News from October 2024:

The Federal Reserve sold another $200 billion in perpetual bonds this week. These “Perps,” as the media refers to them, have no expiration date and pay interest forever, or until recalled.

Proceeds from the “Perps” sale will fund Fed-coins that are downloaded to digital wallets on government issued UBI-phones. Over 96% of adults have received UBI-phones that are loaded monthly with Fed-coin currency. The phones also track locations, movements, and spending. A second benefit is they enable contact-tracing for the COVID-19, 21, and 23 pandemics.

The official inflation rate for this week is 11.75% annualized. Prices may increase by that amount without requiring an exemption from the Bureau of Price Controls. Some consumer prices will rise much higher after nearly automatic exemptions.

The Federal Reserve reported that Fed-coins have replaced 99% of paper currency in the U.S. All paper currency has been recalled and will decrease to zero value as of January 1, 2025. You should convert paper dollars to Fed-coins immediately.

The Fed’s monthly distribution of digital currency units via the Universal Basic Income (UBI) legislation increased the importance of Fed-coins. They are popular among the more than 100 million unemployed Americans who need Fed-coins to survive.

The European version of Fed-coin, the ECB-coin, replaced paper euros last year. The Chinese outlawed all paper currencies and private crypto currencies several years ago when they digitized their economy. Their digital yuan is scheduled for gold backing in 2026.

The IRS reported that tax collections are down, because of the sluggish economy, but overall tax compliance is higher due to the increase in reportable Fed-coin taxable transactions.

The year is 2024…

Georgie Johnson checked the Fed-coin wallet on his UBI-phone. The wallet app showed his balance had dropped below 175 coins and suggested he should reduce expenditures to make his coins last until the next reload in 11 days. The app offered advice and information. “Buying beer and marijuana may not be a proper use of your Fed-coins. Consider healthier and less costly alternatives. Further, your contact tracing app shows no recent interaction with an infected person. We encourage a booster shot for your COVID vaccine within 90 days. Have a carefree day. Remember that your government cares about you and asks you to vote in the November election.”

Georgie told himself. “What I want is a new GMC pickup. Unfortunately, the cost for that model has risen to $157,500, with nine-year financing for qualified buyers. I’ll never be a qualified buyer, so I’m hosed while I’m unemployed and living on the UBI. Damn the crazy inflation and the unemployment disaster. I blame politicians because they created this mess.”

His UBI-phone announced, “Your vital signs show an increase in stress. Calm yourself to live longer. Your government has programs that teach you to reduce stress. Have a carefree day.”

Georgie sneered at his phone. “Yeah, I’ll have a carefree day when I get a job and I've paid my student loans. Take your suggestions and shove them where the sun doesn’t shine.”

His phone responded, “Anti-social and anti-government attitudes are unacceptable. If you persist with inappropriate behaviors, your monthly Fed-coin allocation may be reduced or cancelled. Have a carefree day.”

Georgie held his phone with his left hand and shook the middle finger of his right hand toward the phone. He thought, I’ll act calm, because I need Fed-coins, but I don’t have to like what you jerks are doing to me.

***

Samuel Herbert Maxwell III closed a silver trade on his home computer and watched his Fed-coin balance update from 592,170 to 741,375. “They aren’t dollars, but they spend like the ancient dollars we used in 2015, except it takes about ten of these Fed-coins to buy what a paper dollar bought back in the old days before the COVID lockdown nightmare.”

He smiled, knowing his Fed-coin balance and guaranteed government job would sustain him and his family. Samuel checked markets on his UBI-phone and read, “The DOW is up 495 to 51,388. Gold is priced at $12,733 per ounce. Silver sells for $371 per ounce. Press here for more quotes.”

Samuel inserted his UBI-phone into a double layer Faraday cage to avoid government monitoring. “I bought gold in 2020, which seems like a lifetime ago. Back then gold was two thousand bucks and gasoline cost less than three bucks. Now, after the inflation wars, COVID pandemics, massive QE, rise of digital coins, currency collapses, and unbelievable political insanity, almost all prices and assets have spiked higher. My cost of living has quadrupled. College at a state university for my eldest son now costs over a hundred grand per year, which he borrows. I doubt he’ll ever repay those debts. He’ll wait for the debt reset that politicians promise but don’t deliver.”

He continued, “I must spend my UBI allocation or lose it. That’s easy, given the outrageous prices for food, clothing and gasoline.”

He sipped coffee, feeling smug because he purchased gold in 2020 and silver in 2018. Samuel had done well financially during the monetary and pandemic insanity of the 2020—2024 era. Most people had not expected the drastic changes that occurred. They hoped 2019 conditions would return. Instead, suicides, alcoholism, violence, riots, terrible inflation, unemployment, and drug abuse surged as people lost hope their lives would improve.

“I could blame the politicians, the bankers, or the medical people, but that’s useless. I’m thankful I looked deeper than the news headlines, beyond the happy talk from the economists, and past the phony reassurances from the politicians and medical experts. I protected my assets and savings long ago.”

His phone beeped from inside the Faraday cage. “Your phone has been disconnected from monitoring services over ten minutes. Please press 111 to confirm that you remain in contact with life monitoring applications.”

Samuel clenched a fist and removed his UBI-phone from the Faraday cage. He tapped “111” and apologized, “Sorry, I was out of service range.”

His phone replied, “Data from your phone shows an inhibited transmission, not out of range. Please remember this phone monitors your activities, location, and contacts for your own good. If you are experiencing anxiety, a medical professional can ease the symptoms. Have a carefree day.”

***

From Jerome Powell, Chair of the Federal Reserve:

“We’re not going back to the same economy.”

“No matter what happens on election day, count on Fed Chairman Jerome Powell…”

Listen to Andy Schectman on Silver:

From James Rickards: “Debunking the Bogus Case Against Gold”

“Gold is in the early stages of its third great bull run that will take it to record highs.”

“Regardless, my research has led me to one conclusion – we’re going to see the collapse of the international monetary system.”

“… I predict gold will reach $15,000 by 2026.”

From Alasdair Macleod: “The Monetary Logic for Gold and Silver”

“A considered reflection on current events leads to only one conclusion, and that is accelerating inflation of the dollar’s money supply is firmly on the path to destroying the dollar’s purchasing power – completely.”

CONCLUSIONS:

• The year 2020 provided a hint for what is coming.

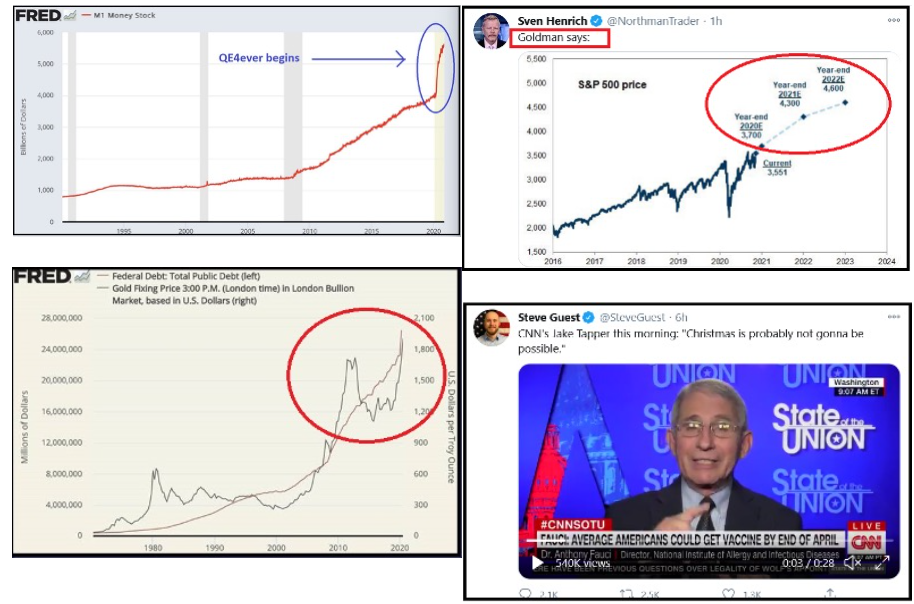

• Universal Basic Income, QE4ever, and perpetual bonds are consistent with MMT (Modern Monetary Theory or Magic Money Tree) economic plans. That train is accelerating down the tracks toward monetary disaster, but who can stop it?

• Digital currency units extract a price. Collect a UBI and submit to controls, location tracking, 24/7 monitoring, and no financial privacy. Many people will happily pay the price.

• Never waste a crisis! The pandemic and lockdowns created a crisis. The destructive consequences of lockdowns aggravated it. The Powers-That-Be (PTB) are using this crisis.

• Gold and silver bullion are private wealth, not tracked by the PTB.

• The official national debt exceeds $27 trillion. It could surpass $30 trillion by December 2021, and $40-$50 trillion by December 2024. The Fed will “print” as needed via their QE4ever programs.

• Watch gold and silver rally as the dollar falls.

• Consumer prices and asset prices will rise. Gold and silver prices will spike higher, depending on monetary insanity, government programs, and QE4ever “printing.”

Buy silver and gold, regardless of the winners in the 2020 and 2024 elections.

Miles Franklin (Call 1-800-822-8080) will exchange paper and digital dollars for real money—gold and silver. Yes, gold and silver sell for more than several years ago. However, the financial world is crazier than several years ago. Worse, the controls, monitoring, QE, and monetary insanity will escalate.

Gary Christenson