- Investors are eager to see a significant rally in price of the world’s greatest metal, which of course is… gold!

- Are these expectations realistic, given the overvalued stock market and the prospect of central bank tapering?

- The answer is yes.

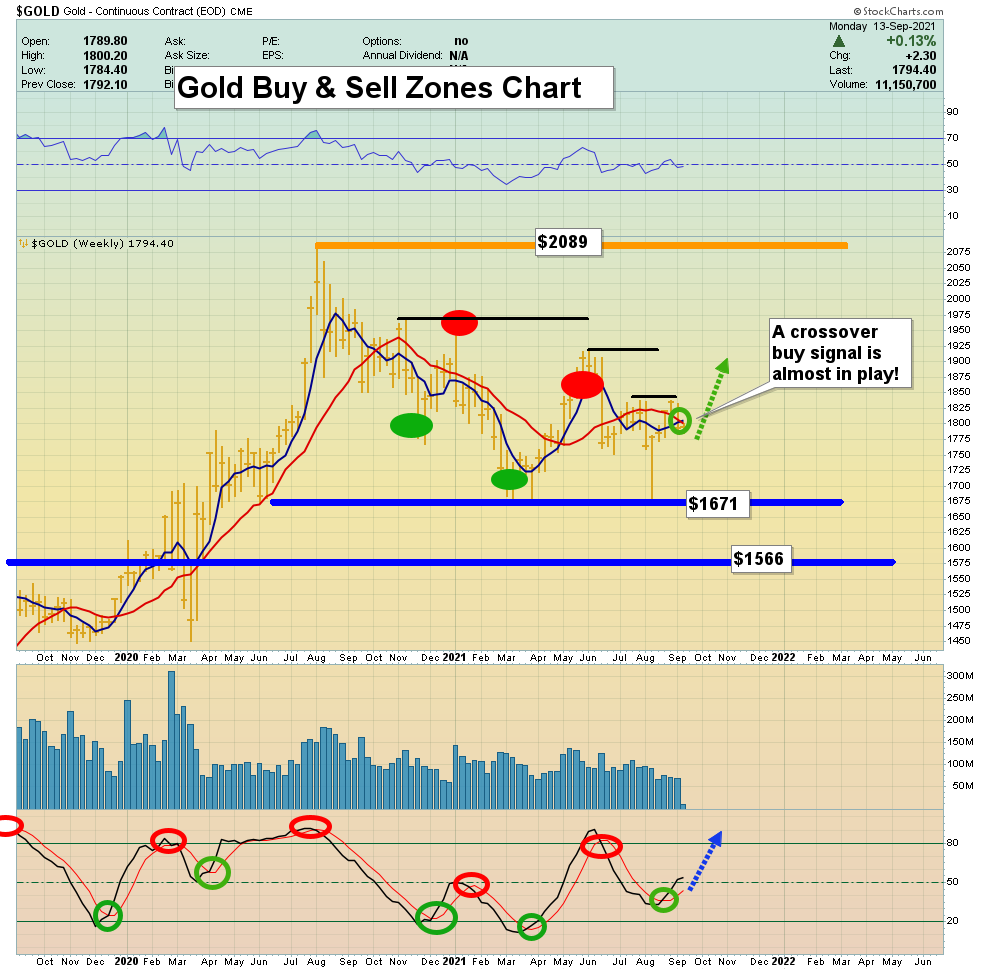

Click to enlarge this important weekly gold chart. A crossover buy signal for the key 5,15 moving averages is apparent.

Click to enlarge this important weekly gold chart. A crossover buy signal for the key 5,15 moving averages is apparent.- It becomes highly significant if it holds into this Friday’s close.

- Please click here now. Double-click to enlarge his Nasdaq moving averages chart. Any sell signal that occurs in September or October needs to be respected.

- Current stock market concerns are driven by rising inflation, and a Fed that is reluctant to taper its stock, bond, and real estate market welfare programs known as “QE”, and even more reluctant to raise interest rates.

- If this theme intensifies, it can create outflows from the stock market and inflows into gold. A “1970s on steroids” theme appears to be at hand.

- Please click here now. Double-click to enlarge this “stagflationary gulag” chart that showcases the time of 1966-1980.

- I’ve suggested that America is at a crossroads akin to a hybrid of the 1966 and 1929 markets, with 1966 coming first.

- When the stock market stalled in 1966, it wasn’t until 1973 that it really collapsed, with many lower tier stocks falling 90% as the Dow was cut in half.

- Please click here now. Double-click to enlarge. Here’s a look at gold during the same period. Gold surged from 1973 to 1975 as inflation destroyed stock market investors… and kept surging with each subsequent stock market swoon!

- Investors who are using the 2008 and 2020 deflationary playbooks to predict a gold price fall with a stock market tumble risk becoming as obsolete as the investors of the 1970s who took that same approach.

- This is a new paradigm, and it’s a bull era for gold!

- Please click here now. Love and fear trade price drivers are coming together to create a “perfect upside storm” for gold… and the storm could last for a decade or longer.

- In 2019 a lot of Western gold analysts thought that Chinese and Indian youngsters would opt for smart phones instead of gold.

- In contrast, I suggested they would get the smart phones, and use them to consistently buy significant amounts of gold. That buying is taking place and it’s set to rise in the years ahead.

- Please click here now. Double-click to enlarge one of the most glorious charts in the history of markets.

- Note that when Janet Yellen raised interest rates a few years ago, she didn’t have to deal with the inflationary dragon that Jay Powell must contend with now.

- If Jay hikes rates and inflation doesn’t subside, he’s likely going to have to deal with the biggest stock market panic since 1929 and a surge into gold not seen since the 1970s!

- Please click here now. Double-click to enlarge this weekly GOAU ETF chart.

- As noted, the moving averages are converging, and a Stochastics buy signal is coming into play.

- What’s particularly interesting is that these “green shoots” for the metals and miners are appearing as brown shoots for the stock market also appear.

- Hardcore gold bugs who have great memories of shorting the stock market while buying gold stocks in the 1970s… they may soon be able to have that cake and eat it too!

Thanks!

Cheers

St