Tuesday the BRICS nations will meet in South Africa for the group’s 15th summit. This could be a game changer for gold.

Tuesday the BRICS nations will meet in South Africa for the group’s 15th summit. This could be a game changer for gold.

For something that only officially existed eight years after the term ‘BRICs’ was created, the bloc known as “The BRICS” has rapidly gone from an informal term for a group of fledgling economies to one which is carrying increasing weight when it comes to the future of the global system.

Next week’s summit, hosted by South Africa, will not only welcome leaders of the BRICS nations (excluding Putin, no explanation needed) but also a further 67 leaders from Africa, Latin America, the Caribbean and Asia. Of these 67 leaders, 23 have formally applied for membership of the bloc, all hoping to follow in the footsteps of South Africa who joined in 2011.

Something that has long been rumoured (and was discussed by me, just last month) is the creation of a common BRICS currency. It makes sense: the main impetus of the bloc is to rebalance the world order. Nothing creates imbalances in the global economy quite like US dollar hegemony.

In truth, discussion of a gold-backed common currency is nothing new. In the last 20 years alone Asian and African leaders have suggested it. Most insightful was in 2009 when the then head of China’s central bank, Zhou Xiaochuan, wrote:

“An international reserve currency should first be anchored to a stable benchmark and issued according to a clear set of rules … [Its] adjustments should be disconnected from economic conditions and sovereign interests of any single country. The acceptance of credit-based national currencies, as is the case in the current system, is a rare special case in history.”

Of course, nothing has happened so far. But are we reaching a point where it might just?

In July we perhaps had confirmation of how serious the proposal was when state-sponsored channel RT reported that the “BRICS were planning to introduce [a] new trading currency backed by gold in August.”

It is worth noting that there is no mention of a new currency on the agenda for next week’s meeting. How much one can believe this, is anyone’s guess.

Is it fool’s gold to plan a common currency?

Clearly it will be no mean feat to agree upon and establish a BRICS currency. The five member nations alone all might all wish to establish an alternative to the status quo, but their agendas on the foreign stage do vary significantly.

Despite the political clout of the emerging group of current and wannabe members of the BRICS, there are some major issues tearing through their economies. Take the collapse of the rouble, or the recent dumping of Chinese stocks and bonds by foreign investors. Not to mention the personal desires of soon-to-be Argentinian President Milie who wants to demolish the central bank and bring in the US dollar as the national currency.

With such differences, how much are the BRICS nations really able to achieve? As BRICS-term ‘creator’ Jim O’Neill told the FT, they have “never achieved anything since they first started meeting”.

But we think this is short-sighted and to believe this is to consider the nations as though they are still in the third-world. No one is suggesting that a single currency is introduced and that sovereign currencies are forfeited (as per the Eurozone).

No, instead a common trading currency has been proposed. And, this could be major.

To take a phrase from Chinese foreign minister Wang Yi:

“The BRICS countries are like five fingers: short and long if extended, but a powerful fist if clenched together.”

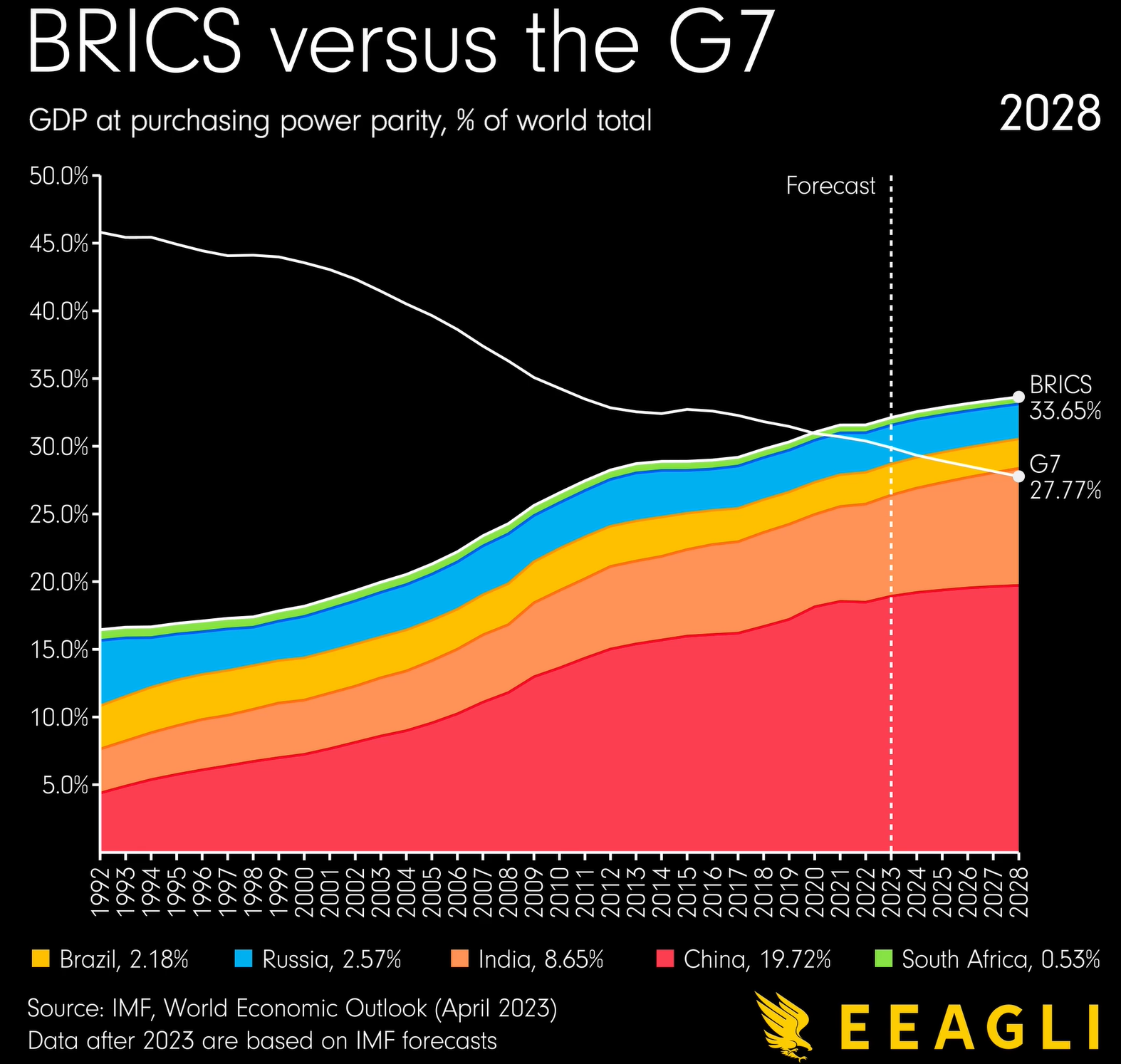

Currently the bloc is made up of just five countries but should the additional 23 members currently seeking membership manage to join then this will significantly improve the political dimension of the group and prove a much stronger counterbalance to the G7 and G20 countries.

The threat is on the sidelines

What is most interesting to note is that it seems to be non-BRICS member Saudi Arabia that is leading the dedollarization process. See their comments in January about being open to a non-dollar oil trade.

Should they become a member, then we will be up for some very interesting times indeed. As former GoldCore TV guest Jim Rickards explained recently:

“…okay so what happens when you let Saudi Arabia into the BRICS given the other members you have two of the three largest oil producers in the world. Russia and Saudi Arabia you have two of the three largest nuclear arsenals [and] some others…These are not basket cases these are many of the biggest economies in the world that collectively have enormous power natural resources: gold reserves, land, mass population, military and again I could go down the list but this is a block that is as powerful in its own way by a lot of these metrics as the collective West.”

Why gold?

One could ask why is it gold that is being touted? Why not a basket of currencies, or even a basket of resources? Why not a totally new currency, as we saw with the Euro?

Because gold is borderless. Is it already accepted as currency – central banks hold it in reserve. It requires no central bank or mechanism by which to manage it.

BRICS currency naysayer Jim O’Neill stated:

“It’s a good job for the west that China and India never agree on anything, because if they did the dominance of the dollar would be a lot more vulnerable.”

But the fact is, they do agree on something – that gold is money. Because it is a sovereign currency, it cannot be manipulated as fiat currencies can. The BRIC nations are unlikely to agree to anything that sees them support another fiat currency – the world learnt the hard way when they watched Bretton Woods play out. Look where that got us.

If countries can get past their differences and agree to a gold-back common currency then the symbolism of holding one another’s gold will be huge. The precious metal is the perfect arbitrator.

As we saw in Roman and later medieval times, rulers would send their children to live in formerly hostile kingdoms in order to secure peace. Imagine Chinese gold being held outside of China.

Does Gold Need There To Be a New Gold Standard?

Do we really need a gold standard to set gold on fire? With gold currently trading in a tight range between $1890 and $1900 it might feel pretty tedious and like we need something more than the FOMC minutes to drive the price, but in truth it’s going to be just fine.

Gold doesn’t need to officially back a currency in order to shine. Should the BRICS decide to create a common currency, the US (and others) won’t take it lying down and this will see gold do well.

Currently, much of the focus is what will happen to gold, should there be a gold-backed currency. Instead, the focus should be on what will happen to gold should the BRICS merely put a plan in place to manage the transition to a new, common currency (gold-backed or otherwise).

Just like when you see invasions of countries or military coups taking place, it is not the final regime that will cause the most upset, instead it is the ‘in-between’, it is the transition to the new regime or the new currency that will cause the most upheaval.

Of the many scenarios gold likes, it is the ones with uncertainty that it likes best. The whole world is (one way or another) invested in the dollar-led financial system. The five countries that currently make up the BRICS represent 40% of the world’s population and 26% of the global economy.

This is not some pesky group that is proving to be a minor distraction. The group does have the potential to be very disruptive, on a number of fronts. Should a move outside of the US-dollar system become one that is etched in gold, then this will make for a very uncertain time indeed.

The mere conversation and posturing around the launch of a common currency will be disruptive enough. It is clear that the first step for the BRICS will be to establish an efficient, widely-adopted and integrated payment system for cross-border transactions and only then will there be a realistic opportunity to introduce a new currency.

There is plenty going on elsewhere in the world (shoddy central bank management, slow US banking crisis, fiscal dominance, etc.) for gold investors to get excited about. So if no new currency is announced next week, then please just keep calm and carry on.

From The Trading Desk

Market Date

The gold price has come under pressure in August.

Bonds have continued their sell-off, the USD has strengthened with an expectation that rates will need to remain higher for longer, with US core inflation still at twice the Fed’s target.

This is the current head wind for Gold but there is only so long the Fed can hold rates at these levels before they will need to pivot.

The narrative for now is that rates need to stay higher for longer.

However, there are signs the US economy is starting to slow, so this narrative could change quickly as we have seen before.

The pullback this week which brought gold just below the $1,900 level has been a trigger to GoldCore’s existing customers.

We have seen clients step in this week to buy the recent dip and add to their allocations.

As one client said to me this week ‘Gold is on Sale’!

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

|

USD $ |

USD $ |

GBP £ |

GBP £ |

EUR € |

EUR € |

|

|

16-08-2023 |

1906.80 |

1904.20 |

1494.55 |

1493.46 |

1744.91 |

1743.87 |

|

15-08-2023 |

1904.10 |

1903.85 |

1497.77 |

1495.47 |

1742.25 |

1740.12 |

|

14-08-2023 |

1913.50 |

1903.75 |

1507.07 |

1507.20 |

1747.79 |

1749.17 |

|

11-08-2023 |

1918.05 |

1915.80 |

1509.31 |

1506.97 |

1745.81 |

1746.44 |

|

10-08-2023 |

1920.10 |

1920.90 |

1505.17 |

1503.87 |

1742.49 |

1739.57 |

|

09-08-2023 |

1928.40 |

1922.75 |

1512.83 |

1509.74 |

1755.62 |

1751.24 |

|

08-08-2023 |

1934.80 |

1926.40 |

1518.82 |

1517.62 |

1762.80 |

1761.31 |

|

07-08-2023 |

1936.90 |

1931.70 |

1521.63 |

1514.26 |

1765.10 |

1758.23 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here.