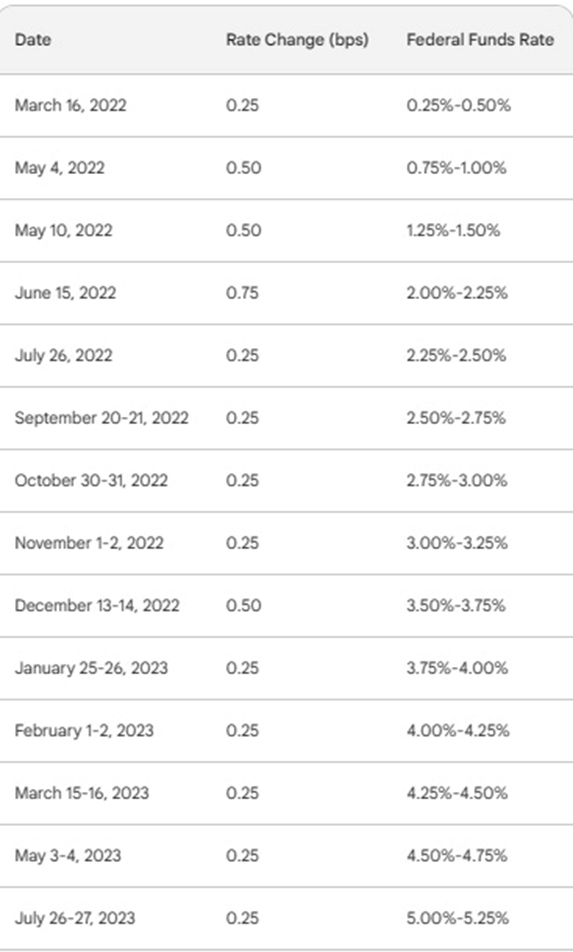

Last week The Federal Reserve announced another .25% increase in the Fed Funds rate, meaning that since March of 2022 (about 16 months), they have raised interest rates 14 times, the fastest rate hike cycle in history.

The Federal Reserve is the World’s Most Dangerous Organization because it is backed by the US military and its client, the US government.

Though the Fed pretends they are raising rates to “cool inflation,” they are really raising rates to crash the economy.

Why would they intentionally wreck things?

This is what Central Banks do, and this can be proven by examining their conduct ever since this "wrecking ball" model started in the modern era. Establishment of the Bank of England

It’s about two things:

- Exhibiting a plan of total control.

- Crash asset classes so the parasitic class (politicians and corporatists) can accumulate assets at rock bottom prices…pennies on the dollar.

Meanwhile in the USA the villagers are being gaslighted by a regime who says the economy is on fire and setting all-time highs for jobs, growth and other success metrics.

These are monstrous style lies (or gaslighting tactics.)

US personal savings have collapsed by $5.5 trillion since April 2020, spelling trouble for the economy.

- Historically high inflation has been the key reason for the decline in American consumers' cash reserves.

- People may try the familiar habit of tapping into Home Equity. Still, this old playbook window is closing because many people don't have homes, and those who do are under the required 20% equity (due to the spiking interest rates.)

- So people start using credit cards to cover everyday expenses, again a death spiral due to the higher interest rates.

- We are seeing record recent spikes in business bankruptcies in the US and Europe.

- This leads to massive layoffs.

One of America's biggest and oldest trucking companies shut down operations on Sunday and laid off workers at all locations. Yellow, a 99-year-old company, cut about 33,000 jobs — 22,000 of which were members of the International Brotherhood of Teamsters union. Its closure comes amid talks to sell its logistics business to avoid bankruptcy, an outstanding debt of $1.5 billion and a strike threat. A bankruptcy filing is expected soon, but details have not be disclosed regarding its assets. Yellow received a $700 million pandemic loan from the U.S. government in 2020; as of March, it owed $730 million. "Its downfall could have a ripple effect across the nation’s supply chain," per The New York Times.

So What's Next after Massive Layoffs? Pick a card, any card!

- Civil strife

- More cultural wars.

- More mass shootings.

- More property crimes.

- More misery from poverty.

- Larger gaps between the rich and poor.

- Dwindling access to wealth, power and prestige.

This means more distractions from the parasitic class ( aka Washington DC)

- More Barbie.

- More Taylor Swift.

- More materialism & products from sweatshops.

- More distractions.

- More misinformation.

But we are used to this.

Here is what's also likely to happen.

Retirement funds will disappear.

I was fortunate to visit online with these gentlemen from Canada who formed a helpful company called Guildhall Wealth.

Their company's purpose is to educate us villagers about social and economic problems created by central planners.

Their two-fold strategy is simple:

1. Unbank as much as possible.

2. Put yourself in a position where you are no longer a debt slave.

Below was our discussion couple of days ago on YouTube.

Don’t get too depressed. We can always feel-good knowing there’s Wayfair and remember their jingle for peace of mind when things get tough.

"Wayfair, you've got just what I need!"

God Hath a sense of Humor