Well done, Rick, for highlighting the crux of markets today. On May 19, the Ten-Year Note broke a triple top to new highs and we were off to the races with our mutual 5.5 % target, which broke several boutique banks parking capital in Treasuries. Long-term T-Bonds now target an even more ferocious 6.75%. Having conjured some $14 Trillion in M1 deposits since 2020 to fight debt default deflation of $294 Trillion in unfunded US debts and liabilities, it's no surprise there are bond vigilantes who don’t quit but get less vocal.Not everyone kens the contracting market signal of M2 savings losing over a trillion in the past year to monetary heaven (or is it hell?) Any wonder, then, that BRICS sell US Treasuries and plan gold-backed currencies while Western banks salivate for central bank digital control fiat with endless war profits on passive populations?

Trafficking

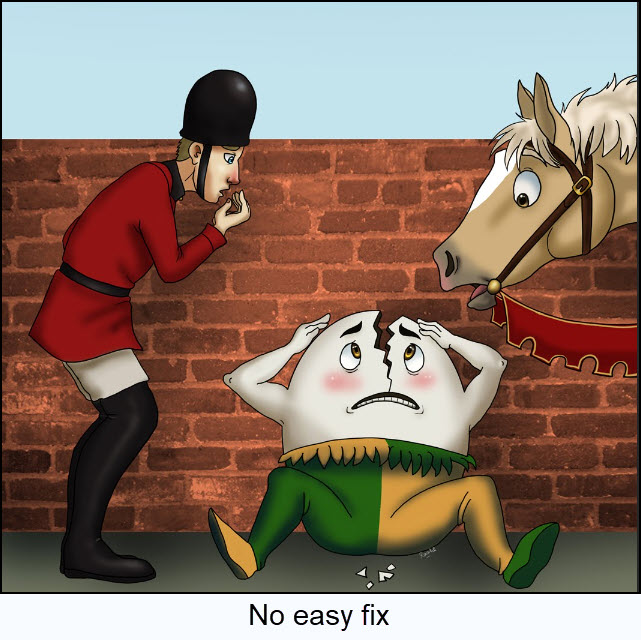

Are the millions of military age men and trafficked children finally on the border political-radar with [the smash-hit movie] Sound of Freedom? Are political candidates really ready to bomb the cartels? Martin Armstrong blames neocons running Uncle Joe and thinks markets may not resolve until 2032 after war demands drive Jim Grant’s predicted decades-long bear market in bonds. We are not so sure. In any event, energy, food and precious metals remain undervalued assets, while commercial/residential real estate and their mortgages (a.k.a. death pledges) decline and default with little media awareness yet. The Old Testament tells us to retire debts every sabbatical. By that calendar we are at least a Jubilee (7X7 = 49 years) behind. Things getting very interesting indeed. Will all the king's horses and men be able to put Humpty Dumpty back together again?