$EQX Equinox Gold announced a friendly takeover of Premier Gold at a price that will create value for all shareholders. Premier has producing and development assets in Canada, the U.S., and Mexico. This is assuming gold prices don't appreciate, which is unlikely. This is a smart, strategic acquisition that will not only boost immediate production (50k oz. Au, though the company believes it can achieve output upwards of 80-90k oz. Au p.a.) but will have a material impact over the medium-term as the Hardrock Project is developed and brought online [Construction start expected 2H 2021]. Hardrock was the focus of this acquisition as it will add low-cost production of scale (>200k oz. Au over the first 4-Yrs based on Equinox’s 50% interest and 180k oz. Au over the LOM. Highlights of the project include:

- 50% interest, with 50% owned by Orion Mine Finance.

- Initial 14-Yr Mine Life ~ Based only on the open-pit portion.

- 5.5m oz. of gold reserves and nearly 6m oz. Au of additional resources.

- Significant expansion potential with a substantial underground deposit (multi-million oz. resource) could increase average annual production and/or increase the mine life, which is wide-open for further resource expansion. There are also three identified satellite deposits, two of which have open-pit and underground components.

- A low-risk development project

- AISC of just $618/oz.

- Adds a 3rd cornerstone asset along with Los Filos and Castle Mountain (Aurizona could and likely will become a cornerstone asset down the road).

- Exposure to a fourth country (Canada) and approx. 50% of NAV from assets in Tier-I mining jurisdictions.

- This will continue declining companywide AISC beginning in 2022 as the Los Filos expansion is complete, Santa Luz comes online, and the Castle Mountain Phase II expansion (expected to be completed in 2024).

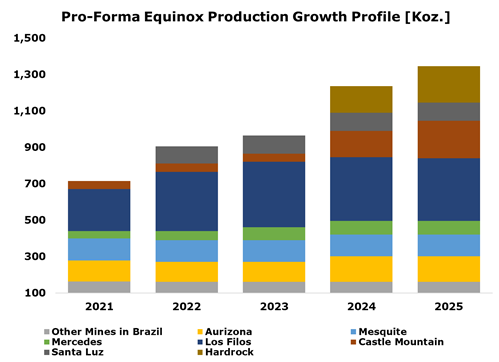

- Positions the company to achieved senior producer status in 2024 (>=1m oz. p.a.)

Equinox has the liquidity and cash flow generation to fund the capital investment remaining at Los Filos, Santa Luz mine build, the Phase II expansion at Castle Mountain, and 50% of the capital required to build Hardrock. With 2020 production of approx. 435-455k oz. Au, 2021 production will be a big step-up in output driven by Los Filos (assuming 10-months of the year), Castle Mountain Phase I, and Mercedes. Medium-term production (2-3yrs) will be driven by Santa Luz, Los Filos, and Mercedes. Longer-term production (4-5yrs) will be driven by Hardrock, Castle Mountain Phase II, and Aurizona (U/G).

Existing equinox shareholders will own 84% of the new company, with existing Premier shareholders owning 16% of the new company. Premier previously announced a spin-off of its Nevada Mines (McCoy Cove, Getchell, and South Arturo), i-80 Gold Mines. Equinox shareholders will own 30% of the spin-off, and Premier shareholders will own 70%.

Equinox is trading at a significant discount to NAV, approx. 0.65x, which is rare for a high-growth mid-tier producer. At Goldseeker, we are updating our Equinox Gold Report. Upon publication, sign-up for our free email list here to have it sent to your inbox.