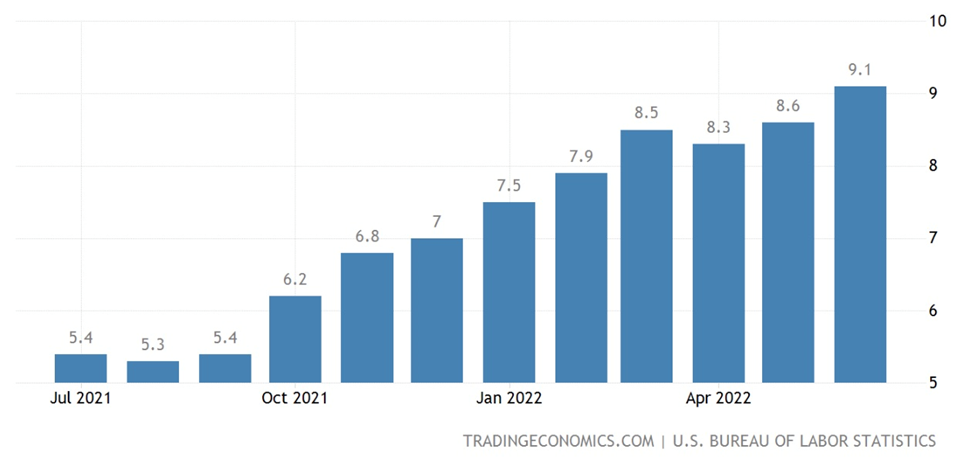

The US Federal Reserve started off declaring that historically high levels of inflation were “transitory” and would go away with the resolution of covid-related supply chain bottlenecks. When inflation rocketed from 5.4% a year ago to 8.5% in March, then 9.1% in June, all the Fed’s talk of transitory inflation dissipated, and its strategy switched to fighting inflation through a series of aggressive interest rate hikes.

The “monetary tightening” policy hasn’t worked, so far. Inflation has actually accelerated since the Fed began raising rates in March, prompting officials to hike them by a half-percentage point that month, instead of the earlier 25 basis-point expectation, and 75 basis points in June rather than the 50 points the Fed thought would be sufficient. Last week, at the Federal Open Market Committee’s regular meeting, the central bank approved another 0.75% increase, lifting its benchmark overnight borrowing rate to a target range of 2.25% to 2.5%.

It seems the Fed is hell-bent on bringing inflation down to its 2% target, despite indications its tightening has already damaged the US economy, and is pushing it rapidly into recession if it isn’t there already.

Falling Misery Index and consumer sentiment: a perfect match

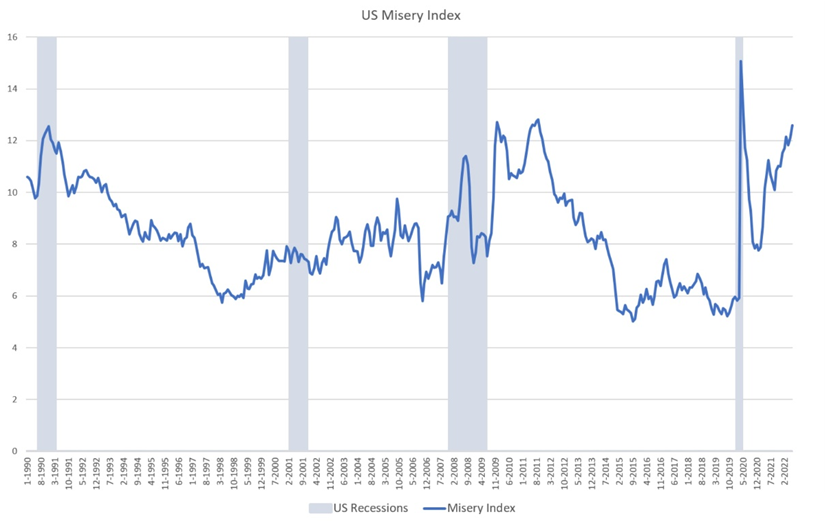

The Misery Index measures the amount of economic distress felt by average people, due to the risk of, or actual joblessness, combined with an increasing cost of living (inflation). The index is calculated by adding the unemployment rate to the inflation rate.

As the chart below shows, the Misery Index has risen steeply since July, 2021. In June, 2022, the index hit 12.5, the highest since 2011 when the US economy was experiencing very weak job and economic growth following the financial crisis. June’s figure also rose above the index from the 2007-09 Great Recession, and was just about equal to where it was in the run-up to the 1990-91 recession. (recessions are shown as light blue shaded vertical bars)

Source: Mises Institute

Source: Mises Institute

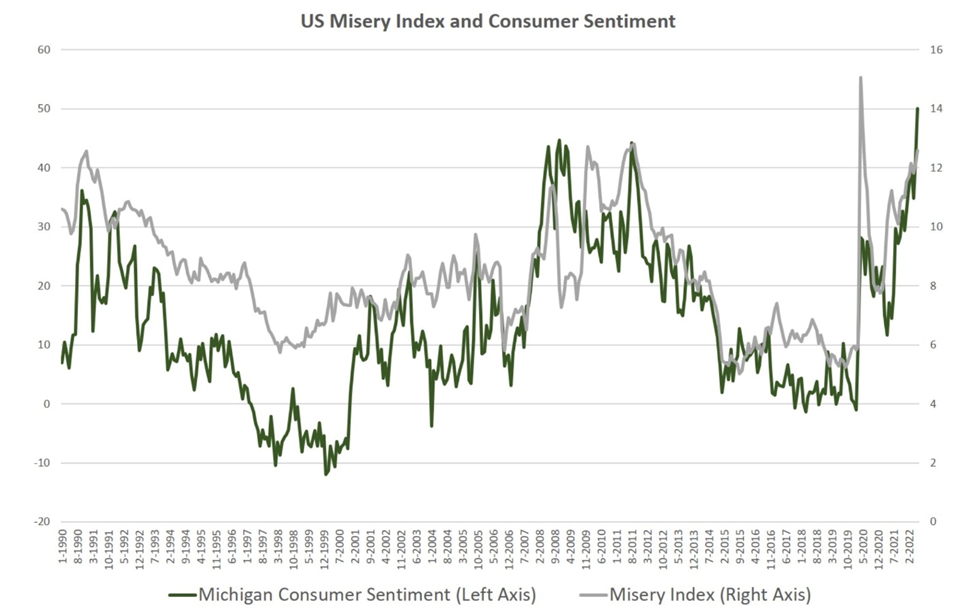

As for whether unemployment and inflation, the two components of the Misery Index, affect consumer sentiment, they most certainly do. The second chart below graphs the Michigan Consumer Sentiment trend alongside the Misery Index. It shows consumer sentiment has plummeted almost lock-step with the increasing Misery Index, and has done so for decades.

This makes perfect sense. Consumer sentiment should naturally reflect the amount of economic distress being measured by the Misery Index.

Source: Mises Institute

Source: Mises Institute

It will probably surprise no-one to learn that the White House is in official denial of these grim statistics. Despite the fact that real wages (wages minus inflation) are going down, the cost of living (inflation) is going up, jobless claims are increasing rapidly, and the savings rate has plummeted, what really matters to the US President and his inner circle is the technical definition of “recession”.

You see, while most economists, and Wall Street, consider the economy to be in recession if Gross Domestic Product stops growing for two consecutive quarters, it falls to the National Bureau of Economic Research (NBER) to “call” the recession. So until the NBER officially says it is so, the White House is going to deny it.

One White House spokesman went so far as to state that, “it’s not like there’s a famine or anything,” so stop complaining.

The Fed’s glass is half full

It also likely won’t shock any of my readers to learn that Federal Reserve officials, including Chairman Jerome Powell, are also playing down any recession talk, preferring to focus on the bright points of the US economy that allow them to keep raising interest rates. In fact, as you shall see below, they don’t even care if economic growth slows to the point of recession; actually that would be a good thing, since it would likely move the inflation rate down, closer to the coveted 2%!

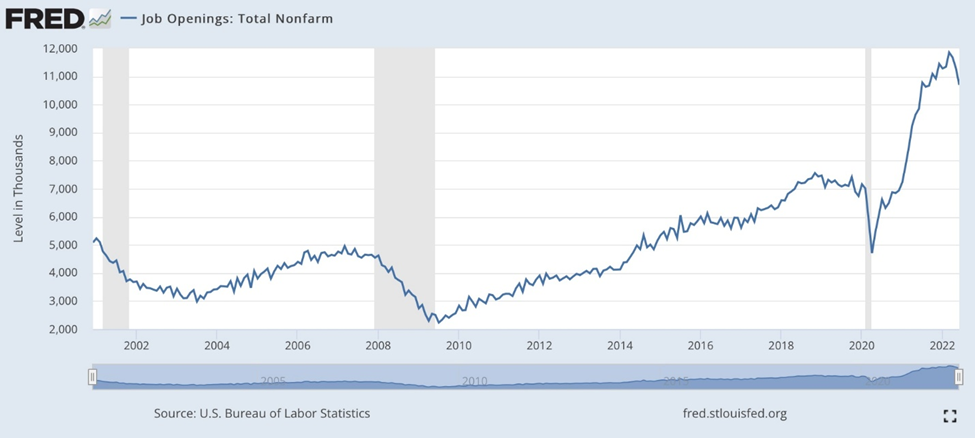

For example, the Fed has long referred to the job openings in the JOLTS (Job Openings and Labor Turnover Survey) report, as evidence of a strong economy. However, on Monday this week, the report showed a clear downturn, compared to the upward trend since an April 2020 low. The FRED chart below shows job openings falling 9.8% since the March 2022 peak of 11.8 million.

Job openings may be down, but so are jobless claims, backing up the Fed’s interest rate increases, which can only happen if the economy is healthy enough to handle them. (raising interest rates typically squelches economic activity, since it discourages businesses and individuals from borrowing)

Despite data last week showing signs of a labor market cool-down, with initial jobless claims at their highest since November, non-farm payrolls increased by 372,000 in June. Unemployment is sticking to a relatively low 3.6%. Notwithstanding the June drop in job openings, CNBC reports near-record number of people are quitting and getting hired into new roles, presumably at the same or better pay. According to the latest JOLTS report, 6.4 million people were hired for new jobs and 4.2 million voluntarily quit.

Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, said during an interview with CBS, that the labor market is “very, very strong”. Remember the Fed has two responsibilities, the first is to keep a handle on inflation, and the second is to keep the economy running at near-full employment. It therefore pays close attention to rising prices and signs of labor market trouble.

Anyone listening to that interview now has a pretty good grasp of what the Fed intends to do regarding its monetary policy, and that is to continue raising interest rates, and “do what it takes” to bring inflation down to the required 2% level.

Kashkari clearly stated that inflation poses a greater threat to the Fed than a recession, telling Face the Nation:

“We’re going to do everything we can to avoid a recession, but we are committed to bringing inflation down, and we are going to do what we need to do.” He added, “We are a long way away from achieving an economy that is back at 2% inflation. And that’s where we need to get to.”

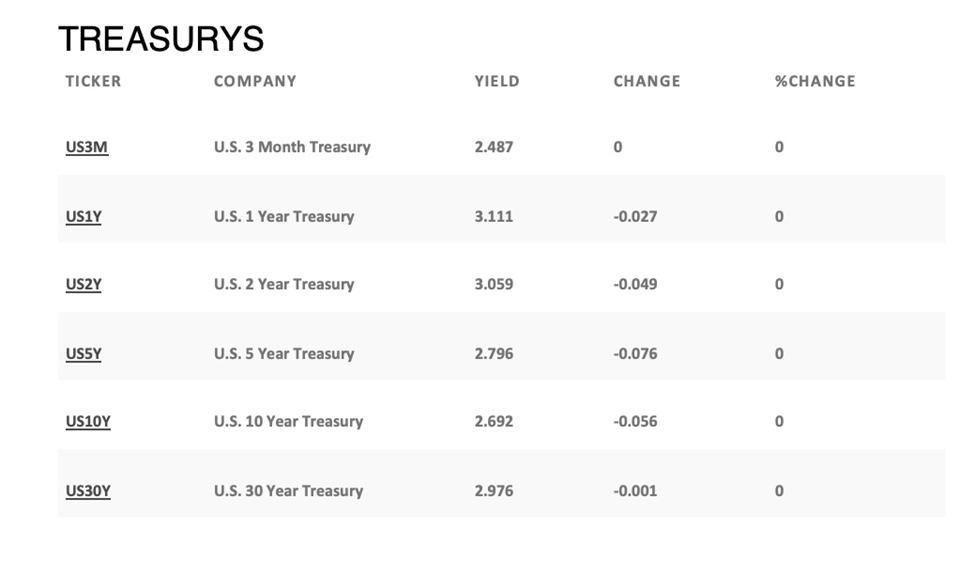

Ok but, what about the recession… what about the fact that the country’s GDP shrank for the second straight quarter, and that since 1948, the economy has never seen consecutive quarterly growth declines without being in a recession? How about the yield curve inverting? Does anyone at the Fed care that the current 2-year US Treasury yield is higher than the 10-year and the 30-year, the “yield curve inversion” being an extremely reliable recession indicator?

Confronted with negative GDP growth in the second quarter, and the possibility of a recession, Kashkari suggested, via CNBC, that an economic slowdown could be a good thing, if it helps reduce inflation to the point where it no longer outpaces wage growth. “We definitely want to see some slowing [of economic growth].”

Kashkari maintains, “I’m focused on the inflation data. I’m focused on the wage data. And so far, inflation continues to surprise us to the upside. Wages continue to grow.”

Maybe so, but there are other things to consider, some of which we have reported on.

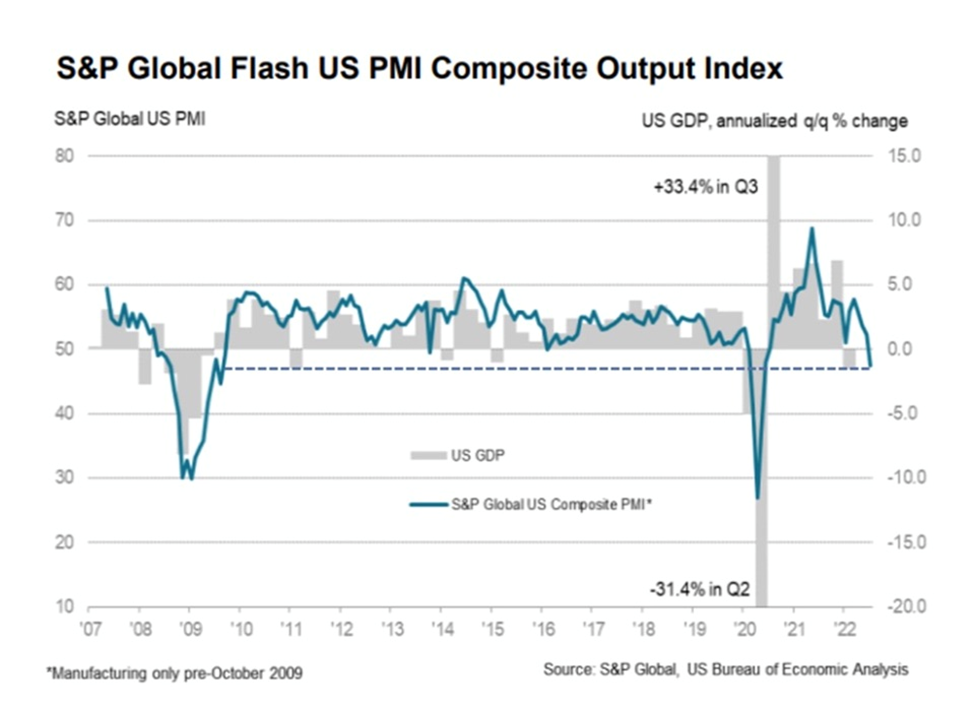

The Producers’ Manufacturing Index is showing weakness, as high inflation impacts customers’ ability to pay, and higher interest rates make borrowing more expensive. As the chart below shows, the S&P Global Flash US PMI Composite Output Index fell for the first time in over two years (26 months), led by services. Manufacturers and service providers both reported subdued demand conditions.

“The preliminary PMI data for July point to a worrying deterioration in the economy. Excluding pandemic lockdown months, output is falling at a rate not seen since 2009 amid the global financial crisis, with the survey data indicative of GDP falling at an annualized rate of approximately 1%. Manufacturing has stalled and the service sector’s rebound from the pandemic has gone into reverse, as the tailwind of pent-up demand has been overcome by the rising cost of living, higher interest rates and growing gloom about the economic outlook,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. He added:

“An increased rate of order book deterioration, with backlogs of work dropping sharply in July, reflects an excess of operating capacity relative to demand growth and points to output across both manufacturing and services being cut back further in coming months unless demand revives. However, with companies’ expectations of future growth slumping to the lowest since the early days of the pandemic, any such revival is not being anticipated. Instead, firms are already reassessing their production and workforce needs, resulting in slower employment growth.”

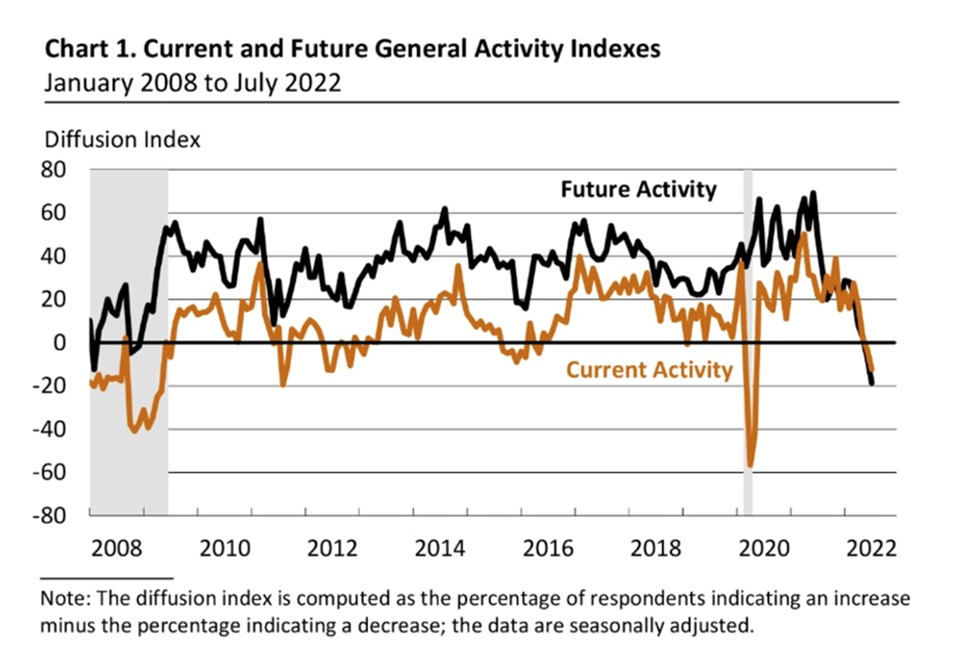

The S&P PMI confirmed figures that came out from the Philadelphia Fed Manufacturing Index, showing the index plunged for the fourth straight month. Even more worrying was the gauge of future economic activity, with -18.6 indicating the worst reading since 1979.

Source: Mish Talk

Source: Mish Talk

Yet there was Fed Chair Jerome Powell, after the central bank’s decision to raise interest rate by 0.75% in July, saying that the economy is not in recession as “there are just too many areas of the economy that are performing well.”

Talk about tunnel vision.

It’s supply, stupid

Let’s get back to the objective of raising interest rates, which is to cool demand, in an economy where for several months now, demand for goods and services has outpaced supply, causing inflation.

However, the Fed can raise rates as high as they want, the problem is they are not going to magically increase the supply of a number of commodities and manufactured goods we are running short of.

A big part of the current inflationary cycle, the worst since the early 1980s, is “supply-side” inflation. This has nothing to do with killing demand, and everything to do with increasingly supply. The Fed can’t control supply-side inflation, and they know it.

In fact the Fed’s mandate of raising interest rates to “destroy” demand, is running up against the policy of several governments around the world who are committed to upgrading their aging infrastructure and fulfilling a massive shift to electrification and decarbonization, so-called “green infrastructure” investments. (read more here)

China, the world’s biggest commodities consumer, plans to spend at least US$2.3 trillion this year alone, on thousands of major projects, according to Bloomberg. They are part of Beijing’s most recent Five-Year Plan that calls for developing “core technologies” including high-speed rail, power infrastructure and new energy. Translation: more money will be aside in years two to five.

China’s $900 billion “Belt and Road Initiative” is designed to open channels between China and its neighbors, mostly through infrastructure investments. Dozens of countries have signed up to it, including Russia.

The United States is pursuing its own $1.2 trillion infrastructure package, to be spent on roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, among many other items.

Between China, the United States, Europe and Japan, we are talking about $2.3 trillion + $1.2 trillion + $600B + $900B = $5 trillion in infrastructure commitments. Among the materials likely to be highly demanded for these projects, are steel, rebar, aluminum, cement, sand and gravel. There will also be large amounts of copper required for wiring and plumbing, nickel-containing stainless steel reinforcement on bridges, zinc coatings used as corrosion protection for steel bridges, etcetera, etcetera, the list of metals goes on.

For China’s Belt and Road Initiative alone, the International Copper Associates estimates the demand for copper in over 60 Eurasian countries, could hit 6.5 million tonnes by 2027, a 22% increase from 2017 levels.

Then there’s the electrification and decarbonization imperative.

Population explosion and urbanization, particularly in Asia and Africa, are macro demand factors pressuring supply. Climate change and resource nationalism are also throwing up impediments to bringing promising mineral deposits into production or expanding existing ones.

On top of all this, we have a food crisis, brought about by the war in Ukraine, where the Russians blockaded ports, that have only recently re-opened, but also long-running droughts in some of the world’s breadbaskets including the US Midwest.

Dumb government policies like mandated reductions in fertilizer-related emissions (read more here), threaten to reverse the Green Revolution that has fed billions and nearly eradicated famine.

Conclusion

It all points to a battle that governments and the Fed appear to be waging against the very people they are trying to help: consumers.

Think about it: the US central bank raises interest rates to fight inflation, while governments around the world work at cross-purposes by investing trillions in infrastructure programs — both “green” and traditional “blacktop”, thus fueling commodity inflation that works its way up supply chains to the consumer, who ends up paying more for, well, everything.

Consumers have no control over food and energy costs, which continue to remain elevated, in fact due to a lack of investment in fossil fuels, oil and gas we predict will keep trending higher, even though prices have pulled back from 2022 highs. Food inflation will only get worse as many parts of the world continue to be faced with droughts, and now, farmers in some countries are being forced to cut their fertilizer usage, which will reduce their yields and output, leading to further food inflation. Again, it’s the consumer who loses.

The Fed doesn’t care if they take down the economy with their interest rate hikes, their only concern — really they only have two mandates, both quite narrow, controlling inflation and preventing unemployment — is to get 2% inflation. All the negative impacts associated with higher interest rates, including low or negative economic growth, are secondary.

The consumer is already being squeezed by near double-digit inflation and higher interest rates on loans and mortgages; the way we are going, we are looking at a recession characterized by high inflation and low economic growth, i.e., “stagflation”. At AOTH, we predict it’s only going to get worse, as the Fed insists on continuing down this path.

Richard (Rick) Mills

aheadoftheherd.com