The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. China is the leader but other countries are catching up, as large automakers like Volkswagen, Mercedes Benz, GM and Ford come out with new EV models and plan new EV manufacturing/ assembly plants in North America and Europe.

Not only do we need to figure out a way to transition from gas and diesel-powered vehicles, but there is also the question of how to fill the batteries demanded by electrification. Creating that energy — mostly solar and wind but also hydroelectric power — involves a massive use of metals to build batteries, battery storage systems, transmission lines and smart grids.

The three most critical inputs in the race to electrify and decarbonize the globe are copper, lithium and graphite.

The continued movement towards electric vehicles is a huge copper driver. EVs use about four times as much copper as regular internal combustion engine vehicles. It’s in the motor, the wiring, and the charging stations. Copper is also in the “smart grid” to get renewable energy to where it’s needed.

It’s not an exaggeration to say that copper is absolutely essential to decarbonization; nothing happens without it.

The electrification of the global transportation system also can’t occur without lithium and graphite needed for lithium-ion batteries.

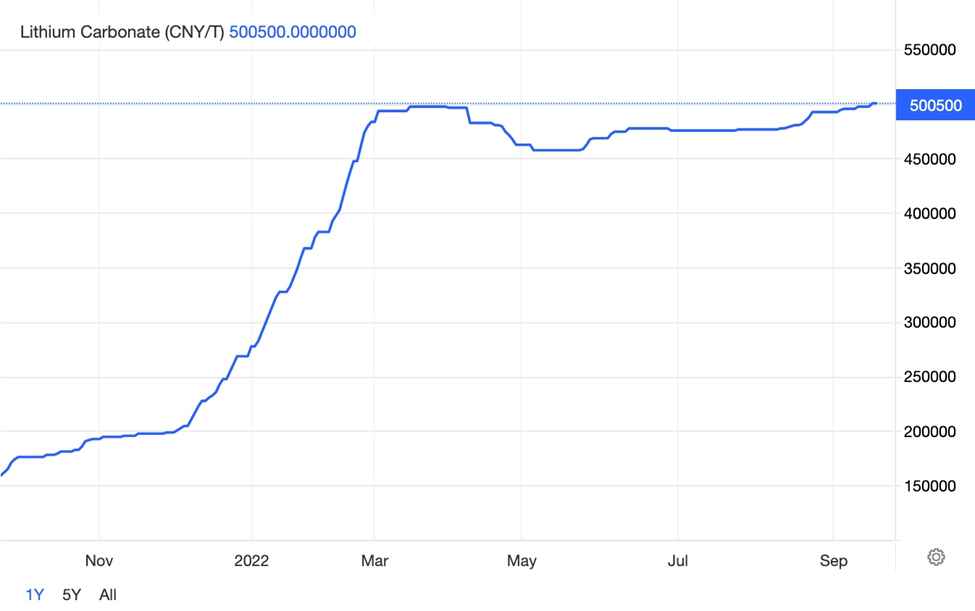

Lithium prices over the past year have tripled in China, underpinned by soaring electric-vehicle sales.

Chinese lithium carbonate prices. Source: Trading Economics

Chinese lithium carbonate prices. Source: Trading Economics

According to S&P Global, further demand growth in 2022 will mean a lithium deficit this year as use of the material outstrips production and depletes stockpiles.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the nation’s economy and national security.

An average plug-in EV has 70 kg of graphite. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced in 2020.

It’s thought that battery demand could gobble up well over 1.6 million tonnes of flake graphite per year (out of a 2021 market, all uses, of 1Mt). Remember, the mining industry still needs to supply other graphite end-users. Currently, the automotive and steel industries are the largest consumers of graphite with demand across both rising at 5% per annum.

Explosive demand for EVs and charging stations

Of course the main reason for the supply deficits expected in all three of the main electrification metals — copper, lithium and graphite — is increasing EV popularity, and sales.

Just about every automaker is transitioning to electric vehicles, with hundreds of billions of dollars earmarked over the next decade for new models, production lines and battery plants. The electrification of the global transportation system also involves the rollout of thousands of electric-vehicle charging stations, a task which governments at all levels are beginning to take seriously. All of this will require copious amounts of raw materials, including copper for EV motors, wiring and charging stations, permanent magnets that use rare earths like neodymium and dysprosium, and battery metals such as lithium, graphite, cobalt, sulfide nickel and manganese.

Despite the challenges in coming up with the metals, automakers are predicting outrageous volumes will be rolling off their EV assembly lines in the not-too-distant future.

When Tesla CEO Elon Musk was asked how many cars Tesla will have made by 2032, the company founder gamely said, “I’d say 100 million is pretty doable.”

100 million EVs?

First off, anything that comes out of Elon Musk’s mouth must be fact-checked. Musk, famously, has made a number of wild statements about electric vehicles and lithium-ion batteries, such as claiming to have the technology to make lithium carbonate from table salt.

Mining.com took the 100M figure and crafted an interview around it with Henry Sanderson, executive editor of Benchmark Mineral Intelligence, an information provider, and price reporting agency, for the battery metals industry.

We’ll get into some of the, imo, false and misleading statements made in the Q&A by Sanderson, a so-called expert who authored ‘Volt Rush: The Winners and Losers in the Race to Go Green’, but for now, how accurate is the 100M figure, and how much raw material does it imply?

According to the International Energy Agency (IEA), the number of electric cars on the world’s roads today, is about 16.5 million, triple the amount in 2018. Global sales of electric cars have risen strongly in 2022, with 2 million sold in the first quarter, up 75% from the same period in 2021. In 2012, just 120,000 were sold worldwide.

100 million EVs by 2032 is a 6X increase from the 16.M in 2022. Leaving out the two main obstacles to EV ownership, range anxiety and sticker shock (EV ownership is still mainly the preserve of the rich and/or urbanites), theoretically a six-fold increase in 10 years is possible.

The thornier issue is how the mining industry would go about supplying the raw materials required for 100M EVs.

We know an electric vehicle contains about 83 kg of copper, some of which (20 kg) is in the lithium-ion battery. In addition to copper wire in the engine, copper wiring is used to connect the electronics and battery packs.

We also know from a recent infographic that cells in the average lithium-ion battery with a 60 kilowatt-hour capacity contain around 185 kg of minerals. This includes 6 kg of lithium and 52 kg of graphite. Converting kilograms to metric tons, we get:

- 100 million EVs X 83 kg copper = 8,300,000,000 kg = 8,300,000 tonnes of copper required

- 100 million EVs X 52 kg graphite = 5,200,000,000 kg = 5,200,000 tonnes of graphite required

- 100 million EVs X 6 kg lithium = 600,000,000 kg = 600,000 tonnes of lithium required

Now for the fun part. According to the most reliable figures we can get, from the US Geological Survey, 2021 production from all the world’s copper mines was 21,000,000 tonnes, or 21Mt for short. So to just supply 100 million Teslas by 2032, in 10 years existing and new copper mines would have to be outputting another 8.3Mt. This is the equivalent production of Chile and Peru, the top two copper producers, combined, plus Canada’s 590Mt.

Another way to think about how much copper is required, is to envision 8 Escondida mines (the largest in the world), with each producing 1 million tonnes per year. Just to provide enough copper for 100 million Teslas! This of course leaves out all the other car companies who will be needing similar amounts of copper per electric vehicle. It also ignores all the other uses for copper, including for construction wiring and plumbing, electrical transmission lines, and transportation i.e. all the copper needed for wiring and for the various components in cars, trucks, buses, trains and airplanes.

It also leaves out all the millions of EV charging stations needed to be built.

Charging stations take 0.7 kg (for a 3.3 kW slow charger) or 8 kg (for a 200 kW fast charger), according to the Copper Alliance.

The Biden administration is planning on spending $5 billion over five years to install EV chargers, mostly along interstate highways, with another $2.5B given to rural and under-served communities. The funds are coming from the trillion-dollar infrastructure bill passed by Congress in November.

In a nod to his green energy supporters, Biden has set a goal of 500,000 public charging stations by 2030, a five-fold increase from the 100,000 in place already. Most of these chargers are “Level 2” chargers powered at 6 to 8 kW, so if we assume a copper content of roughly 1.5 kg per charger, an additional 400,000 chargers would need 600,000 kg of copper or 600 tonnes (1 tonne = 1,000 kg). Last week the Biden administration announced the approval of the first $900 million to build EV charging stations in 35 states.

For Europe to meet its charging infrastructure goal of 9 million public chargers, the extra 8,550,000 chargers, if they are Level 2s, would require 12,825,000 kg of copper, or 12,825 tonnes.

If these figures are correct, supplying enough copper for US and European charging stations is do-able.

However if Europe’s EV fleet grows to 65 million as predicted, by 2030, the amount of copper required for the additional 60 million electric cars @ 85 kg per EV, is 4,920,000,000 kg, or 4,920,000 tonnes. This is more than four times US copper production in 2021 of 1,200,000 tonnes, or 87% of Chile’s annual production, the world’s top copper-mining country.

The problem is, by 2032 the copper market is expected to be deeply in deficit, well short of producing the amount of metal demanded.

We’ve trotted the numbers out before, but here they are again:

Bloomberg New Energy Finance (NEF) estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 21 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

This is a tough ask considering some of the world’s largest mines are seeing depleted copper reserves and lower ore grades, its going to be almost impossible for global production to even maintain a 20-million-tonne-per-year pace.

Bank of America in a recent report predicts the copper market will flip into a deficit as early as 2025 following the completion of the current wave of project buildouts, the latest being Ivanhoe Mines’ massive Kamoa-Kakula project in the Democratic Republic of the Congo (China has off-take agreements for 100% of Kamoa’s copper production). Short-term copper supply will be bumped up by newly established copper mines that are expected to begin production soon. They include the Timok Mine in Serbia and the Mina Justa Mine in Peru.

“While visibility over the near-term project pipeline is good, activity increases come with a wrinkle,” the bank’s analysts say. “Indeed, many of the projects currently developed have been in the making for almost three decades, and with exploration activity relatively limited in recent years, supply increases may fade from 2025.”

Five years later, analysts at Rystad Energy project that copper demand will outstrip supply by more than 6 million tonnes. That equates to nearly the entire annual production of Chile, the world’s top producer.

By 2040, the supply shortfall grows to 14Mt, according to a BloombergNEF August report, with a “best-case scenario” shortage of >5 million short tons possible by 2040.

Does it sound like there will be enough copper to manufacture 100 million Teslas?

Now for the likelihood of the mining industry being able to supply enough lithium and graphite for Tesla’s 100M EVs. From above, they require 5,200,000 tonnes of graphite and 600,000 tonnes of lithium.

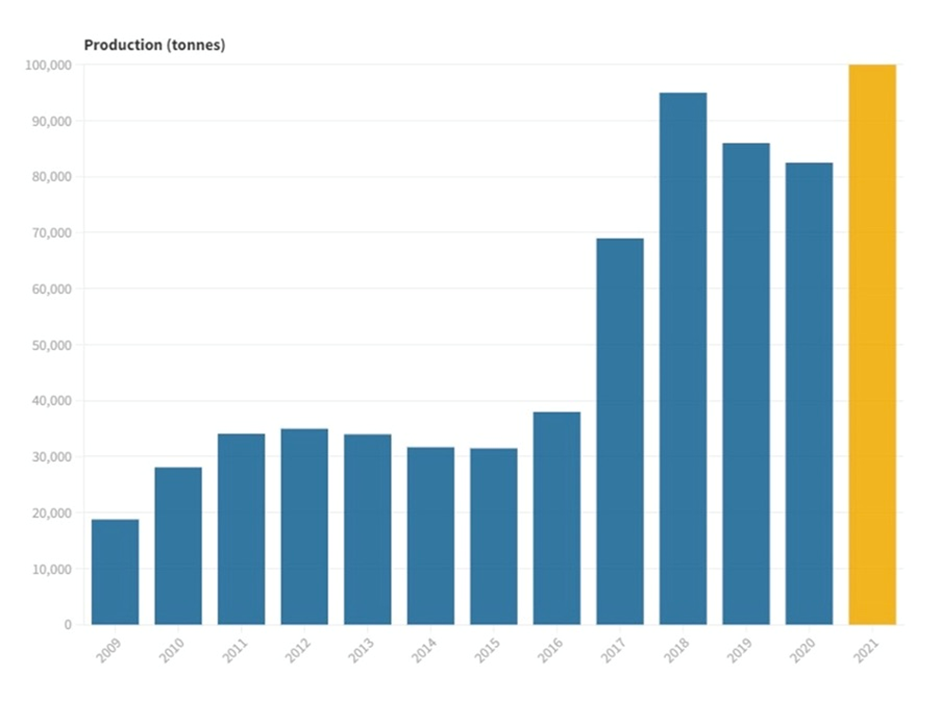

The world’s graphite mines produced a million tonnes last year, so by 2032, they would need to quintuple (5X) their output. Globally, lithium production hit a record-high in 2021 of 100,000 tonnes, which is a 21% increase from 2020. According to the US Geological Survey, output has increased in response to strong demand from the lithium battery market and increased prices. But to supply Tesla’s 100M EVs, would require 6X the amount of lithium currently being mined.

Where are the EV makers going to find the lithium and the graphite? Remember even if they could they will not find the needed copper.

Source: USGS

Source: USGS

While supply is currently outstripping demand, the gap is closing. According to the USGS, global lithium consumption in 2021 was estimated at 93,000 tonnes, a 33% increase from 2020, leaving a relatively small surplus of 7,000 tonnes.

“Lithium supply security has become a top priority for technology companies in Asia, Europe, and the United States,” the USGS said in its latest report.

The S&P Global Platts China Battery Metals Outlook for 2022 says China’s lithium market will face tightening supplies throughout 2022 as the demand-supply mismatch widens.

According to the China Association of Automobile Manufacturers, EV sales in the country will reach 5 million units this year, up 40% from 2021.

S&P says further demand growth in 2022 will mean a lithium deficit this year as use of the material outstrips production and depletes stockpiles.

BMI forecasts supply will fall short of demand, even as it predicts output to roughly double from 2021 to 2025.

“There’s a complete overoptimism about the responsiveness of supply in the lithium market,” Bloomberg quoted Andrew Miller, BMI’s chief operating officer. “It’s very hard to see how it’s going to accelerate at the speed that the battery market and electric vehicles are accelerating.”

Bloomberg notes the relatively small size of the lithium market, compared to say, copper or iron ore, is preventing the major mining companies from getting into the lithium game, for fear of overwhelming supply and crushing prices, like what happened a few years ago. Rio Tinto is the only large-cap miner so far that has been tempted to move into the metal.

The article also says that supply could lag due to the industry’s reputation for missing targets, quoting an estimation by McKinsey & Co that more than 80% of projects come in late and over budget.

Environmental hurdles are another brake on supply. The most recent example is Rio Tinto’s controversial lithium project in Serbia, now on hold due to environmental protests.

Battery demand could gobble up well over 1.6 million tonnes of flake graphite per year (out of a 2021 market, all uses, of 1Mt) — only flake graphite, upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries.

Global graphite consumption has been increasing steadily almost every year since 2013.

According to Benchmark Mineral Intelligence, the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand will easily outstrip supply in a few years.

Analyst Visual Capitalist Elements, via Battery & Energy Storage Technology, says demand for graphite from battery makers is expected to expand 10.5-fold to 2030. They forecast the natural graphite market could be in deficit as early as 2023, due to a shortage of new sources outside China.

China is not only the world’s biggest graphite miner, it is also the number 1 refiner, handling a combined two-thirds of global cathode and anode production. Yet even China is feeling the pressure of steady, rising demand — the country in 2019 was a net graphite importer for the first time in its history.

According to Urbix, an American manufacturer of battery anode materials, due to the unprecedented global demand for lithium-ion batteries, a shortage of battery-grade graphite is expected as soon as this year. (graphite is predicted to remain the predominant anode material regardless of a battery’s cathode chemistry)

Are there enough metals to replace oil?

In the Mining.com interview, BMI’s Henry Sanderson insists there are enough minerals on Earth to transition from fossil fuels (clearly he hasn’t done the math, nowhere does he talk about looming supply shortages for lithium and graphite, and he doesn’t even mention copper, w/o which none of the transition is possible). Although he admits that “it has to be fast to meet the climate goals” set out in the Paris climate summit, and that “it’s gonna be hard for mines to keep up.”

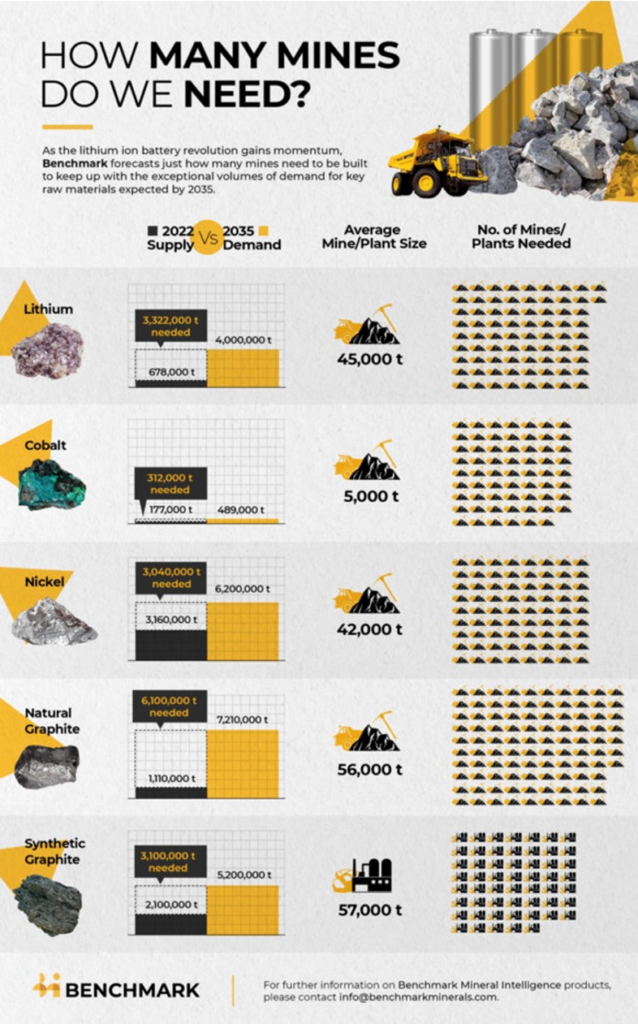

No arguments there. Where Sanderson (and BMI) gets into trouble, in my opinion, is his forecasted number of mines (300) needed to meet the volume of demand for key minerals by 2035. And where the new mining would take place, given that, as one Mining.com question put it, “Mining in America is not a really popular topic.”

300 new mines in 13 years is completely unrealistic. In Canada and the US, it can take up to 20 years to build one mine, from discovery to commercial production. Other jurisdictions are faster, but imo there is just no way that many mines could be discovered or developed in such a short time frame. In the table below, Benchmark indicates that in 2022, 678,000 tonnes of lithium came to market, meaning 3.322 million tonnes are required to meet the expected 4Mt demanded by 2035. At an average mine size of 45,000 tonnes, that works out to — wait for it — 74 new lithium mines!

The number of new graphite mines required is even more outlandish. Benchmark splits the market between natural graphite and artificial/ synthetic graphite, with natural producing 1.1Mt in 2022 and synthetic producing 2.1Mt. A whopping 6.1Mt of natural graphite is needed to meet demand of 7.2Mt by 2035. At an average mine size of 56,000 tonnes, that’s 97 new graphite mines! Come on, guys. Above we detailed all the obstacles to mining more lithium, graphite and copper.

Source: Benchmark Mineral Intelligence

Source: Benchmark Mineral Intelligence

But wait. Maybe Benchmark thinks those obstacles can be overcome by mining somewhere other than the United States, where the Biden administration has shown its anti-mining bias. When asked about Biden’s Inflation Reduction Act, Sanderson said the critical minerals requirements (the act requires at least 40% of the value of critical minerals contained in the vehicle’s battery to be processed in the US) make it difficult for new mines to be approved.

Therefore, he says it’s more likely that mines will be developed in Canada (where it takes 20 years to build a mine), Australia, and other free-trading countries. In other words, developing new mines is akin to “friend-shoring”, a topic we covered in a previous article.

(A quick recap: “Friend-shoring” presumes a world divided between free-market economies and countries that align with authoritarian regimes. The idea is for a group of countries with shared values, and at a similar stage of development, to source raw materials and to manufacture goods, from within that group. The goal is to prevent less like-minded nations from exploiting their comparative advantage, or in some cases, their monopolies, in key raw materials, technologies or products. An AOTH analysis found that friend-shoring’s harmful effects far outnumber its benefits, including making existing shortages of metals worse.)

“What you need to do is build up the processing in the US or North America and Canada. So you know that you can divert the raw materials from Australia to North America, not to China. It’s just an industrial facility, it’s not rocket science,” Sanderson tells Mining.com.

“If the US and Europe want to completely develop their own supply chains by scratch, that’s going to be very challenging,” he continues. “I think probably the best thing is to help these mineral-rich countries with mining backgrounds to develop their mines. That’s probably easier than building in the US. Why aren’t we helping the DRC? There’s graphite in Mozambique, for example, and these are all places that will suffer from climate change but can benefit from these minerals.”

Where do I begin? His first statement implies that it’s easy to process/ refine critical minerals, when in fact, nothing could be further from the truth. The Chinese managed to wrench control of the rare earths industry from the United States and they now control 90% of the processing. If it was only an “industrial facility,” why didn’t the US develop their own REE processing capability? Same with graphite, lithium and cobalt processing. All controlled by China. It’s not rocket science, but it is material science, and until flow sheets are made and proven by domestic mining companies, Chinese dominance will prevail.

Why aren’t we helping the DRC? Well to start with, the rape capital of the world is probably not the best country for the United States, Canada or Europe to partner with in the production of cobalt, one of the building blocks of the green economy. Also, the corrupt Congo has shown itself to be vulnerable to resource nationalism. The US is trying to get out from under the yoke of authoritarian regimes that have wielded resource control for decades (US impotence against oil-rich Saudi Arabia is a good example), but Sanderson’s suggestion only replaces one energy master with another.

Places like the DRC and Mozambique will surely suffer from climate change, but how about the United States? Which this year experienced the 22nd consecutive year of drought? The worst dry spell in 500 years has depleted major rivers, drained reservoirs like bathtubs, ruined crops and destroyed farmers’ livelihoods. Surely the US can also benefit from these minerals?

Finally, Sanderson suggests that, when it comes to the environmental effects of mining, “the battery minerals pale in comparison to fossil fuels.” Well that depends, on the type of minerals being mined/ processed.

In Indonesia, nickel is produced from laterite ores using the environmentally damaging HPAL technique. (HPAL stands for High Pressure Acid Leach). The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL employs sulfuric acid, and it comes with the cost, environmental impact and hassle of disposing the magnesium sulfate effluent waste.

The Indonesian government only recently banned the practice of dumping tailings into the ocean (DST) for new smelting operations, but it isn’t yet a permanent ban.

Most of four HPAL plants currently under construction, led by Chinese stainless steel producers and battery makers, plan to continue the environmentally egregious practice of DST, due to the much higher cost of managing the tailings on land.

Not only that, the process of refining nickel to make nickel pig iron, and now, nickel matte, is highly energy-intensive (it relies on coal-fired power) and creates a lot of air pollution.

Earlier this year, the S&P 500 ESG Index chose to remove Tesla from its ESG Index for supposed racial discrimination, when its real crime — an environmental one — is processing laterite nickel for its batteries.

In 2020 Tesla signed a contract with Vale-NC to supply intermediate mixed nickel and refined cobalt produced in New Caledonia. Nickel mined in the South Pacific French territory is laterite. The only way to process laterite nickel is through highly polluting HPAL.

In May, company representatives flew to Indonesia to visit Morowali, the nickel production center on Sulawesi Island. This was followed by a visit from the Indonesian President to Tesla’s Gigafactory in Texas, to meet with Elon Musk.

Conclusion

Years of neglecting its critical metal supplies is finally catching up with the United States, whose government now realizes it must invest heavily in mining and manufacturing, as demand for the raw materials needed to build a new green economy that rejects fossil fuels gears up.

The problem is, this epiphany comes 20 years too late. For the past two decades, China has been signing offtake agreements to procure the metals it needs to grow and modernize its economy. There are few details as to how the United States will go about re-building its mining sector after decades of mal-investment and relying on other countries for doing the “dirty job” of mining and mineral processing.

Globally, we have neither the scale — the number of new mines required to meet the demand for critical and industrial minerals — nor the time to do it. Benchmark’s 300 mines in the next 13 years has no basis in reality.

More clean energy means more solar panels, wind turbines, electric vehicles, and lithium-ion batteries, both for EVs and grid-scale storage. For some materials, like silicon, supply is plentiful, but for others, such as the rare earth neodymium for wind turbines, lithium, cobalt, graphite, sulfide nickel for batteries, and copper for just about everything involved in wiring, the supply chains will need to shift.

That’s because for most of the metals used in clean energy and electrification, the United States relies on imports.

We weren’t paying attention when China cornered the rare earths market back in 2010 and were also blind to the Chinese locking up global supplies & processing capabilities for nickel, cobalt, graphite and lithium. About 85% of the world’s neodymium is concentrated in a few Chinese mines, and most of the world’s cobalt production comes from the politically unstable Democratic Republic of Congo. The lion’s share of palladium, used in catalytic converters, and nickel, a crucial ingredient of electric-vehicle batteries and stainless steel — is mined in Russia, which is subject to Western sanctions after invading Ukraine.

It’s hard to imagine the US being able to fulfill the Biden administration’s clean energy agenda without either a significant increase in critical metal imports that frankly may not be possible in current market conditions, i.e., the hostility between the United States and Russia and China; or executing a home-grown strategy to explore for and mine them in North America.

At AOTH we have been beating the drums of electrification and encouraging the domestic (US and Canadian) mining, processing and smelting/refining of critical metals since President Obama first started talking about it in 2009.

His Vice President, Joe Biden, was a key architect of the American Recovery and Reinvestment Act, which despite spending billions, never really went anywhere. Now that Biden is President, and was elected on a mandate of clean energy, we are hopeful that industry-driven plans to mine and process battery metals, and essential industrial metals like copper and zinc, will have the support of US and Canadian national governments — for example by building the infrastructure for mining, such as roads, ports, railway sidings, etc and the refineries and smelters.

The first step is recognizing that we have these metals, we do not need to purchase them from China, the DRC, Russia or any other foreign producer, we can mine and refine them right here.

Next is upping our exploration game – and nobody is better at it than Canadian junior resource companies — so that we can find and develop the deposits that will become the world’s next mines.

Third inject some reality:

Bloomberg New Energy Finance (NEF) estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 21 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

Richard (Rick) Mills

aheadoftheherd.com

Follow me on Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.