- There are no major US economic data releases today and Monday. It will be a technical trade.

Fatigue among buyers will be there if gold and silver take more days to break past $1800 and $23.00. There can be a crash or sell off first if $1800 is not broken in the next seven days. Silver has to trade over $20.60 till next week to be in a bullish zone.

One needs to remain on the sidelines today. A daily close over $1750 today should be positive for next week. Silver needs a daily close over $20.90 today to be in a bullish zone next week.

Silver will be deficit this year as per International Silver Institute

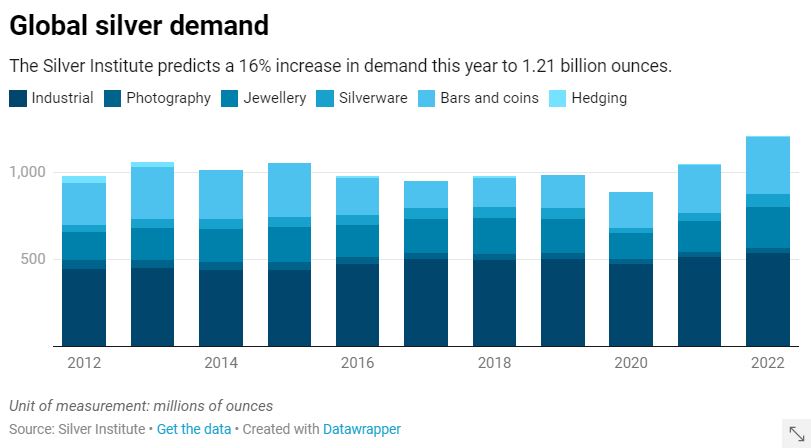

- Global demand for silver is expected to rise 16% this year to 1.21 billion ounces, creating the biggest deficit in decades.

- The Silver Institute predicted a deficit of 194 million ounces this year, up from 48 million ounces in 2021.

- Demand in India almost doubled in 2022 as buyers took advantage of low prices to replenish stockpiles drawn down in 2020 and 2021.

- Use of silver by industry, for jewellery and silverware and for bars and coins for retail investors were all forecast to reach record levels.

- Automakers are using more silver as the amount of electronics in vehicles increases, but the sector accounts for only around 5% of total demand.

- Solar panels account for around 10% of silver demand.

- Exchange traded funds (ETFs) storing silver for investors shrank.

OUR VIEW:

Spot silver will near $50.00 if and when silver ETF demand starts to rise. Everything is positive for silver from a physical demand perspective. Investment demand is still way below normal in silver. Silver investment demand if and when it starts to rise, will create a parabolic rise. Overall silver is an invest on crash strategy. Silver is also the best for low risk day trading. I am against making short term investment in silver at current price. I will prefer to wait for a week and then decide.

In India, some of my clients were selling jewellery made of gold, diamond and platinum. They were not selling silver jewellery (only silver coins and silver bars were being sold by them.). They all are now looking for new locations for a silver jewellery only store. Everyone is still buying silver in any form they can. I still get queries from everyone on whether one should wait to buy silver in any form. In India, If you are not selling silver jewellery, you have missed a big business opportunity.

USA is closed on 24th November/Thanksgiving. Options expiry is there next week in CME December futures in gold, silver, and copper. Position squaring and rebuilding will be there for next futures contract in CME. Options traders will start placing their bets for end January in gold and end February in silver and copper.

Position squaring and rebuilding has also started for US November jobs between 1st December and 2nd December.

Spot Gold:

- Daily support: $1720.80 and $1745.10 AND $1753.00

- Daily resistance: $1769.00 and $1784.00

- Spot gold has to trade over $1769.00 to rise to $1784.00 and $1799.00.

- There will be sellers on rise as long as spot gold does not break $1769.00.

- Key support is at $1740.00. There will be a technical breakdown if spot gold trades below $1740.00.

- Trend after London AM Fix is the key.

Spot Silver:

- Daily Support: $20.23 and $20.51

- Daily Resistance: $21.39 and $21.90

- Spot silver will crash if it trades below $20.90 to $20.66 and $20.23

- Watch $21.00 all the time. Spot silver can move $1.50 either side from $21.00.