Conspiracy theories, especially lousy ones, grab the attention of a lot of people. So, if you want to acquire a lot of followers while making a nice buck doing so, then it pays to continue regurgitating the “GRAND CONSPIRACY” mantra. I see this everywhere in the Alt-Media. And, it doesn’t matter if facts are provided that disproves one of these lousy conspiracy theories, people rather believe in a GREAT SOUNDING LIE than deal with the TRUTH.

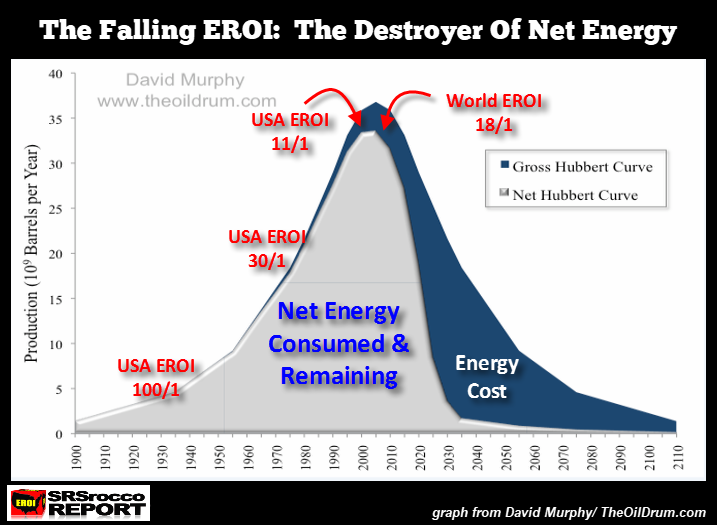

This is the subject matter of my article today. So, I am going to point out the difference, as I see it, between the “Great Grand Elite Conspiracy & The Energy Cliff.” So, when I mention the term “ENERGY CLIFF,” the chart below should clarify any doubts or questions.

Nearly 20 years ago, when I first became interested in silver, I followed silver analyst, Ted Butler. Ted was putting out some interesting work on the silver market during the early 2000s. However, if you compare Butler’s more recent work today, it isn’t that much different than his analysis was in 2002. Quite simply, while his analysis is more up to date, it still just focuses only on one issue… Silver Manipulation.

My analysis on the subject of “Silver Manipulation” is a bit different than Butler, and the majority of individuals who may call themselves “Alt-Media followers. If silver is being manipulated, I can assure you; it isn’t the only asset on the Fed’s Intervention Playbook. Due to the Fed and central bank interest rate policy over the past 40+ years, including the massive stimulus and liquidity injections since 2008, the entire market is being manipulated in one way or another.

So, to yell ” FIRE” in a small town in California when there have been dozens of larger ones in the state at the same time suggests that it’s time to get a BIGGER VIEW of the world.

Is Silver Really Worth $600 Based On Being $50 In 1980?

Many analysts have suggested that the silver price on an inflation-adjusted metric, should be worth $600 today. These same precious metals analysts likely acquire this $600 price by using John William’s Shadowstats inflation data. Thus, a $50 silver price ($49.45 to be exact) in early 1980, would be worth $600, adjusted for inflation.

However, there are two sides to the story. If the primary silver miners were receiving $600 an ounce today, then their profit margins would be a mind-blowing 3600+% or something very close to it. So, is it realistic for a silver mining company to enjoy a $580+ profit per ounce if it cost them $15-20 an ounce to produce silver??

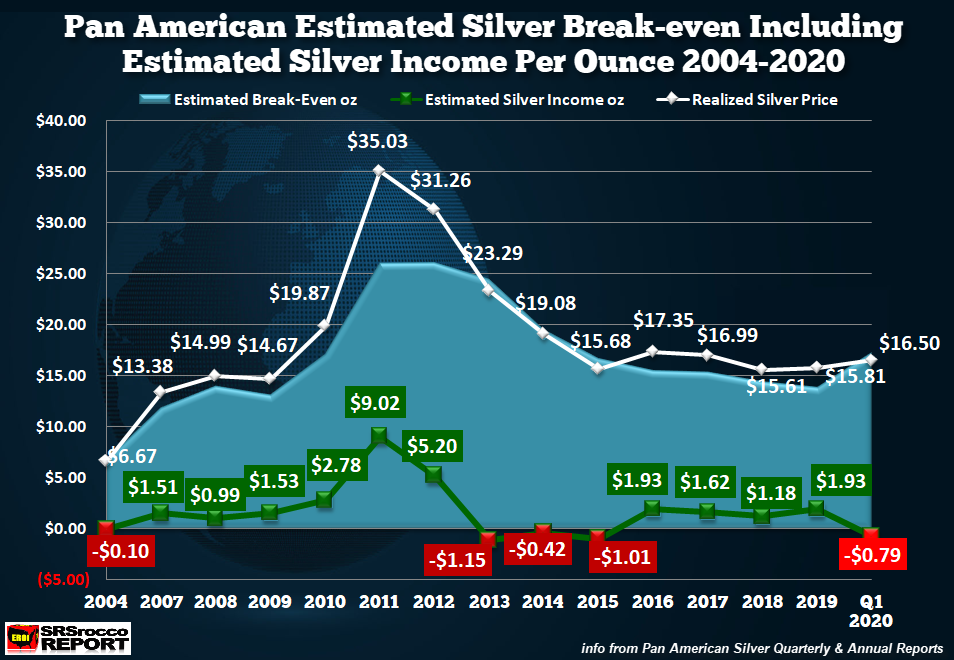

Here is my estimated profit per ounce for Pan American Silver from 2004 to Q1 2020:

Pan American Silver’s profit per ounce is shown on the bottom of the chart in either the GREEN or RED figures. If they are green, then Pan American Silver posted a profit per ounce for the year, and the opposite is true if the color is red. Can you imagine if Pan American Silver was receiving $600 an ounce for silver, because that is what the “Inflation-adjusted” data suggests?

Pan American Silver would be enjoying a profit of $583.50 per ounce based on a $16.50 total cost (my complete cost analysis). I can assure you; there are no companies in the iron, aluminum, and base metal mining industry, making a profit margin of more than 25%, on average. So, do you really think it is “REALISTIC” for Pan American Silver to make a 3600+% profit margin??

Why doesn’t someone email Ted Butler and ask the same question? Don’t get me wrong; I am not saying the markets are not manipulated, but if we apply a bit of LOGIC, it is quite silly to expect a mining company to enjoy a 3600% profit margin.

Now, that doesn’t mean I don’t see silver prices moving higher in the future. I do. However, it will be based upon a silver market when the world heads over the ENERGY CLIFF, as investors try to acquire physical silver, what little metal there is in the world.

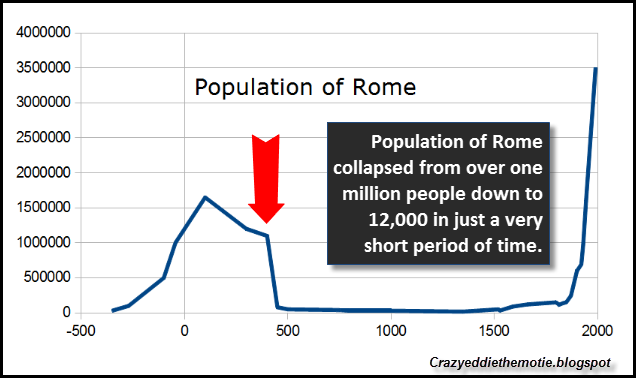

The Grand Elite & The Collapse of The Ancient Roman Empire

If you read some history books, you will know that Ancient Rome had its own Elite that controlled a large percentage of the empire. So, nothing has changed in 2,000 years. You would think as mere mortals, we would figure this out that AS THE WORLD TURNS, not much changed over the Millenium. There have been Elite running the show for thousands of years.

However, something quite significant has brought about a massive change in the world over the last 150 years. The world brought on the most condensed source of energy that was also easily transportable… OIL. Yeah, I know uranium has more condensed energy per unit than oil, but try mining uranium and building a nuclear power plant without oil, natural gas, and coal. You can’t do it.

In the past, countries that controlled the silver and gold mines became the leading empires. However, when oil came into the picture, the new prize was to control the oil reserves and market, not the gold and silver mine supply. So, gold and silver as money became second fiddle to oil. And in time, the Dollar was backed by oil via the Petro-Dollar Standard.

So, gold and silver transitioned to behaving more like mere commodities, which are based upon the cost of production and supply-demand forces, than as monetary metals. But, this is all changing now due to the problems we are facing with energy.

I can assure you that the Ancient Roman citizens who were once criticizing the “Elite” for all their economic and societal ills had much worse things to worry about when the empire collapsed. This is the same issue confronting individuals today who focus on the “ELITE GRAND CONSPIRACY.” When energy becomes a real problem, a large percentage of the Elite are going to get wiped out financially just as much as the lower classes. So, I gather as we head over the ENERGY CLIFF; we will need to come up with another BOOGIE-MAN to hate.

The World Is Heading Into A New Paradigm: Protect Wealth Rather Than Build It

A significant portion of my future analysis will be focusing on how the world will need to “PROTECT WEALTH” rather than try building it. Of course, there will always be a group of individuals or companies that will do well during the next phase, but that won’t be many. As the world heads over the Energy Cliff, most assets and real estate will lose a great deal of their value. Very few are prepared for this reality.

Due to my energy analysis, I have become even more confident in owning physical gold and silver. The best reason to own the precious metals has to do with their ability to be “Stores of Energy Equivalent Value.”

Try this one on for size…

It takes 70 gallons of diesel energy equivalent to produce an ounce of gold, explained in my article below. That equals the human energy equivalent of 3,500 people working 8 hours a day.

This article will be available on Friday for those who select to become GOLD MEMBERS.

When energy becomes really problematic, a lot of the stuff that we are currently using to run everything will get into serious trouble. So, if you have spent a lot of time focused on the ELITE and all the problems that have caused the working man, you will not be prepared for what’s ahead.

So, it’s time to switch our attention to the issue that really CONTROLS everything… and that is ENERGY. If you understand the coming energy dynamics, you will be much better prepared mentally and financially.

Another quick reminder for followers that the SRSrocco Report will be transitioning to a Subscription Service by Friday, August 21st.