Constrictors… Are… Terrifying…

As a boy I occasionally had nightmares involving snakes and the idea of a boa constrictor forcing all of the air out of my little lungs was beyond terrifying. Later in life, I learned that constrictors are far more efficient and that the air isn’t actually forced out of the lungs of their prey, but instead the constrictor adjusts its grip on every out breath until there is just no room for the prey to breathe into, a death by removal of wiggle-room. As gruesome of an image as this paints, it is exactly what came to mind when I realized the brilliance of the proposed BRICS Development Bank, BDB, gold-pegged currency that is being considered at the BRICS Summit today, tomorrow and Thursday in South Africa.

“Backed” is not “Pegged”

The key to understanding the brilliance of this dollar trap lies in the concept of a “gold-pegged” versus a “gold-backed” currency, so a little review of history may help the understanding of the mechanical differences between “pegged” versus “backed” and why it matters.

The recent history and problems with being “gold-backed”

Precious metals-backed currencies required a specific quantity of precious metal for every dollar unit in circulation and were the desired standards for currencies for centuries, but these standards made it hard to grow the money supply for both legitimate and illegitimate reasons. In 1965 the US got called out by France in a colossal game of “chicken,” when France sent war ships over to the US to turn in their US dollar reserves for gold bars. They knew we had been growing our money supply faster than our gold reserves and planned on capitalizing on our stretching of the truth, so we rapidly changed the rules of redemption and then left the gold standard all together in 1971. In 1978 the IMF member countries decided to formally block the use of precious metals to back currencies going forward. For years, critics of these metals-backed standards had stated that when the population grew faster than gold could be mined, the money supply would shrink and force deflation, which would inevitably slow that economy down. For the low population growth countries of Europe this was less of a problem, as countries like France had only grown 2.5-X over the last 250 years versus the United States which had grown 132-X over the same period. This need for increasing the supply of gold on the same timeline as the population growth was a recognized and documented problem, but it was tolerated, as unpegged free-floating currencies had (and still have) their own problems, as they have always been abused by governments to create unseen inflationary taxes by quietly increasing the money supply and devaluing the currency.

Governments’ Love Affair with Free-floating Currencies

To understand the money supply / political relationship problem you don’t have to think very far. If you can imagine a honest and loving politician campaigning for election and promising to improve and increase services above the current standard, you’re already halfway there. Now imagine what happens when the politician must try to remain in office, deliver on their promises and not increase taxes or borrowing. All too often over the history of currencies this has played out, where instead of using an unpopular tax to take money out of your pocket, the politician just creates more money in total and makes the money in your pocket worth less. For an honest and moral politician this ability to “just print a couple extra dollars” is very tempting, for a politician of lesser standards it becomes an incredible power that cannot be resisted. Which is the reason that proponents of gold backed currencies have traditionally loved them, they take away the options from the governments for printing or borrowing additional dollars and require them to go to market and buy more gold if they want to create more money. Another recognized challenge with free-floating currencies is stabilizing their value when they are not backed by a commodity.

The Difficulties of Free-floating Currencies

All major modern currencies are free floating currencies that face the stabilization problem. Behind the scenes, economists use formulas to wage bets on currency demand and then use financial instruments to regulate the supply of money to try to maintain a consistent value per monetary unit. In an ideal world, the value of the money remains close to constant, and the money supply expands and contracts at the same rate as the changes in the demand for the money. In the real world the value is not constant and is often adjusted in relation to other major currencies to maintain trade relationships. As a result, stable becomes a bit of an illusion and the winning currency is just the least inflated one due to the spending needs of its country. Unfortunately, money supply manipulation is not an exact science, and when it goes bad it can snow-ball out of hand with rapid declines in value that can cause hysteria or sudden increases in value to the point of freezing the economy. As a result, many countries choose to “peg” their currency to one of the top currencies in the world, which provides a hybrid option to a pure commodity backed currency. These countries choose to let the other country worry about the money supply gymnastics and they simply have their own money that is worth a fixed value against another currency, but this too has its problems.

“Pegging” is Slaving

When a country decides to “peg” their currency to the dollar, they essentially are making a promise to inflate their currency at the same rate that the United States Fed is inflating the dollar at. Every time the US prints more money, the country must print more money and every time the US tries to send financial instruments into the market to reduce the dollar supply the country needs to do the same, to some degree. In theory the timing of all of this all happens in absolute synchrony, in practice the country’s money supply just needs to be somewhat growing and shrinking in similar time with the dollar. This makes pegging a currency a much easier operation than fully managing a country’s money supply against the velocity of its money, in order to do this, the country must give up their option to inflate their way out of debt. The problem with pegging to the US dollar is that the printing mistakes of the Federal Reserve become the inherited mistakes of the pegged currency, but what if there was an inflation countering mechanism to use with the “peg?” This is precisely what the BDB (BRICS Development Bank) Gold “pegged” currency aims to do.

Best of Both Worlds?

The gold pegged currency of the BDB does not want the troubles of dealing with money supply and gold store issues for a gold backed currency, especially when it would require all participant countries to maintain high stores of gold for money supply regulation. Nor does the BDB care to deal with the hazards of a free-floating shared currency that participating countries all must also manipulate for their own needs (the Euro disaster). Instead, the BDB has indicated that it will peg itself to the stability of the dollar, but through the dollar / gold price relationship. Meaning that if the US government minimizes their inflationary printing and the gold market doesn’t go crazy, the BDB would be effectively securely pegged to the dollar, but if the US government continues their policy of printing dollars to deal with their debt and market issues, the value of the BDB currency will rise against the dollar with the price of gold. So, is this really a great bet on the BDB part?

It's Complicated, Like a Russian Chess Move

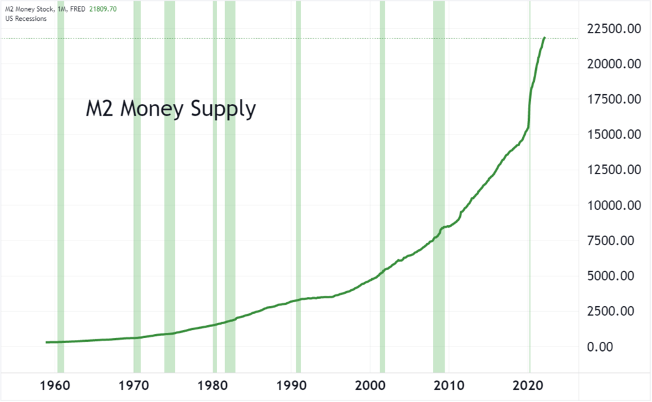

The short answer is, “Yes, but it’s complicated.” In theory, the BDB currency, once in place like the constrictor, doesn’t have to aggressively go after its prey, the dollar, it just has to stay alive, close by and wait for it to struggle a bit. Any wiggling that takes place with the dollar could become an opportunity for the BDB currency to gain strength. In practice, however, the gold market is on record as being heavily manipulated so why would the BRICS and their affiliated countries even consider this? Controlling 78% of the world’s oil reserves and 36% of the Global GDP is always a good start to a power play, but many of these countries have also been leading the way in recent gold acquisitions for central reserves. Admittedly they are far behind the stated gold reserves of the United States, but if they were to set the BDB currency in motion any future purchases of gold would only potentially strengthen their position (and intensify the squeeze) and make their currency worth more. On top of that, gold is now 5,500% stronger than the dollar since abandoning the gold-standard while the M2 money supply has approximately increased by 5,200% over the same time frame. If history is any indication of how the future may go, this move by the BDB appears to be a very strong move over the long run that could put a serious nail in the US dollar.

How Could This Play Out?

Once the BDB python currency snuggles up with the dollar, the dollar may not have the breathing room it needs to print itself out of trouble. This could force the removal of the inflationary tax option from the arsenal of the Fed all together, which would signal the end of the game for how the US currently handles its debts and struggles and possibly be the end of the dollar. As US debt numbers start to become numbers that only trained astronomers can understand the magnitude of, simple arithmetic shows that the current pathway for the dollar is not sustainable and most countries have to see this. So, the BDB currency may quickly turn into a hedging option for those countries looking to distance themselves from the risks that the dollar may present.

Or

This could become a key moment for the US to pick a fight with one of the larger players behind the BDB in a last-ditch chance at a divide and conquer move. This would include an international defamation campaign, and multiple other ploys to prevent an alliance from forming with the BRICS and their applicants. The BRICS alliance meeting that began today, Tuesday the 22nd of August and will end Thursday the 24th, may be one of the most pivotal moments in recent monetary history. The US has been known to pick fights, or support fights with those who threaten the dollar, but this time there may be too many countries already signed up.