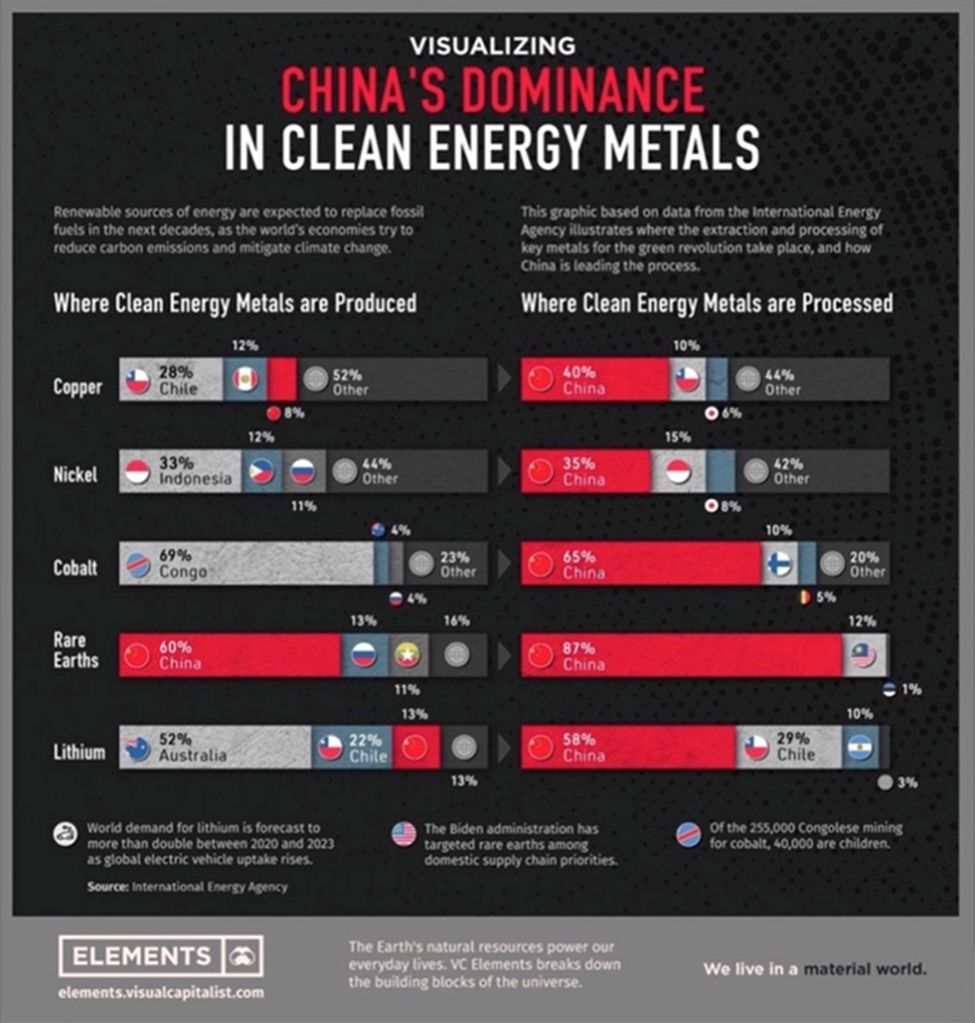

For decades, China has dominated critical minerals, with Canada and the US, among other nations, all too willing to let Beijing do the mining and/ or processing and sell the end-products.

Source: Visual Capitalist

Fighting back

But Washington has finally begun to recognize its critical minerals vulnerability.

The movement to lessen dependence started in 2019 under then-President Donald Trump. Trump authorized the Pentagon to utilize funding available under Title III of the Defense Production Act (DPA) — a tool established during the Cold War to ensure the US could secure goods needed for national security — to support the re-establishment of a US rare earths supply chain.

In 2022, a bipartisan group of senators led by Alaska’s Lisa Murkowski and West Virginia’s Joe Manchin wrote to President Joe Biden urging him to authorize the Pentagon to tap into DPA funds to bolster domestic supplies of other critical minerals. The request resonated with President Joe Biden, who used the DPA authority to designate battery minerals and metals – graphite, lithium, nickel, manganese and cobalt – as “essential to the national defense.” For all the partisanship pulling Washington apart, an emerging consensus on critical minerals – and the dangers of Chinese dependency – began to take shape.

The result: a bipartisan understanding that China is “the enemy”, with both Democrats and Republicans supporting legislation that keeps Chinese goods behind high tariff walls and other restrictive measures.

In fact the US government has committed billions worth of loans and grants to support a domestic critical mineral supply chain — as the country seeks to become more resource-independent and less beholden to China and other countries for minerals critical to a clean-energy future, and to the tech-intensive defense systems that safeguard national security.

China’s latest move

Earlier this week, the Chinese government showed that it isn’t waiting for the Trump administration to take power in January 2025, to get an edge in the coming trade war.

Beijing announced on Tuesday it is banning exports to the United States of several critical minerals and further tightening sales of graphite.

The move came after the White House on Monday slapped fresh curbs on the sale of memory chips made by US and foreign companies to China, said Bloomberg, adding the Biden administration’s goal is to slow China’s development of advanced semiconductors and artificial intelligence systems that may help its military.

The country’s Commerce Department said gallium, germanium, antimony and superhard materials will no longer be shipped to the US.

Bloomberg reported the targeted materials are used in everything from semiconductors to satellites and night-vision googles, but noted China’s sales to the US had already plunged following export restrictions on gallium and germanium announced last year.

However, according to the US Geological Survey, a total export ban on gallium and germanium would deliver a $3.4 billion hit to the US economy. Even that may understate the knock-on impact, as these metals and minerals are embedded in larger technology systems increasingly important to U.S. competitiveness.

Trump and minerals

While Trump has opposed the Biden Inflation Reduction Act and other clean-energy initiatives that are the darlings of progressives, one area that is likely to see a continuance is critical minerals.

According to Benchmark Mineral Intelligence, “Trump voiced his support for domestic mining, which could result in a more profound permitting reform and further financial support for domestic mining projects.”

Recall Trump’s support for coal miners during his first presidential term, and his “drill baby drill” mantra bolstering the oil & gas industry. In 2020 Trump declared a national emergency regarding US dependence on a range of critical minerals.

Trump has already announced that his administration will “pursue a path towards US energy dominance” that will require substantial amounts of minerals, from tungsten in exploration drill bits to copper in electrical transmission lines.

However, according to a recent guest column on Mining.com, fragile mineral supply chains pose a risk to energy dominance; not having sufficient supplies could mean significant delays and may drive up prices. Because many minerals are sourced from a limited number of countries, US energy initiatives are particularly vulnerable to disruptions.

Authors Gregory Wischer and Dr. Shubham Dwivedi declare that the most secure source of energy and minerals is domestic production.

“Ultimately, the pursuit of US energy dominance could coincide with a push for US mineral independence,” the authors conclude.

US manufacturing renaissance

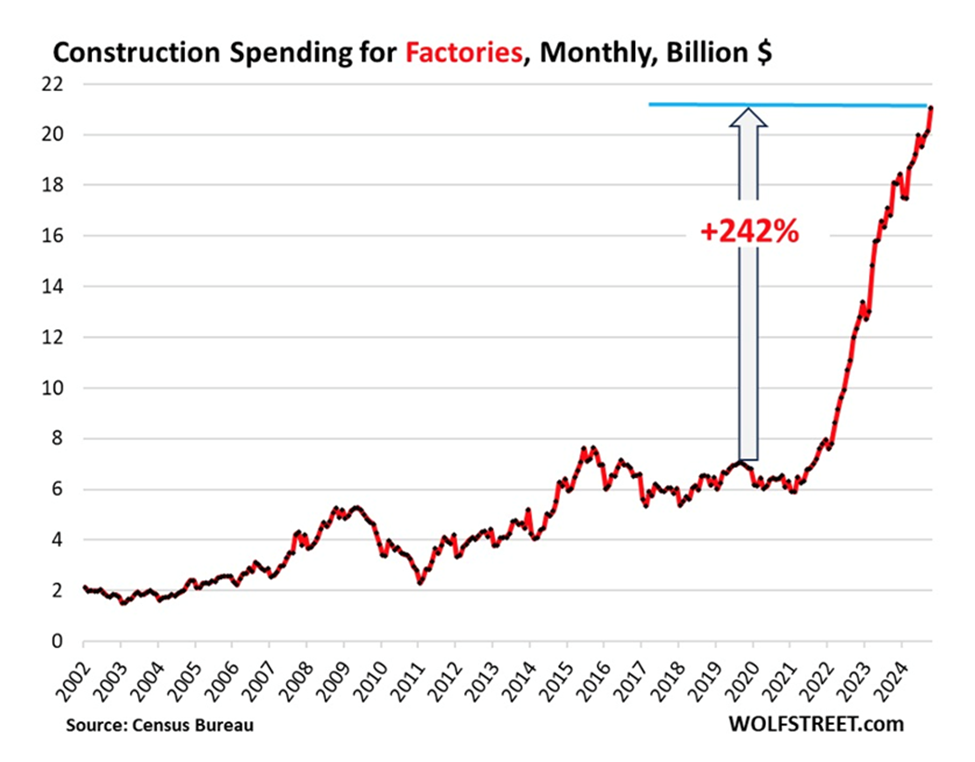

Trump’s push for energy independence and support for the mining side of critical minerals is coinciding with a renaissance and a re-think in US manufacturing. It actually started last year with a total investment of $246 billion.

Where is all this money coming from? You guessed it: the government.

Earlier this week Wolf Street posted an article titled ‘Factory Construction Spending Soars to New Record, +16% YoY, +242% since 2019: Result of Corporate & Strategic Rethink’.

The gist of the story is that the Biden administration has been spending billions on manufacturing, but it’s high-tech industry not low-tech.

According to the Census Bureau, investments in the construction of manufacturing plants jumped to a record $21.1 billion in October, up by 4% from the prior month, up by 16.3% from a year ago, up by 177% from the beginning of 2022, and up by 242% since 2019.

The folly of tariffs

Yet all of this, and the mining of critical metals, could be undermined by Trump’s tariff policy.

A study on the effects of the 2018-19 tariffs shows that US consumers bore most of the cost.

Now Trump is threatening to impose 25% tariffs on all good imported from Mexico and Canada, and 60% from China.

25% tariffs on USD$974 billion worth of trade into the US in 2022 = $243B worth of tariffs Americans will pay extra for.

This isn’t even counting the proposed 60% tariffs on Chinese imports.

How long before we all say enough is enough to America’s bullying and start trading more with others?

In fact many businesses are expected to shift their production to other countries to avoid paying the exorbitant tariffs, states CNN.

Countries likely to benefit from the US-Canada-Mexico-China trade war include Vietnam for low-value goods; nations that can out-compete Mexico on cars, i.e., Japan and South Korea; clothes and shoes from Indonesia, Bangladesh and Cambodia; and Malaysia, Thailand, Vietnam, South Korea and Japan for electronics.

China has already got the ball rolling by building a port in Chancay, Peru that will bypass North America and allow shipments from South America to go directly to China. Chinese imports will flow tariff-free into countries like Peru, Brazil, Ecuador and Colombia. Nearly 150 countries have signed on to China’s Belt and Road Initiative, of which the port is a part.

Two mining industry umbrella groups have come out strongly against the Trump tariffs. The Mining Association of Canada says China’s move to ban exports of raw metals to the US underscores the need for trade cooperation between Canada and its southern neighbor.

“Imposing tariffs on Canadian mineral and metal exports to the US would run counter to the shared goals of secure and reliable supply chains,” Pierre Gratton, the mining association’s president, said in Tuesday’s statement.

More than half of Canada’s mineral exports — valued at more than CAD$80 billion (USD$56.9 billion) — were destined for the US in 2022.

According to Black Press Media:

Michael Goehring, president and CEO of the Mining Association of British Columbia, said Wednesday that China’s decision to ban exports of certain critical minerals and rare earths to the United States demonstrates why it is “vital” for Canada and the U.S. to reduce their dependence on authoritarian regimes for critical mineral supplies and mineral processing…

“B.C. has, or produces, 16 of the 50 minerals the United States has identified as being critical to the nation’s economic and national security. In fact, seven per cent of B.C.’s exports to the US in 2022 were critical minerals and metals, including aluminum, germanium, gallium, indium, lead and zinc.”…

With 17 new critical mineral projects under development, British Columbia can make what Goehring called “a meaningful contribution to North America’s future ”while creating jobs for workers, stability for resource communities and shared prosperity throughout B.C.

Conclusion

China’s restrictions on graphite and other critical metals are making it harder for the United States to obtain the raw materials required for both economic and defense/ military purposes.

Graphite is the ideal material for defense thanks to its unique properties, i.e., it is able to withstand very high temperatures with a high melting point; it is stable at these high temperatures; it is lightweight and easy to machine; and it is corrosion-resistant.

Trump says he supports the mining of critical minerals on US soil but he is threatening to impose 25% tariffs on minerals imported from Canada and Mexico.

Instead of joining forces with countries friendly to its interests, like Canada, the United States is becoming more insular and protectionist at the same time as China is becoming more outward-looking.

While there is little that Canada can do to change Trump’s mind his tariff policy makes greenfield and brownfield mining projects in the United States, free from tariffs, all the more desirable.