The gold miners’ stocks collapsed into mid-May, exasperating contrarian traders. Plunging gold stocks were amplifying a sharp gold selloff, which was driven by heavy gold-futures selling fueled by a monster US-dollar rally. That anomalous carnage gutted sentiment, leaving this sector grinding along near lower support and mired in herd bearishness. But that major drawdown reloaded the gold stocks for big upside.

While deeply out of favor now, the gold miners’ stocks were faring well and gaining popularity before that recent drubbing. That was readily evident in the GDX VanEck Gold Miners ETF, which has long been this sector’s leading benchmark and trading vehicle. The gold stocks were thriving into mid-April, with GDX up a strong 27.6% year-to-date. That trounced the flagship S&P 500 stock index, which fell 7.9% in that span.

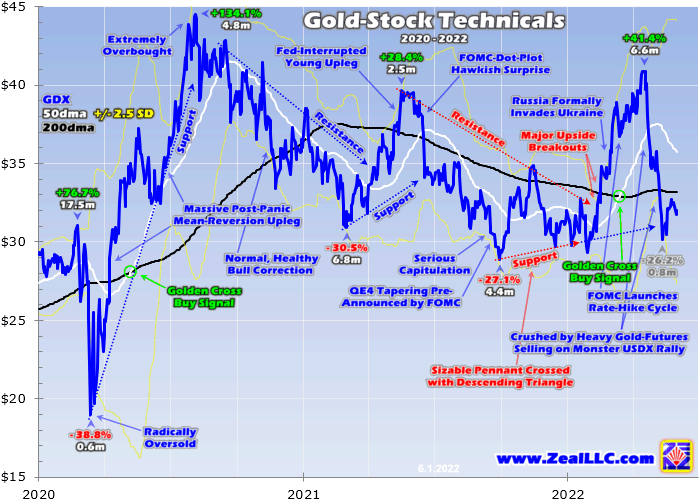

Those excellent 2022 gains were part of a larger GDX bull-market upleg, which extended to +41.4% over 6.6 months. Yet that was still small compared to GDX’s previous five uplegs during this secular bull, which averaged awesome 85.0% gains! This latest young upleg had lots of room to run, buttressed by strong spring-rally seasonals into late May. But then everything went pear-shaped, utterly derailing that upleg.

Vexed traders capitulated and fled, abandoning this high-potential sector. But the causal chain of market events slamming gold stocks was exceedingly-unusual, has fully run its course, and was so unique that it can’t be repeated. So that anomalous sector setback has created fantastic buying opportunities in now-battered gold stocks. The Federal Reserve was the culprit behind GDX plunging 26.2% in just 18 trading days!

The Fed just executed its most-extreme policy shift ever in its century-plus history! Back in March 2020 the S&P 500 plummeted 33.9% in just over a month, in a full-blown stock panic over pandemic-lockdown fears. Dreading a resulting economic depression, Fed officials freaked out. Their Federal Open Market Committee slammed its federal-funds rate to zero, and redlined its monetary printing presses to crazy extremes.

The Fed kept that zero-interest-rate policy in place until mid-March 2022, when it launched a new rate-hike cycle. Way more importantly, the Fed also ballooned its balance sheet by an insane 115.6% or $4,807b over just 25.5 months into mid-April 2022! Effectively more than doubling the US monetary base in just a couple years, that radically-unprecedented quantitative easing spawned today’s raging inflation.

Vastly-more money conjured out of thin air was injected into the system, which soon started chasing and bidding up the prices on far-slower-growing goods and services. Legendary American economist Milton Friedman warned in 1963 that “Inflation is always and everywhere a monetary phenomenon.” Last year as reported headline inflation mounted and grew red-hot, Fed officials realized they had to reverse course hard.

So they started jawboning about a coming rate-hike cycle and slowing QE4’s epic money printing. Their tightening talk has only grown more aggressive this year, peaking between mid-April to mid-May when the gold stocks plunged. It has profoundly impacted the entire financial markets, nearly bludgeoning the S&P 500 itself into a new bear. The US stock markets plunged 18.7% at worst from early January to mid-May!

Just two days after hitting an all-time high as 2022 dawned, heavy selling erupted after minutes from the FOMC’s mid-December meeting. They revealed Fed officials were already discussing soon ramping up quantitative tightening to destroy some of QE4’s vast torrents of money printing. Removing the majority of that from the system is probably the only way to stake this inflation beast, but bearish for QE4-levitated stocks.

Fed officials’ hawkish jawboning grew more extreme as 2022 marched on, crescendoing in that mid-April-to-mid-May timeframe when gold stocks were gutted. After hiking the FFR just 25 basis points off ZIRP in mid-March, Fed officials wanted to convince traders that hiking pace needed to accelerate dramatically to fight red-hot inflation. So they increasingly forecast bigger 50bp hikes, and markets feared huge 75bp ones!

The FOMC indeed hiked a half-point at its next meeting in early May, its first 50bp rate hike dared since May 2000 which helped burst the dot-com bubble. In his subsequent press conference, the Fed chair warned “there’s a broad sense on the Committee that additional 50-basis-point increases should be on the table for the next couple of meetings.” This tightening cycle is shaping up to be the fastest since the late-1980s!

Piling on the epic hawkishness, QT jawboning was extreme too. In early April the Fed vice-chair gave a speech calling for bigger-and-faster QT, “I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly-larger caps and a much-shorter period to phase in the maximum caps.” The Fed’s original QT1 gradually ramped from $10b per month to $50b over an entire year.

At that same wildly-hawkish early-May FOMC meeting where the Fed hiked 50bp and promised a couple more half-point jumps soon, it revealed QT2. That would start at $47.5b of monthly bond runoffs in this current June, and double to $95b monthly just three months later in September! QT has never before been attempted at this scale, and QT1 was prematurely killed soon after hitting terminal velocity in Q4’18.

The Fed caved on unwinding QE1, QE2, and QE3 with QT1 because the S&P 500 plunged 19.8% to the verge of a new bear market. QT1 only unwound 22.8% of those earlier QE money-printing campaigns, a far cry from the half-unwind Fed whisperers predicted when QT1 launched. But with inflation raging, the Fed pegged QT2 at nearly-double QT1’s final monthly pace blasting to full-steam in just a quarter of the time!

The crucial takeaway for gold stocks is the Fed has never before done such an uber-hawkish hard pivot in its entire century-plus history! A big FFR hike with more promised soon combined with big QT monetary destruction at wildly-unprecedented levels is something never before witnessed. And Fed officials can’t repeat the extreme shock of rapidly transitioning from ZIRP and QE4 to this new tight monetary regime again.

This recent epic Fed hawkishness didn’t directly hammer gold stocks lower, as they really don’t care what the FOMC is doing. All that matters to the gold miners is the price of gold, which is influenced by the Fed’s machinations. The primary driver of gold’s short-term price action is leveraged gold-futures trading. Low margin requirements enable huge leverage around 25x+, which is crazy-risky necessitating a myopic focus.

As gold has been the ultimate global currency for millennia, gold-futures speculators watch the fortunes of the US dollar for their main trading cues. When the dollar rallies, they usually sell gold futures which has an outsized impact on gold’s price due to their extreme leverage. The US dollar in turn is heavily affected by the FOMC’s monetary-policy direction, as interest-rate differentials are important in world currency trading.

So gold stocks follow gold, which is often slaved to leveraged gold-futures trading, which usually runs inverse to the US dollar, which is very dependent on what the Fed is doing! This casual mechanism is the sole reason gold stocks were eviscerated in that month between mid-April to mid-May. This multi-year GDX chart for perspective and scale really illuminates how violent that Fed-spawned gold-stock plunge proved.

The leading US Dollar Index benchmark for this world reserve currency started marching higher in mid-January as new-rate-hike-cycle Fedspeak mounted. The USDX shot up again into early March on safe-haven buying after Russia invaded Ukraine, but stalled for the rest of that month consolidating its gains. Then the USDX started rallying solidly again in early April, but not fast enough to shake loose gold-futures selling.

Although the USDX surged a strong 5.3% higher between mid-January to mid-April, that didn’t faze the gold-futures speculators. Goosed by Russia’s war against Ukraine, gold surged 8.5% higher during that exact span! The major gold stocks dominating GDX amplified that mightily to a hefty 30.2% gain! That made for great 3.6x upside leverage to gold, better than GDX’s usual 2x-to-3x range on material gold moves.

Everything was awesome in contrarian-land until a catalytic inflation report in mid-April. That latest March print of the US Consumer Price Index came in up a red-hot 8.5% year-over-year! That was its fastest rise since December 1981, a scary 40.3-year high underscoring the first inflation super-spike since the 1970s is underway. The next day the wholesale Producer Price Index shot up a record-for-this-iteration 11.2% YoY!

So market-implied rate-hike expectations started to soar, and Fed officials upped the hawkishness of their jawboning. The USDX started nearly shooting parabolic that day, as gold closed at $1,977 while GDX neared its $40.87 upleg high. Over the next month between mid-April to mid-May, the USDX rocketed another incredible 4.9% higher! That’s a monster surge in the usually-glacial world of major currencies.

That huge dollar rally peaked at an extraordinary 19.4-year USDX secular high in mid-May! How often does the US dollar rocket vertically on the most-extreme Fed-tightening pivot ever? Only once, this event was unique in market history. With the dollar blasting stratospheric, those hyper-leveraged gold-futures speculators ran for the exits dumping huge amounts of long contracts while ramping up their downside bets.

Their aggregate trading is only reported weekly in the famous Commitments-of-Traders reports, which are current to Tuesday closes. Over five CoT weeks from mid-April to mid-May, speculators sold a massive 59.8k long contracts and short-sold another 21.4k! That added up to enormous gold-equivalent selling of 252.6 metric tons, far too much for markets to absorb so fast. That pummeled gold prices sharply-lower.

Gold dropping 8.4% to $1,811 in that single wild month scared gold investors, who are mainly momentum players. So they soon started selling in sympathy, as evident in the combined holdings of the dominant GLD and IAU gold ETFs which are the best high-resolution proxy for global investment demand. From mid-April to mid-May those holdings shrunk 3.6%, which spewed another 59.1t of gold into world markets.

All that heavy gold-futures and gold-ETF-share selling hammering the yellow metal is the sole reason GDX plunged 26.2% within that same month-long span. That was a brutal kick in the teeth for gold-stock speculators and investors, slamming the miners’ stocks low enough to trigger a frustrating mass-stopping in mid-May. Cascading capitulation-like selling tripped even loose trailing stops, forcing out most traders.

While gold’s 200-day moving average which is major bull-market support largely held, GDX knifed down right through its own 200dma. The gold stocks didn’t find their own support until a lower zone extending from a big technical chart formation they broke out above earlier this year. That serious drawdown was challenging to weather psychologically, but it was bound to be short-lived. Market extremes never last long.

Once they set expectations for a series of consecutive big 50bp rate hikes and the biggest-and-fastest-ramping quantitative tightening ever attempted, Fed officials had to have hit peak-hawkishness. The lower their aggressive tightening batters stock markets into serious bear territory, the greater the odds the resulting negative wealth effect will spawn a severe recession or even a devastating full-blown depression.

And that wildly-overbought US Dollar Index can’t shoot parabolic to multi-decade highs for long. In fact it already started rolling over hard since cresting in mid-May. And despite their extreme leverage, the gold-futures speculators’ capital firepower is limited and finite. They can only do so much selling before they exhaust their longs to dump. Their heavy selling already reversed to buying in the latest CoT into late May.

The gold bounce that fueled already turned around identifiable investment-capital flows since mid-May as well. Those combined GLD+IAU gold-ETF holdings surged 21.7t higher in one week, already unwinding 3/8ths of their big mid-April-to-mid-May draw. And if gold is poised to mean revert higher and resume its interrupted upleg with the Fed’s hawkish shock passed, the gold stocks will follow it up amplifying its gains.

The gold miners’ fundamentals remain strong, making their anomalously-pummeled stock prices major bargains today. In mid-May as gold and gold stocks were bottoming, I analyzed the new Q1’22 operational and financial results they just reported. The GDX-top-25 gold miners dominating this sector earned hefty profits. Those should surge even higher later this year on expected better production and lower costs.

Gold’s own outlook remains incredibly-bullish too. Thanks to this profligate Fed’s extreme QE4 money printing, we are already in the first inflation super-spike since the 1970s which suffered two of them. Gold soared 196.6% higher during the first, which ran 30.0 months into a 12.3%-YoY CPI peak in December 1974! Then gold skyrocketed 322.4% in the second, that crested at a 14.8% CPI in March 1980 after 40.0 months!

Gold ought to at least double in today’s inflation super-spike after the Fed more than doubled the US money supply. And contrary to gold-futures speculators’ irrational paranoia, Fed-rate-hike cycles have actually proven bullish for gold. There have been a dozen before today’s in this modern monetary era since 1971. Through the exact spans of all twelve prior ones, gold averaged impressive 29.2% gains!

In eight of those where gold rallied after entering them relatively-low, its average gains soared to 49.0%! And in the other four where gold fell, its average losses were an asymmetrically-small 10.5%. Gold tends to thrive during Fed-rate-hike cycles because they are so darned bearish for stock markets. Sustained selling in bears naturally boosts gold investment demand for prudently diversifying stock-heavy portfolios.

So that anomalous gold-stock plunge from mid-April to mid-May effectively reloaded gold stocks for more big upside! Their prices were battered back down to major support from which their last prematurely-truncated upleg launched. That offers traders a rare second chance to deploy in this high-potential sector before it powers much higher. Raging inflation and a Fed-tightening-driven stock bear are super-bullish for gold!

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful. All 1,296 newsletter stock trades realized since 2001 averaged outstanding +20.0% annualized gains! While we suffered a mass-stopping during gold stocks’ recent plunge, we’ve rebuilt our trading books with cheap fundamentally-superior mid-tier and junior gold and silver miners to ride their coming upside. Subscribe today and get smarter and richer!

The bottom line is the Fed just reloaded gold stocks for another big run higher. Their latest bull upleg was interrupted by the Fed’s most-extreme hawkish pivot ever witnessed. Fed officials transitioned into a big-and-fast new rate-hike cycle, and launched the most-aggressive QT monetary destruction ever attempted! That ignited a monster US-dollar rally which unleashed heavy gold-futures selling, slamming gold sharply-lower.

But that anomalous market event is already reversing, with the dollar rolling over and gold recovering on resuming buying from both gold-futures speculators and investors. The Fed’s shock-and-awe tightening jawboning has passed. Higher gold prices are very bullish for these battered gold stocks, which already have great fundamentals. So they are likely to rebound strongly as gold resumes powering higher on balance.

Adam Hamilton, CPA

June 3, 2022

Copyright 2000 - 2022 Zeal LLC (www.ZealLLC.com)