Read article in full on SilverSeek:

https://silverseek.com/article/another-egregious-bear-raid-big-8-shorts

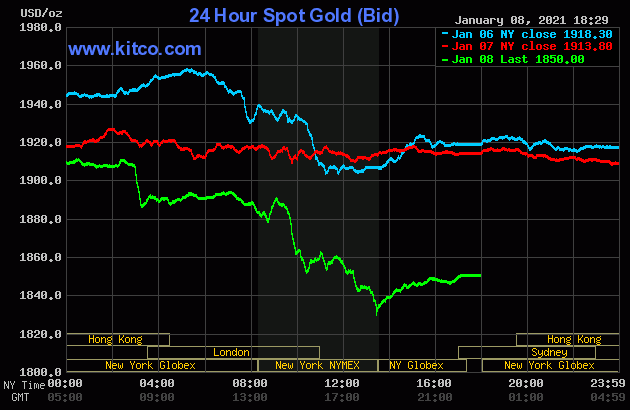

The gold price drifted quietly lower until shortly before 1 p.m. China Standard Time on their Friday morning -- and then traded sideways until the London open. The bids got pulled -- and gold was back below $1,900 spot and down twenty bucks in a very few minutes. From that juncture it crept a bit higher until the noon GMT silver fix -- and then was sold lower anew. The Big 8 shorts appeared in force once again at the 9:30 a.m. low tick in the dollar index -- and the equity market opens in New York. Gold's low tick was set a minute or so before the 1:30 p.m. COMEX close -- and from that point it drifted quietly higher until around 3:45 p.m. in after-hours trading. I didn't do much after that.

The high and low ticks in gold were recorded by the CME Group as $1,918.40 and $1,827.80 in the February contract. The February/April price spread differential in gold at the close yesterday was a mere $1.90...April/June was $3.00 -- and June/August was $2.70. These numbers certainly encouraged traders to roll out of February and into future months, which they did in droves yesterday.

Gold was closed in New York on Friday afternoon at $1,850.00...down $63.80 from Thursday -- and about 22 bucks off its Kitco-recorded low tick of the day. Net volume was enormous for sure, but not quite as enormous as one might expect on such price action, at a bit under 369,500 contracts -- and there was a huge 85,000 contracts worth of roll-over/switch volume out of February and into future months...mostly April and June. I'll have more on this in The Wrap.

|

|

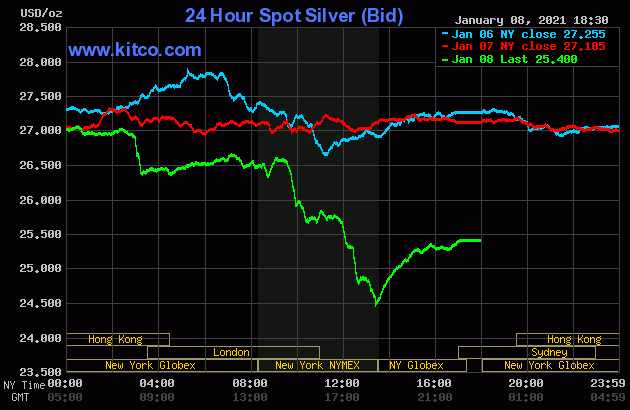

The Big 8 shorts handled the silver price in an identical manner as they did in gold, including all the major price inflection points, so I'll spare you the gory play-by-play in this precious metal.

The high and low ticks were reported as $27.335 and $24.53 in the March contract...an intraday move of $2.805 cents. The March/May price spread differential in silver at the close yesterday was only 6.2 cents...May/July was 7.4 cents -- and July/September was 7.2 cents.

Silver was closed on Friday afternoon in New York at $25.40 spot, down $1.705 on the day -- and about a dollar off its Kitco-recorded low tick. Net volume was ginormous at a bit under 181,000 contracts -- and there was a hair over 8,000 contracts worth of roll-over/switch volume in this precious metal...mostly into May and July.

|

|

Read article in full on SilverSeek: https://silverseek.com/article/another-egregious-bear-raid-big-8-shorts