options in everything silver-related went off the board worthless...including those SLV calls mentioned in this missive on Friday.

Not only were volumes very light in both...gold in particular...both were in backwardation during part of COMEX trading...which was surprising in silver considering how few contracts were traded in January.

Platinum would have closed at some fantastic price in the spot market if 'da boyz' hadn't appeared at or minutes after the 10 a.m. afternoon gold fix in London. It only closed higher by 5 bucks in the spot market...but up $17.10 in April -- and back above its 50-day moving average. It would have easily blow through its 200-day...but that obviously wasn't allowed.

Palladium was allowed to trade a tad above it 50-day moving average in March intraday yesterday, but was carefully closed right on it. It has spent the last six trading sessions trying to close above that mark, but 'someone' is watching over it to ensure it doesn't happen...at least for the moment.

Despite the continuing bullish fundamentals in copper, it got hit for 7 cents yesterday -- and spent a bit of time back below its 200-day moving average ...but managed to close above it by 2 cents at $4.37/pound. As I stated about copper in yesterday's column..."How long the collusive commercial traders of whatever stripe will allow this rally to continue is open for debate." -- and it still is.

Natural gas [chart included] got clocked by 31 cents/7.28% on Friday. It finished the day back with a '3' handle, at $3.95/1,000 cubic feet. WTIC was closed lower for the second day in a row...down 46 cents at $77.39/barrel -- and out of overbought territory on its RSI trace.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

With options expiry out of the way, I'm certainly hoping for better things next week.

But next week isn't starting out as anything ordinary. First of all, it's Martin Luther King Jr. Day in the U.S. -- and the markets will be closed...but which ones, I don't know for sure.

Secondly, it's Inauguration Day for President-elect Donald Trump on Monday as well -- and one can only hope that all goes smoothly. But it's what's coming after that will get everyone's attention. This guy has big Imperial plans -- and we'll just have to watch and wait it out.

As reader Gordon Foreman pointed out in an e-mail exchange we had yesterday...

"It is clear that Biden and crew are doing all they can to poison the well on their way out the door, and leave as many disasters on the doorstep as they can For Trump and his crew as they arrive officially on Monday. Given that the physical silver deficit is a problem that is becoming imminent, I wonder if the plan is that this weekend all efforts to suppress the price will be ended, allowing the price to explode higher. Monday is a trading holiday in the U.S...and the day that Trump will be sworn in. I have no idea how high silver and gold might open on Tuesday in such a case, but as you have noted many times, it could be multiples of its current price. This would cause chaos in the markets, and no telling what other dominoes might fall as a consequence, but such chaos would be a serious distraction to the incoming administration, and would be widely cited as an indication of a lack of confidence in them."

There's certainly something going on in the gold market that's unprecedented -- and I get the impression that good delivery bars in London are picking up a lot of 'frequent flyer' points on their one-way trip to New York...as the amount being delivered to the depositories there has been continuous and at very high levels since almost the beginning of the year.

From that Bloomberg story in the Critical Reads section above...

“The markets are in total dislocation,” Robert Gottlieb, a former precious metals trader and managing director at JPMorgan Chase & Co., the world’s top bullion dealer. “There seems to be a scarcity of available stocks in both gold and silver.”

So far, including the massive amounts of gold bullion brought in this past week...Thursday in particular...the rush for immediate delivery shows now signs of letting up. But as you've already noticed, that fact has not been allowed to manifest itself in its price...as the collusive commercial traders of whatever stripe have been working overtime in the paper market, to keep it from reflecting the realities in the physical market.

But this can't go on forever.

As always, I'm still "all in" -- and will remain so, to whatever end.

I'm done for the day -- and the week. If I have a column on Tuesday -- and it's a big IF at the moment, will be as brief as I can make it.

Ed