The Doge of Venice in 1204 was Enrico Dandolo. Enrico Dandola was shrewd and played a vital role in the Fourth Crusade. Dandolo convinced the Crusaders to divert their course from Jerusalem and attack Constantinople, the capital of the Byzantine Empire.

The sack of Constantinople was a significant turning point in history, mainly due to Dandolo's machinations.

Dandolo was born in Venice around 1107. He was blind in one eye, but he was still a skilled politician and military leader. He served as Doge of Venice from 1192 until he died in 1205.

Dandolo was a strong supporter of the Fourth Crusade. He believed that the Crusade could be used to expand Venetian power in the Mediterranean. He also thought the Byzantine Empire was corrupt and decadent and deserved to be overthrown.

Dandolo convinced the Crusaders to divert their course from the Holy Land and attack Constantinople. He argued that the Byzantines had yet to fulfill their promises to help the Crusade and were not worthy of Christian support.

The Crusaders agreed, and they sacked Constantinople in 1204.

The sack of Constantinople was a significant victory for Venice. It gave Venice control of the Byzantine Empire's trade routes and wealth. It also helped to establish Venice as a substantial powerhouse in the Mediterranean.

Dandolo died in Constantinople in 1205. He is remembered as a complex and controversial figure. He was a brilliant politician and military leader but also ruthless and ambitious. His role in the sack of Constantinople has earned him a reputation as one of the most reviled figures in history.

There's much more to this story as it relates to 2023 US Foreign and monetary policy.

After a little more context from 12th Century Venice, we dive in!

In the 12th century, Venice was a powerful maritime republic that controlled much trade between Europe and the Middle East. The Doge of Venice was the elected leader of the republic, and he had great power over the city's affairs.

In 1204, the Doge and the Venetian bankers and merchants decided to join the Fourth Crusade, a military expedition that was supposed to recapture Jerusalem from the Muslims. However, the Crusaders diverted their course and sacked Constantinople, the capital of the Byzantine Empire.

The Doge and the Venetian bankers and merchants profited greatly from the sack of Constantinople.

They seized vast wealth, including gold, silver, jewels, and artworks. They also acquired a monopoly on trade with the Byzantine Empire.

The Doge and Venetian bankers and merchants issued war bonds to finance the Crusade. These bonds were loans made to the republic in exchange for a promise of repayment with interest.

The war bonds were a successful way of raising money and helped make Venice even more powerful.

The sack of Constantinople was a significant turning point in history.

It marked the Byzantine Empire's end and Venice's rise as a significant power in the Mediterranean.

The war bonds the Doge and Venetian bankers and merchants issued also played a significant role in this history.

Here are some additional details about the war bonds issued by the Doge and the Venetian bankers and merchants:

- The bonds were called "imprests."

- They were issued in denominations of 100, 200, and 500 ducats.

- The interest rate was 10%.

- The bonds were payable in 10 years.

- The bonds were secured by the wealth that was seized from Constantinople.

The imprests were a popular investment among the Venetian people. They were seen as a safe and profitable way to invest money. The imprests also helped boost the Venetian people's morale during the Crusade.

The sack of Constantinople and the issuance of war bonds were significant events in the history of Venice.

They helped to make Venice a powerful and wealthy city-state that would play a major role in European history for centuries to come.

Then evil imitators step up, and the playbook backfires.

Spain and France F*ck Up Things with Juros and Rentes.

Juros and Rentes are War Bonds.

Like Venetian War Bonds but unsuccessful and almost all have been unsuccessful since 1204

Below, please read some examples of when war bonds infected the population with inflation (like in the cases of Spanish “juros” or French “rentes”)

Spanish juros:

The Spanish juros were a type of government debt issued in the 16th century to finance the Spanish Empire's wars against France and the Ottoman Empire. The juros were perpetual bonds that paid a fixed interest rate. As the Spanish Empire's finances deteriorated, the juros became increasingly devalued, eventually contributing to a hyperinflation crisis in the 17th century.

Signs that Habsburg Spain was declining became visible during the reign of Philip III. Throughout Philip III's reign the main currency was a copper-based coin called vellon, which was minted in response to the fall in imports of silver.

Ironically, the copper needed to make vellon was purchased in Amsterdam with silver. Imports of silver bullion from the Americas fell by half during Philip III's reign.

French rentes:

The French rentes were government debt issued in the 17th century to finance the French king's wars against Spain and the Holy Roman Empire. The rentes were annuities that paid a fixed interest rate. As the French king's finances deteriorated, the rentes became increasingly devalued, eventually contributing to a hyperinflation crisis in the 18th century.

Bank of England infects the population with War Bonds

The Bank of England was founded in 1694 by King William III to help finance the Nine Years' War (1688-1697) against France. The bank was granted a monopoly on the issue of banknotes, which were initially backed by gold and silver. Still, soon after that, the bankers started vaulting the gold and silver and issuing paper representations of gold and silver.

Then, the government soon began to overspend, and the bank was forced to print more money to meet its financial obligations. This led to inflation, as the value of the pound sterling decreased.

The inflation was exacerbated because the government also borrowed money from private investors by issuing war bonds. These bonds paid a high-interest rate, attracting investors and putting upward pressure on prices.

Inflation peaked in 1696, when the price of food rose by 50%. This caused widespread hardship and riots in some parts of the country. The government was forced to take measures to control inflation, such as raising taxes and reducing spending.

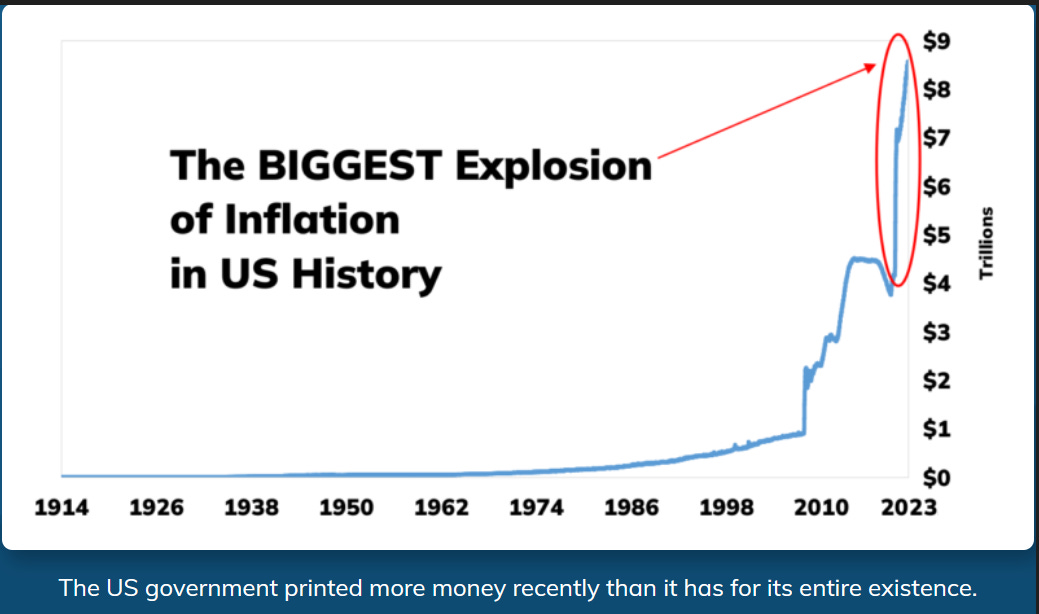

More Lies From US Government on the Consumer Price Index, a fake number used to pacify the villagers

US Government officials claim inflation is 4% in today's environment, but this number is a monstrous lie. It doesn't count food and energy. The US government printed more money recently than it has for its entire existence. That is the textbook definition of inflation (inflating the printed money supply, like Juros, Rentes, War Bonds, whatever name you like these are paper representations of gold and silver)

Diesel is up 40% since May, and 98% of shipping (rail, ocean containers, truck) is fueled by diesel, creating a new wave of inflation.

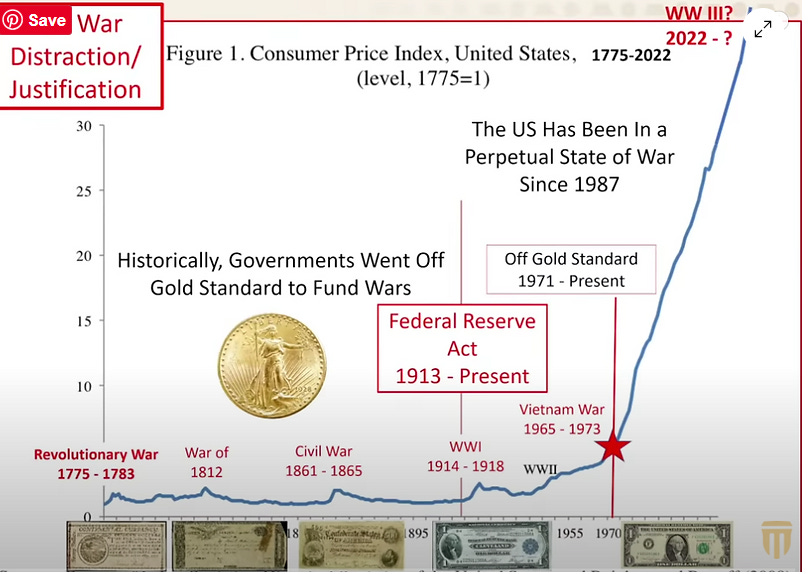

Below is a chart that explains what has happened since departing the gold standard.

Just like the social ills attributed during the eras of King William III, King Phillip III, Juros, Rentes, or any paper representation of gold/silver, it follows the same rinse-and-repeat pattern:

- Government expands through war to enrich the Parasitic Class.

- Via a cozy syndicate between military, political, and banking elites (Parasitic Class)

- Villagers get F*cked over by social misery and hyperinflation, an intentional political phenomenon, not some accidental condition.

War Adventures and Today's NeoCons

The chart below shows the same trajectory as Juros, Rentes, Bank of England Bonds and all paper currencies.

Whenever you hear someone say “backed by the full faith and credit” of US Government (as is the case with the Federal Reserve note in your wallet) develop a plan B.

Gold and Silver are your Plan B