Short term sentiment is still not very bullish for gold. Everyone is bullish on silver. Less numbers of traders and people are bullish on gold as compared to silver. I am a hardcore long term silver bull. I am not commenting on silver. Silver’s industrial demand and long term demand potential makes me believe silver is undervalued to the core.

Right now am focusing on gold and gold price trend in the short term. Pandemic related non-recurring factors between April 2020 and July 2020 is being ignored by me. Non-inclusion has to be there for non-recurring events for any price forecast of any metal, energy and forex. Gap between spot gold and comex near term gold futures had risen over $70.00 in April 2020 due to a global coronavirus induced lockdown. This and other similar factors have been ignored by me.

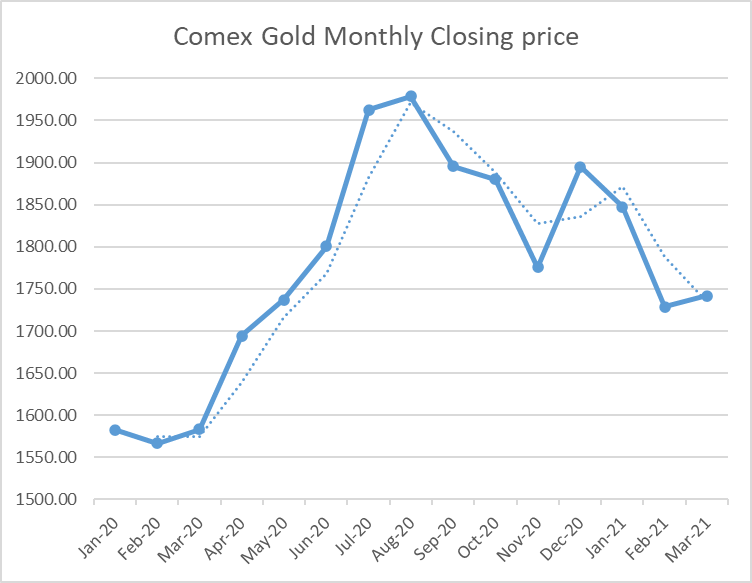

March 2021 is comex gold April futures closing price on 19th March.

- On a monthly closing basis gold price have traded between $1500-$2000 range in the past fifteen months.

- Averaging closing price on the last day of the month is at $1778.00.

- Lowest monthly closing price was $1566.70 in February 2020.

- Highest monthly closing price was $1978.60 in August 2020.

One key observation is that gold price failed to close over $2000 on the last trading day of the month. Technically and psychologically gold’s failure to get a monthly closing price of $2000 is one the reason for the short term bearish trend in gold. Vaccine, bond yields, central bank selling and preference for crypto currencies over gold are the other reasons for the selloff in gold price.

Where is gold price headed? Gold price has to trade over $1484.90 for the rest of the year to rise to $2150.90 and $2389.80. Long term support is at $1484.90.

In the short term gold has to trade over $1778.00 (fifteen month closing moving average) for at least seven consecutive days to restart its bullish zone. Gold price can test $1484.90 in case $1778.00 is not broken in the next thirty days.

Gold price will get over bearish factors like continued rise on bond yields, bitcoin’s super rise, central banks ignoring inflation and zero impact of political factors. The pace of rise will be slow. Patience will be tested for those who have invested in gold.

One should treat gold as a safe haven. Gold is never to be confused as a short term money making opportunity. Gold futures offers adequate day trading opportunities. Intraday volatility and short term volatility (n gold futures) is high enough to make good profit. One can even hit in Jackpot on certain week in a year while trading in gold. Gold futures is not a zero risk investment. Do not slam down gold just because you have incurred trading losses in gold futures.