For me it doesn’t not matter who wins the election. The person in the Oval Office is not in control of the monetary policies that form the fundamental basis for owning physical gold and silver. Regardless of which party sits in the Oval Office and Congress, the budget deficit and debt load will accelerate and thereby money printing will accelerate. The dollar will start to decline at a more rapid pace than it has declined since mid-March. Gold and Silver will climb over $2,000 and continue moving higher. At some point the stock markets will buckle under the pressure of a falling dollar and rising interest rates.

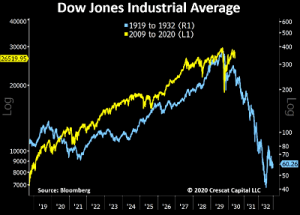

The chart above (from Crescat Capital) shows an analog that compares the Dow between 1919-1932 and 2009 to the present. The key underlying factors that drove the the stock market in both time periods to an insanely overvalued top and subsequent descent are worse now than back in the 1920’s/early 1930’s: currently stocks have higher multiples, the global economy is more leveraged and Central Banks have created a far bigger systemic imbalance now vs. then.

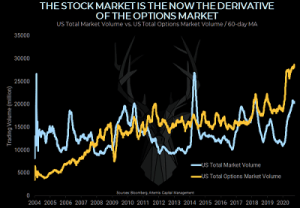

Also, derivatives were not yet invented and thus not a factor in creating a far bigger “leverage factor” that is impossible to quantify but that will ultimately be lethal to the financial system. This chart illustrates this point using the volume for exchange-traded options – the OTC derivatives market is far larger in nominal value than the stock market (data from Bloomberg, Artemis Capital):

The light blue line shows total stock market volume plotted against the yellow line which shows total options volume. The proverbial tail is wagging the dog and the Fed and the Government regulators are to blame. The unwind will be ugly for stock market bulls.

That said, I expect the Fed will juice the money supply after a Presidential winner is declared. This may or may not push the stock market higher. I think we can expect a brief move higher in stocks after the election. But soon thereafter the fundamental realities will sink in and have a negative effect on the stock market.

Did the tech bubble pop on September 2nd? – “Bubbles tend to topple under their own weight. Everybody is in. The last short has covered. The last buyer has bought (or bought massive amounts of weekly calls). The decline starts and the psychology shifts from greed to complacency to worry to panic. Our working hypothesis, which might be disproven, is that September 2, 2020 was the top and the bubble has already popped.” – David Einhorn, Greenlight Capital

We won’t know the answer to that question for at least a few months. In the chart above I sketched in loosely the uptrend line followed by the Nasdaq to an all-time high since the March bottom. The Nasdaq broke below the 50 dma in September (yellow line), then rallied to retest the uptrend line. It bounced off the uptrend line and headed lower almost immediately to form a lower high, after which it fell back below the 50 dma.

At some point I expect the Fed to step in with more money-printing but not until some point after an election winner has been declared. That money will directed at injecting more liquidity into the TBTF banks and funding another big wave of Treasury issuance after the election. But for now the path of least resistance in the stock market is down punctuated with bouts of high two-way volatility.

The commentary above is an excerpt from the Short Seller’s Journal, a weekly newsletter that dissects the latest economic reports and presents ideas for short seller’s. You can learn about it here: Short Seller’s Journal information.