“Taper talk” or reduction in money supplies or direct and indirect interest rate hikes is now the headline talk among traders and investors. Bets are being placed for “taper by Federal Reserve and other central banks” for 2022. Central banks say that inflation and hyperinflation will be temporary. Central banks are very vogue in spelling out the timeline for the phrase “temporary phase”. It can be between three months to one year. Rising commodity prices have a lagging effect on inflation, consumption and growth. For example s brent crude oil price floats over $80 in July to August months. It is accompanied by an equally sharp rise in global food prices. Inflation and negative impact of inflation will be felt only from November. Till then global stock markets and all asset classes will be highly overvalued or near busting price levels.

World is now taking US jobs creation as the criteria for the Federal Reserve to decide on the timeline for an interest rate hike. There is an old saying that “World catches cold when the US sneezes”. Every central bank will copy the Federal Reserve on interest rates rise for next year. Traders have started pricing in an interest rate hike for next year. The big question is whether bullion will continue to rise on taper or will it trade with a softer bias. My answer is that gold will continue to rise irrespective of central bank policies on interest rates. Only the pace of rise will vary. There will be a quarter or two when the gold price gives slightly negative returns. I am a silver bull to the core. I believe that silver is way undervalued in the precious metals group just as nickel is undervalued in the base metals group. The room for silver to rise is multiple times more than gold.

Gold price has been trading in the $1660-$1960 range. This is a $300 range. Silver has been more volatile than silver. After the March sell off both gold and silver have recovered. Copper and crude oil has been more or less a one way ride. There have been corrections in copper. But the overall trend has been bullish.

Crude oil has been riding on expectation that post covid crude oil demand will be significantly higher than pre covid demand. Industrial metals have been rising as the switches to electric vehicles (EV) from integrated combustion engines (ICE). Steel prices have moved into another galaxy. Every metal, energies and soft commodities are way over pre covid price (I am taking the closing of January 2020 price as pre covid time.)

Central banks printing money has beaten global stock markets by miles. There have been boom-bust price moves in all asset classes in the last eighteen months. (including crypto currencies) Stocks got battered between February 2020 and April 2020. Crude oil prices were negative in April 2020. Bonds also sold off in the second quarter of last year. Gold and silver have seen boom-bust type of price moves at least twice in the last eighteen months.

Covid vaccines are now pushing the world towards normalcy. Supply-demand mismatch is aiding all metals and energies. The pace of rise of industrial metals, stocks and crypto assets have surpassed all expectations. Only gold, silver, platinum and nickel have been highly undervalued.

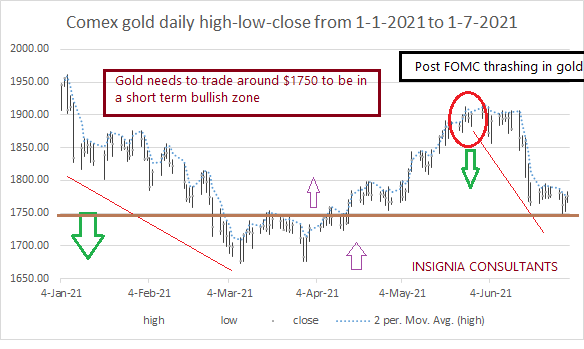

Comex Gold Futures technical view

The moving averages (as of closing price on 1st July 2021)

50 day MA: $1832.10

100 day MA: $1790.80

200 day MA: $1833.70

300 day MA: $1833.20

Convergence of moving averages suggest very big price moves for gold.

- A consolidated break of $1833.70 will pave the way for $1940.70 and $2060.80 in the third quarter.

- However failure to break $1833.70 will result in a crash to $1687.10, $1602.50 and $1563.50. (this is the technical view).

Immediate resistance is at one hundred day moving average of $1790.80. Gold needs to trade over $1790.80 on daily closing basis to target $1833.70.

Bearish factors for gold for the rest of the year

- US dollar Index trades over 93.50 for a very long period of time.

- Federal Reserves does a Paul Volcker type interest rate hike to curb inflation.

- Inability to break past key short term resistances.

- Crypto currencies rise over hundred percent in third quarter. A renewed rise with vigor in crypto assets can result in bullion trading with a softer bias in the short term.

- Central banks become net sellers in gold. [Central banks are net buyers of gold this year.]

- Gold ETF ouflows rise by over twenty percent.

- Last but not the least, global stock markets move into a short term bearish trend. Also stocks remain bearish for over a month.

I am not discussing the bullish factors for gold. Gold is the real money. Converting the cash (which you all keep as a contingency fund) into gold at current price is the only way to hedge against a falling purchasing power of money. Cash is the king only if it is converted into physical gold. Cash is junk if kept in a safe or a bank locker. (I always prefer investing in physical gold and physical gold for long term. Futures investing in only for a three month to six month period.)

If you want to play a T20 cricket game w.r.t to investing then better switch to crypto assets and selected stocks. Gold is good for trading and investing but returns will be way behind stocks and crypto assets.