Over the August period, it’s easy for people to switch off and to some extent, it might feel like the precious metals have been doing the very same!

Over the August period, it’s easy for people to switch off and to some extent, it might feel like the precious metals have been doing the very same!

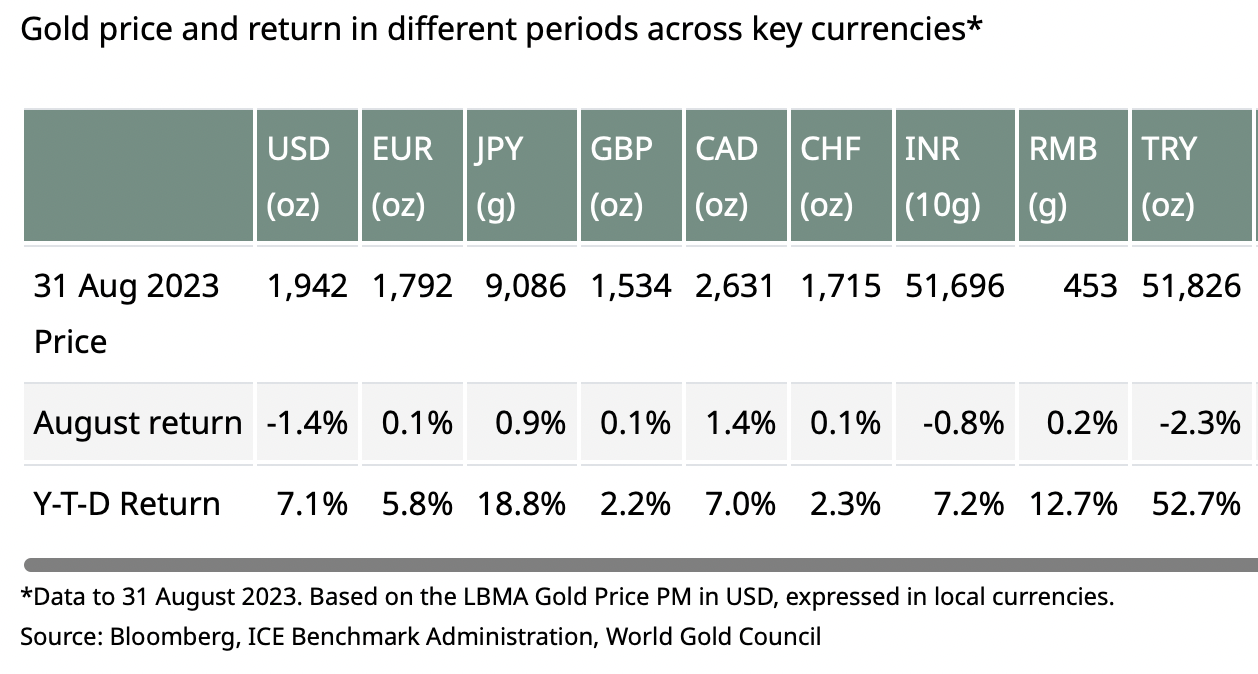

However, if you look at the YTD performance of gold across key currencies in the World Gold Council table provided below then you will take some heart that things aren’t so bad (especially if you bought in Turkish Lira!).

But it does seem as though gold and silver have been under some pressure of late. This is largely thanks to the strengthening US dollar and US Treasury yields (they reached a 14-year high right before Labor Day weekend). Oil prices have also been rising.

But it does seem as though gold and silver have been under some pressure of late. This is largely thanks to the strengthening US dollar and US Treasury yields (they reached a 14-year high right before Labor Day weekend). Oil prices have also been rising.

Interest rates and currencies have been relatively stable. All whilst the rest of the market seemed to take a bit of a tumble earlier this week. Why is this? Because things are looking up across a number of sectors and so there is a (new) expectation that the FOMC will keep interest rates at these relatively higher levels for longer. Therefore, it’s more attractive to hold US dollars than other liquid assets such as gold and silver, right now.

Why Is the US Dollar So Strong?

The strength of the US dollar is largely thanks to the fact that it is currently the biggest, bestest bully in a bad bunch. So strong is the US dollar against other currencies (namely Asian currencies) that both the Chinese and Japanese central banks have issued statements to warn that they will defend themselves should they feel the need to.

This strong US dollar will exacerbate inflation across the world, of this we have little doubt. The majority of commodities (including oil) are priced in dollars. This makes imports expensive and so causes inflation to rise in countries that are already struggling with housing crises, cost of living crises and currency weakness.

Weak growth across China (and calls for intervention from the central bank) is only boosting demand for the dollar more, as international savers and investors flock to it.

Meanwhile market expectations suggest that both the UK and Eurozone may lower interest rates, sooner than the US given their own sluggish performances of late. This will only serve to boost dollar demand as it maintains its top-dog status when it comes to interest rates.

There is little doubt that the US Treasury yield curve is the most important economic indicator right now. Since July 2022 it has been inverted and in the last month or so it has been steepening as long-dated rates have risen faster than short rates.

A situation like this is tricky for assets such as gold. Investors tend to look at a yield curve such as this and expect that we are heading into a period of reflation and (therefore) further interest rate hikes. So, it is likely to be a tough period for gold. Especially, if we see periods when long and short term rates rise together.

Why Do You Buy Gold?

However…we always come back to this – why are you buying gold? Because it outperforms the dollar? No. Because it makes you a quick buck or two? No. You buy gold because it’s insurance for your portfolio.

As perverse as it sounds – all the reasons why the US dollar is doing so well are the exact reasons why you should buy gold and hold onto it.

Just because something is doing well, doesn’t mean that it is well. The US dollar is doing well relative to other currencies. The US country is doing well relative to other countries, largely because of dollar hegemony. This does not mean that the dollar is a safe asset.

Currency markets are fickle. Think back to a few months ago when they were betting against the dollar. Expectations were that rate rises in the EU and UK would put pressure on the dollar, short positions were increasing. And, don’t forget the BRICS warming themselves up to use the dollar less and less.

It is still suffering and will suffer more, from the effects of very poor monetary policy. The currency and the economy have been inflated to never-imagined levels and the country is in a level of debt we struggle to write down numerically, in full.

You do not buy gold because it is a competitor to a fiat currency, you buy gold because it secures your wealth when your portfolio is suffering the effects of decades long monetary abuse. A slow month or two for gold is not a sign that things are doing well, we would perhaps see this latest US dollar strength as the fat lady enjoying her moment, singing her head off.

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

|

USD $ |

USD $ |

GBP £ |

GBP £ |

EUR € |

EUR € |

|

|

06-09-2023 |

1923.45 |

1922.05 |

1532.03 |

1537.26 |

1793.23 |

1793.46 |

|

05-09-2023 |

1931.80 |

1926.10 |

1539.84 |

1533.75 |

1797.15 |

1796.09 |

|

04-09-2023 |

1942.05 |

1937.20 |

1537.72 |

1534.46 |

1798.34 |

1795.01 |

|

01-09-2023 |

1944.30 |

1940.55 |

1532.89 |

1532.84 |

1791.28 |

1790.74 |

|

31-08-2023 |

1944.20 |

1942.30 |

1533.58 |

1532.47 |

1788.28 |

1789.83 |

|

30-08-2023 |

1938.35 |

1947.55 |

1530.33 |

1528.63 |

1780.57 |

1779.87 |

|

29-08-2023 |

1923.50 |

1930.00 |

1525.91 |

1528.37 |

1779.43 |

1779.27 |

|

25-08-2023 |

1917.85 |

1915.50 |

1522.96 |

1519.37 |

1777.27 |

1772.22 |

|

24-08-2023 |

1920.70 |

1917.05 |

1514.09 |

1516.58 |

1769.35 |

1768.29 |

|

23-08-2023 |

1904.55 |

1916.65 |

1505.17 |

1512.24 |

1761.14 |

1767.73 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here.