First published Monday March 13 on Seeking Alpha: What a week we had last week. As we came into the week, I said I was standing aside, as I was not sure how this would resolve. But, I was going to give the bulls the opportunity to prove themselves early in the week. So, I laid out a very specific path they would need to take to suggest we were going to take a direct route to 4300, rather than the scenic route, which took us down to 3800SPX first.

We started with a 30-point rally in the first half of trading on Monday. And, as the market was hovering near the high on Monday, I sent out an alert to our members of ElliottWaveTrader telling that risk has now risen, and you may want to head to the sidelines until the market clarifies itself. I even warned that we could be hitting a high at that time that could set us up to drop to the 3800SPX region if the bulls faltered.

As the day progressed, we developed a smaller degree 5-wave drop off those highs. And, I told our members that they should now be on high alert for the potential that we can drop down to the 3800SPX region and take the scenic route to 4300SPX instead of the direct path.

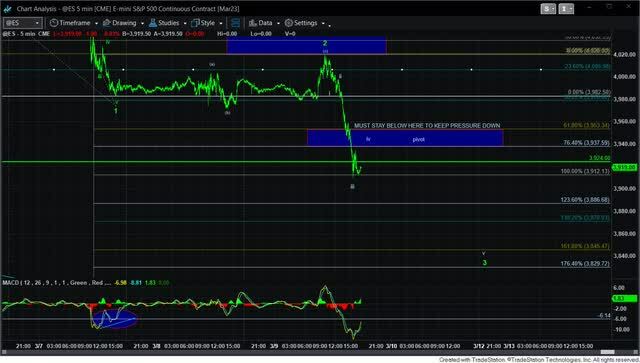

As we went into Tuesday, the market completed a larger degree 5-wave structure to the downside. So, it was time to prepare for a retracement and a follow through to the downside. And, early on Thursday morning, these are the charts I posted to our members as the market progressed to our wave 2 topping target:

EWT

EWT

EWt

As we now know, the market continued down quite rapidly from there, as my next lower target was the blue box below the market, as you can see from the charts above.

And, as one of our members noted during the day today:

“I'd like to coin a new term: Avi-ously. I don't know what he sees, but his methods and analysis are not of this world, at least not my world. But, Avi-ously, he knows. Props to our Big Guy.”

EWT

As I noted in our update on Thursday evening, as long as the market was able to hold that pivot noted on the charts above as resistance, my next downside target for Friday was 3845ES (in the futures), which is marked by the v of 3 on the chart. In fact, I even posted a blog update on it with the charts that evening:

Yet, based upon the number of hits that it got, most of you did not bother to read it. You would have known how to trade Friday’s downside almost perfectly if you did read it.

As we know, the market rallied early in the day to the pivot, which held as resistance. We then began the decline that took us through the day on Friday, and our target for v of 3 was the exact low struck on Friday at 3845 in the futures.

Now, I want you to take note that these charts were set up on Wednesday. We did not know what the various economic reports were going to say, nor did we know about SVB. Yet, that chart tracked the market perfectly through the last half of the week, just as we set it up on Wednesday.

When I see markets react so perfectly, and almost to the penny on many moves, it reminds me of a 1997 study conducted by Caldarelli, Marsili and Zhang, in which subjects simulated trading currencies, however, there were no exogenous factors that were involved in potentially affecting the trading pattern. Their specific goal was to observe financial market psychology “in the absence of external factors.”

One of the noted findings was that the trading behavior of the participants were “very similar to that observed in the real economy,“ wherein the price distributions were based on Phi. This is one of the supporting proofs that one does not need to know the news in order to trade accurately. And, this past week was a perfect example.

And, as some of our other members noted this past week:

“It's like we have the other team's playbook.”

“Trading with EWT is akin to being behind the curtain with the Wizard of Oz!”

As an aside, I know the news surrounding SVB this past week has shaken many about the banking industry. And, to be honest, I do not blame them. When you look at the complex in depth, there is plenty about which to be concerned.

For those that have been reading me for some time, you would likely remember that I began warning about the potential for a major bear market a number of years ago. While I expected it would begin after the market was able to exceed the 5000SPX region, there is potential that it may have begun already.

One of the main themes I expected to play out during the bear market is another financial crisis based around the poor quality of our banking industry balance sheets. And, while many may have been convinced by the actions after the 2009 financial crisis that another such crisis will not again happen in our lifetime, I do not count myself amongst them.

In fact, I fully expect another financial crisis, and one of potentially greater magnitude.

You see, the larger degree 4th wave bear market that I expect will be of a degree larger than the one we experienced in 2008. Therefore, I think the pain will potentially be more prolonged and much greater. And, even during the relatively short banking crisis we experienced in 2008, take note that the FDIC Deposit Insurance Fund went negative by $21 Billion. So, I strongly question the wear-with-all of the FDIC to be able to backstop a much longer and protracted banking crisis, which I fully expect.

So, a number of years ago, I began preparing you for the potential that our banking system may face extreme stress again in the coming bear market that I expected. To this end, approximately 3 years ago, I began to work with a banking analyst to assess not only the quality of the major banks in the United States but to also identify what we deem to be the top 15 banks in the country. And, this led to the establishment of saferbankingresearch.com. Moreover, what we learned in this process was truly quite eye-opening and even quite scary.

Many will attempt to explain why the SVB failure is different from all the other major banks. And, they would be right in the one certain respect that they cite. Yet, most of the larger banks have their own specific issues which could easily lead them down the same path as SVB in the coming years.

Over the past year, we have been writing public articles outlining the issues we see at the major banks. While there are still many more to be covered, you can read the articles we have written here:

Safer Banking Research Articles

Based upon the issues we have seen, it is likely only a matter of time before these issues come to light in a more public way, as they threaten to take down these banks over the coming years.

For those of you that think the Fed stress tests will allow you to sleep at night, I would strongly urge you to read this article we recently wrote:

The Fed Is Trying To Pull A Fast One

What is most interesting is that within this article we wrote several weeks ago, we outlined that the Fed completely ignores maturity mismatches in its stress tests, which is what basically caused the SVB collapse.

In the meantime, it behooves each and every one of you to assess the risks within the banks that house your hard-earned money. I think it is only a matter of time before the issues that lie within the balance sheets of many of the United States banks come to light. By then, it may be too late.

But, I digress. Let’s look at our expectations for the coming week.

I am going to keep this very simple, as the market has made it quite simple. But, the details I am leaving for the members of ElliottWaveTrader.

Support this coming week is in the 3750-3810SPX region. Resistance is 3912-3937SPX. While I think we can have several movements between support and resistance in the coming week, to make it easy, I will summarize my view by saying that as long as support holds, and we begin an impulsive 5-wave rally through resistance – which should target the 4014-4087SPX region - then I will be looking to buy a corrective pullback after that rally, with the expectation for a rally to 4300+. In other words, this is what would confirm the scenic route to 4300+ I have been speaking of late.

If we see anything less than that structure play out, I will not likely be deploying any money to the long side. Moreover, a sustained break of 3740SPX will likely begin a more protracted downside fall. But, that is not my expectation at this time.

However, if the market struggles with the 3800/3811SPX support early in the week, that could be a first indication of the more bearish scenario taking shape. We will be monitoring the action this week very closely.

Lastly, many of you challenge me as to why I do what I do publicly rather than just do it on my own to make money. Well, it is due to the difference we make in people’s lives, as we are told weekly:

“Before coming here I would have puked to death in such moments, now I am eating popcorn, watching, and unloading my hedge/short at support. So happy to have found you Avi. Told you several times but you changed my life, and therefore my family's future.”

Have a good week.