At one of his campaign rallies, Donald Trump asked: “Are you better off now than four years ago?” The thunderous “no!” from his audience implies that life under the former president would become more affordable than under Biden.

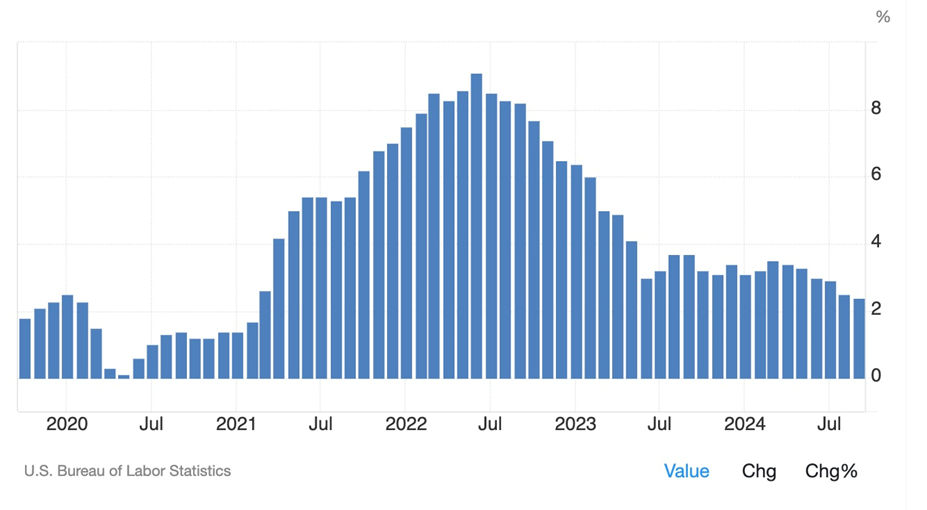

In fact, the economic policies Trump campaigned on, if implemented, threaten to undo the economic progress achieved by the current US Federal Reserve, which for the past four years has been fighting an inflationary spiral that has only recently come down to an acceptable target of approximately 2.5%.

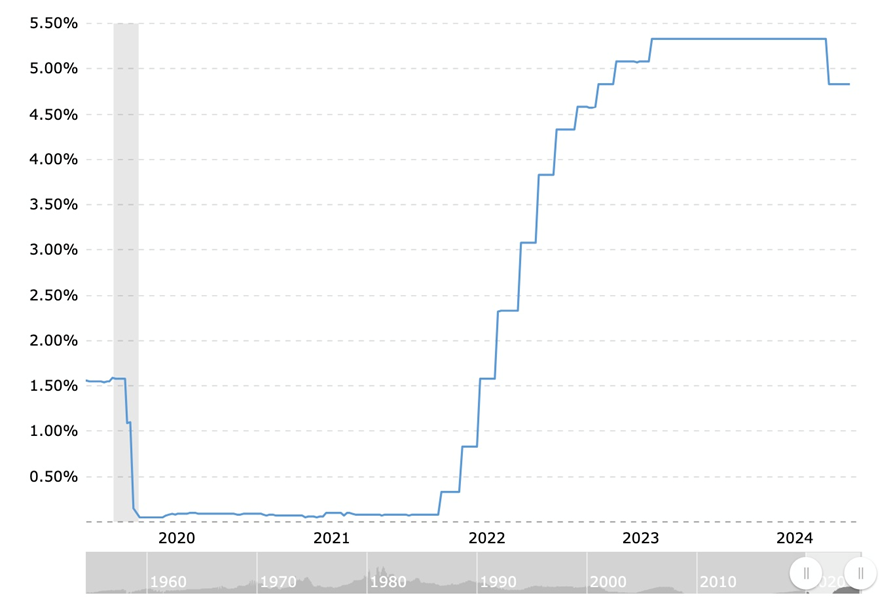

They did it by hiking interest rates, with the Federal Funds Rate climbing from 0.08% in February 2022 to a peak of 5.3% in July 2023, where it stayed until the Fed started cutting rates in September 2024, by 50 basis points that month, and by 25 bp on Nov. 7, as inflation slowed. A report due out this Wednesday is expected to show headline inflation of 2.6%, slightly higher than September’s 2.4% annual gain in prices, which was the lowest reading since February 2021 (Yahoo Finance, Nov. 12, 2024)

Despite the MAGA campaign bluster, the research points to a return to higher inflation and higher interest rates under a second Trump term — the opposite of what voters have been led to believe will happen.

Bond market sell-off

One of the strongest indications that the market thinks inflation will worsen under Trump is the way US Treasury bonds sold off following his election last Tuesday.

This is strange given that bond yields generally fall when the Fed reduces interest rates. But the quarter-point cut last Thursday did nothing to arrest the T-bill selloff.

Bond yields actually started rising in October, as the chart below shows. Yields go up when bond prices move downward.

Source: U.S. Bank Asset Management Group, Bloomberg as of

Source: U.S. Bank Asset Management Group, Bloomberg as of

According to US Bank, beginning in October, a long trend of declining interest rates reduced course. In a matter of weeks, yields on the benchmark 10-year Treasury, which dropped to nearly 3.6% in September, jumped more than 0.5%.

Rob Haworth, the bank’s senior investment strategy director, said the bond market wasn’t so much concerned about inflation, but expectations of stronger economic growth.

Something different happened on Nov. 6. US yields posted sharp gains as the Trump victory triggered caution over deficits (Reuters, Nov. 6, 2024).

The 10-year shot up to 4.479%, its highest since July, on bets that Trump’s economic policies could boost deficits and inflation. The 30-year hit 4.678%, the highest since late May. Last Wednesday, $25 billion worth of 30-year bonds were sold at auction, with the note priced at 4.608%.

As Reuters explains it,

Trump campaigned on a platform of tax cuts, which economists say would juice the economy, widen budget deficits, and increase government borrowing. He also touted tariffs, which analysts expect to stoke inflation and reduce the Federal Reserve’s scope to cut interest rates.

Regarding the latter, traders reportedly reacted to the election results by trimming bets on Fed rate cuts; rates are seen staying above 4% until May 2025.

Bloomberg reported on Nov. 10 that analysts widely expect the federal deficit to worsen under the next Trump administration, with the Committee for a Responsible Budget last month estimating Trump’s plans would increase the debt by $7.75 trillion through 2035.

Trump added $8 trillion to the national debt in his first term.

Bloomberg also noted that October’s losses in the bond market wiped out much of this year’s gains. As for why,

Less than two months after the Federal Reserve started pulling interest rates back from a more than two-decade high, the likelihood that Trump will cut taxes and throw up large tariffs is threatening to rekindle inflation by raising import costs and pouring stimulus on an already strong economy.

His fiscal plans — unless offset by massive spending cuts — would also send the federal budget deficit surging. And that, in turn, has renewed doubts about whether bondholders will start demanding higher yields in return for absorbing an ever-rising supply of new Treasuries.

Morningstar reported that bond investors are concerned that potential Republican tax cuts could widen the already-growing federal deficit. This would mean the government has to sell more bonds to finance the debt, raising the cost of borrowing.

A Bloomberg opinion writer noted the market’s response to Trump’s victory was oddly divergent. While Bill Dudley felt the increase in bond yields was consistent with expectations that the Fed’s short-term interest rate target will bottom out around 3.75%, higher than the 2.9% expected a few months ago, he found the stock market rally “baffling”:

Yes, lower corporate tax rates, deregulation, and higher tariffs could lift profit margins, at least temporarily. But there are ample offsetting negatives, including the effect of tariffs on inflation and of deportations on the supply of labor. Add the 50-basis-point increase in real interest rates since late September and the fact that the Fed will have to take away the punch bowl if the Trump party gets too wild, and equity market valuations seem unduly rich. Investors may live to regret their exuberance.

Barron believes “the outlook for interest rates in 2025 is only becoming less certain. The market is currently pricing in a half-point worth of cuts by June–a month ago they were predicting a full percentage point cut from current levels. The possibility of inflationary Trump policies is perhaps being priced in.

While puzzling at first, Wednesday’s reaction (Fed lowers interest rates by .25) makes sense. The Fed can’t pre-empt Trump’s policies and can only look at the data. Stock markets aren’t missing the future risk–it’s there for all to see as long-term Treasury yields creep higher. Investors are just choosing to seize the day as Trump trades continue to lift sentiment.”

Dollar gaining

No question about it, Trump’s election has been good for the US dollar.

On Monday, Nov. 11, the greenback touched its highest level in a year, with traders betting that Trump’s policies will be dollar-positive and negative for other currencies. For example, on Nov. 13 the Canadian dollar slumped to a USD$0.71, its weakest level since October 2022.

The dollar has gained for six consecutive weeks on expectations of higher economic growth.

MarketWatch

MarketWatch“We see a good chance of substantial dollar strength through next calendar year and potentially into 2026 as well,” said Helen Given, a foreign-exchange trader at Monex, via Bloomberg. “A Trump administration changes the calculus on forecasting in a very material way as domestic policy points to a big spending spree and international policy is likely to be quite protectionist.”

The key though to a higher dollar is what happens to interest rates. Higher rates power the currency higher, as seen in the chart below. The US Dollar Index (DXY) hit a high of 106.22 in April 2024, then sunk to a one-year low of 100.38 following the Fed’s first rate cut in September. It has been moving higher ever since on expectations of a Trump victory and on Wednesday reached a new one-year high of 106.51.

The Economist notes the prospect of higher interest rates has pushed the dollar up 1.5% against a basket of currencies over the past four weeks:

Traders reckon the incoming administration will boost profits at American firms through tax cuts and deregulation, as government borrowing soars. A combination of higher deficits and rekindled inflation, in turn, may force the country’s central bank to keep interest rates higher than it would have without Mr Trump in power. Those higher rates would make holding dollar securities more attractive, providing a tailwind to the greenback.

Metal prices falter

A strong dollar is bad news for commodity prices because those holding non-dollar currencies have to shell out more to buy commodities priced in USD. This dents demand for commodities.

Sure enough, gold fell to around $2,600 an ounce on Tuesday, losing ground for a third consecutive session to its lowest level since Sept. 20, pressured by a strengthening dollar and less demand for safe assets. (Trading Economics, Nov. 12, 2024)

In another sign of gold’s waning appeal, the world’s largest gold ETF, SPDR Gold Shares (GLD), saw an outflow of $1 billion last week, the most since July 2022.

Source: Kitco

Source: KitcoCopper, meanwhile, came under renewed pressure on Monday, Nov. 11, with December futures falling 1.7% to $4.23 a pound. The bellwether metal spiked at the end of September on optimism about Chinese economic stimulus, but is now down nearly 12% since then. (Mining.com, Nov. 11, 2024)

Source: Kitco

Source: KitcoThe site quoted economists at Australia’s Macquarie Bank saying that the potential for a 60% tariff on all imports from China, if combined with broad-based tariffs that restrict trade reshuffling, could reduce China’s exports by 8% and consequently reduce China’s GDP by 2% in 2025. China consumes more than half the world’s copper.

China is by far the leading iron ore importer followed by India. In late September China’s central bank lowered interest rates and injected liquidity into the financial system to achieve a 5% growth target.

A $7.1 trillion stimulus package was expected at the 14th National People’s Standing Committee on Nov. 4-8, but the committee only released $1.4T. The lesser amount weighed on iron ore prices, which fell to their lowest in more than two weeks, on Monday.

Reuters noted a potential hit to the Chinese economy from threatened US tariffs could hurt demand for Australia’s biggest exports to China, iron ore and coal. Citi analysts said additional supply from Simandou in Guinea, incremental supply from Australia and Brazil, and weak demand from Chinese customers at a time when steel producers are trying to reduce their carbon emissions will pressure iron ore prices.

Source: Trading Economics

Source: Trading EconomicsMass deportations inflationary

One of Donald Trump’s principal campaign promises, which clearly found purchase among a large portion of the electorate, was his intention to round up, detain, and deport every undocumented/ illegal immigrant.

The Center for Migration Studies estimates there were 10.9 million undocumented immigrants living in the US in 2022. In New York State alone, there are currently 470,100 undocumented workers. Most have been in the country for over 10 years, so Trump cannot claim that they arrived under the Biden administration.

Just over half come from six countries: Mexico, Ecuador, Guatemala, El Salvador, China, and the Dominican Republic. Among the jobs the undocumented find themselves taking are maids, cooks, home health/ personal care aides, janitors, and delivery drivers.

Forty-two percent of these workers are paid below the minimum wage, and 52% do not receive enough pay to be considered living wages.

Why is this important? Because Donald Trump’s plan to kick out 13 million illegals will not only be expensive — according to the American Immigration Council it could cost $315 billion — it will leave a massive hole in low-wage occupations that average Americans are not accustomed to doing, and frankly will not do unless wages are hiked to at least minimum wage if not a living wage.

Labor shortages could be particularly acute in agriculture and construction. The wage inflation this creates would be huge, and it would trickle down to end products, like houses (mortgages are already soaring after the election) and groceries.

Consider California, which has the highest number of undocumented immigrants in the country. After the undocumented are frog-marched across the southern border, who is going to pick the walnuts, pistachios, berries, and wine grapes, for example?

According to the US Chamber of Commerce, in May 2024 there were 8.5 million job openings, with 6.5 million unemployed people available to fill them. That means with current levels of immigration there are currently, country-wide in the US, 2 million jobs needing to be filled. Trump wants to deport 13 million illegals. If they all leave, that creates another 13 million job openings, adding to the 2 million jobs going begging.

Wages will have to rise for legal-status Americans to take on the work, which naturally, will be reflected in higher food prices. And it’s not just fruit and nut farming but meat processing and packaging too. Slaughterhouses are big employers of the undocumented.

If Americans think grocery prices are high now, wait till the mass deportations begin.

This isn’t counting the cost of tariffs Trump has promised to slap on all US imports — 10% and 20% have been floated as possible blanket duties. Any imported good will suddenly become up to 20% more expensive. Tariffs are paid by the importing company which passes the added costs onto their customers.

The Center for Migration Studies points out the social cost of this mass deportation program:

Implementing Trump’s plan would be a logistical nightmare and social tragedy, with consequences reverberating beyond the deportees and into the lives of over 20 million people living in mixed-status households, including 5.5 million U.S.-born children suddenly missing one or both parents.

Presumably, no effort will be made to keep families in mixed-status households together — those with one parent a legal immigrant and the other parent an undocumented immigrant.

Families will be broken up, creating widespread social unrest that will ultimately spill over into social services. Consider, for example, an undocumented mother with two children. Trump’s plan would force the mom and kids to leave the country. Or, maybe just the mother leaves and the legal immigrant dad stays. He is now a single father forced to bring up two children alone. If the kids are too young to go to school, who is going to care for them while they go to work?

Conclusion

The US workforce includes 7.6 million undocumented workers representing 23% of the total immigrant workforce — all doing jobs that no self-respecting American would consider doing at sub-minimum non-liveable wages, and imo few would take even if wages were to rise.

This is the Achilles heel in Trump’s mass deportation plan, which is expensive to carry out and, as suggested at the top, will have a huge inflationary effect on the supply of labor.

This services inflation will trickle down to goods inflation, including food and housing.

Upon inauguration Trump would immediately start a trade war, effectively imposing up to a 20% tax on Americans who buy imported goods, shutting out Chinese goods, and re-damaging relationships with its trading partners, including the European Union, Mexico, and Canada.

Trump’s plans including tax cuts would add nearly $8 trillion to the national debt, which currently sits at an astronomical $35.9 trillion.

Bond investors are concerned that Republican tax cuts could widen the already-growing federal deficit. This would mean the government has to sell more bonds to finance the debt, raising the cost of borrowing.

Higher interest rates mean higher mortgage rates, higher rates on personal and car loans, and higher credit card interest — all of which hurt the average American.

Until 2026 Trump will be fighting against Fed Chairman Jerome Powell who will just be doing his job by raising interest rates to combat rising inflation, not long after his Federal Open Market Committee voted to lower them amid falling inflation.

When the market sees the Fed taking away the punch bowl of low rates and economic stimulus, the stock market will come under major selling pressure, kicking out the third leg keeping Americans standing.

At which point everyone who voted for Trump will start asking themselves whether life was actually better under Biden.