Breaking News:

- Gold fell $48 to $1,729 for the week ending February 26.

- Silver fell $0.86 to $26.40.

- The S&P 500 Index closed at another all-time high on February 12.

- Tesla sold for $900 in early February, and closed the month at $675, down 25%.

- Bitcoin reached $58,000 and closed at $45,637, down 21%.

- ARE YOU WORRIED? The DOW and NASDAQ hit all-time highs and then fell. Is this a pause in the extended bull market that began in 2009, or advance warning of a meltdown?

- ANSWER: We don’t know. The stock market has been stretched into the stratosphere for months. Valuations are too high, which is nothing new. Valuation ratios include price to earnings, price to sales, and market cap to GDP. But the market listens to its “drummer,” not valuation metrics. Prices could rise higher or collapse.

- The Fed, owned by Wall Street and the financial elite, will do whatever it takes to keep the markets rising. Will their efforts be enough?

- In other words, “DO YOU FEEL LUCKY?”

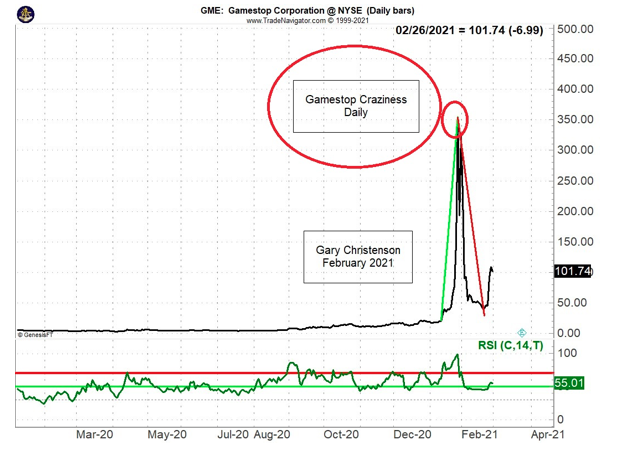

- If you feel lucky, ride the stock market up, buy Tesla on dips, purchase options on GameStop, and keep those market chips active in the Wall Street casino.

- If you prefer value, rather than paper and guesses, consider something real, like selected real estate, gold, silver, platinum, whatever.

- Buy what is undervalued and sell something overvalued. In the opinion of many, gold and silver, well off their 2020 highs, are undervalued. Why?

- a) Fed policy is print, print, yak yak, and print more. They will push the dollar’s purchasing power lower.

- b) The dollar is falling against other fiat currencies. If rising interest rates can’t support the dollar, what will? Assurances from President Biden or Almost President Harris? A new Treasury Secretary? Doubtful!

- c) The Democrats control the House, the Senate, and the Administration. We hear the chants, “Spend, Spend, Spend, More, More, More!”

- d) Inflation is here, regardless of what the tortured statistics from the U.S. government show. Their “print and spend” debt extravaganza ensures inflation will destroy the purchasing power of the dollar.

- e) The Fed suppresses interest rates. The 10-Year yield was 0.52% (amazingly low) in August 2020 and 1.46% (low) at the end of February. Rate repression has been partially successful.

- f) If the Fed stops supporting their self-created inflationary disaster, they’ll crush everything when most debt defaults. Nope, only as a last resort…

- g) Gold backed currencies: Maybe, but only after the Fed has exhausted all other alternatives. Not this year, but it is a sensible, if unlikely, solution.

- WHAT ABOUT INFLATION?

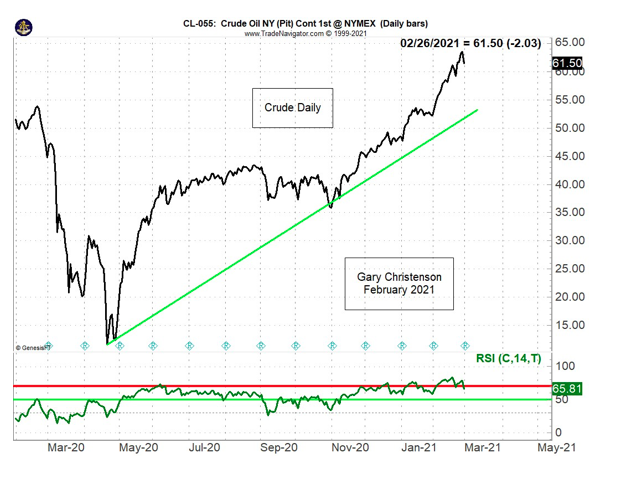

- Look at the prices of soybeans, corn, crude oil, and silver since March 2020, and observe their price rises.

These charts suggest inflation exceeds 2% per year (Fed target). Everyone pays higher prices for food, beer, gasoline, and most other items used in daily life.

IMPORTANT DATES:

What do August 25, 1987, January 14, 2000, October 9, 2007, and February 24, 2021 have in common?

- Those dates marked major highs in the DOW, before it fell hard.

- 1987: The DOW dropped 36% in two months.

- 2000: The DOW fell 36% in 30 months. The NASDAQ 100 crashed over 80%.

- 2007: The DOW was down 54% in 18 months. The S&P fell 57%.

- 2021: The DOW closed at 31,962, a new all-time high. Next stop is where? 35,000 or 15,000?

WHAT DO THOSE HIGHS HAVE IN COMMON?

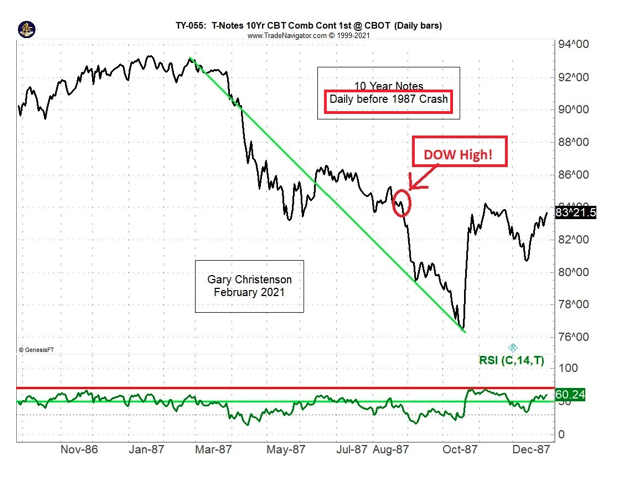

- The common characteristics are not exact, but they have strong similarities. In 1987, the 10-Year bond fell hard (interest rates rose) in the seven months before the crash. The dollar index declined for most of two years prior to the crash.

- In 2000, the 10-Year bond fell hard in the 15 months before the crash. However, the dollar index was in a strong uptrend.

- In 2007, the 10-Year bond rallied (falling interest rates) in a strong uptrend, and the dollar index fell in a strong downtrend prior to the crash.

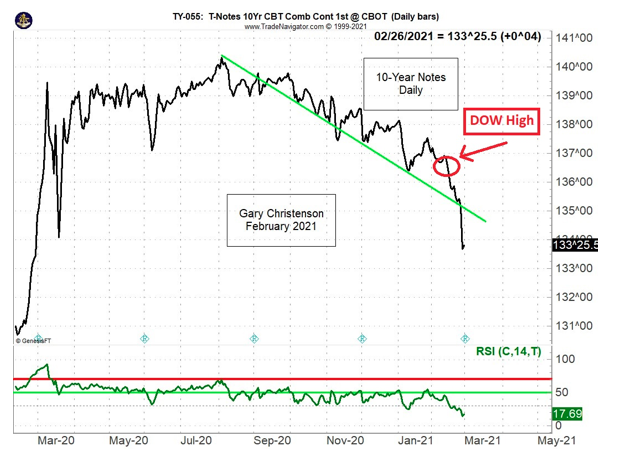

- In 2021, the 10-Year bond has been falling for almost a year (rising rates), while the dollar index has dropped for over a year, prior to… whatever is coming…

SUMMARY:

- In two of three examples, interest rates rose rapidly before the crash.

- In two of three examples, the dollar index fell rapidly before the crash.

- 2021 is similar to 1987 with a falling dollar, rising interest rates, and speculative euphoria.

- Large changes in interest rates and the dollar index often precede a stock market crash.

CONCLUSION:

A crash possibility is genuine. Consider sky-high valuations, speculative euphoria, rising interest rates, falling dollar index, goofy politics for decades, and the “inflationistas” who claim to be in charge at the Treasury and the Fed.

THOUGHTS:

- People watched as their Internet stocks sunk in the 2000 crash. Avoid the “deer in headlights” approach to speculation and investments.

- Gold bottomed during the 1999-2001 crash era and has been strong since 9-11.

- Gold protects from dodgy fiscal and monetary policies, which are ongoing. When they fail again, expect a “double-down” and more debt and “printing.” Central bankers “solve” excess debt problems with more debt, fight extreme income disparity with more disparity, and counter political nonsense with more nonsense.

- Inflate or die! The Fed and Treasury support the elite, as always. It’s too bad about stagnant wages and a higher cost of living for the lower 90%.

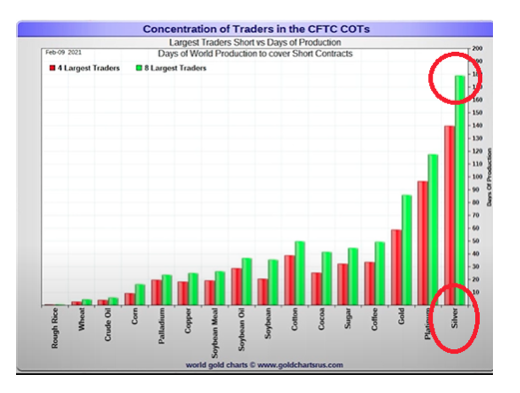

- Silver is deeply undervalued in a crazy world where Tesla stock reached $900, GameStop blasts from $11 to $483, and Bitcoin sells for $50,000. Stack silver to protect savings and retirement.

MORE IDEAS AND CRAZINESS TO CONSIDER:

Read Charles Hugh Smith: “Trapped”

“If price discovery of credit and risk is allowed to live, the Fed’s carefully inflated speculative bubbles pop. And so the Fed’s Job One is killing all price discovery via shadow nationalization.”

Kill authentic price discovery, you also kill markets, and in killing markets, you kill allocation of capital and risk management, and in killing those, you kill the economy.”

From Paul Singer (Billionaire Hedge Fund Manager):

“We believe that hindsight will show the champion of head-smacking craziness in the American stock market will be the period playing out right now.”

“Trouble ahead is signaled by a rare combination of low-quality securities, staggering valuation metrics, overleveraged capital structures, a scarcity of honest profits, a desperate dearth of understanding evinced by the most active traders, and economic macro prospects that are not as thrilling as the mobs braying ‘Buy! Buy’ seem to think.”

Listen: BILL HOLTER & ANDY SCHECTMAN

CONCLUSIONS:

- Conditions are ripe for a stock market correction/crash. Interest rates are rising, and the dollar is falling, as happened in the months leading up to the 1987 crash. Maybe soon… or maybe the Fed can manufacture a few more months of rally.

- Valuations are insanely high, but they can become even higher. Sky-high valuations are like dry sticks in a forest. Nothing burns until a spark occurs or lightning strikes. Then run to escape the conflagration!

- All bubbles crash. Markets correct, and sometimes crash. In 2021, the U.S. stock market (paper) is more likely to crash than the physical silver market where demand is multi-decade strong.

- ARE YOU WORRIED? DO YOU FEEL LUCKY? STACK SILVER!

Miles Franklin will recycle dollars from overvalued investments into real money—silver and gold. Demand is strong, supply is small. This imbalance could intensify as the Fed “prints,” congress hands out another $2 trillion, or maybe $5 trillion, the dollar weakens further, interest rates rise for another year, and sanity slowly and painfully returns to the U.S. economy. Call 1-800-822-8080.

Gary Christenson