NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 48th year in the gold business

November 2021

“The lights for the whole world’s economy seem to be flickering.”

Tim Harford, Financial Times

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

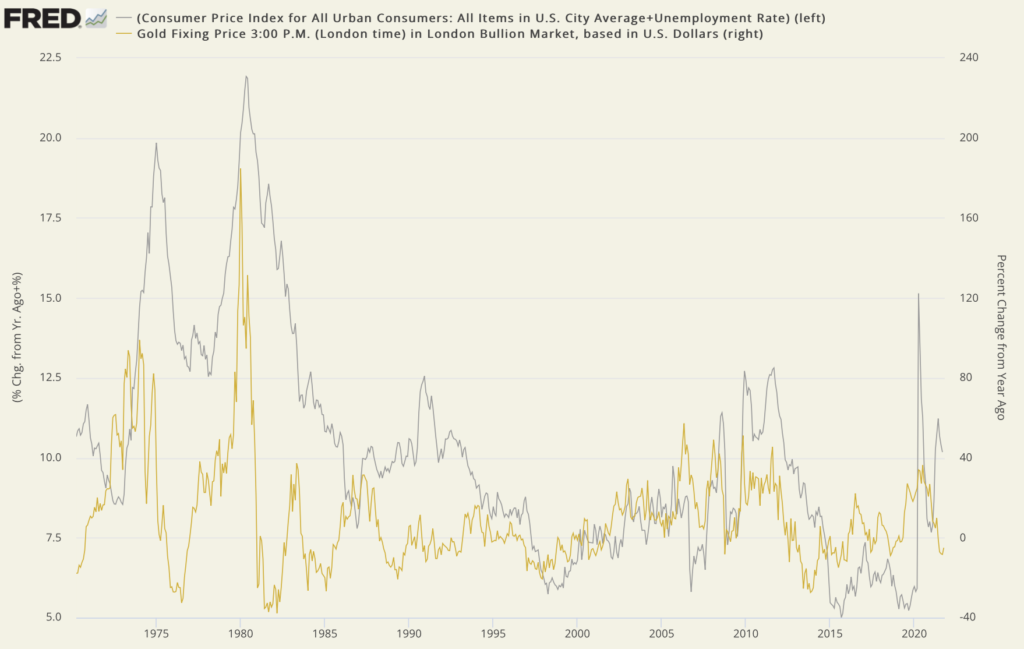

Gold and the Misery Index

Stagflation could force ‘a macro rotation into the precious sector’

Since the launch of the fiat money era in the early 1970s, when economies have gone very wrong, the unemployment and inflation rates have skyrocketed. On the campaign trail in the late 1970s, then-presidential candidate Ronald Reagan added the two numbers together and famously named the result the Misery Index. Subsequently, the Misery Index became the bellwether for stagflation – the combination of economic stagnation and runaway inflation.

Over the past several weeks, with stagflation rising once again to the top of investor concerns, the Misery Index has made something of a comeback. Accordingly, we thought it would be a matter of interest to build a chart showing changes in the index plotted against changes in the price of gold. Though we had an inkling of the result, the uncanny long-term correlation between the two data sets took us by surprise. At a glance, the chart tells the story of gold as a runaway stagflation hedge. The Misery Index nearly doubled in the ten-year period between 1970 and 1980, but gold rose by more than fifteen times. There were instances during the decade when the year-over-year increases in the price of gold surpassed 80%, and in early 1980 it surpassed 175%!

In a certain sense, the U. S. experience during the 1970s was the first of many runaway stagflationary breakdowns following the abandonment of the gold standard in 1971. Subsequently, similar situations cropped up in other nation-states. Argentina (the late 1990s) comes to mind, as does the Asian Contagion (1997), Mexico (1986), and more recently, Zimbabwe (2018) and Venezuela (2013). In each instance, as the Misery Index rose, citizen-investors who took shelter in gold preserved their assets as the crisis moved from one stage of deterioration to the next. In fact, today, gold, not the bolivar, is the preferred medium of exchange in some areas of Venezuela, where stagflation has given way to something even worse – hyperinflation. (Please see ‘Flakes of gold’ below.)

Misery Index and gold

(1971- to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration • • • Click to enlarge

(For a real-time version of the Misery Index-Gold chart, please visit USAGOLD’s Gold Trends and Indicators page.)

Gold glittered during the 1970s stagflation, but it also closely tracked the index more recently during the 2008 credit crisis and the 2020 pandemic-driven breakdown. Curiously, though, it has lagged the surge in the Misery Index over the past year and a half. This divergence probably has to do with Wall Street largely buying into the Fed’s contention that inflation is transitory. That narrative took a direct hit in late October when Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen warned that high inflation could extend into late 2022. If both high unemployment and high inflation do indeed persist – i.e., if the Misery Index once again begins advancing – that lag on the chart might prove to be temporary. MKS Switzerland’s Nicki Shiels advises that a “stagflation would force a macro rotation out of typical reflation assets or commodities like oil and copper, and into the precious sector.”

Top analysts warn of a repeat of the 1970s, perhaps even worse

Noriel Roubini, the widely-followed professor of economics at Columbia University, believes stagflation is in the cards – one perhaps even worse than the 1970s. “Faced with a debt trap and persistently above-target inflation,” he writes in a recent Project Syndicate analysis, “[central banks] will almost certainly wimp out and lag behind the curve, even as fiscal policies remain too loose. … Over the medium term, as a variety of persistent negative supply shocks hit the global economy, we may end up with far worse than mild stagflation or overheating: a full stagflation with much lower growth and higher inflation.”

Similarly, Deutsche Bank analysts warn that “we do think it worth noting that many factors like debt, demographics and globalization all indicate that we could be facing an even more difficult situation than we saw back then.” Last week, Alan Greenspan, who warned of a coming stagflationary crisis almost two years ago, revisited those concerns. “If growth expectations continue to decline and price expectations continue to rise,” he wrote, “we may be heading into a stagflationary environment as increased supply-side costs erode consumer purchasing power and, ultimately, final demand.”

Hedge fund guru Paul Tudor Jones put it a bit more bluntly in a recent CNBC interview: “The inflation genie is out of the bottle,” he said, “and we run the risk of returning to the 1970s.” Over this past weekend, the Wall Street Journal’s editorial board officially put an end to the speculation on stagflation declaring that it is already here: “We’ve been reluctant to predict stagflation’s return given what should be a robust recovery from the pandemic destruction. But there’s no doubt from the government data that it arrived this summer.”

Contagion

China leans into an already ‘combustible mix’ fueling a predicament for the Fed

Credit Bubble’s Doug Noland recently chronicled China’s unfolding debt crisis, starting with the Evergrande meltdown, and working his way in careful detail to the possibility of the contagion, as he now labels it, washing up on “our shores.” Secretary of State Blinken directed comments to China last month that serve as a wake-up call for western financial markets as well. He said that China should act “responsibly and deal with the challenges” imposed by the problems in its real estate and credit markets. What the country does economically, he said, “is going to have profound ramifications, profound effects, on literally the entire world because all of our economies are so intertwined.” In short, Blinken, too, is raising the specter of a contagion.

“Beijing waited much too long to begin reining in its Bubble,” writes Noland in a detailed analysis titled Contagion, Pandemic stimulus stoked already perilous excess. Now Chinese officials face a terrible predicament and onerous decisions. At this point, large liquidity injections could further stoke inflationary pressures, while risking a disorderly decline in the Renminbi. The Fed waited much too long to begin reducing historic monetary stimulus. Pandemic stimulus stoked already perilous excess. Federal Reserve officials could soon face quite a predicament and difficult decisions. …”

“What does the world look like a month from now?” he asks in conclusion. “Has China’s unfolding crisis by then enveloped the ‘Core’? How powerful are de-risking/deleveraging dynamics in November, globally and in U.S. markets? My thoughts harken back to the March 2020 dislocation in bond (and equities) ETFs. Since then, Fed pandemic measures have spurred additional gargantuan bond fund inflows (at historically low bond yields) while simultaneously unleashing powerful inflationary dynamics. Quite a combustible mix. Clearly, the Fed is not about to ‘slam on the brakes.’ Might the bond market?”

Financial Times recently pointed out that the developer “for all of the high drama of its meltdown, is merely the symptom of a much bigger problem” – a broader collapse of the Chinese property market brought on by an over-extension of credit. As such, because building and real estate are such significant components of China’s domestic economy, the danger it imposes on the rest of the world economy is not likely to dissipate anytime soon. “The risks that spring from the Evergrande saga,” says FT, “encompass both financial contagion — especially in the offshore U.S. dollar bond market — and the prospect that a flagging property sector will strike at some of the vital organs of the Chinese economy, potentially depressing GDP growth for years to come.” Though the crisis has faded from the headlines over the past several days, South China Morning Post reported late last week that “Evergrande is barely out of the woods, as more payment deadlines loom ahead.”

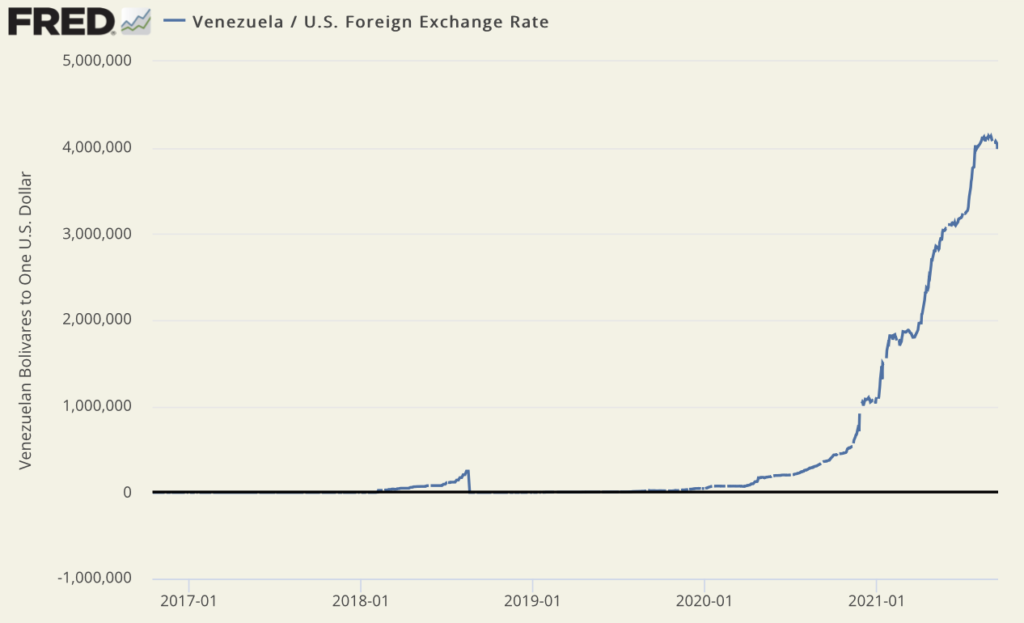

In Venezuela, flakes of gold serve as money

An ounce of gold cost 383,207,885,304,659.50 bolivars before October currency fix

While hyperinflation in the U.S. economy is unlikely, it is a reality in Venezuela. One of the characteristics of hyperinflation is how quickly it can impose itself on an economy. The chart below shows the rapid depreciation in the value of Venezuela’s bolivar over the past nearly two years against the U.S. dollar. At the end of 2019, it took, as you can see, 45,760 bolivars to buy a dollar. Just before the country lopped six digits off the bolivar’s value in early October, the exchange rate was 4,133,144 bolivars per dollar. At that time, it took 383,207,885,304,659.50 bolivars to buy an ounce of gold, according to Goldrate24 – an indication of its utility as a long-term store of value under even the most extreme circumstances.

In the more remote parts of Venezuela, gold is used as money to pay for everyday necessities. “There, in the barbershops and restaurants and hotels that constitute the main strip of one dusty little outpost after another,” Bloomberg reported recently, “you’ll find prices displayed in grams of gold. A one-night stay at a hotel? That’ll be half a gram. Lunch for two at a Chinese restaurant? A quarter of a gram. A haircut? An eighth of a gram, please. Jorge Pena, 20, figured that eighth came to three small flakes — the equivalent of $5. After getting a trim one recent weekday in the town of Tumeremo, he handed them over to his barber, who, satisfied with Pena’s calculation, quickly pocketed them. ‘You can pay for everything with gold,’ Pena says.”

Note: Officially adjusting the nominal value of the bolivar per dollar does not address Venezuela’s hyperinflation problem. It only simplifies everyday purchases and record-keeping.

Sources: St. Louis Federal Reserve, Board of Governors of the Federal Reserve System (U.S.) • • • Click to enlarge.

Notable Quotable

“The big question on gold investors’ minds, for good reason, is why gold is not higher given the unprecedented money printing and rising inflation. The second question is when will it change? To some extent, gold has simply been in a long consolidation after the extraordinary move early last year, when gold jumped over 30% from its end-March low to early-August high. That kind of move – in four months – is extraordinary for an asset that is intended as a hedge and an insurance. Gold is not supposed to do that. Bitcoin…Tesla…perhaps, but not gold!” – Adrian Day, Gold Eagle

“[T]he reason that gold tends to do well in inflationary times is not because of inflation as such, it’s because when inflation goes up, ‘real’ interest rates (that is, interest rates adjusted for inflation) go down. Gold historically does well when real interest rates are falling. If inflation goes up faster than interest rates, that spells falling real interest rates (even if nominal rates are rising). That, in turn, is good for gold.” – John Stepek, Money Week

“Overconfidence, complacency, recklessness and intoxication come to mind when characterizing the current financial market zeitgeist. Market positioning for an abrupt loss of confidence in the mechanism inflating the bubble is almost non-existent, in our opinion. Sobriety is scarce and denial of risk is commonplace.” – John Hathaway, Sprott Insights

“We think the reason is that if the Fed were to actually fight inflation, it would harm the financial markets and trigger a fresh recession that our fiscal and monetary policies aren’t capable of addressing. We don’t think our leaders are prepared to take responsibility for doing so. As a result, the Fed is left with a strategy of obfuscating inflation, claiming it’s transitory and just hoping that it goes away on its own.” – David Einhorn, Greenlight Capital

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

“The trade with gold and silver is pretty straightforward here. If you believe [the] Fed will get ahead of the curve or at least in line with it with regards to inflation then sell. If you think Fed will crab walk their tightening, then this selloff is a gift. I believe in the latter.” – Paul Boockvar, Bleakley Advisory Group

“For it is, so to speak, a game of Snap, of Old Maid, of Musical Chairs — a pastime in which he is victor who says Snap neither too soon nor too late, who passed the Old Maid to his neighbour before the game is over, who secures a chair for himself when the music stops. These games can be played with zest and enjoyment, though all the players know that it is the Old Maid which is circulating, or that when the music stops some of the players will find themselves unseated.” – John Maynard Keynes

“So the world at large welcomed the collapse of Bretton Woods as a ‘liberation.’ In reality, though, the world was not free. It became more and more dependent on financial markets which are now the financiers and decision makers of our system.” – Jacques de Laosierre, former president of the Bank of France, The New York Sun

“‘Experience keeps a dear school,’ said Ben Franklin, ‘but fools will learn in no other.’ The wise man remembers. The fool forgets. The wise man listens. The fool talks. He ignores both the living and the dead… the immemorial dead, whose whispers carry the distilled wisdom of history. No – this time is different, comes the fool’s eternal cry. The past is of no use to me.” – Brian Maher, Daily Reckoning

“This is the paradox of gold. There may be no earthly reason to hold gold or for gold to be the one long-term constant in the millennia of innovation and fraud in finance! But it is. And that constant provides protection against all manners of risk and uncertainty. As such, investors ignore gold at their peril.” – David Ferguson, Yahoo!Finance

“Animal spirits have clearly sustained a damaging blow in recent months; whether that blow proves fatal, though, will be revealed in time. The fact that interest in day trading is plummeting stands in direct contrast to the fact that interest in getting help for stock market gambling addiction is soaring. – Jesse Fedler, The Felder Report

“As for whether empty shelves equal inflation, that’s complicated. For now let’s just say that 1) shortages are both a cause and an effect of rising inflation, and 2) it’s getting harder to view Third World financial crises as something that can’t happen here.” – John Rubino, Dollar Collapse

“[W]hen ‘investors catch on the move upward in COMEX gold is very likely to be gradual and then sudden. [Canadian mining executive] Rob McEwen suggests a price as high as $3000/ounce, but that’s not a likely first target. Instead, look for COMEX gold to eventually overshoot its most recent all-time high by 10% or so—just as it did in August 2020 when it peaked at $2080 versus the September 2011 high of $1920. … So, continue to prepare for what’s to come. You’ve been granted some time here in 2021 to add physical metal to your stack at some surprisingly low prices. But this period of consolidation and faulty expectations is ending. Patient investors will soon be rewarded…gradually, and then all at once.” – Sprott’s Craig Hemke on the changing inflation psychology

The Fourth Turning 2021 update

How bad will it get, how long will it last and what comes next?

“The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation, and empire.” – Neil Howe and William Strauss, The Fourth Turning (1997)

It has become our custom to annually post an update of Neil Howe’s thinking in advance of the new year. As many of you already know, Howe is the co-author (along with William Strauss, now deceased) of The Fourth Turning – the prescient analysis of long-term, generational cycles that first hit the bookstores in 1997. In this interview posted at the Wealthion website, he tells Wealthion’s Adam Taggart that “the weight of history strongly suggests we are headed into a decade-plus period of economic and social disruption that will transform our political, economic, financial and social systems. Volatility will reign. Crushing inflation looks likely. We may see a stock market crash and widespread job losses. Perhaps even war.”

In The Fourth Turning, Strauss and Howe predicted several events that have already occurred – a terrorist attack on New York (2001), a credit crisis (2008), Russia invading a former Soviet Republic (2014), and, believe it or not, a supervirus forcing lockdowns and quarantines (2020) – all in all, a remarkable track record by any standard. Last year he warned of the coming era of Modern Monetary Theory and to stay away from “nominal assets.” For those unfamiliar with Howe’s theories, this interview is a complete immersion that will likely change the way you view history and offer a new perspective on what the future might hold – from the master theorist himself.

Final Thought

‘The Biden-Yellen-Powell economy is less than inspiring

“It is said,” writes essayist Bruce Wilds, “the dance band on the Titanic played on as the ship went down. This was all done as a grand effort to reassure the passengers and ease the panic in their hearts. Consider the possibility that behind all the noise we hear today a similar effort is being made to comfort us and take your attention off the hopeless feeling that comes when things sink away beneath your feet. For the last several months, I have come to feel a similar story is playing out here. The Biden-Yellen-Powell economy is less than inspiring.” Wilds raises concerns many of us have entertained in recent months. If you are thinking about precious metals diversification and you have yet to pull the trigger, perhaps you are doing yourself a disservice, i.e., not giving your instincts the proper credit.

Looking to prepare your portfolio for whatever uncertainty lies ahead

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ORDER GOLD & SILVER ONLINE 24-7

Up-to-the-minute gold market news, opinion, and analysis as it happens.

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.