Much has already been written and said of the convictions last week of former JP Morgan head precious metals trader Michael Nowak and his associate Gregg Smith. However, before we move on from this story, there are a few things you need to consider.

First of all, these convictions for market manipulation should come as no surprise to anyone who follows the precious metals. The major bullion banks have managed and manipulated prices for their own profit (and bonus pools) for decades. Perhaps the only real surprise is that these criminal traders finally got caught and were successfully prosecuted.

Left unsaid in the media coverage are two secondary items you must consider:

- Up until the day of his indictment in 2019, Nowak was also on the board of directors for the LBMA. What's that old idiom about criminals and the company they keep?

- Despite the verdicts, the same dupes and shills who have defended the bullion banks for years continue to spew their propaganda and support for the current pricing scheme. If anything, these convictions shed light on the character and motives of these "analysts". Henceforth, all precious metals investors should fully ignore their “analysis".

OK, that said, the only remaining thing I have to add is detailed below, and it deals with the corruption that is now prevalent in nearly all levels of government and the government agencies that are staffed with "regulators" who have been fully captured by the industries they are supposedly "regulating".

The United States Department of Justice only began to investigate corruption in the precious metals markets in 2015. Prior to that, the Commodity Futures Trading Commission had initiated their own investigation in 2008. There was even a public hearing in 2010 where testimonies were given and evidence was presented.

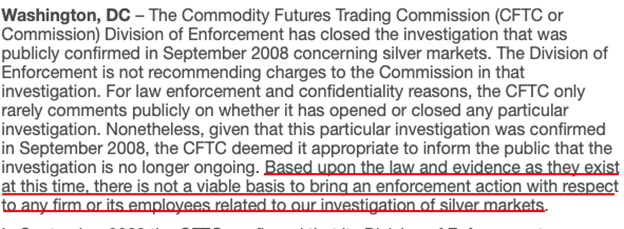

However, in September of 2013, the CFTC summarily closed their investigation and ruled that it could find "no viable basis to bring an enforcement action". See the link and screenshot below:

What's interesting are the dates. The CFTC's investigation ran from 2008-2013. The DoJ investigation, which led to the indictments and convictions of Nowak and Smith, covered the period from 2008-2016. So where the CFTC could find nothing, the DoJ was able to find actions consistent with price manipulation, commodities fraud, and wire fraud.

Ultimately, this should lead you to ponder the potential complicity of the "regulators" at the CFTC.

Let's start with Gary Gensler. Until January 2014, Gensler was chairman of the CFTC, having been appointed to the role by President Obama in May of 2009. This places him at the head of the agency for nearly the entire period of the silver investigation. Gensler left the agency four months after the silver investigation closed and soon surfaced as the Finance Chairman for Hillary Clinton's 2016 presidential campaign. Gensler was later rewarded for his stellar accomplishments when President Biden appointed him to head the Securities and Exchange Commission in 2021, a position he still holds today.

But you must also consider David Meister. Who's he? Well, David Meister was the head of the Enforcement Division for the CFTC from his appointment in November of 2010 to his abrupt departure on October 1, 2013.

October 1, 2013? Hmmm, that's interesting. What's the date of that CFTC press release linked above? The one where they announced the closure of their silver price manipulation investigation? September 25, 2013.

Well, that seems pretty handy. Perhaps ole Dave was so fed up with the CFTC's inaction regarding price manipulation that he left in disgust? Maybe. Perhaps he had simply served his purpose? How would we know? The next step in Meister's career after he left the CFTC might shed some light on the subject. Here's Meister's bio from the website of his current employer, the law firm Skadden and Affiliates in Washington, D.C.:

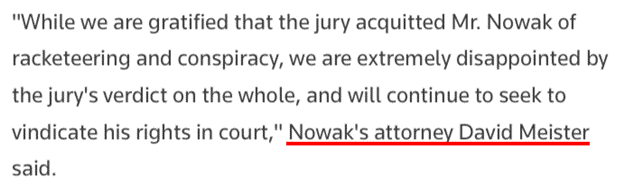

And now if we refer back to the criminal trial of Michael Nowak, who was it that acted as Nowak's chief counsel? None other than...drum roll, please...David Meister!

So, did you get all of that? The former head of the CFTC, who could find no price manipulation and also failed to implement the position limit provisions of the Dodd-Frank law, gets rewarded with a promotion to head the much-larger and more-important SEC. And the former Enforcement Director of the CFTC leaves for a cushy D.C. law firm job where he ends up representing the same character he was supposedly investigating just a few years earlier.

In case you can't figure it out for yourself, let's check Merriam-Webster for assistance:

And it's not just in finance where the corruption is pervasive. How many lawyers have left the FDA to go work in Big Pharma? How many former investigators at the Department of Transportation now "consult" for the auto makers? In the end, this latest example in precious metals simply exposes another revolving door between government regulators and the industries they are supposed to regulate.