At a glance:

- COVID Games have devastated large sections of the economy, as well as state and federal budgets.

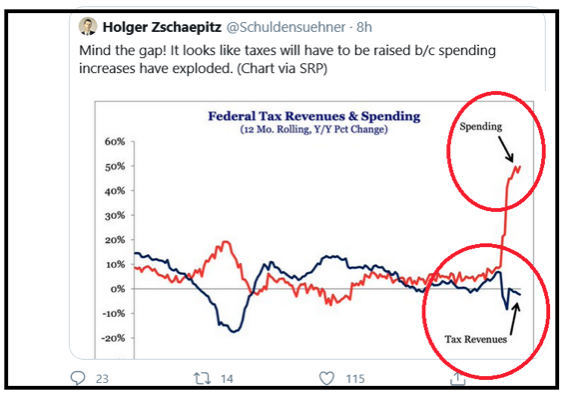

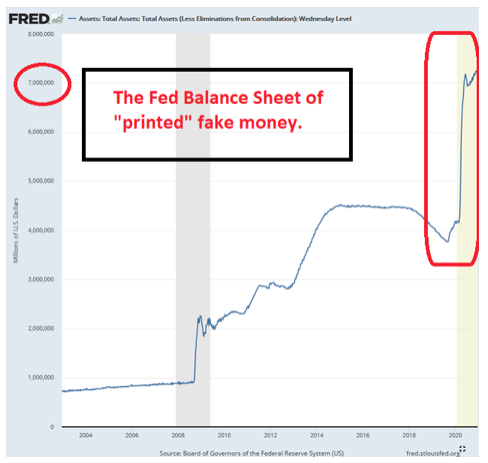

- Declining federal revenues plus massive expenditures have increased debt and forced the Fed to “print” to fund deficits.

- Gold and silver prices will rise. A currency crisis is possible.

Breaking News:

- Gold fell $5 to $1,830 for the week ending January 15, 2021.

- Silver rose $0.22 to $24.86 for the week.

- Tesla stock (in a bubble) fell to $826 from its high of $884. It won’t happen, but Tesla could sell for $4,000 by July, based on the last six months of bubblicious rally. $400 is also possible.

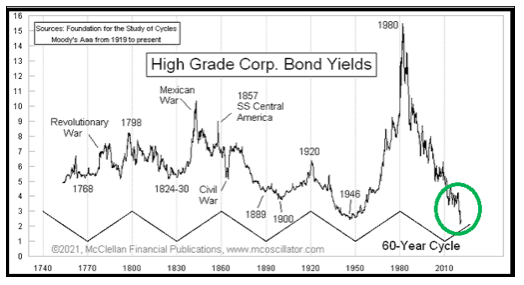

- The ten-year note yield rose to 1.09%. Has the 40-year bull market in bonds ended?

- President-elect Joe Biden proposed a multi-trillion stimulus (bailout). Government will fund it with new debt. Ho hum!

In the “Hunger Games” series, the Capitol forces the other 12 districts to sacrifice children in their annual “Hunger Games” punishment for past rebellion.

In 2020, our “medical experts” and politicians forced cities and states into lockdowns to prevent the spread of the virus. Regardless, the virus is spreading. Read “Did Not Find Evidence Lockdowns Were Effective.”

Loss of many lives, lower standard of living, unemployment, bankrupt businesses, diminished physical health, emotional trauma, spousal abuse, and drug abuse expanded. There is always a price that must be paid.

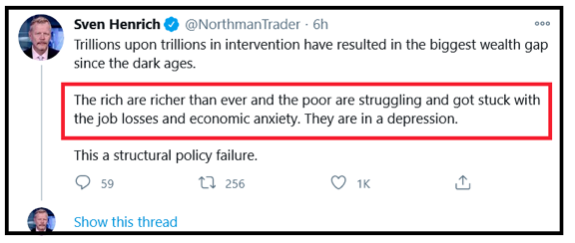

Because of lost jobs and a damaged economy, many people are hungry, cars line up for miles to get free food, and food banks are busy. However, billionaires increased their wealth during the 2020 COVID Games, and stock markets boomed. People waiting for handouts at food banks probably weren’t checking their stock portfolios.

Read: “One of the Greatest Economic Blunders in History”

WHAT CHANGED?

- Small businesses failed by tens of thousands.

- Unemployment skyrocketed.

- Federal and state budget deficits went crazy as revenues declined and expenditures rose.

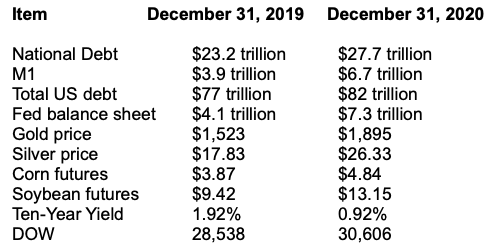

- National debt as January 16, 2021 was $27.8 trillion, up from $23.2 trillion one year earlier.

- Pension plans fell deeper into under-funded territory.

- Layoffs and mask sales rose.

WHAT DID NOT CHANGE?

- The stock market chugged higher, even though earnings were mostly flat.

- The Fed “printed” currency units and assured everyone… yada yada yada.

- Politicians… did what they always do.

- Censorship increased, for our own good, of course.

- The US government ran huge deficits. The Fed “printed” to fund those deficits.

- Politicians promised giveaways and bailouts. Read “The Bailout Binge Begins.”

- “Deficit hawks” disappeared.

- “Deficits don’t matter.” Create more debt, spend lots to save the economy, now is not the time to worry about additional debt etc.…

HUNGER AND COVID GAMES 2020:

- The Capitol (Washington DC) spent, the political and financial elite increased their wealth, and people hoped for bailouts, stimulus, unemployment benefits, and giveaways.

- The people sacrificed incomes, jobs, mobility, social interaction, outdoor activities, sports, and much more to survive during the COVID Games 2020. They wanted to stay safe and healthy, virus free. However, many died.

- Large businesses prospered, small businesses failed, individuals lost jobs, and people depended upon bailouts from the government.

- The nation polarized. Left vs. right, Dems vs. Repubs, maskers vs. non-maskers, blue vs. red, rich vs. poor, and more. Divide and conquer…

- The Fed “printed,” bonds remained expensive, stocks rallied, Bitcoin soared, and we edged closer to the economic Twilight Zone where only Fed “printing” matters.

BUT CONSEQUENCES ALWAYS OCCUR:

1) Lockdowns may prevent the spread of the virus, but they damage economies. Read “One of the Greatest Economic Blunders in History.”

2) Damaged economies destroy the tax base and crush state and local budgets.

3) State and local governments, after losing tax revenue, can’t afford to pay employees and pension funding. They lay off people and under-fund pensions.

4) Unemployment compensation increases after layoffs.

5) Under-funded pension plans will eventually collapse unless they get huge Federal bailouts. President-elect Biden knows massive bailouts are needed to fund pension plans, plus city and state budgets.

6) Huge bailouts mean larger federal deficits, more debt, and expanded Fed “printing.” QE4ever is more “necessary” every day.

7) Larger deficits, massive debt, and QE4ever will devalue the dollar further and/or push interest rates higher—probably both.

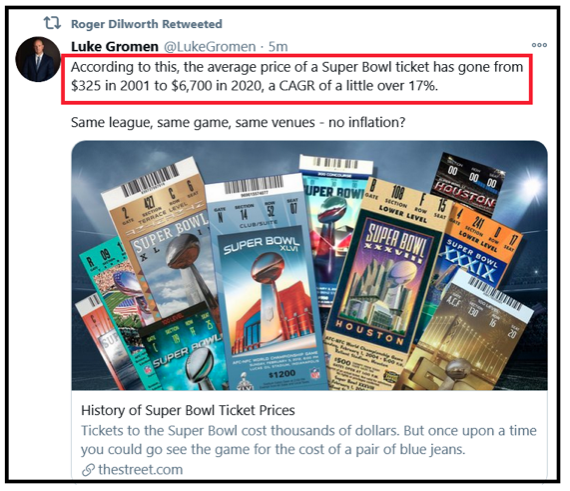

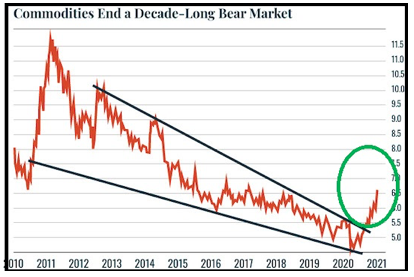

8) A devalued dollar means higher prices for food, energy, trucks, medical care, and most consumer items. Read “Inflation Will Come Back with a Vengeance.”

9) Higher consumer prices squeeze impoverished consumers. Hence the government must fund more bailouts to help consumers. Higher prices, lockdowns, and angry consumers damage economies. Go back to item 1 and repeat.

COVID GAMES DATA:

THE 2021 COVID AND HUNGER GAMES:

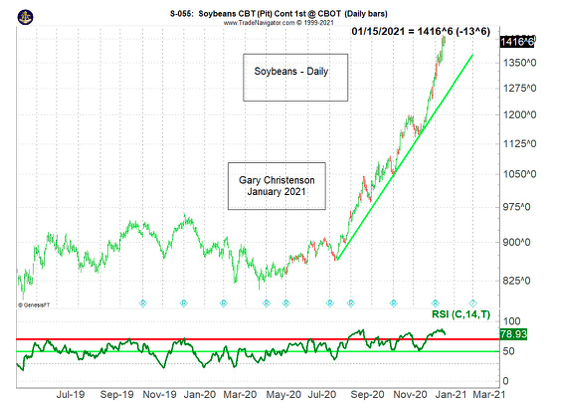

- Expect higher prices for food, gold, silver, and necessities.

- Expect the dollar to devalue further, pushing consumer prices higher.

- Expect more bailouts, stimulus, giveaways, and Fed “printing.”

- Expect debt to skyrocket higher, especially under a Biden Administration.

- Expect the Fed to “print” to fund US government deficits, especially under a Yellen Treasury.

- Expect politicians and the Fed… you know what they’ll do.

AND WHAT ELSE?

- Bitcoin and Tesla stock are in bubbles. Bubbles pop—probably in 2021.

- Central banks want more control. Governments demand more taxes. Central bank digital currencies (CBDC) will provide both. This statement from Lagarde is a warning.

- If the Fed loses control of interest rates and rates on the ten-year note jump higher… oops! Higher rates cause larger deficits and more borrowing. More borrowing brings higher rates and the cycle repeats.

- If the Fed loses control of the dollar’s value, a currency crisis is possible/probable. Inflation and hyper-inflation are in play. Oh dear!

- If “medical experts” and the government worry they are losing the battle with the virus, expect more lockdowns, economic failures, and bailouts. More debt, higher prices, and dollar devaluations follow. Not good!

- If the stock market crashes from its over-bought level, look out below. Bubbles always implode, but often extend longer than anyone expects. Maybe the COVID Games of 2021 will be the “pin” that pops the bubbles.

CONCLUSIONS:

- Hunger Games pitted the people versus the Capitol. COVID Games have devastated city, state, and national revenues, destroyed jobs and businesses, and made more people dependent upon Federal bailouts.

- Declining revenues and large expenditures forced the Fed to “print” to buy Federal debt. Interest rates are rising. Has the 40-year bond bull market reversed, or will interest rates stay low forever?

- The dollar will devalue further, increasing consumer prices.

- Prices for food, gold, silver, and necessities will rise.

- A currency crisis is possible. Hyper-inflation may occur. We hope the US will avoid most of the horrific consequences of bad monetary policy, lockdowns, excessive spending, and other nonsense.

- The stock market bottomed in March 2020 and is still rising. Gold and silver bottomed in March, topped in August, and have been correcting. They are ready to rally.

- Buy gold and silver! Avoid bubbles in Tesla, Bitcoin, and others.

Miles Franklin will convert digital stock market profits into real money—gold and silver bullion and coins. Call 1-800-822-8080.

Gary Christenson