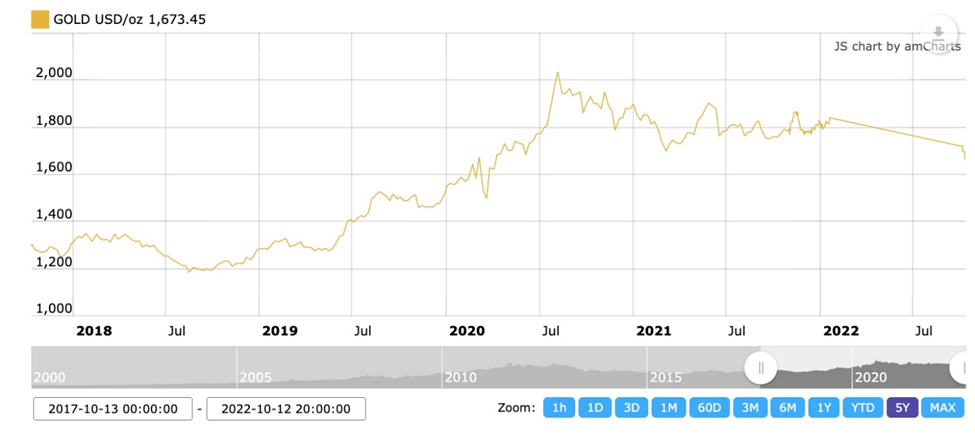

This year has seen a correction in the gold price, commensurate with rising interest rates/ bond yields, and the spectre of more to come. The precious metal has also been hammered by a strong US dollar, which is negatively correlated to the gold price.

Spot gold has fallen from $1,801.40 at the start of the year, to $1,666.45 currently, a drop of 8%. On Sept. 15, gold plunged to its lowest level since April, 2020, on expectations of a 0.75% interest rate increase by the Federal Reserve, which happened on Sept. 21.

Source: Kitco

Source: Kitco

In fact the Fed has raised interest rates an astounding five times this year, to combat 40-year high inflation. The CME FedWatch Tool expects at least another 0.75% increase when the Federal Open Market Committee meets in early November.

Gold investors are being warned the gold market could continue to struggle through year-end as higher interest rates support the US dollar.

“The longer the Fed continues on its current path, the longer that a strong dollar will depress the gold price,” commodity analysts at Heraeus Precious Metals wrote in a report. Also weighing on gold is the fact that the markets keep pushing out any “Fed pivot”, referring to a shift from monetary tightening to easing, as a result of poor US economic performance and/or the widely anticipated recession. According to Kitco News, the markets don’t see a pivot until the end of 2023.

But it’s not all gloom and doom for the gold price. In our last article, we identified three new trends pointing to light at the end of a tunnel: investors bailing on US Treasuries; a shift in gold-buying from Western markets to Eastern/Asian; and the fact that we appear to be at a point in the “gold cycle” just before gold turns upward.

The gold cycle has been repeated several times over the past few decades, and we see a fundamental shift happening again, as global growth grinds to a halt and the Fed’s tightening efforts fail, resulting in recession. History tells us that gold does well during economic downturns and particularly in stagflationary environments.

The Great Stagflation 2.0 and gold

For these reasons, and others, we are supportive of gold going forward. The “others” include the following:

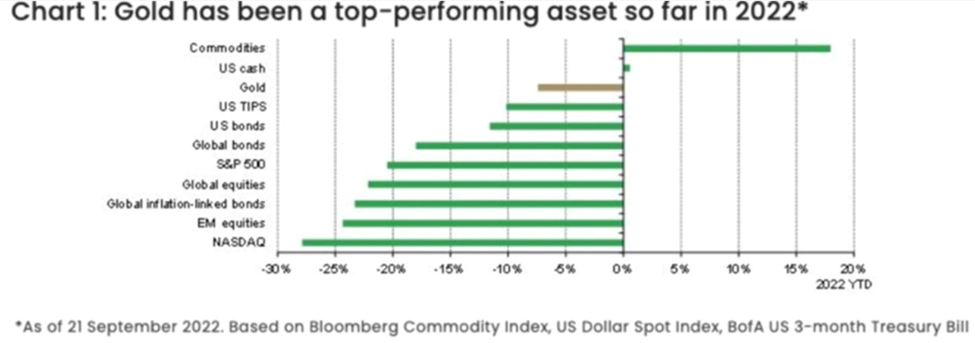

- When weighed against other asset classes, gold has actually been one of the better performers of 2022. Gold has outperformed US bonds, foreign bonds, the S&P 500, foreign stocks, the NASDAQ, and US Treasury Inflation-Protected Securities (TIPS). The only things that have outperformed gold are commodities, especially oil and agricultural goods, and the US dollar.

This is confirmed in the chart below by the World Gold Council.

- Soaring bond yields indicate that investors think the Fed will do whatever is necessary to bring down inflation, and will succeed, without crashing the economy. But, once the Fed can no longer deny that it’s wrong about being able to control inflation, and that the economy is weaker than they think, it will go back to loose monetary policy, i.e., quantitative easing (good for gold).

- In the meantime, other central banks are playing catchup. The ECB for example has gotten more aggressive in its inflation fight. The World Gold Council argues this will begin to curb dollar strength, as the value of other currencies rise. Longer-term, dollar dominance continues to erode.

How much longer can the dollar trade last? – Richard Mills

- Positioning in gold futures has turned net short again and this, historically, has not lasted long — often mean-reverting in subsequent weeks. At the same time, central bank demand for gold remains quite strong. The World Gold Council said central banks added 20 tons to their net gold holdings in August, making it the fifth straight month of additions. Finally, as recessionary and geopolitical risks increase, investors may shift to more defensive strategies, looking for high-quality liquid assets such as gold to reduce portfolio losses. Given these factors, the World Gold Council said it is optimistic that gold’s headwinds may start to subside, but that supportive factors will remain, “thus encouraging demand for gold as a long-term investment hedge.”

- Global leading indicators are turning down, hard. The United States is already technically in recession, and China may not be far behind. Corporate profit margins are under downward pressure from a toxic mix of rising input costs and tepid demand.

- The US government would be forced to default on its $31 trillion debt if it actually let interest rates rise high enough (say, 7.5%) to bring inflation down to 2%.

2% inflation target blinding the Fed to economic reality

- Although nominal interest rates have been climbing since March, real rates remain negative because inflation is so high (3.25% – 8.3% = -5.05%). Historical charts prove that practically every time yields fall below the rate of inflation, i.e. they turn negative, gold goes up.

- The yield curve has inverted 28 times since 1900, and in 22 of those times, a recession followed. The yield curve (the difference between the 2-year and the 10-year Treasuries) has been negative since July 8. On average historically, a recession occurs 11 months after the yield curve inverts, meaning we may not be far away from the Fed pivot that results in a tremendous upswing for gold.

I see us going into a rising gold price environment and historically the greatest leverage to an increasing gold price is a quality junior. Below are three gold exploration companies I’ve been following closely. If you agree with my thesis that we are about to undergo a fundamental shift in the gold cycle, I recommend you take a close look at them.