Buyers and sellers of gold and silver are sitting on the fence today. Both will be waiting for trend in London and USA. Momentum has picked up for gold and silver. Tuesday to Thursday (Asian session) can see some very wild price moves in gold and silver due to US July retail sales and July FOMC minutes. Jobbers, day traders and weekly traders still need to trade very carefully till Thursday. Do not be overly excited or overly pessimistic on bullish trend/bearish trend in gold, silver and copper. There can still be some knee jerk price moves. Sentiment for US dollar Index is bullish as Federal Reserve will be the first central bank to start withdrawing covid induced stimulus money among all central banks.

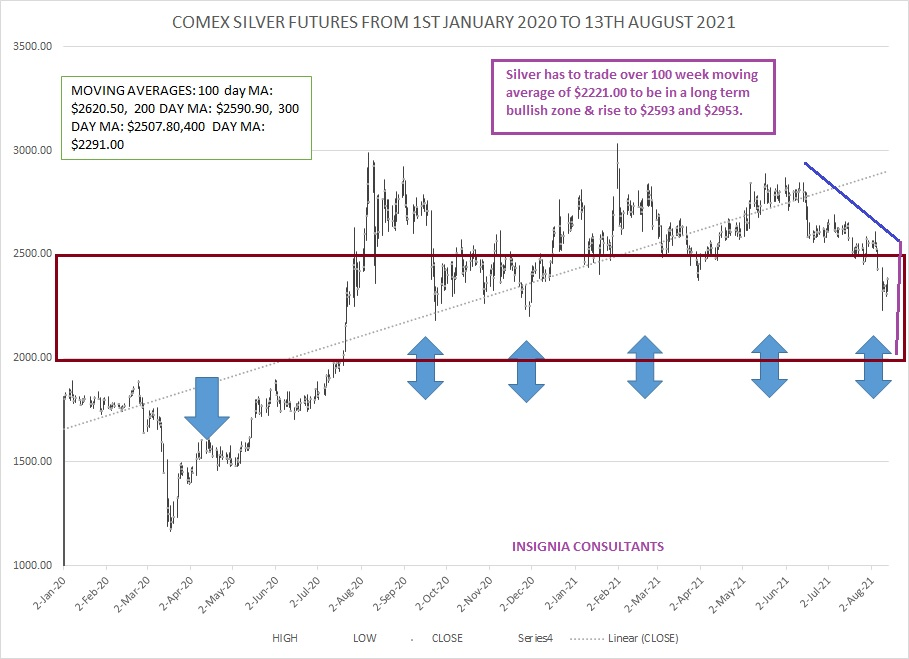

Comex Silver chart from 1-1-2020 to 13-8-2021

Cautious optimism in silver as the silver price takes much longer time to recover than gold when price falls. Trend of silver on or after 19th August is the key.

The key lesson learnt this week is not to invest in precious metals by hype and frenzy. One can invest in base metals and stocks on hype and frenzy but not bullion. An average gold trader does not take a risk of more than $30. Think this in mind and then trade and invest.