At a glance:

- It’s a new era—or is it? Debt increases, QE continues, and the dollar devalues. This new era sounds like the past five decades of fiscal and monetary craziness.

- Bubbles pop. We don’t know when, but they always pop.

- Expect more of the same - lots of talk, rising food prices, and dollars devaluing. Gold and silver prices surge higher.

PRESIDENT BIDEN’S NEW POLICIES (a few…)

- Large bailouts for cities and states and their pension plans. The bailouts will be funded by increased debt.

- Extended unemployment benefits for many jobless workers. The benefits will be funded by increased debt.

- Bailouts issued to Americans—another $1,400 per adult. These payments will be funded by increased debt.

- Increase “food stamps” (SNAP) for poor families. This “giveaway” program will be funded by increased debt.

- Free tuition, student loan forgiveness, and expanded Medicare. The extra expenditures will be funded by increased debt.

- Raise minimum wage for Federal workers and contractors. The increased costs will be funded by increased debt.

- Many bailouts, giveaways, boondoggles, payoffs, and D.C. crony business as usual, all funded with increased debt.

SUMMARY:

Agree or disagree, good policy or big mistake, nonsense or enlightened thinking, progress or disaster… All these “new era” policies will be funded by DEBT.

But the U.S. and the world are drowning in debt… no matter… we must do more of what created the fiscal and monetary mess, and… pretend the consequences will be good.

From the head of the IMF: “Spend as much as you can and then spend a little bit more.” A plan or utter nonsense?

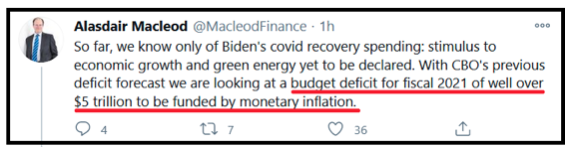

HOW MUCH DEBT? HOW LARGE WILL THE DEFICIT BECOME?

To answer these questions, we make guesses about the future policies of our “leaders.”

a) More of the same. Democrat or Republican, left or right, the debt and deficits increase.

b) Bubbles Implode. When the stock and bond bubbles implode, history suggests the Fed and other central banks will panic and increase QE and “printing.” The debt and deficits increase.

c) Economic Crash. If the economy crashes into a new and greater recession/depression, history suggests government will respond with larger giveaways, stimulus, “new deals,” “green energy projects,” shovel ready programs, and other boondoggles. The debt and deficits will increase.

CONCLUSION: DEBT AND DEFICITS WILL INCREASE UNDER ANY LIKELY SCENARIO.

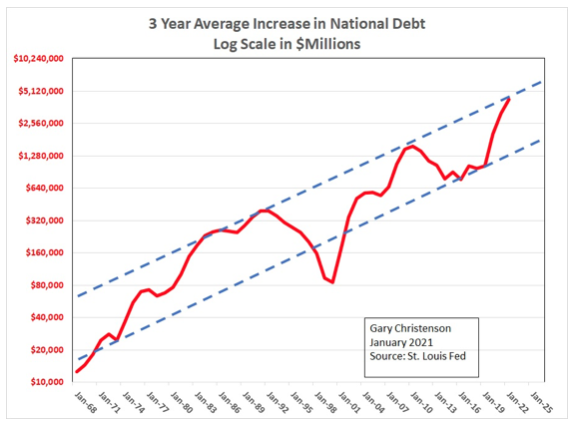

Examine five decades of annual increases in the national debt on a log scale. Average over three years to smooth the graph.

BREAKING NEWS:

- The Dow closed at another new high on Inauguration Day, the beginning of a supposed new era based on the same policies that created massive and unpayable debt, consumer price inflation, large government, and bubbles in stocks, bonds, and Bitcoin.

- Gold rose $26 to $1,856 for the week ended January 22, 2021.

- Silver rose $.69 to $25.55 for the week.

- The Dow closed on January 20 at 31,188, a new high.

- Bitcoin fell to $28,989 from $41,969 on January 8. It closed at $32,952.

Summary:

a) The annual increase in national debt (the real deficit) increased exponentially over five decades. With policies that act like “more of the same” a $5 trillion increase for 2021 is likely and $10 trillion deficit per year is a few years away. “Emergency” spending could create $10 trillion deficits sooner than most believe possible.

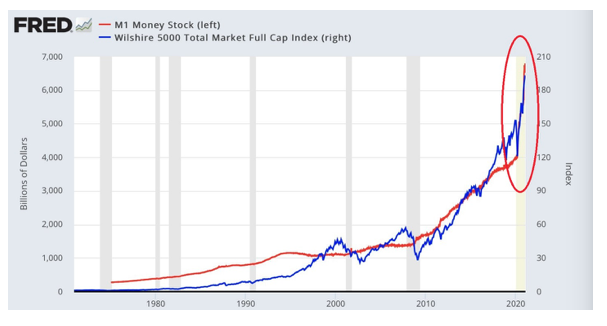

b) Fed "printing" will fund the huge increases in national debt. Dollar devaluation will accelerate.

c) As dollars devalue, consumer prices rise. Governments will be forced to provide more giveaways, helicopter money, Universal Basic Income, and higher taxes. Can we solve an excessive debt problem by issuing more debt?

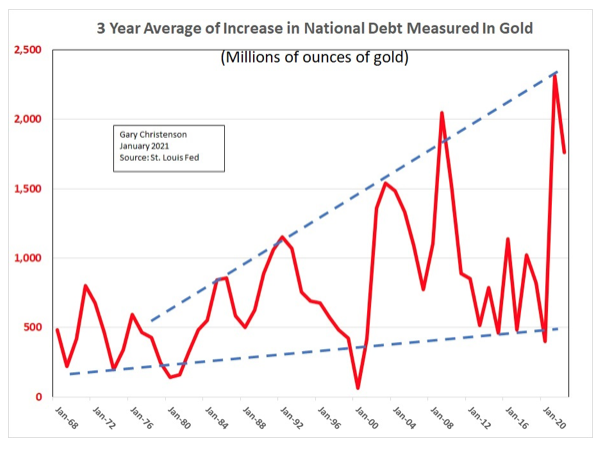

Calculate deficits priced in gold. Take the deficits and express them in millions of ounces of gold.

Deficits and national debt grew exponentially. Gold prices rose along with deficits. The above graph shows that deficits increased more rapidly than gold prices. Occasionally gold prices “catch up.” Expect larger deficits and much higher gold prices in coming years. Silver prices should rise more than gold prices.

WHY WOULD GOLD AND SILVER PRICES RISE?

Question: If you were confident the Fed would devalue the dollar further, would you buy gold or ten-year treasuries that yield slightly over 1%?

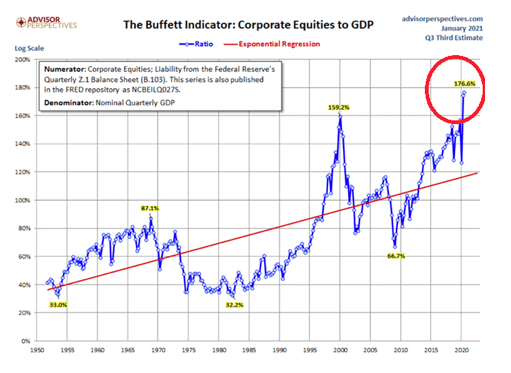

Question: If you worried that many stocks and Bitcoin had risen too far and too fast, creating an enormous bubble, would you buy silver or Tesla stock?

Question: If you were confident government expenditures would rise, regardless of which party is mismanaging government, and you were confident that rising debt and deficits devalue the dollar, would you buy gold or stash your retirement funds in a savings account that paid next to nothing?

Question: If you worried bubbles were ready to implode, would you “take some chips off the table” from the Wall Street casino and buy gold?

WHAT BUBBLE?

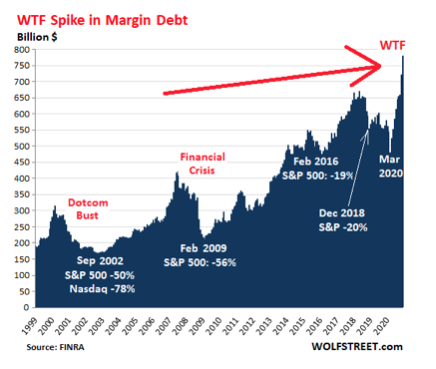

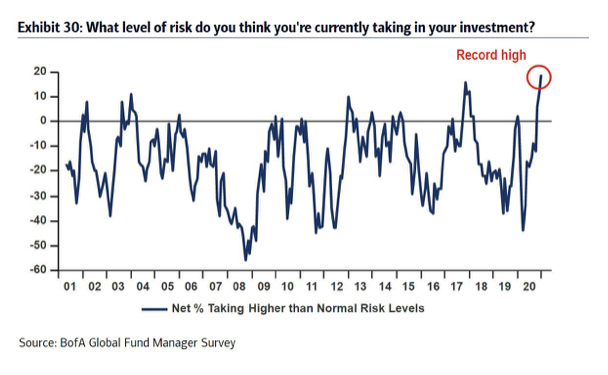

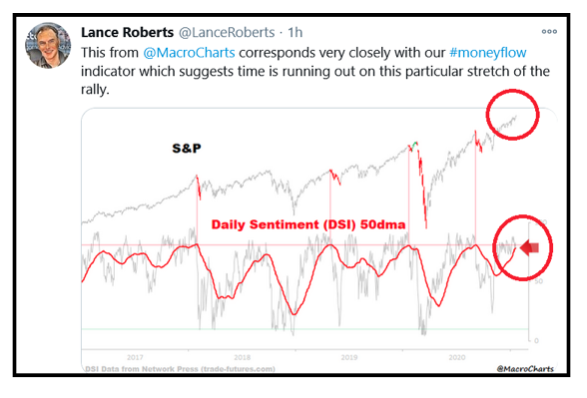

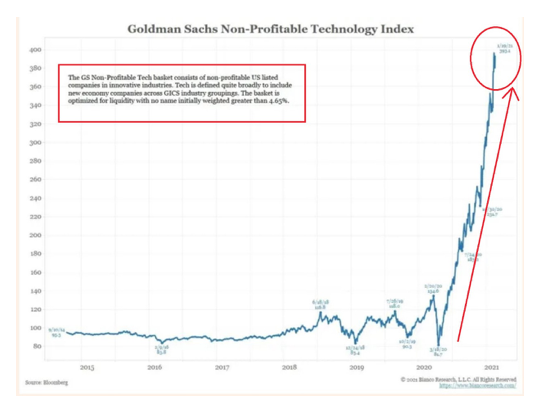

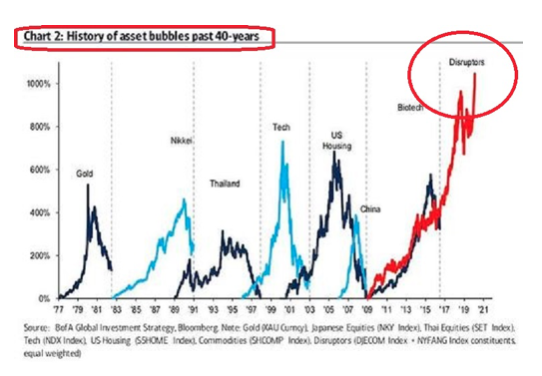

Yes, bubbles have emerged. The Fed created over $7 trillion from nothing and boosted many stocks and Bitcoin into the financial stratosphere.

The silver bubble of 1980 crashed. The NASDAQ bubble of 2000 crashed. The Cisco bubble of 2000 crashed. The housing bubble of 2007 crashed.

The crude oil bubble of 2007 crashed. Bitcoin crashed in 2017.

WILL THIS TIME BE DIFFERENT?

Read: “When Boom Turns into Crack-Up Boom”

“… free money debases the rewards of hard work, saving money, and paying one’s way in life. It also propels the economy and financial system to an ever more precarious place… a place where only total catastrophe is possible.”

“The rapid vaporization of wealth the central planners have set us up for will be of scope and scale the world has never before seen. We don’t know if the bottom will fall out next year or five years from now. But we’re certain the boom has turned into the crack-up boom.”

THOUGHTS:

- Bubbles implode rapidly. It is better to take chips off the table too early rather than too late.

- Gold and silver have thousands of years of history—protecting assets and holding their value. We can’t say the same for fiat currencies.

- Vast changes are coming in 2021 and 2022. Not all will be good for stocks, bonds, commodities, pensions, gold, silver, or fiat currencies. Choose carefully.

CONCLUSIONS:

- Many stocks have exploded higher into bubbles.

- Bubbles always implode.

- Bonds yield next to nothing. Some $17 trillion in global bonds have a negative “yield.” Troubles lie ahead!

- Deficits and debt have risen exponentially higher for five decades.

- President Biden’s new era of giveaways, bailouts, and massive spending will push deficits higher and speed dollar devaluation.

- Gold and silver prices will rise for several years.

Miles Franklin will convert those “chips taken off the table” into real money that protects and lasts. Think silver and gold! Call 1-800-822-8080.

Gary Christenson