- Trend after the release of US November consumer price index number at 7:00 pm Indian Time is the key.

- A very low CPI will push gold near $1900 by tomorrow and $25.00 in silver by tomorrow. (before FOMC meeting.)

- Crash or sell off in gold will be there if spot gold does not break $1830 by tomorrow.

$1760 is the crash point for spot gold. $1830 is the zoom price point for spot gold. If spot gold has to near $2000 it needs to break and trade over $1830 today, tomorrow and till Friday. Keep a close watch at $1830. There can be a big sell off first as well in case spot gold does not break $1830 by Thursday close. But use the same to go long or invest for the first week of January.

I will prefer to use all the price crash (if any) till Thursday close to go invest for the short term in gold, silver, and copper. The only risk to my bullish view is the federal reserve chairman powell saying that a 0.50% interest rate hike will be there in January meeting.

Day traders and jobbers have to remain on the sidelines. There can a sharp correction just before CPI or just after CPI followed a rise. Most of the traders are long in gold and silver, and copper. Once again technical resistances have to be broken for the rise to continue.

Spot Gold:

- Daily support: $1760.00 and $1771.80

- Daily resistance: $1804.90

- Gold has to trade over $1760.00 to rise to $1826.80 and $1843.50.

- Gold will crash only if it trades below $1770.00 after London opens.

- Gold will also crash if it does not break $1804.90 today in USA session.

FOMC, CENTRAL BANK MEETINGS AND END OF THE YEAR TRADES TO INCREASE VOLATILITY

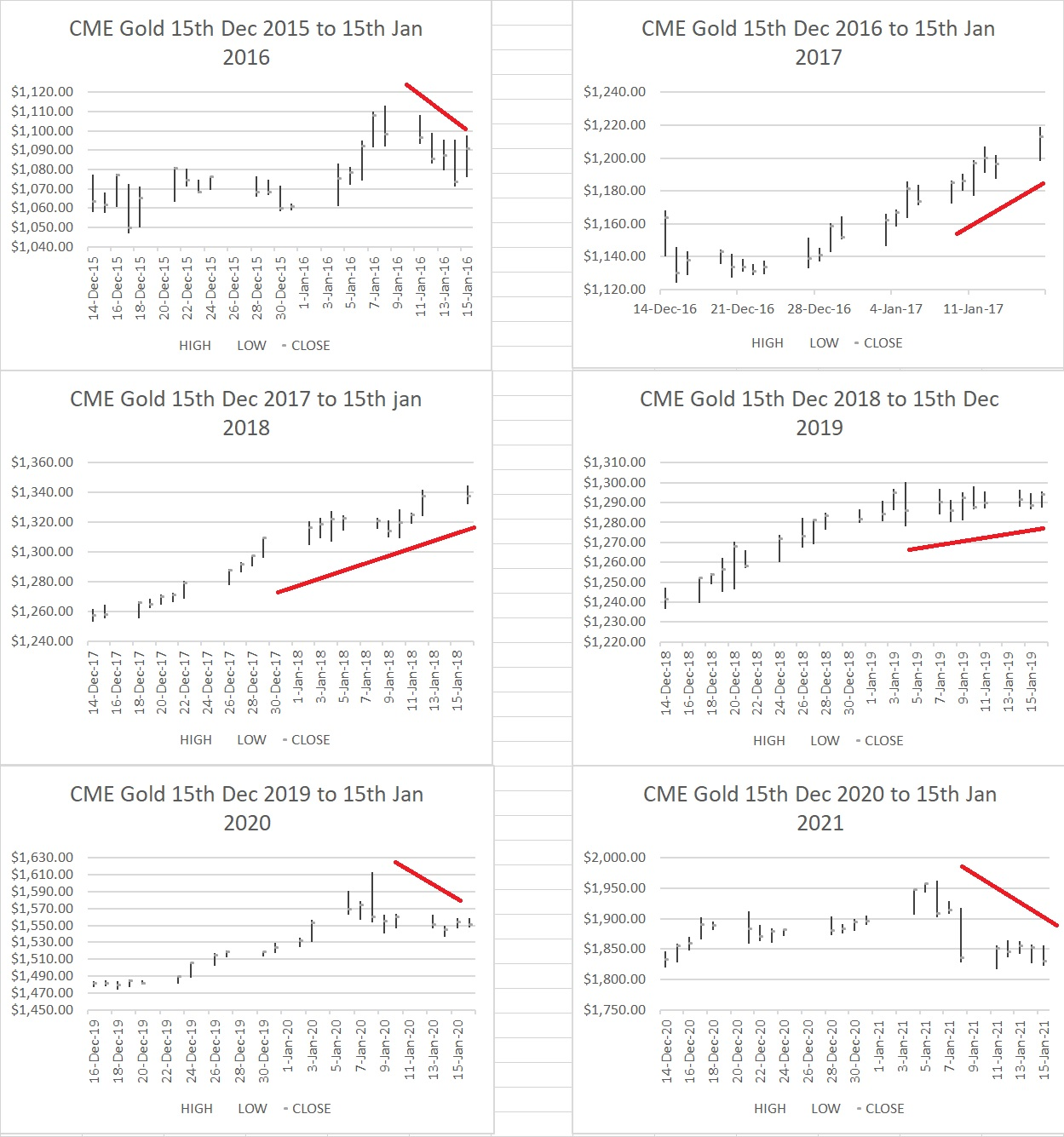

The above graph is of Comex gold February future between 15th December and 15th January every year. (2015 to 2022). Two key observation is below:

- Gold has generally risen between 15th December to 15th January period in most of the years.

- Sharp correction or a crash has mostly after the release of December nonfarm payrolls which is released on the first Friday of January.

- Sharp correction is also seen in gold before January FOMC meeting.

- Gold price has risen sharply after December FOMC meetings since 2015. If history repeats itself then one should all the price fall/crash this week to invest for the short term for the first week of January, (but only with higher trailing stop loss.)

CORRELATION – CRUDE OIL VERSUS GOLD, SILVER, COPPER AND US DOLLAR INDEX

- In the short term there is an inverse correlation between crude oil versus gold, silver, copper and US dollar index.

- In the long term correlation will not work (between crude oil with precious metals and base metals.)

- Crude oil is the preferred short term investment avenue among commodities if it is in a bullish trend (whether intraday basis or weekly basis or monthly basis.)

- Whenever crude oil falls, crude oil traders switch to gold, precious metals and base metals. (in the short term.)

- One needs to keep a close watch on short term technical trend of crude oil. It will help in short term investment decision for other asset class as well.

CONCLUSION

Risk appetite has certainly increased sharply once it became known that interest rate are nearing a top globally. Large hedge funds are aggressively investing in base metals, emerging market stock and emerging market bonds, Asian stocks and Asian bonds. The pace of rise of base metals and food price if substantial will create murmurs on longer than expected interest rate hikes.

Recession is also the buzzword in social media. So far there is no recession. The positive impact of Chinese economy moving away from zero covid policy is also keep global recession at a distance. Chinese central bank brought gold for the first time in three years. Base metals demand from factories in China is expected to rise. Chinese real estate market is expected to be near normal by March 2023. Chinese demand will be the key for precious metals and base metals for the next two months.

Recession at the earliest (in my view) will be there after Middle of January in USA, UK, and Europe. People are going to be frugal after the Christmas and New Year celebration are over. The economic impact of proposed large scale layoffs by large US corporates will be felt after middle of January.

Recession will cause a sharp correction in gold followed by a big rise. Stocks, precious metals and base metals should fall and trade with a softer bias for a few months if recession were to happen.

In technical parlance an inverted head-shoulder formation is needed for minimum six continuous weeks in global stock markets for recession to be there.