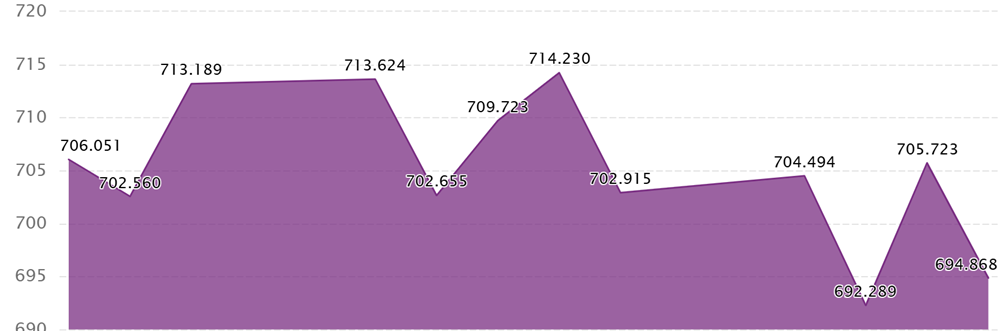

Iron ore prices are anticipating more Chinese stimulus at the upcoming 14th National People’s Standing Committee, scheduled to meet Nov. 4-8. This is despite a pullback in prices earlier this week.

Hexun Futures, via Finimize, attributes these short-term gains in ferrous metals prices to China’s fresh economic policies.

According to Trading Economics, markets expect a stimulus package of up to USD$7.19 trillion as China struggles to achieve full-year growth targets.

China is by far the leading iron ore importer followed by India. The United States is fourth.

In late September China’s central bank lowered interest rates and injected liquidity into the financial system to achieve a 5% growth target.

Reuters reported Shanghai and Shenzhen are planning to lift home purchase restrictions, joining a long list of smaller cities that have done so to ease a years-long property crisis. China plans to issue sovereign bonds worth about $284.43 billion this year as part of fresh fiscal stimulus, Reuters said. Finally, the central bank cut the reserve requirement ratio by 50 basis points to encourage lending.

Analysts quoted by Finimize note a 1.1% bump in daily crude steel production at major Chinese steelmakers, hitting 2.7 million tons a day. Yet, higher steel mill inventories signal demand bumps, especially with northern China prepping for winter. Meanwhile, steel-related commodities like coking coal and coke are gaining traction, driven by expected fiscal boosts at China’s upcoming legislative meeting.

Deutsche Bank earlier this month brushed aside signs of oversupply in the iron ore market, with Financial Review reporting that China’s stimulus package, expected in early November, could make prices of the steelmaking ingredient soar to $130/tonne in 2025.

Meanwhile, iron ore shipments to China are continuing apace, despite steel output slipping. The country is likely to import a record 120 million tonnes in October, a hefty increase from 104.1Mt in September and smashing the previous record of 112.7Mt in July 2020.

China’s steel output for the first nine months of 2024 was down 3.6% from the same period in 2023. Whether the drop in steel output can be lifted to show an increase in the next few months largely depends on whether steel mills see rising demand on the back of Beijing’s stimulus efforts, Reuters said.

Steel-consuming megaprojects

Iron ore bulls discouraged by the price drop from the January 2024 peak of $145 per tonne to its current $104 will be heartened by recent news out of Saudi Arabia.

According to Newsweek, a massive construction site known as Neom is currently using 20% of the world’s steel and it will likely be the largest steel customer over the next few decades.

Newsweek reportsNeom is a 10,200 sq mi area in northwest Saudi Arabia that has been turned into the world’s biggest construction site as an urban living megaproject launched in 2017 by Crown Prince Mohammed bin Salman is underway.

Newsweek reportsNeom is a 10,200 sq mi area in northwest Saudi Arabia that has been turned into the world’s biggest construction site as an urban living megaproject launched in 2017 by Crown Prince Mohammed bin Salman is underway.

Its flagship development is the horizontal city The Line, which will stretch across 105 miles with the ability to house 9 million people. Other projects include a winter resort called Trojena, 12 luxury resorts called Magna, the Sindalah Island Resort, and a planned industrial city called Oxagon.

The publication quotes Dr. Andrzej Kotas, a steel industry consultant with over 20 years of experience, saying that this is a “colossal amount” of steel for one construction. Even large transnational oil and gas pipelines pale in comparison to Neom’s 20% of global consumption.

“It leaves anything else absolutely way behind, really,” he told Newsweek.

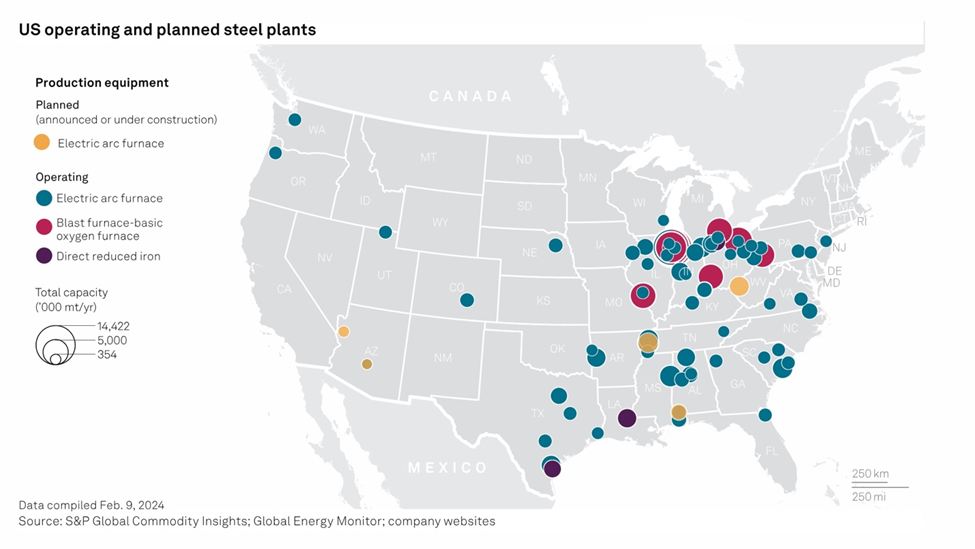

Meanwhile, a US law aimed at boosting computer chip manufacturers is providing a lift to steelmakers supplying the construction industry, S&P Global reported back in March:

The US CHIPS and Science Act, signed into law in August 2022, includes over $50 billion in direct incentives for activities including semiconductor manufacturing, with a 25% investment tax credit for capital expenses…

The law’s effects on the domestic steel industry are expected to be relatively brief as factories get built, but steelmakers see longer-lasting benefits on the horizon via two other laws passed during the Biden administration: the Bipartisan Infrastructure Law and the Inflation Reduction Act. The two laws are expected to drive further industrial construction while also increasing the production of electric vehicles and other specialty items, broadening the benefits to more of the steel industry.

Conclusion

Iron ore, like copper, is a bellwether metal that rises and falls according to new construction orders and economic growth. The fact that so many megaprojects are in the works bodes well for the price of iron ore, a key ingredient in steel, along with metallurgical coal.

With China poised to pass a $7 trillion stimulus package aimed at growing the economy, along with all the other measures introduced in September to improve its sagging property market, demand for iron ore, including 20% of the world market taken by one project in Saudi Arabia, is only likely to grow stronger.