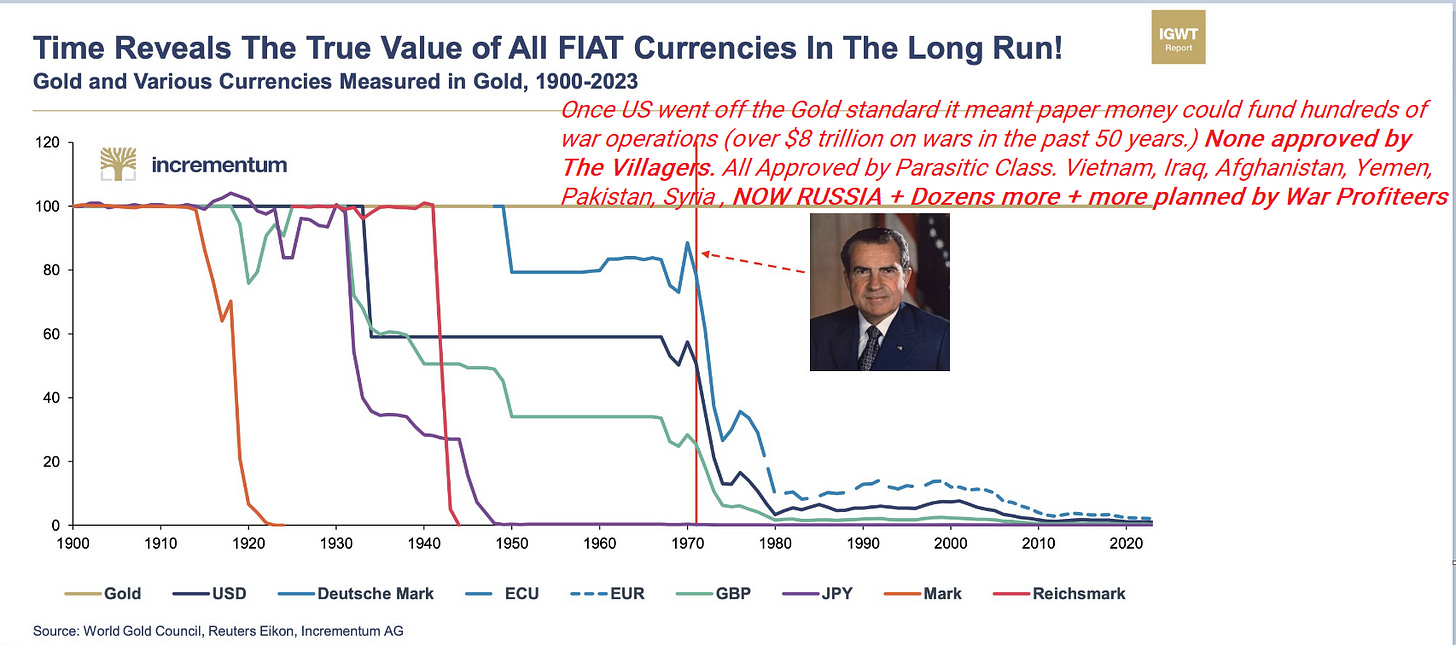

- Introduction - Gresham’s Law

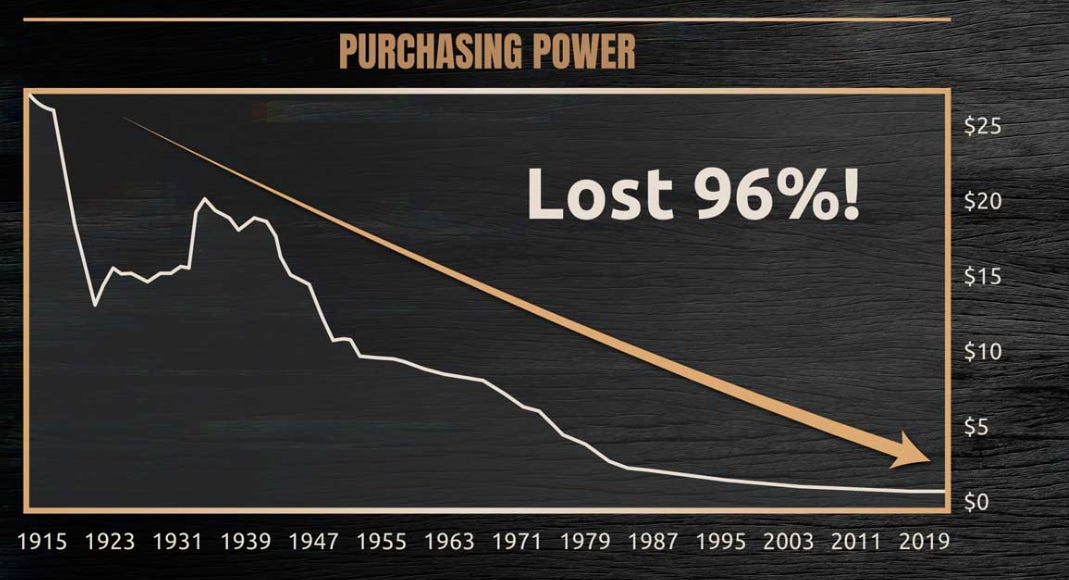

- Delta from appreciation to loss of purchasing power

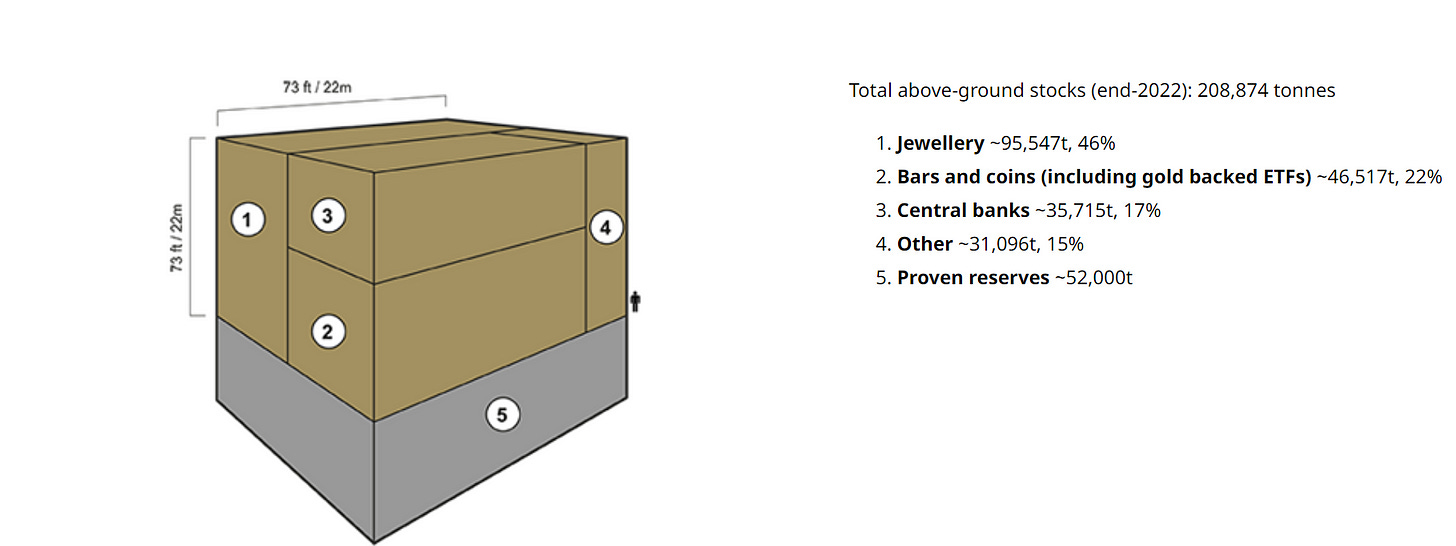

- Above ground gold stocks remain constant over history. Gold mining throughout history occurs only when it is profitable to mine gold so there is never a surplus or saturation (the opposite of paper money) and throughout history tracks human global population in a steady curve

- Arriving at Fundamental Value of Gold with logic and math

Introduction - Gresham’s Law

Gresham's Law states that the bad money pushes out the good money from circulation. This is playing out live today for those paying attention.

Recent Historical Example Here in USA

In the mid-1960s, the US Mint, under the direction of the Department of Treasury and Federal Reserve, removed silver from dimes, quarters, and half dollars. Once they introduced the copper-clad equivalents (debased), the good money (silver coins) started being collected by the people paying attention (it took a while), and as the inflation of the 1970s intensified, all the silver coins were almost entirely out of circulation (into private collections) leaving only the copper clad substitutes for silver.

Result

Today, one dollar grouping of these pre-1965 silver-based dimes, quarters, and half dollars is worth between $18 to $20 (in junk silver) whereas the copper-clad (silver substitute) coins are only worth their existing face value of $1. Most importantly, due to the dollar losing purchasing power, this dollar is now worth about 15 cents.

Let's discuss further the difference between 15 cents and 20 bucks.

This gives us further insight into how the Parasitic class F*cks over the villagers by debasing the currency. Moreover, in 99.9% of the cases currency debasement is necessary to pay for unending wars that the villagers would not vote for.

OK, what is the difference between 15 cents and 20 bucks?

- The delta appreciation in magnitude is the change in value expressed as a percentage of the original value.

- To calculate this, we first need to find the difference between the original value and the new value

- $20 - $0.15 = $19.85

- Next, we divide this difference by the original value and multiply by 100 to express the result as a percentage

- ($19.85 / $0.15) x 100 = 13,233%

- Therefore, the delta appreciation in magnitude is 13,233%.

- In other words, the value has increased by 13,233 times its original value.

We can apply this same math to what is going on with the US dollar today.

Gresham's Law on the World Stage

According to the World Gold Council, the above-ground inventory of gold in the world as of August 4, 2023 is estimated to be 208,874 tonnes.

This includes gold in all forms, including jewelry, bars, coins, and central bank reserves. The breakdown is as follows:

- Jewelry: 95,547 tonnes.

- Bars and coins (including gold-backed ETFs): 46,517 tonnes.

- Central banks: 35,715 tonnes.

- Other: 31,096 tonnes.

There are 32,150.75 troy ounces in a metric tonne. To convert from metric tonnes to troy ounces, you can use the following formula:

- Troy ounces = metric tonnes multiplied by 32,150.75

- 32,150 (Troy ounces per Metric Tonne) multiplied by 208,874 equals 6,715,299,100 (Troy Ounces of Gold in above-ground stocks.)

- So there are 6.7 billion troy ounces of gold.

- Global debt has reached 307 trillion.

Fundamental Value of Gold

- 307 trillion divided by 6.7 billion Troy ounce of Gold equals $45,821 per Troy Ounce.

- Today’s paper price of Gold is $1,829 per ounce (denominated in US dollars losing value at alarming rate)

- 45,821 is 25 times greater than 1828.

- We can find this out by dividing 45,821 by 1828

45821 / 1828 = 25

Fact Checking Pixy

- recall earlier in this article I stated Gold inventories track World population. 6.7 billion troy ounces above ground Gold.

- 6.7 billion troy ounces is equal to 7.4 billion ounces

- As of October 4, 2023, the estimated world population is 8.1 billion people

- Thus Pixy is within the margin of error

- Invest accordingly