Briefly:

- GameStop (GME), AMC, and Tesla (TSLA), are a few of many bubbles.

- Bubbles always implode, but some persist for a long time.

- Gold and silver are safer and undervalued.

Breaking News:

- Gold fell $9 to $1,847 for the week ending January 29, 2021.

- Silver rose $1.36 to $26.91 for the week.

- The DOW fell 1,014 to 29,982.

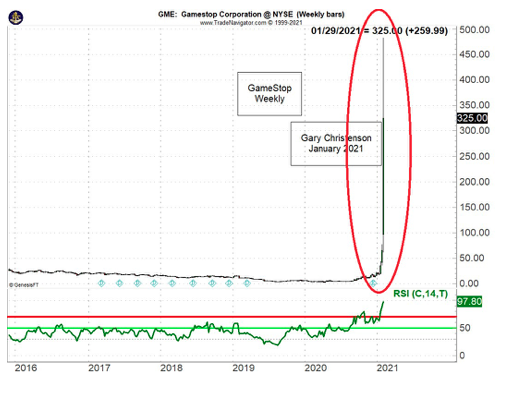

- GameStop (GME) closed on January 22 at $65. It reached a high of $483 and closed the week at $325. Do you think price and value are the same?

Americans love bubbles. We went crazy in 1929 and drove stocks to record highs. The Dow returned to 1929 highs in 1954, not counting inflation and survivorship bias. Bubbles are dangerous and destructive.

The DOW reached 1,000 in 1966. It sold for 900 in 1982, sixteen years later, but during that time inflation had wiped out 2/3 of its value. A new high measured in purchasing power occurred years later.

Silver sold for less than $5 in 1977 and over $50 in early 1980. Nominal silver prices fell to $3.51 in 1993, a loss of 93%, not counting dollar devaluations. The actual loss was perhaps 96-97%. Grim!

The NASDAQ 100 loss after the 2000 bubble was over 80%, top to bottom. Remember when almost every bar tuned to CNBC so people could watch their stock portfolio rise? We discovered that price is not value and paper wealth can disappear.

The consequences of the housing bubble in 2007 were ugly. How many millions of people lost their homes? How many Wall Street bankers were prosecuted for their involvement in the fraud?

Bitcoin sold for $800 in early 2017, nearly $20,000 in late 2017, $3,300 in December 2018, and $41,969 in January 2021. Bubbles inflate, implode, and sometimes rise again.

Many people like baths, washing the dirt and grease off their bodies, and feeling fresh and clean. Some add soap and enjoy a bubble bath.

In the investment world, “taking a bath” means taking a tremendous loss in a speculation or investment. Perhaps the phrase comes from the idea that a correction/crash washes away the paper wealth and delusions from our speculative investments. Hence, we reset to a fresh condition, no longer soiled with fake money, greasy delusions about value, gambler’s euphoria, Wall Street Hopium, and bubblicious ideas.

Yes, bubbles are dangerous and destructive, but investors and speculators indulge in bubblicious behaviors again and again.

A few bubbles (in my opinion) in early 2021:

- Bitcoin: $9,000 in July 2019 and $41,969 on January 8, 2021.

- GameStop: $17 on January 5, 2021 and $483 on January 28, 2021.

- AMC: $2 on January 5, 2021 and $16 on January 28, 2021.

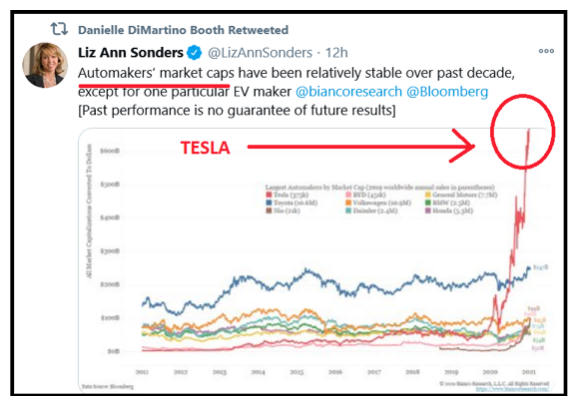

- Tesla: $71 in March 2020 and $900 on January 25, 2021.

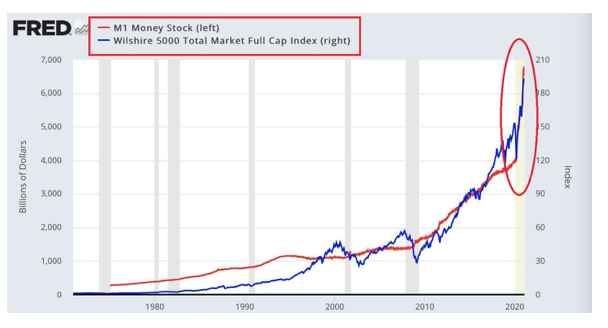

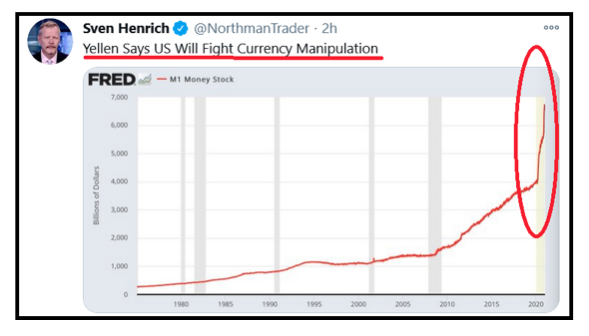

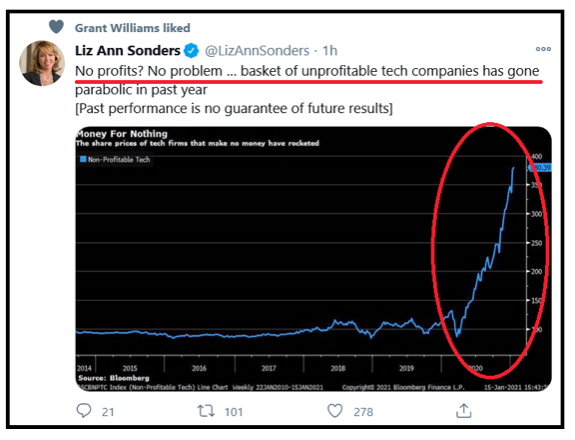

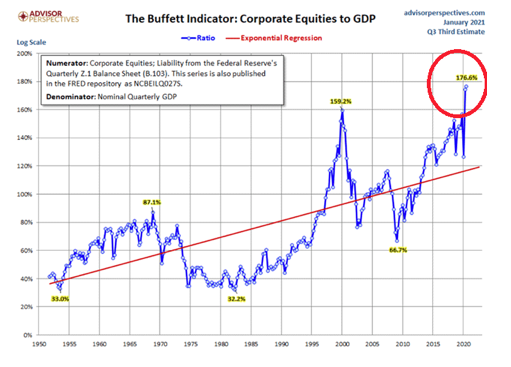

EXAMINE THE GRAPHS:

QUESTIONS:

- What is the intrinsic value of a Bitcoin? What is the intrinsic value of a paper dollar? What is the intrinsic value of a one-ounce gold Eagle?

- What will be the price of a Bitcoin if most governments declare it illegal? Major central banks will promote their digital currencies, not Bitcoin.

- GameStop has no earnings and a market cap of $22 billion with revenue of $5 billion. Is this a short-squeeze, bubble, mania, or insanity? All the above? Does the chart look sustainable?

- Tesla has a P/E greater than 1,200, and a market cap of $750 billion, which exceeds the sum of market caps for many other car manufacturers including Toyota, Ford, BMW, Honda, GM, and others. Is this a bubble or craziness or both?

- OTHER BUBBLES:

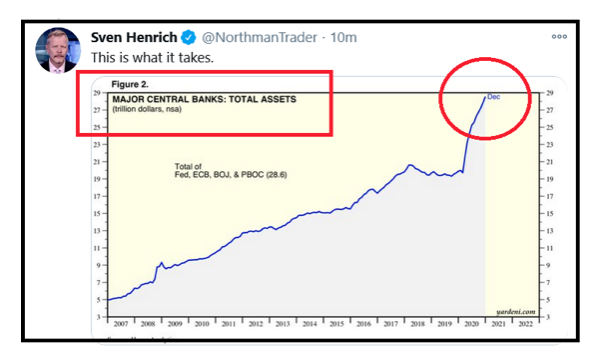

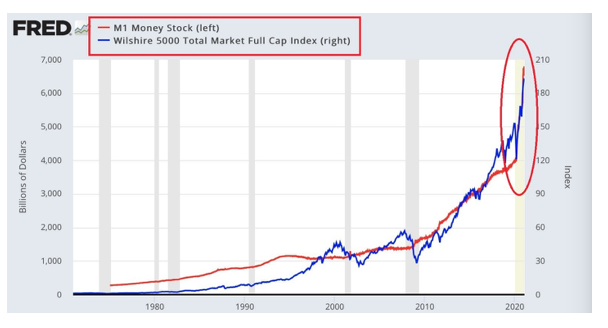

- Central Banks Fake Money: The Fed created over $7 trillion from nothing. Global central banks created over $27 trillion. Bubble in fake money?

- Entire stock market: The “Buffet Indicator,” market cap ratio to GDP, reached all-time highs after the Fed poured $7 trillion of fake money into government debt and Wall Street. Is the entire stock market a bubble?

- Bonds: Bonds have been in a bull market since the early 1980s. Ten-year rates bottomed at 0.40% (so far) in March 2020. Rising interest rates will sink hundreds of corporations and many government budgets, so rates can’t rise. Really? Are bonds a multi-decade bubble?

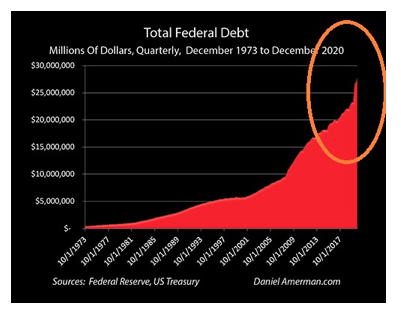

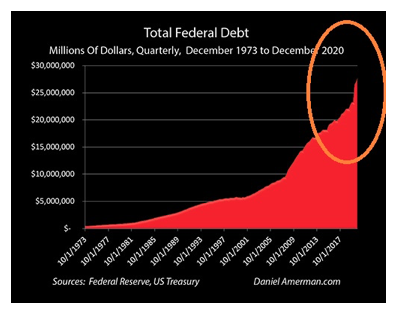

- Sovereign Debt: Global debt that “yields” less than zero (how is that sensible?) exceeds $17 trillion. Is sovereign debt a massive bubble?

EXAMINE GRAPHS:

TIME FOR A BUBBLE BATH! POSSIBLE CONSEQUENCES:

- Bubbles always implode.

- Bubbles appear inevitable, never-ending, and glorious for a while.

- Tears follow bubble failures.

- Some bubbles inflate for an extended time.

- The “Bubble Bath” washes away the delusions, insane valuations, and corruption.

- The political and financial elite often escape the consequences from the bubbles they created.

- Small investors, savers, and the middle classes suffer the losses, business failures, foreclosed homes, collapsed pension plans, and devastated retirement accounts.

WE COULD IMPROVE OUR WORLD IF:

1.The U.S. used honest money—gold coins and gold backed digital and paper dollars. The Fed doesn't need to issue fiat dollars, except to transfer wealth to the elite.

2.The U.S. required balanced federal and state budgets. Why use debt to conceal fiscal mismanagement?

3.The U.S. followed the Constitution, returned to the “rule of law,” and enforced it most of the time.

4.Congress dissolved the Fed. Certainly we need an audit.

5.We used honest voting. Both political parties have stolen or influenced elections. If the Powers-That-Be wanted honest elections, we would have honest elections.

6.Audit Fort Knox Gold. An independent auditor should audit Fort Knox and other gold depositories.

CONSEQUENCES OF THE ABOVE (a few):

- Stable purchasing power of the dollar. Back it with gold and most consumer price inflation disappears.

- Reduced federal spending. Balance the budget. Let congress do its job.

- If congress wants to spend $ trillions on a war, spend it from savings. If congress has already spent the savings, reconsider declaring war, or raise taxes.

- Trust in government, agencies, media, and congress might increase.

- Stop Quantitative Easing. Federal Reserve dollar devaluation minimized or terminated.

- Clarity on existing or missing Fort Knox gold. We hope the gold remains, unencumbered, in the Fort Knox Bullion Depository.

MORE QUESTIONS:

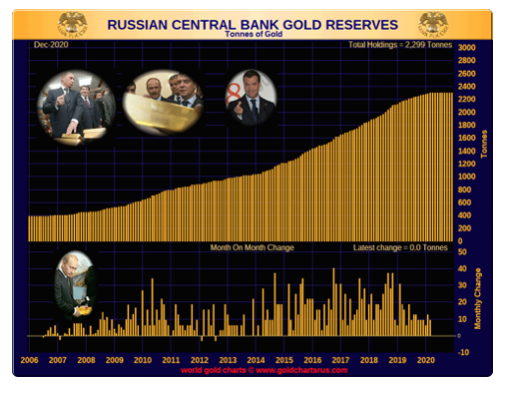

- Russia and China are accumulating gold. Why is the U.S. accumulating a pile of debt instead of stacks of gold?

- American billionaires added over $1 trillion to their wealth in the past year. How much of that “trickled down” to the average American?

- Is the economy strong if nearly one million Americans file for unemployment every week?

- Food prices are rising, the national debt increased by over $4 trillion last year, the Fed created from nothing over $7 trillion, and tens of millions of Americans are unemployed. Is something wrong?

- Do you expect QE and Fed “fake money creation” to stop?

- Why buy over-valued bonds or stocks when you can buy under-valued gold and silver?

THE REAL ISSUES:

- A Bubble Bath: Our financial and debt-based economic system creates bubbles. Bubbles crash, prices collapse, and businesses fail. The bubbles cause many to “take a bath” in the market.

- Deficits, Debt, and Devaluation: Do you expect more of the same or material improvement? If you expect more deficits, debt, QE, unemployment, and business failures, then the dollar will devalue. Consumer prices will rise.

- Gold and Silver: If the dollar continues its 100-year journey toward zero, should you hedge with gold and silver instead of 10-year notes, Tesla, GameStop, and other over-valued stocks?

CONCLUSIONS:

- Too many bubbles! Danger Zone!

- Too little financial and economic sanity!

- Beware of over-valued markets.

- Buy gold. Buy silver. Wait for a return to sanity.

- Sleep well!

Miles Franklin will recycle dollars from over-valued stocks and bonds into real money—gold and silver. Call 1-800-822-8080.

Gary Christenson