Calibre Mining, a company which acquired B2Gold's Nicaraguan assets in the not so distant past provided multi-year initial production and cost guidance. Calibre posted solid Q1 numbers, only to report very weak Q2 numbers, though primarily a result of the 10-week suspension of mining activities at its assets.

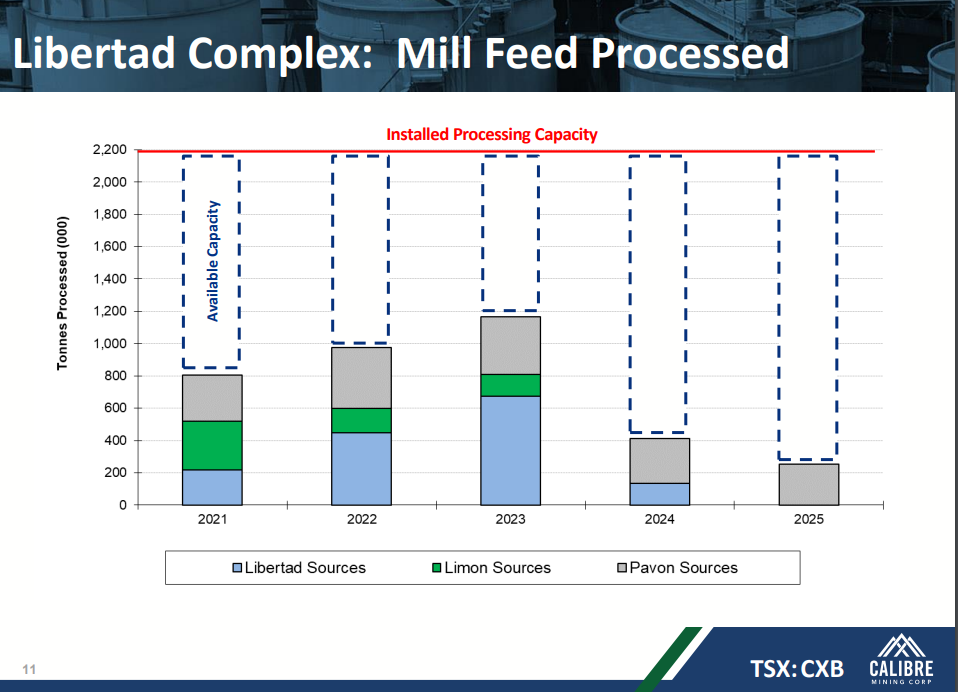

Per the PEA at the Libertad Complex, 2021-to-2023 average annual production will be 120k oz. Au with AISC of $906/oz. This doesn’t include any drilling results after year end 2018, other than Jabali and Panteon underground, which have more current drilling results and a mid-2020 effective date. Calibre will focus on near-mine and infill drill programs to provide additional mill feed. The company will have 1.5mtpa of average tons of surplus capacity (from 2021-to-2025), which leaves room for material near-term organic growth.

The 10-year outlook at the Limon Complex (open-pit only) is for average annual gold production of 50-70k oz. with AISC of $900-$1,100/oz. The open-pit reserves as of year end 2019 will be mined from 2020-2023. Additional open pit mineral resources as at year end 2019 has the potential to extend the mine life through 2031. In other words, these are preliminary estimates and company-wide average annual production is likely to be increased upwards, given the significant excess mill capacity and Calibre's hub-and-spoke strategy. Read Full Press Release Here.

Disclosure: Calibre is a Sponsor of Goldseek. This author owns common shares of Calibre Mining.